Calendly: The $4B DocuSign of Scheduling

Jan-Erik Asplund

Jan-Erik Asplund

Just a feature

Join our list for access to more of our exclusive private markets research and company coverage.

Success!

Something went wrong...

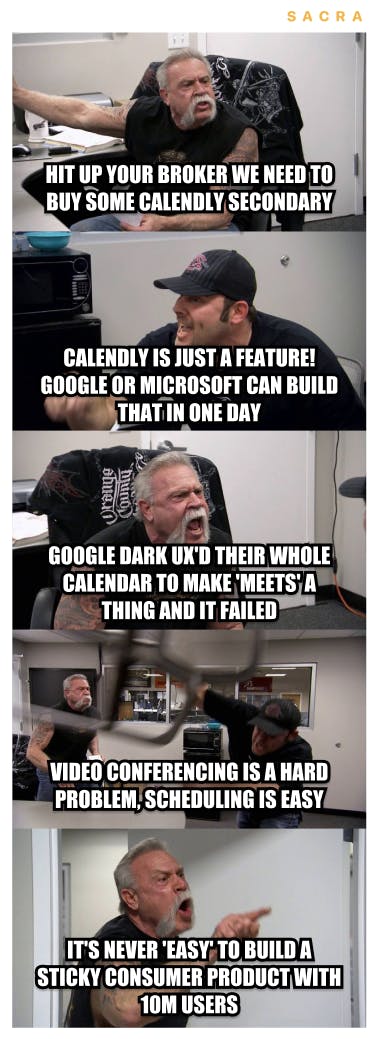

Calendly is a company many believed was never going to build a big business. “It’s only a matter of time until Microsoft/Google puts out their own e-signature/scheduling service.” “Someone will buy them.” “It’s just a feature.”

Not long ago, DocuSign skeptics also referred to that company as a “feature”. Few understood that behind the seemingly boring business of e-signatures, DocuSign had a powerful, organic growth loop and 70% share of a market that would go on to grow from $1M in size to $1B in just over a decade. DocuSign’s growth was slow but steady, and today, the company is worth more than $40B.

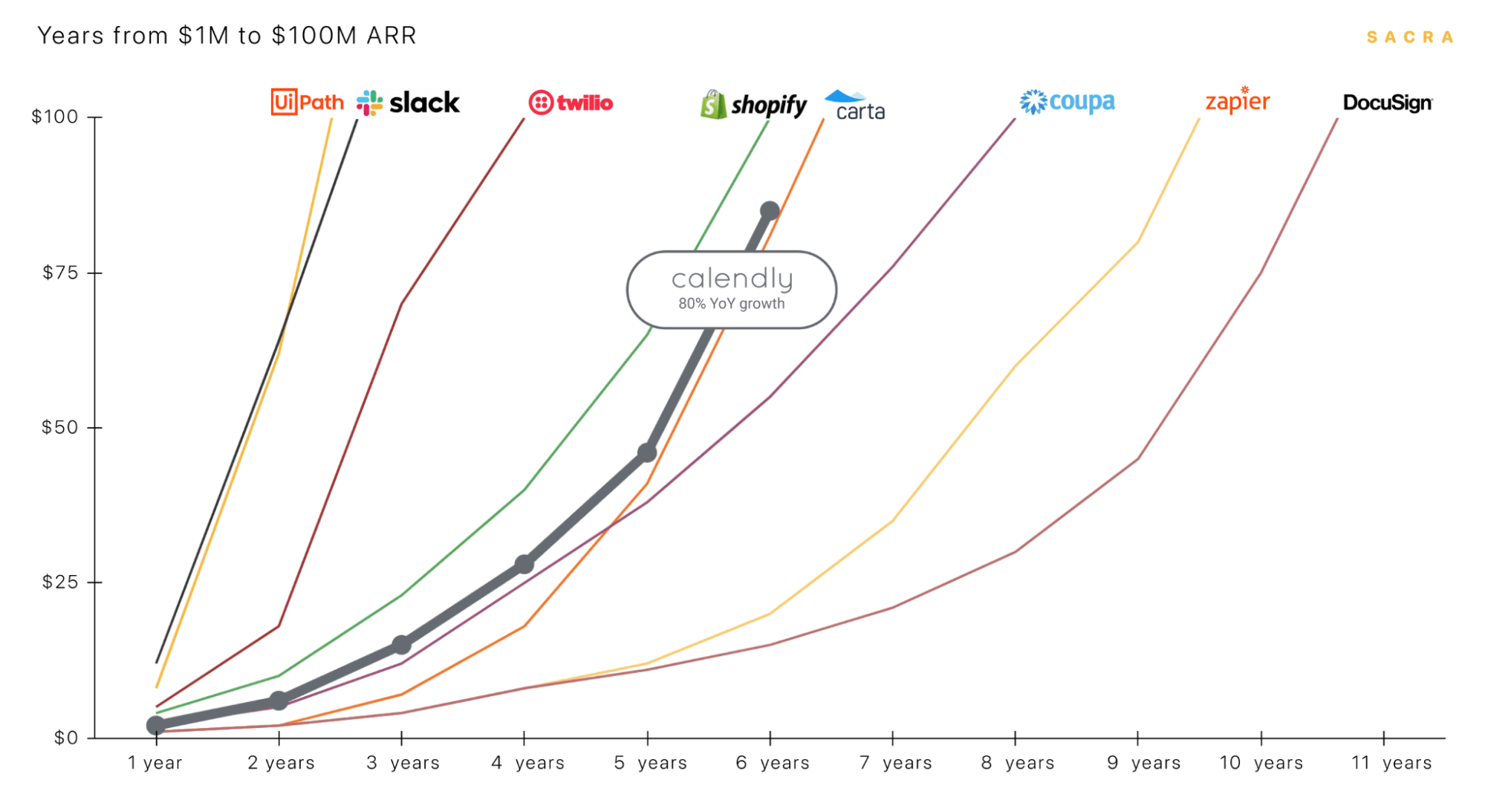

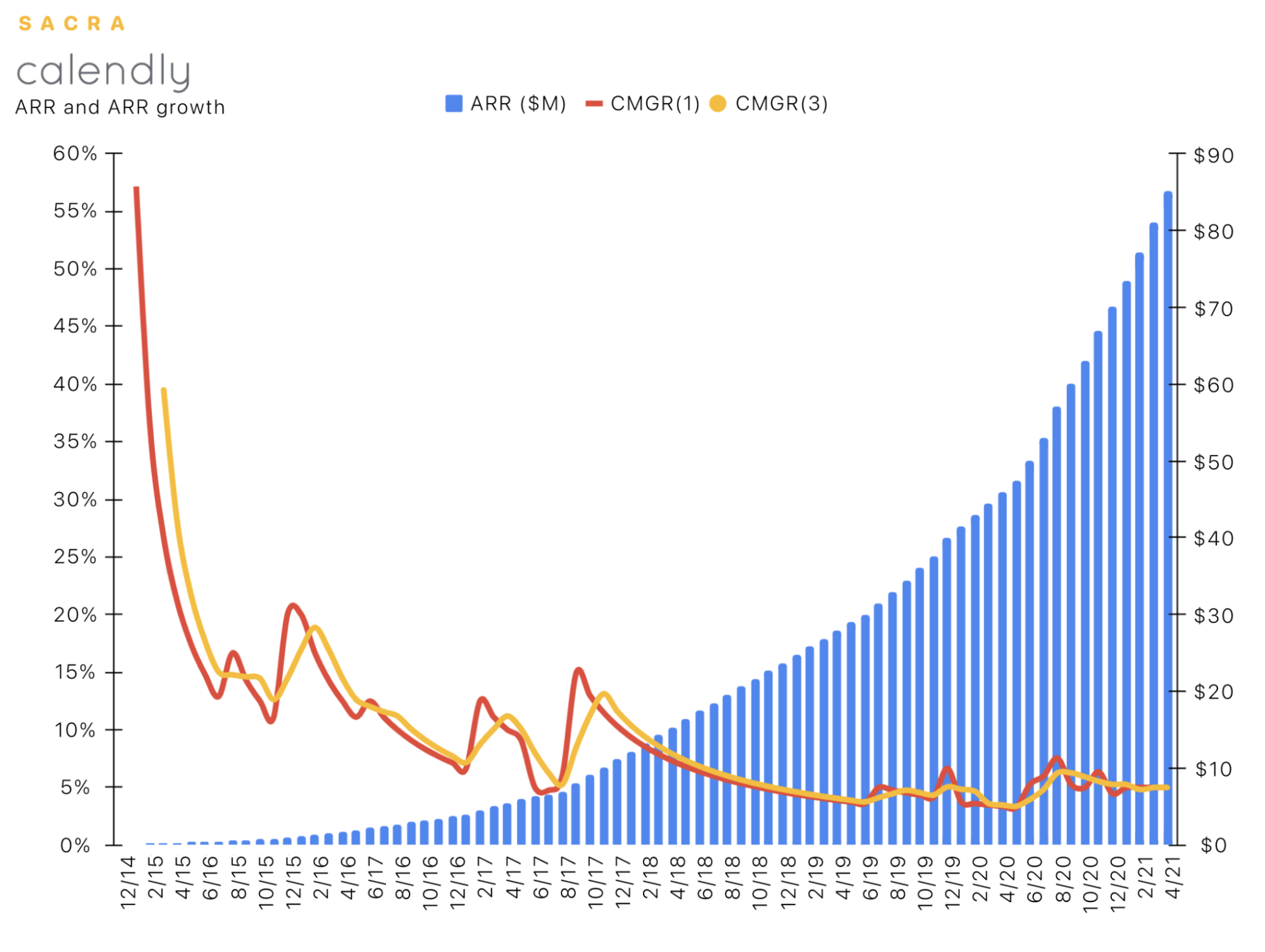

Calendly crossed $70M ARR at the beginning of the year, growing 75% year over year, and has more than 50% market share in the scheduling space. They’re on track to hit $100M ARR in about half the time it took DocuSign. And with the trend towards hybrid and remote offices accelerated by COVID-19, Calendly’s recent growth spurt could just be the beginning.

Calendly is on track to hit $100M ARR by August 2021.

Calendly has tended to be overlooked for a number of reasons. One factor is fundraising. Before raising their last round of fundraising that valued them at $3B, Calendly had raised just one round: a $550K seed in 2014.

But Calendly has—like DocuSign—spent the last seven years quietly and steadily building a SaaS juggernaut. Today, “Calendly” is virtually synonymous with scheduling the way “Google” is synonymous with search. And with this most recent round of fundraising, the stage is set for Calendly to begin the next phase of its evolution.

Calendly changed the scheduling game by bringing the kind of technology used by spas and salons to book appointments to the consumer. Like Dropbox and Slack, it then made its way into the enterprise from the bottom-up. Now, Calendly has the opportunity to use that leverage, their access to the critical atomic unit of the B2B meeting, and their newly-filled war chest to reinvent the way companies do marketing, sales, recruiting, and customer success.

Key points

- Calendly is a SaaS scheduling product founded by CEO Tope Awotona, that launched in 2014. The majority of its usage comes from sales, customer success, marketing and recruiting teams that regularly schedule a high volume of meetings and want to remove friction from the process.

- COVID has been a huge accelerator for Calendly’s business, with growth hitting 5-6% per month and revenues growing from $60M ARR last November to $70M ARR at the end of the year to about $85M ARR today.

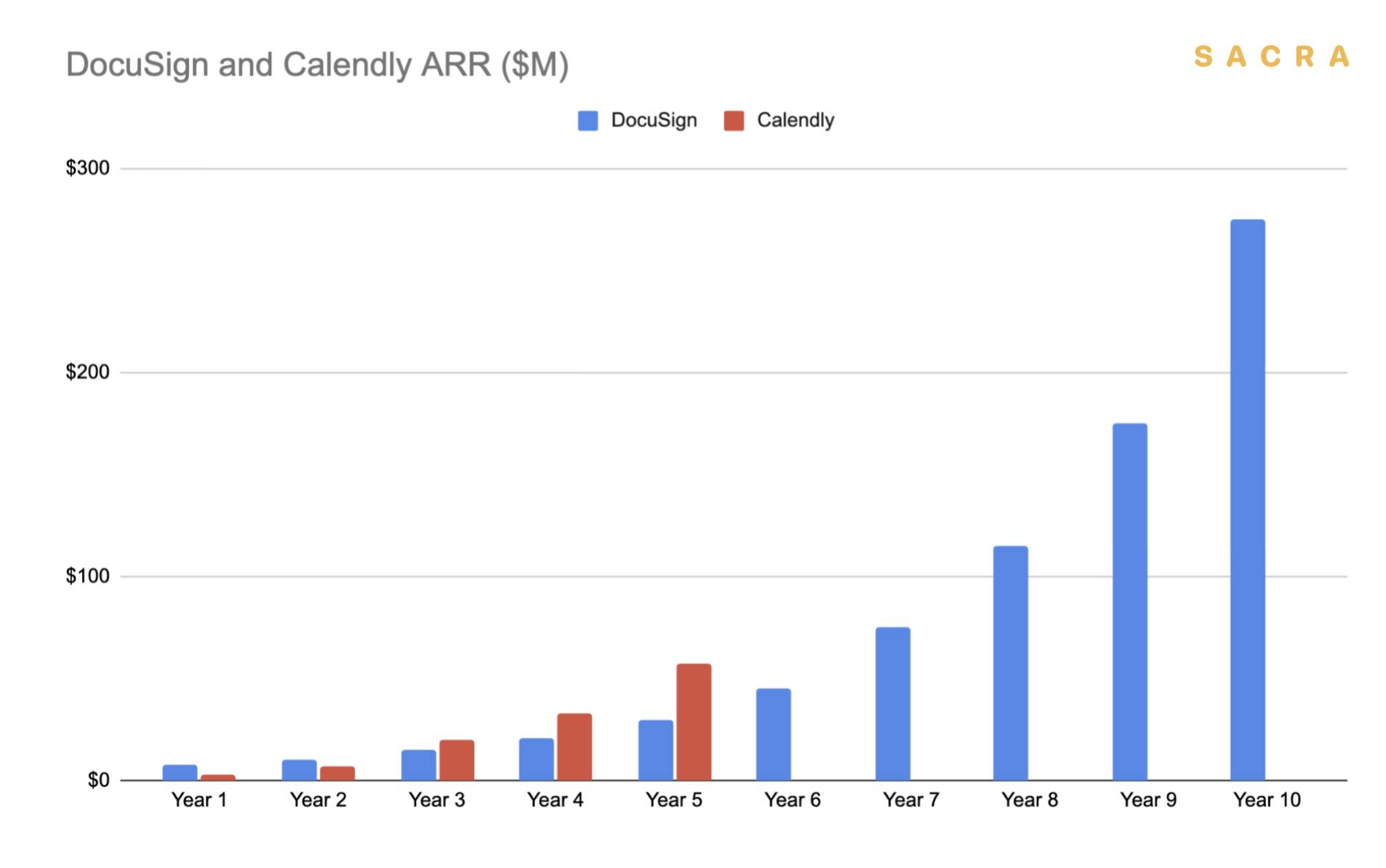

- Calendly is currently on track to pass $100M in ARR by summer 2021—if they do, they’ll have hit that milestone 3 years faster than the similarly-capital-efficient Zapier and more than 4 years faster than the now-$40B+ DocuSign.

- In our base case, Calendly becomes the DocuSign of scheduling, maintaining 50% YoY growth and increasing their enterprise revenue mix. In our bear case, competition, low barriers to entry and high cost of customer acquisition erode Calendly’s product and growth advantages over time. And in our bull case, Calendly is able to leverage its position at the forefront of customer management and integrate backwards into sales, customer success, recruiting and marketing to build the next HubSpot and a $1B+ ARR company.

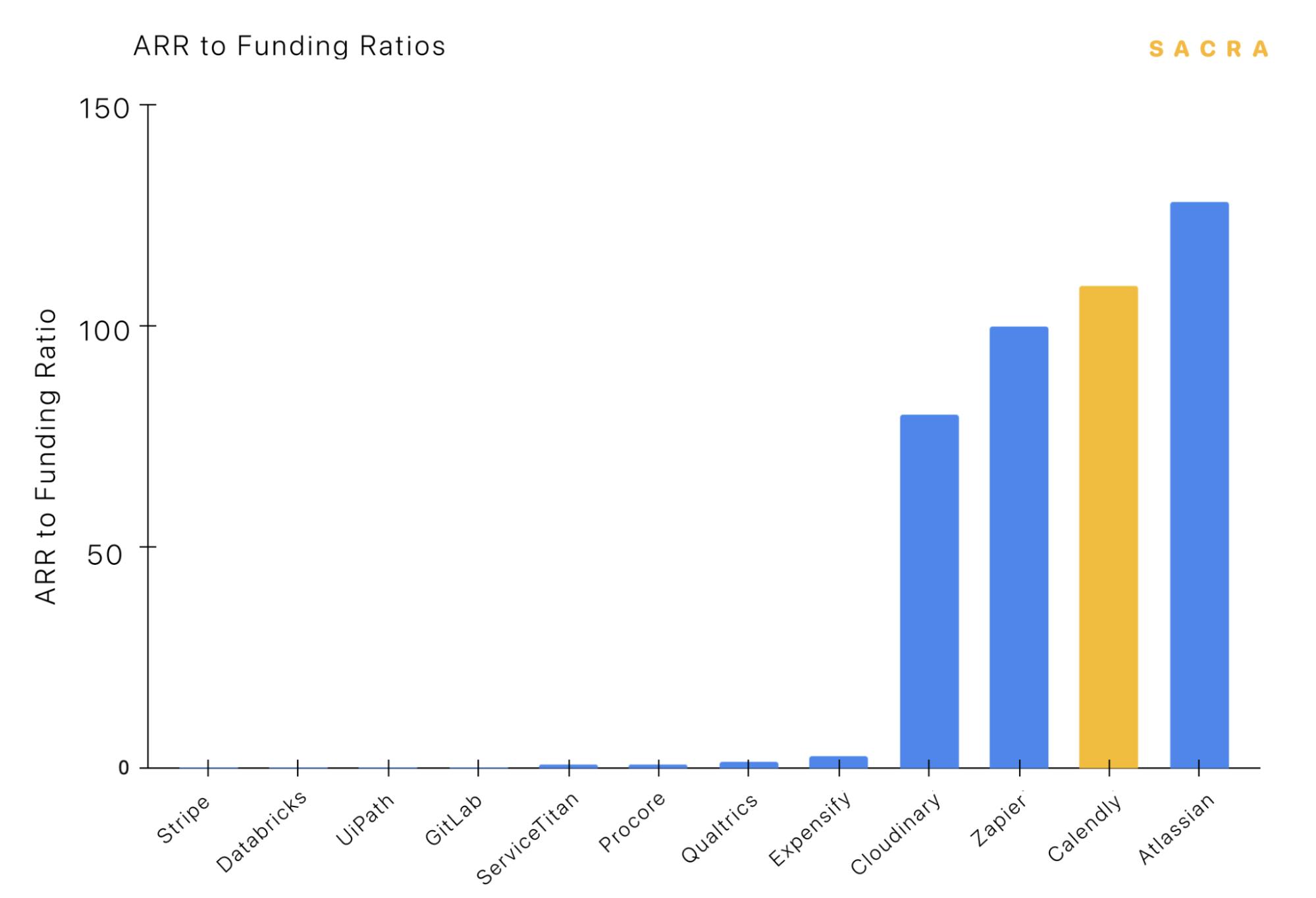

- Before their recent fundraise from OpenView, Calendly had raised just $550K en route to $60M ARR (109x multiple), making them only slightly less capital efficient than Atlassian (128x multiple) and even more efficient than Zapier (100x).

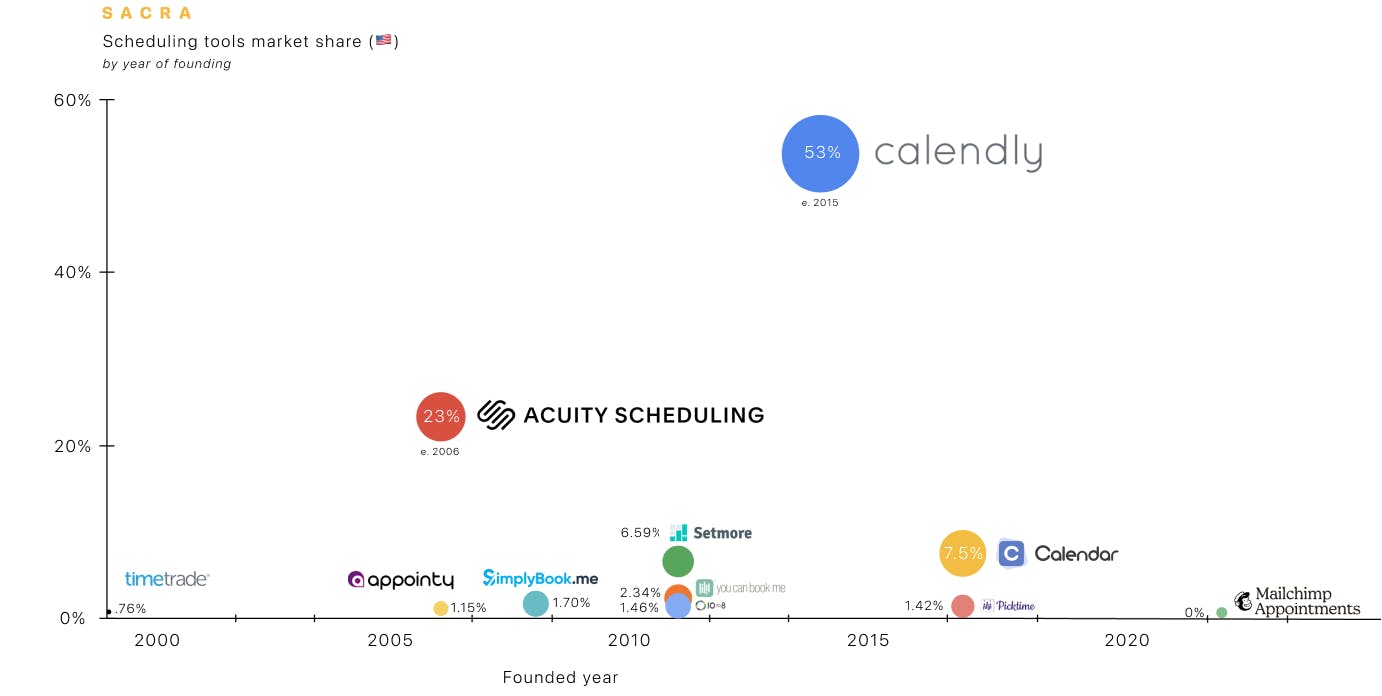

- Calendly has about 53% market share in the U.S. scheduling market, beating out the Squarespace-owned Acuity Scheduling, Calendar.com, and a host of other, smaller contenders.

- While Calendly has been able to acquire customers very cheaply via the organic sharing-based growth loop built into their product, there still aren’t meaningful network effects to having a Calendly account, creating a vulnerability companies like HubSpot and Freshworks can exploit.

- DocuSign grew from $100M ARR to $1B+ ARR by integrating “backwards” from e-signatures into the highly valuable enterprise contracting workflows adjacent to e-signatures. Today, Calendly has a parallel opportunity to leverage the atomic unit of the meeting to integrate backwards into sales, marketing, success and recruiting,

- Deeper enterprise penetration means better retention (DocuSign has net dollar retention of 115%) and higher ARPU via the expanded pricing power of selling a “solution” vs. a “tool.”

Valuation: Calendly is worth $4B

Today, based on our model, we estimate Calendly is worth about $4.2B.

Calendly was reported to be raising at a $3B valuation in November 2020. At the time, Calendly was at $60M ARR growing 6% MoM, for a 50x ARR multiple.

Since November, Calendly’s revenue is up to $85M ARR, growing at a comparable rate. At that 50x ARR multiple, we get a valuation of $4.2B.

Calendly has nearly tripled ARR since June 2019, growing from $30M ARR to $85M ARR.

Before this $350M Series B, Calendly was largely bootstrapped, previously raising just $550K from OpenView in a 2014 seed round.

Calendly got to $60M ARR on $550,000 raised, putting them next to companies like Zapier and Atlassian on capital efficiency.

Calendly’s annually recurring revenue to funding multiple before their last round was 109x, putting them in between bootstrapped juggernauts Atlassian (128x) and Zapier (100x).

Our three cases for Calendly hinge on how well the company can continue to move upmarket, how well it can fend off increasing competition in the scheduling space, and how well it can continue to drive more interactions on their platform:

- In our base case: Calendly continues to grow at 50% year-over-year, driving higher ARPU and retention through premium features

- In our bear case: Tight competition in scheduling, low barriers to entry and high cost of customer acquisition erode Calendly’s product and growth advantages over time, increasing churn

- In our bull case: Calendly is able to integrate backwards into sales, customer success, recruiting and marketing to build a better HubSpot and hit $1B+ in ARR

One of Calendly’s biggest challenges in building a big, DocuSign-like business will be transitioning from a primarily free, self-serve product to a product that is primarily sold into enterprises—Calendly’s invite-based acquisition loop gives them an advantage landing in organizations as a scheduling tool, but expanding to cover other use cases will necessitate increased investment in both sales and marketing.

Product: The scheduling SaaS driving $85M ARR

Calendly is a SaaS product for scheduling appointments and meetings launched in 2014. The core problem it solves is identifying and matching availability between two people.

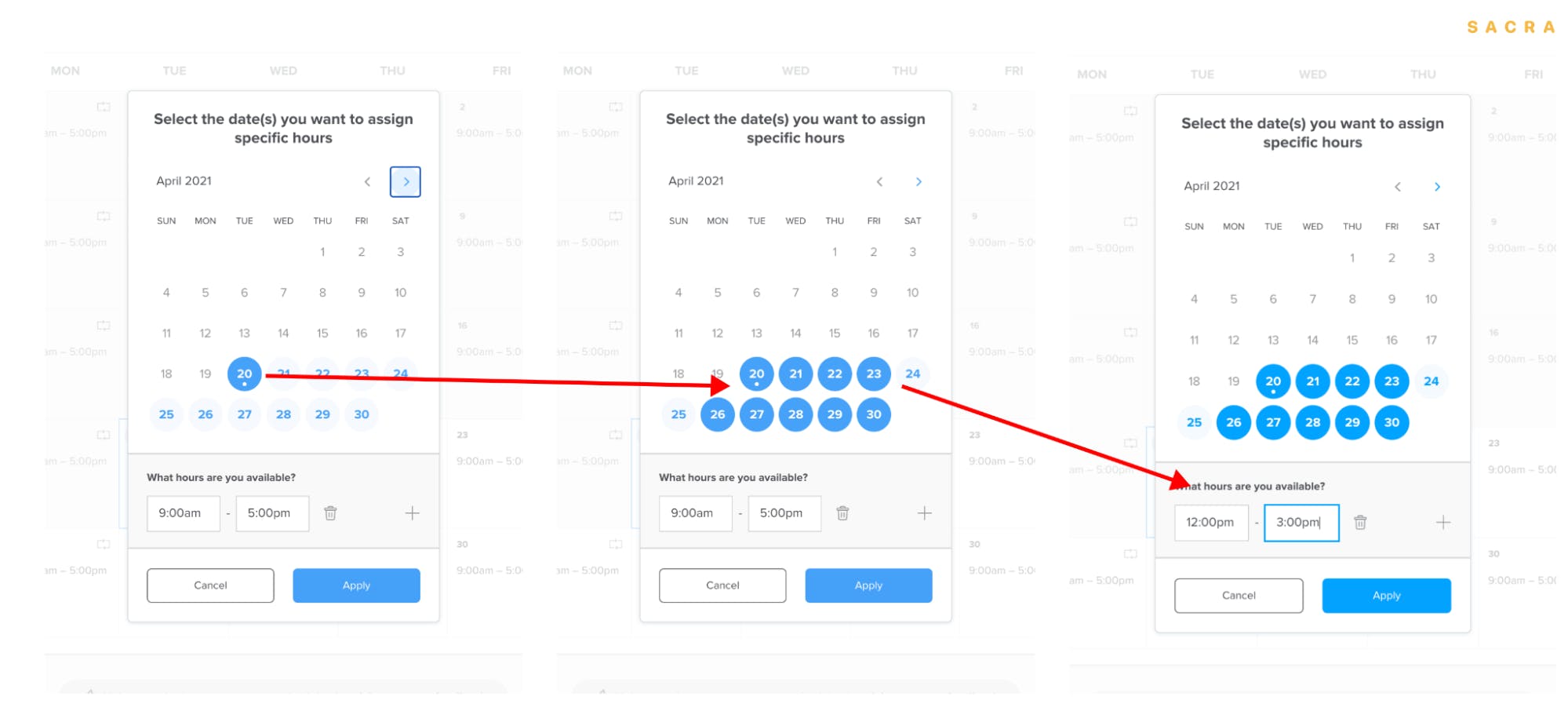

Setting your availability in Calendly—this dictates what times people will be permitted to book with you from your Calendly link.

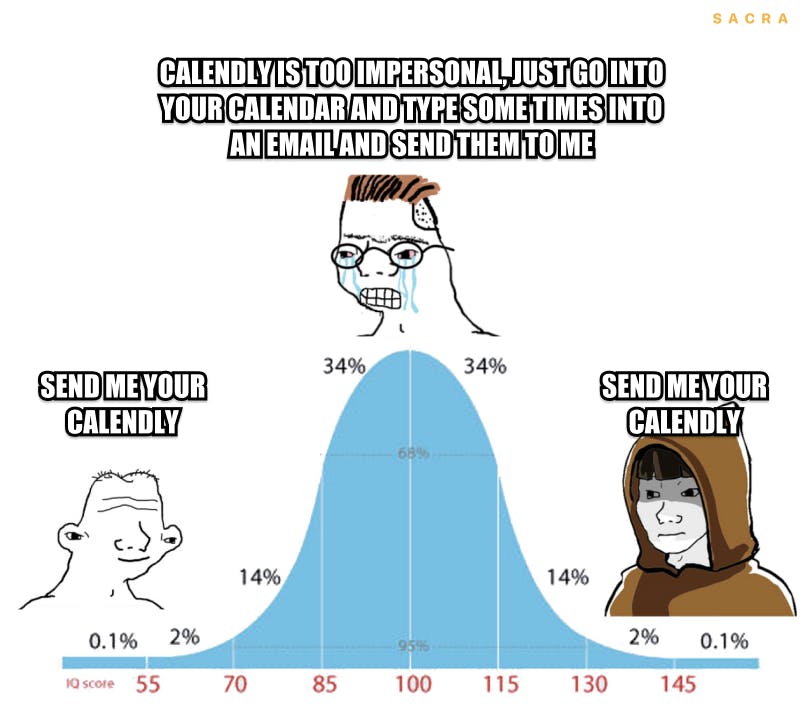

One of the popular default ways to “find time” involves looking at your calendar, identifying 2-3 open time slots, then writing those in an email and sending them to the person you want to meet with.

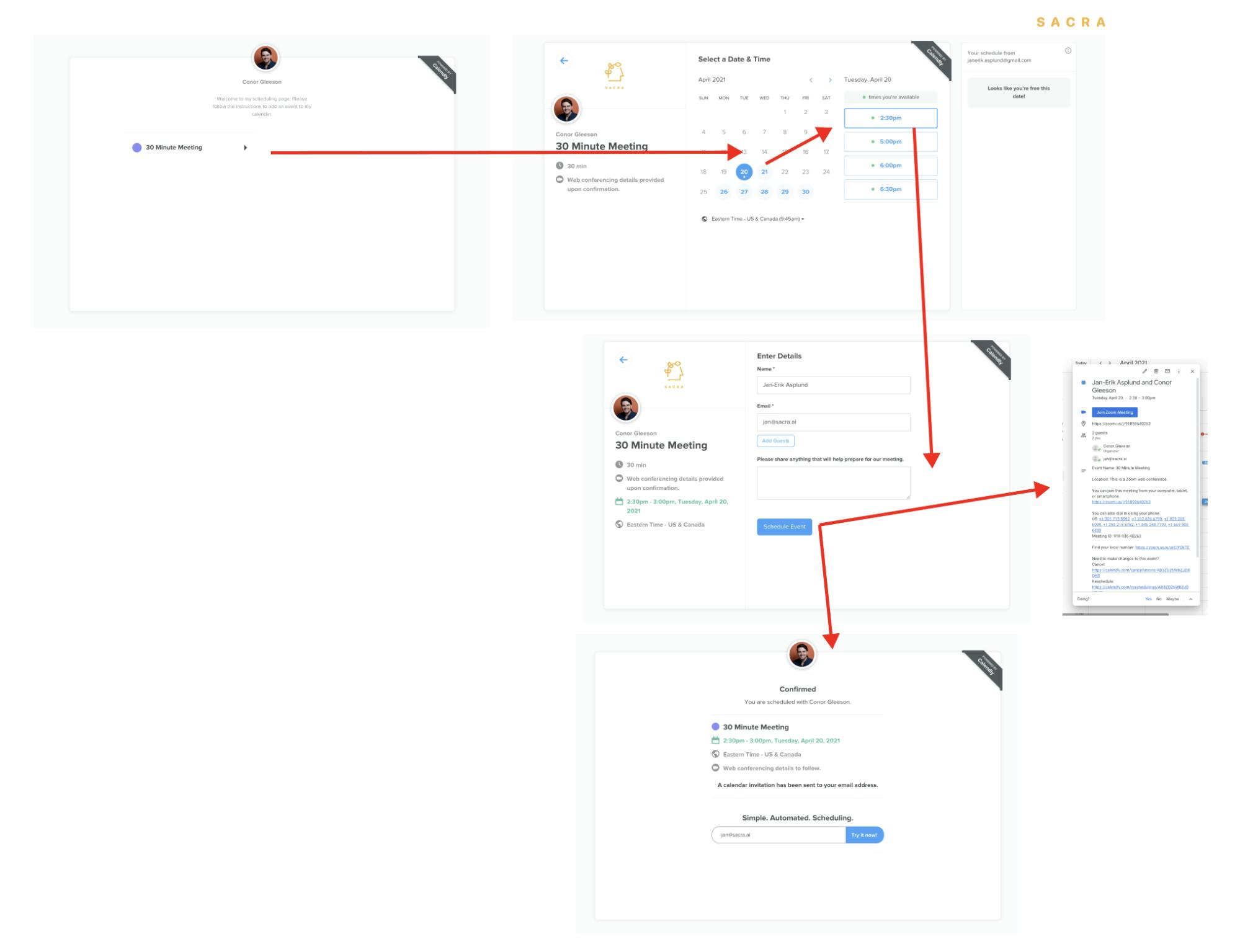

Booking time with a Calendly user from their link.

With Calendly, a salesperson can sync their Google or other external calendars, and Calendly will give them a link or embed that they can send to prospects or customers who they want to meet with that shows their availability. From a simple calendar view, their recipient can choose a time to meet. Calendly then auto-generates a calendar invite for that event and sends it to both parties.

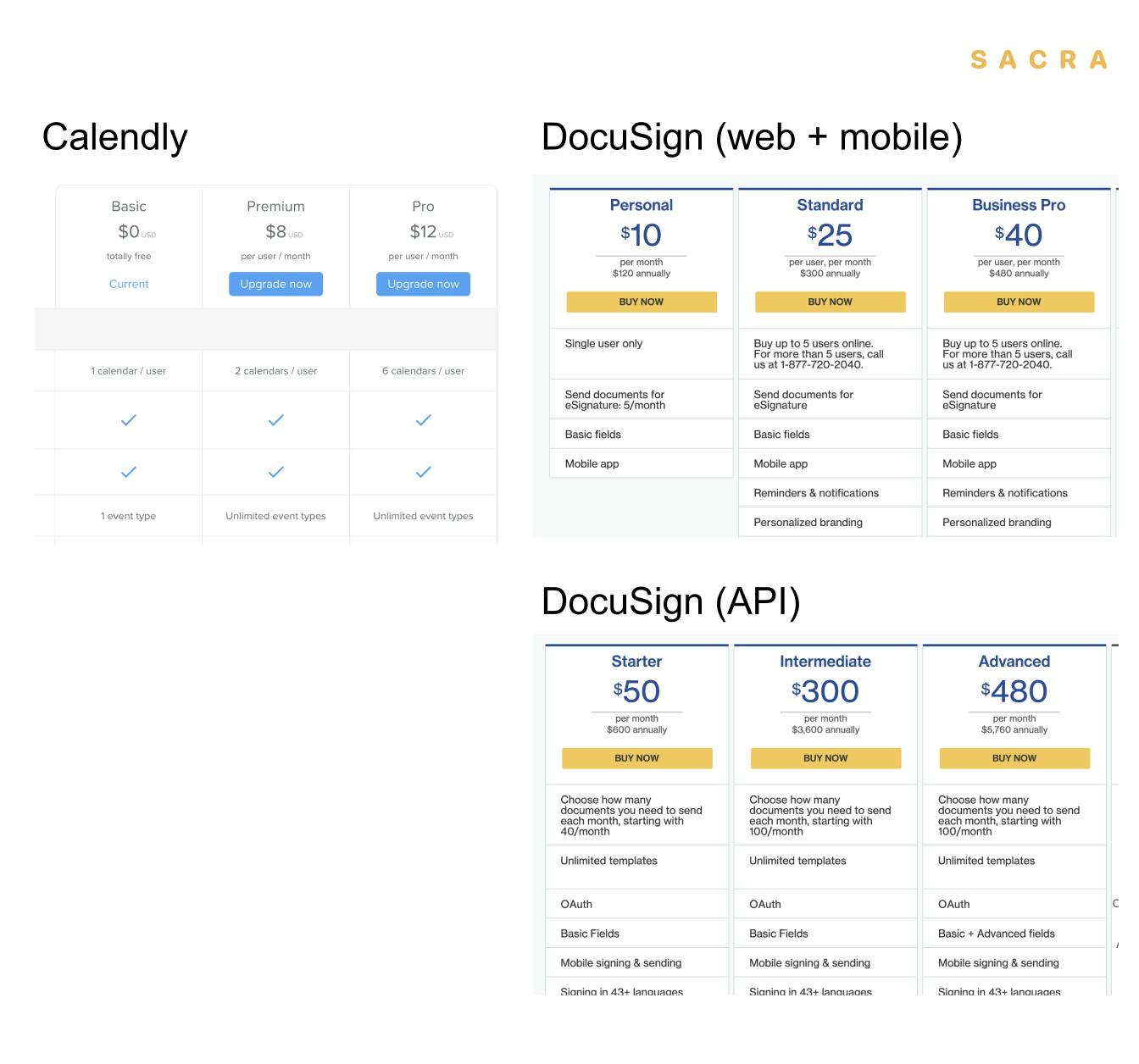

Calendly’s paid plans are targeted primarily at sales, marketing, and customer success teams and offer features to make Calendly more robust for those teams such as:

- pooled availability options for teams (useful for setting up meetings that need 3+ participants)

- custom email notifications

- custom reminders

- SMS notifications

- branding

- integrations with tools like Stripe, Hubspot, and Intercom.

In addition to allowing users to send their availability via a URL, Calendly has website and email embeds. These shorten the process of finding time even further by allowing users to embed their calendar and availability into conversation, reducing the clicks needed to booking an appointment.

Analysis: Calendly’s path to becoming the DocuSign of scheduling

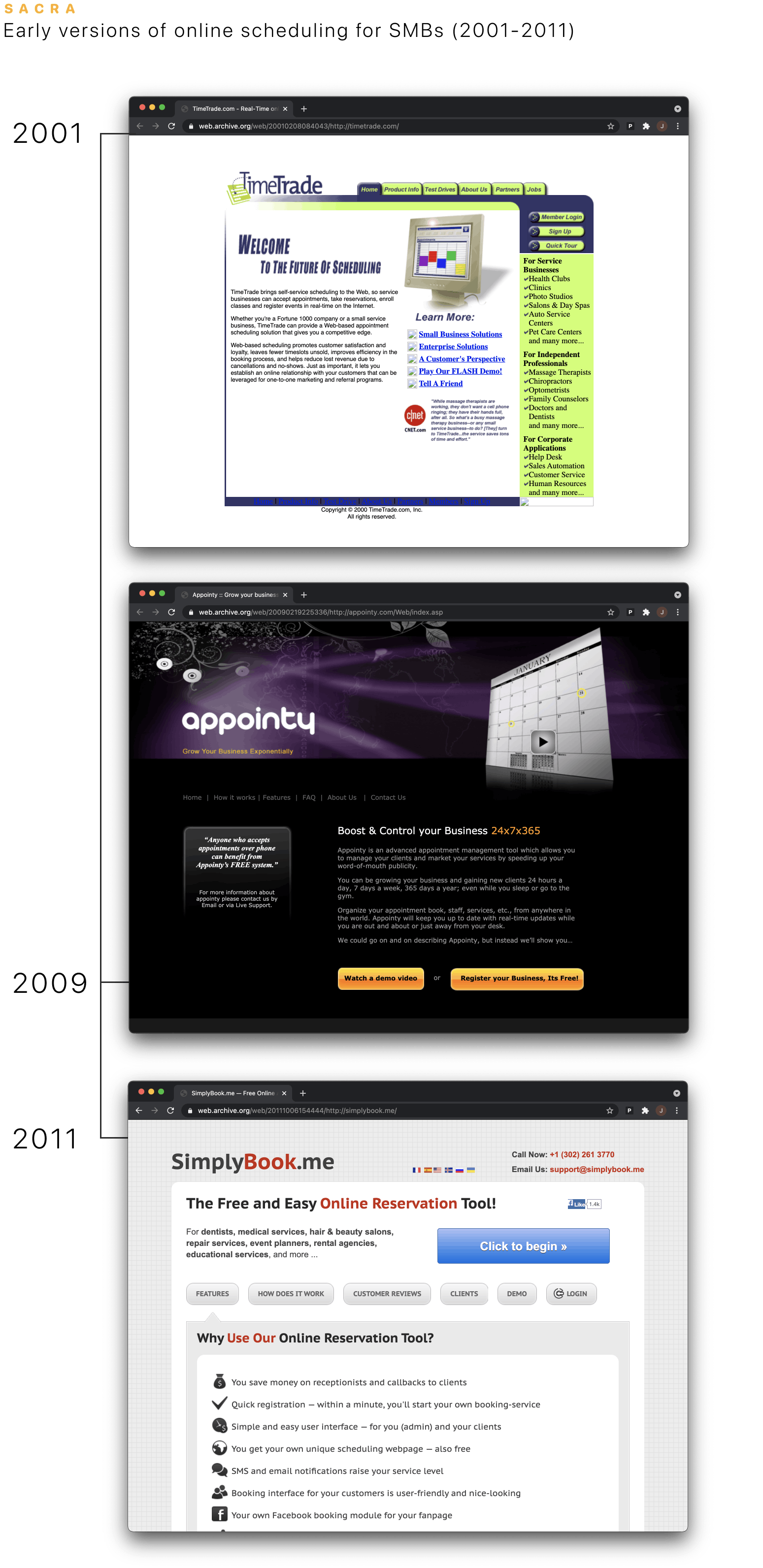

Early iterations of online scheduling were aimed squarely at brick-and-mortar SMBs and service businesses.

For years before Calendly, most scheduling software was built around the needs of the kinds of businesses that had appointment-based workflows in the brick-and-mortar world: 1) service businesses like salons and health clubs, 2) independent entrepreneurs like massage therapists and dentists, and 3) small companies like event planners and consultancies.

These products gave spas, salons and barbershops the power to set up online, branded, self-serve appointments systems. Some of them also offered SMBs other related customer management tools, like the ability to send out email marketing or accept direct payments from them over the internet.

With TimeTrade, businesses could set up their own branded appointment tools that ran on TimeTrade servers.

But in the years after TimeTrade launched, there was a shift in how software was treated in the workplace. With the founding of Skype (2003), Evernote (2004) and Dropbox (2007), consumers started bringing the tools they were comfortable with to work, and they started expecting a consumer-centric experience even out of enterprise software.

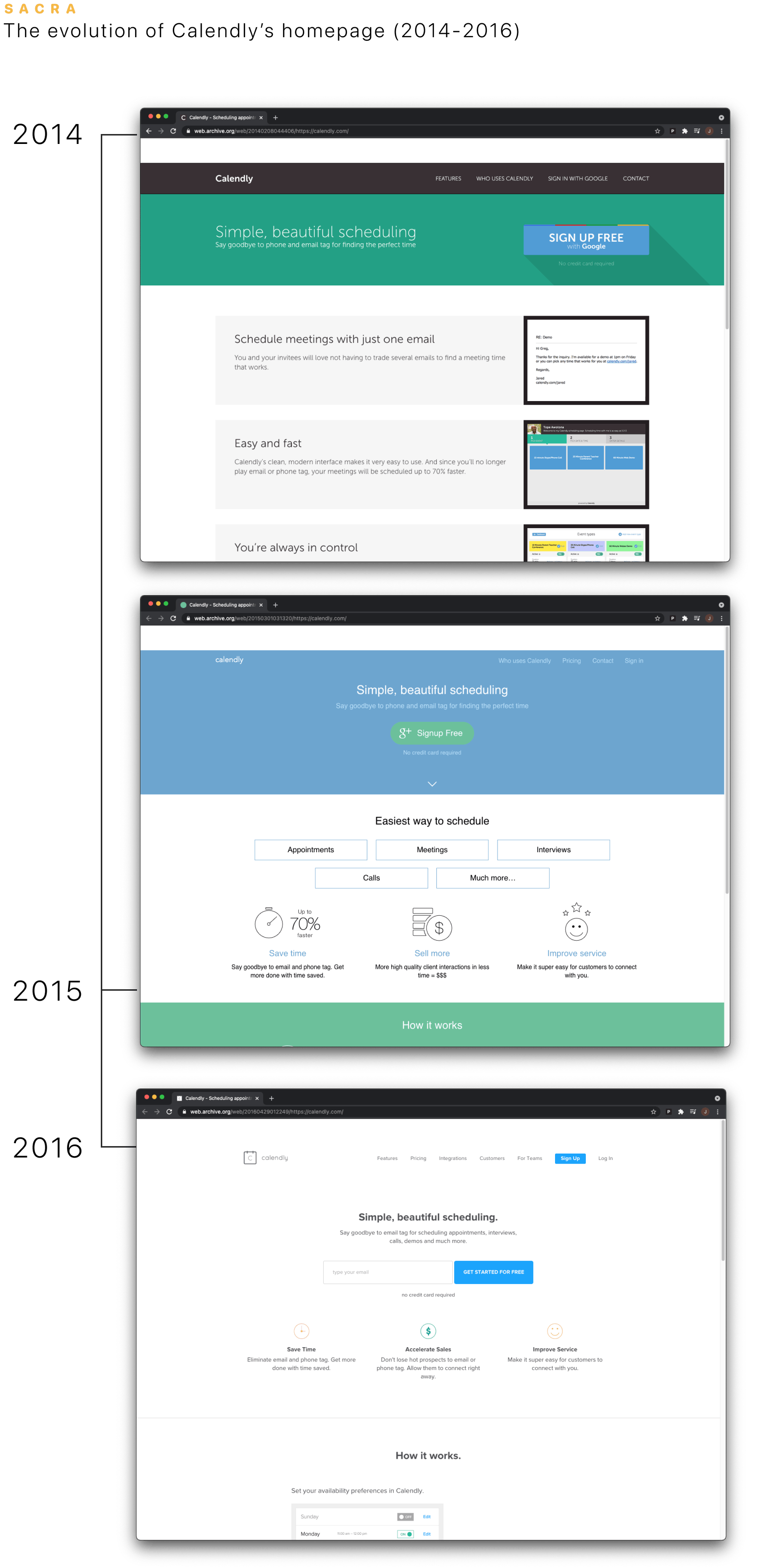

Calendly brought consumer style to scheduling, but also marketed its product to everyone who does business—not just service businesses and SMBs.

It would take until Calendly’s launch in 2014 for the ‘consumerization of the enterprise’ to reach scheduling, but when it did, it took off.

It was important that Calendly was minimalist and cleanly designed—more like an Apple product than a piece of enterprise scheduling software. It was also important that with Calendly, invitations were branded not just with the brand of the salon or barbershop sending them out, but with Calendly’s branding, driving a viral growth loop that would get Calendly to 10M users.

Calendly gave the power and organizational flexibility of online scheduling—that had previously just been for salons and barbershops—to everyone.

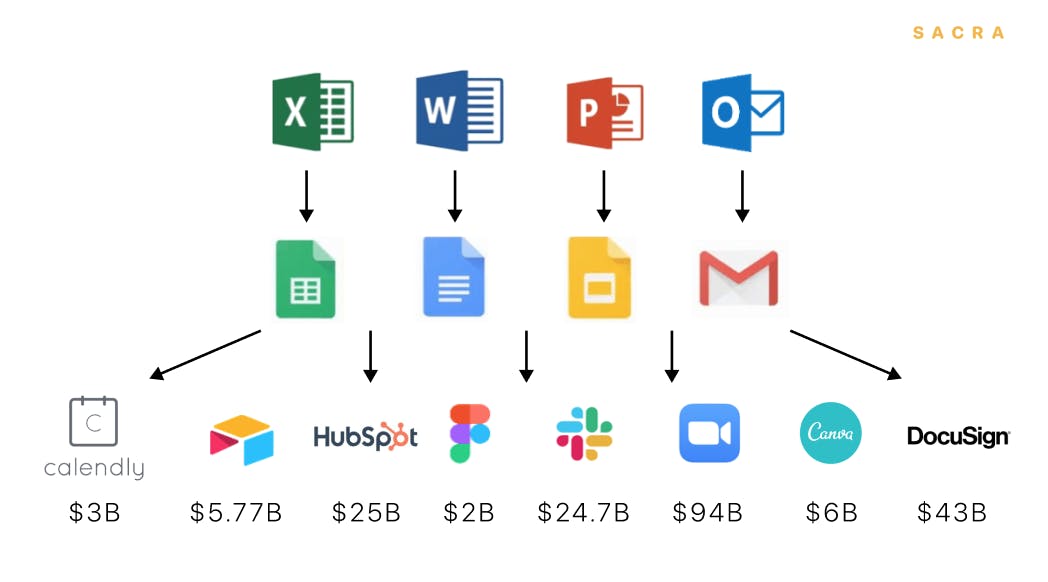

Calendly is doing for scheduling what many other products have done for the last generation of workplace products.

And now, Calendly’s strategy of disrupting an existing market with a consumer-centric experience has given it the chance to break into the enterprise and disrupt an even bigger market from the bottom-up: sales, marketing and customer success management.

Just as DocuSign went from a niche e-signature product to a $1B+ ARR solution for enterprise document management by owning the atomic unit of the contract, Calendly has the potential to change the way companies begin, nurture and grow their customer relationships by owning the atomic unit of the meeting.

1. The growth loop that got Calendly to 10M users

Calendly is currently on track to pass $100M in ARR by summer 2021. If they do, they’ll have hit that milestone 3 years faster than the similarly-capital-efficient Zapier and more than 4 years faster than the now-$40B+ DocuSign.

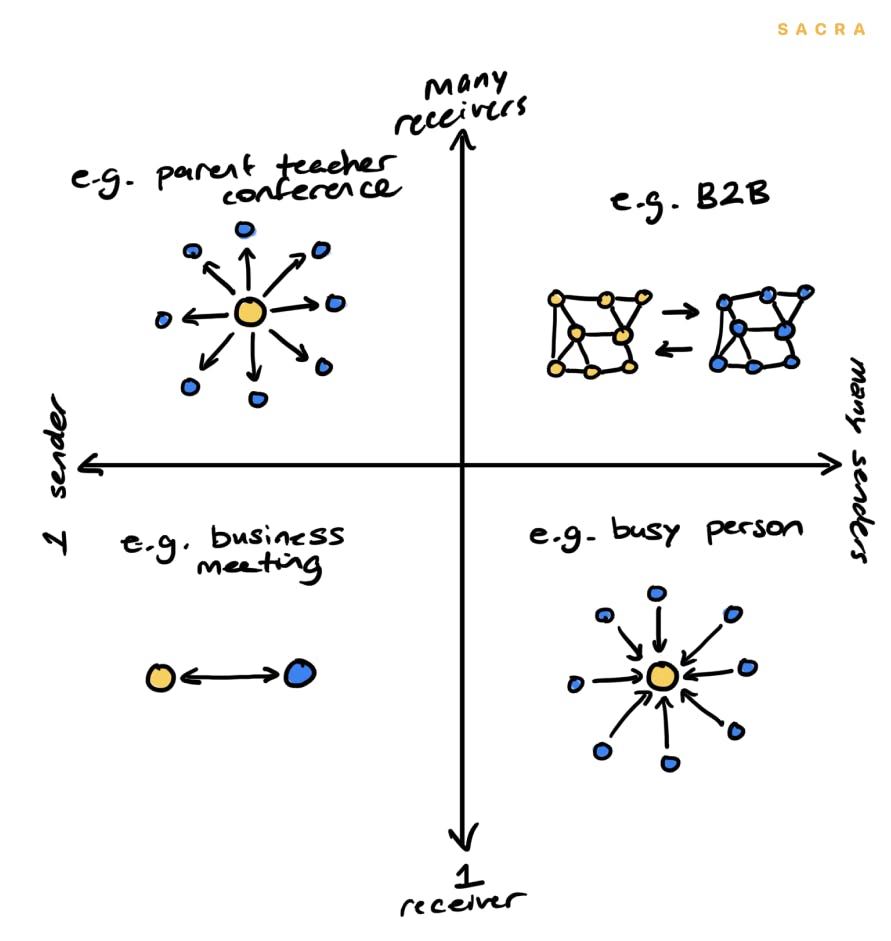

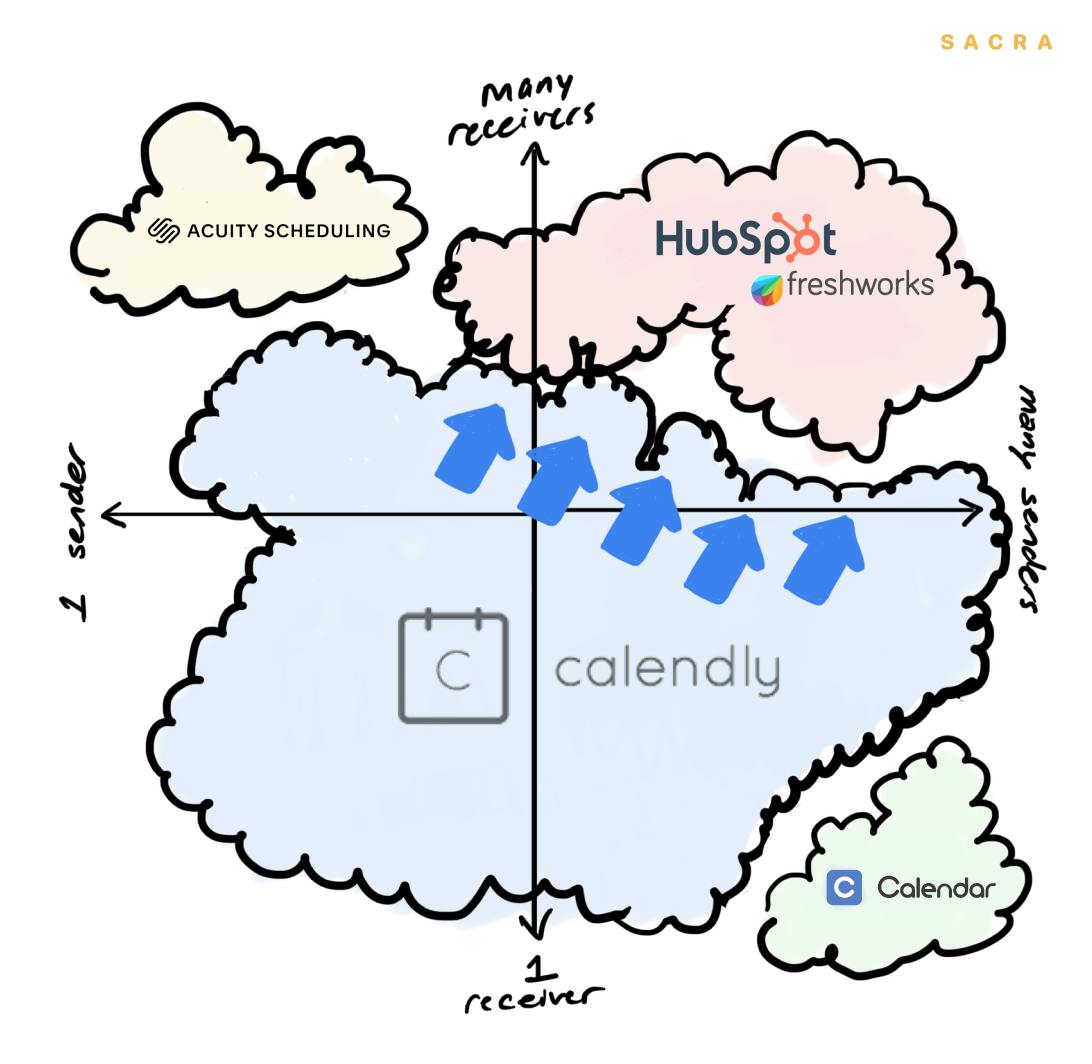

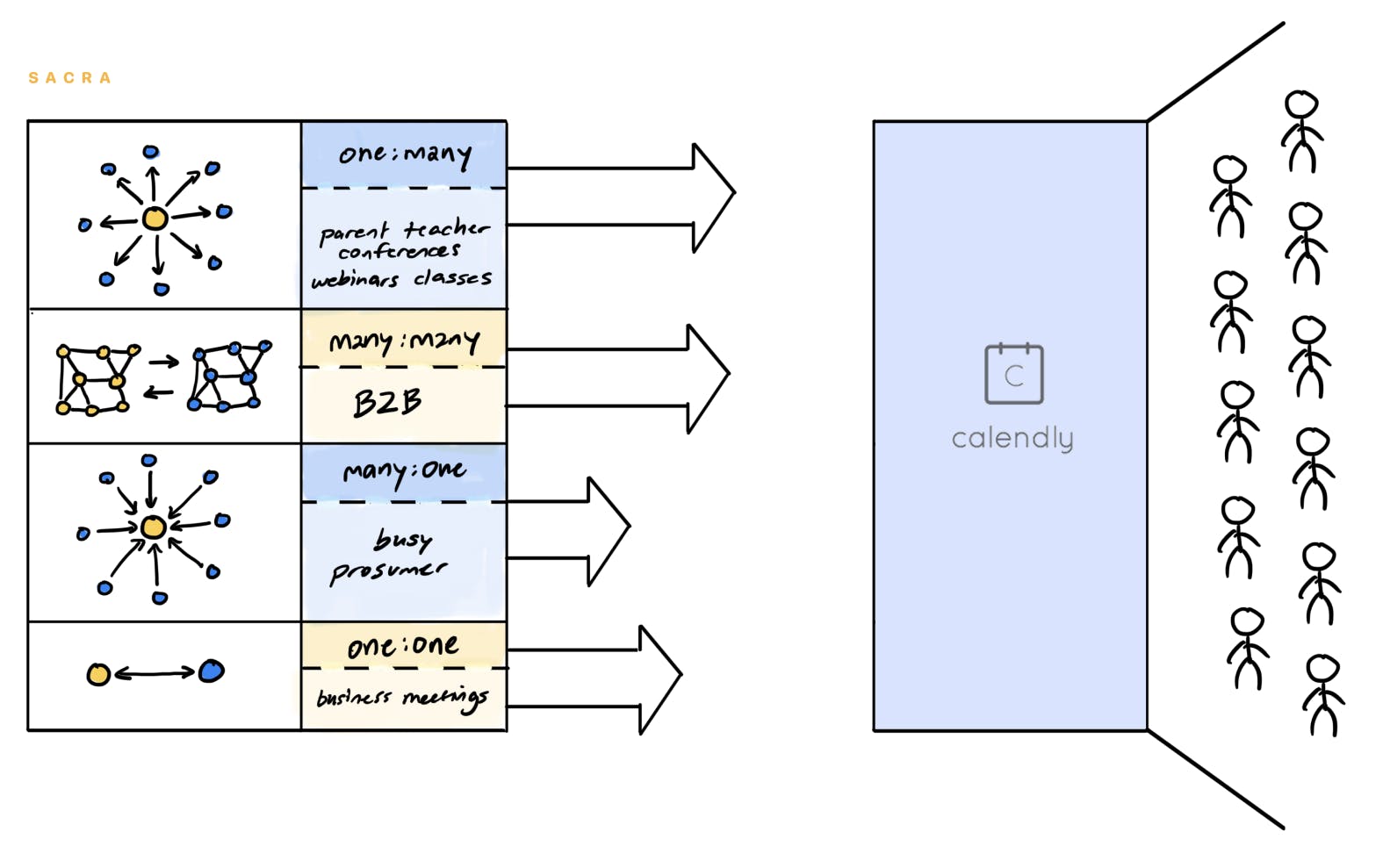

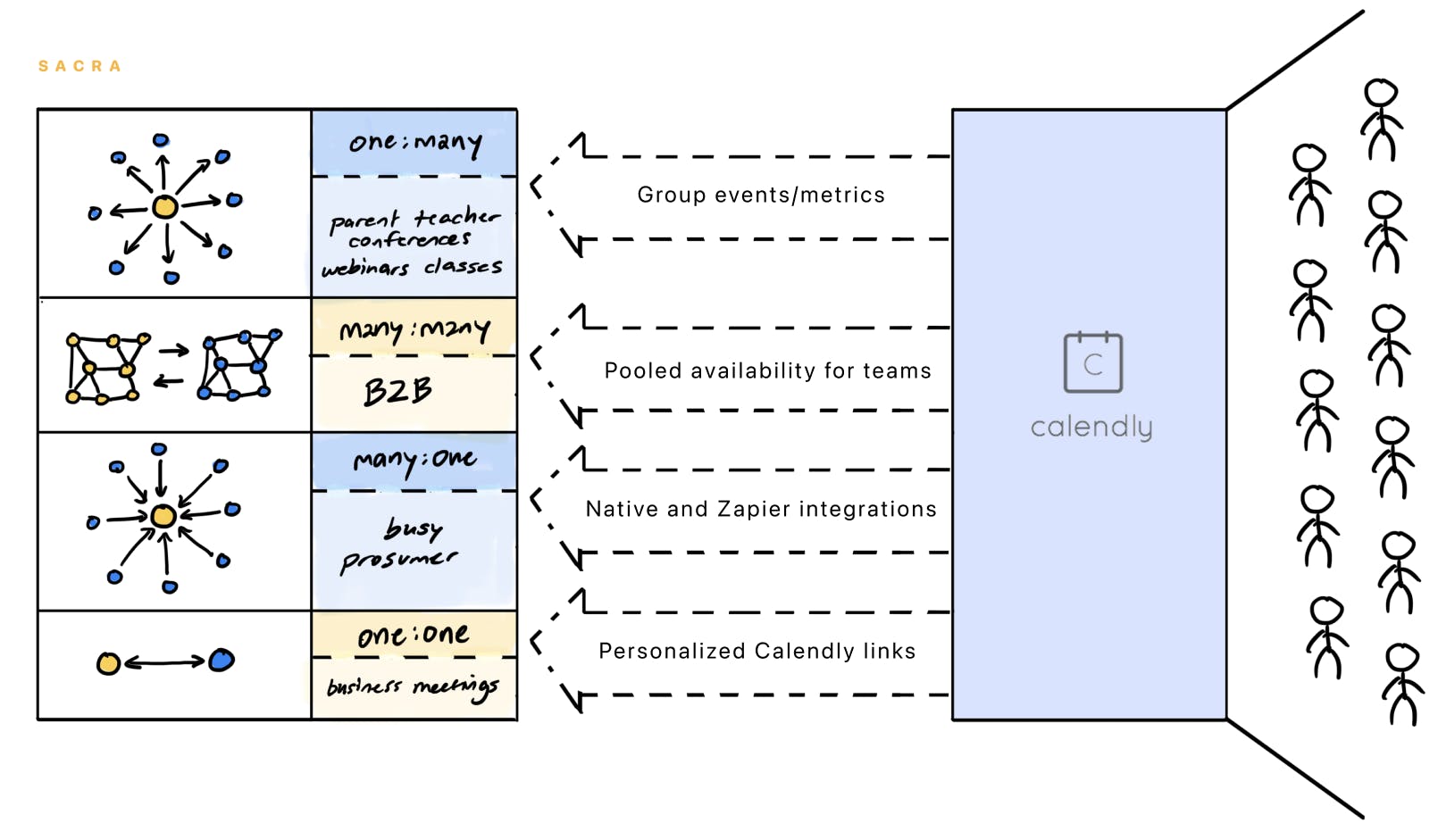

All of Calendly’s use cases can be organized according to whether there are 1 or many senders and receivers.

Calendly’s first product-market fit came with teachers, who used it for the “1-sender-many-receivers” use case of setting up parent-teacher conferences. Instead of trying to manually schedule non-overlapping slots with every parent or set of parents they needed to meet with individually, they could use Calendly to broadcast out a single link with their live-updating availability from which parents could choose compatible time slots.

Over time, more and more of Calendly’s usage came from “1-sender-1-receiver” and “many-senders-many-receivers” use cases. This includes things like sales pitches, syncs between agencies and their clients, meetings between CEOs and their legal counsel, and new SaaS customer onboarding calls. These use cases turned out to represent a much larger swath of valuable interactions than “1-sender-many-receivers”, hence why Calendly today primarily sells into sales, marketing, success and recruiting teams.

As Calendly transitioned towards “1-sender-1-receiver” and “many-senders-many-receivers” use cases, they quickly began hitting revenue milestones:

- $100K ARR by the end of the year

- $1M ARR by the end of 2015

- $4.1M ARR by the end of 2016

- $8M by the end of 2017

Key to that success has been Calendly’s ability to cheaply acquire users through an organic growth loop embedded in their product—similar to DocuSign.

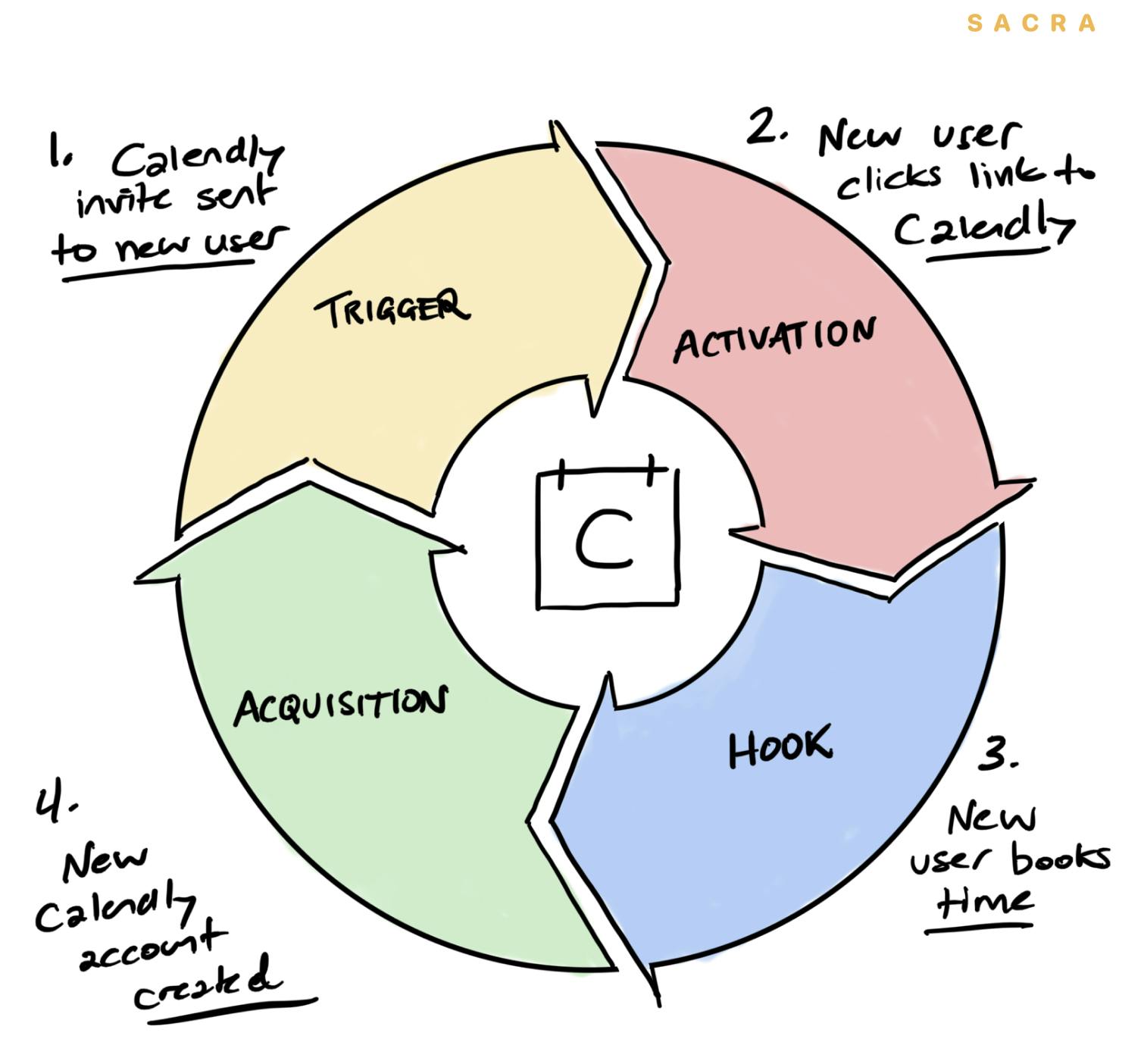

The Calendly growth loop.

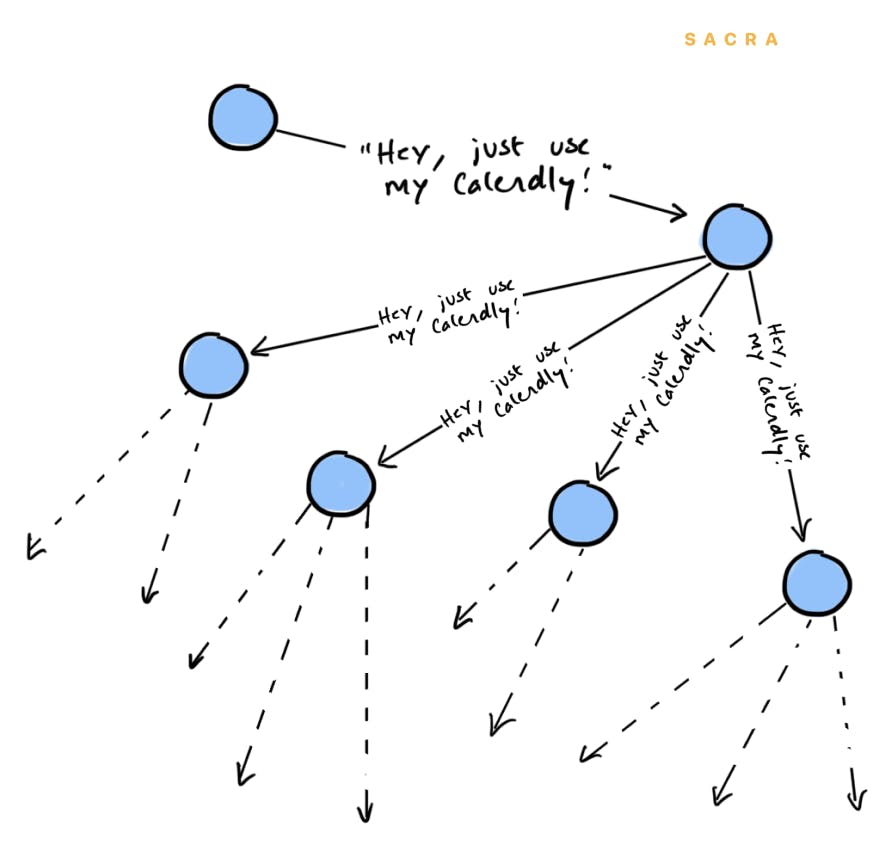

One Calendly user sends an invite to multiple other users, who then go on to do the same.

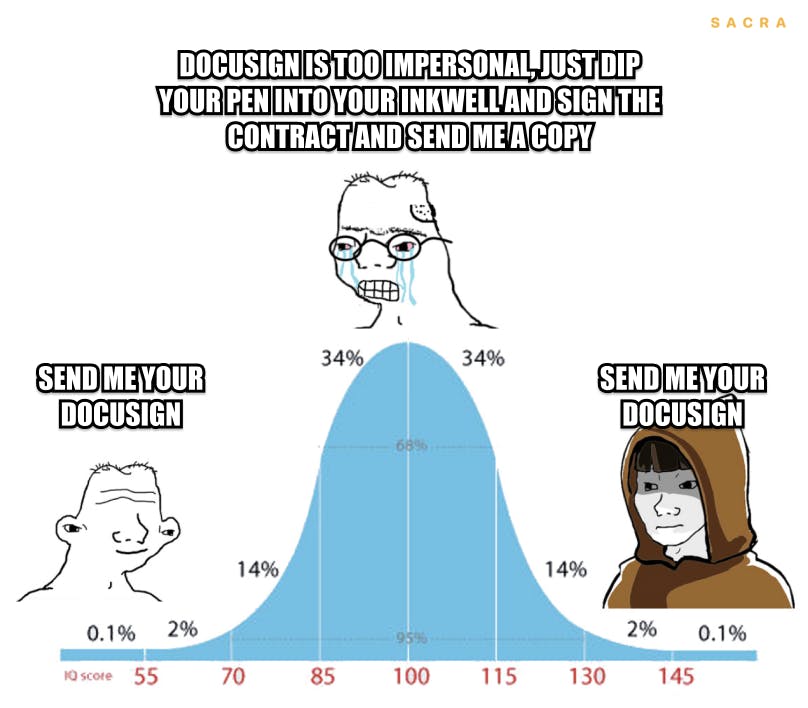

DocuSign’s loop centered around sending documents. When you send a document via DocuSign, it introduces all the recipients of that document to the product. They can see the DocuSign badge. They’re prompted to set up their own accounts to facilitate signing the document, and from there on they’re more likely to use the product when they need an e-signature.

By 2016, DocuSign had 100M users around the world, they owned 70% of the e-signature market, and this growth loop was bringing 130,000 new unique users to the product every day.

In Calendly’s case, you send out a link to your calendar’s availability and then your recipient opens it, sees the Calendly badge, creates an invite through the product, and is reminded again about the product on the confirmation page.

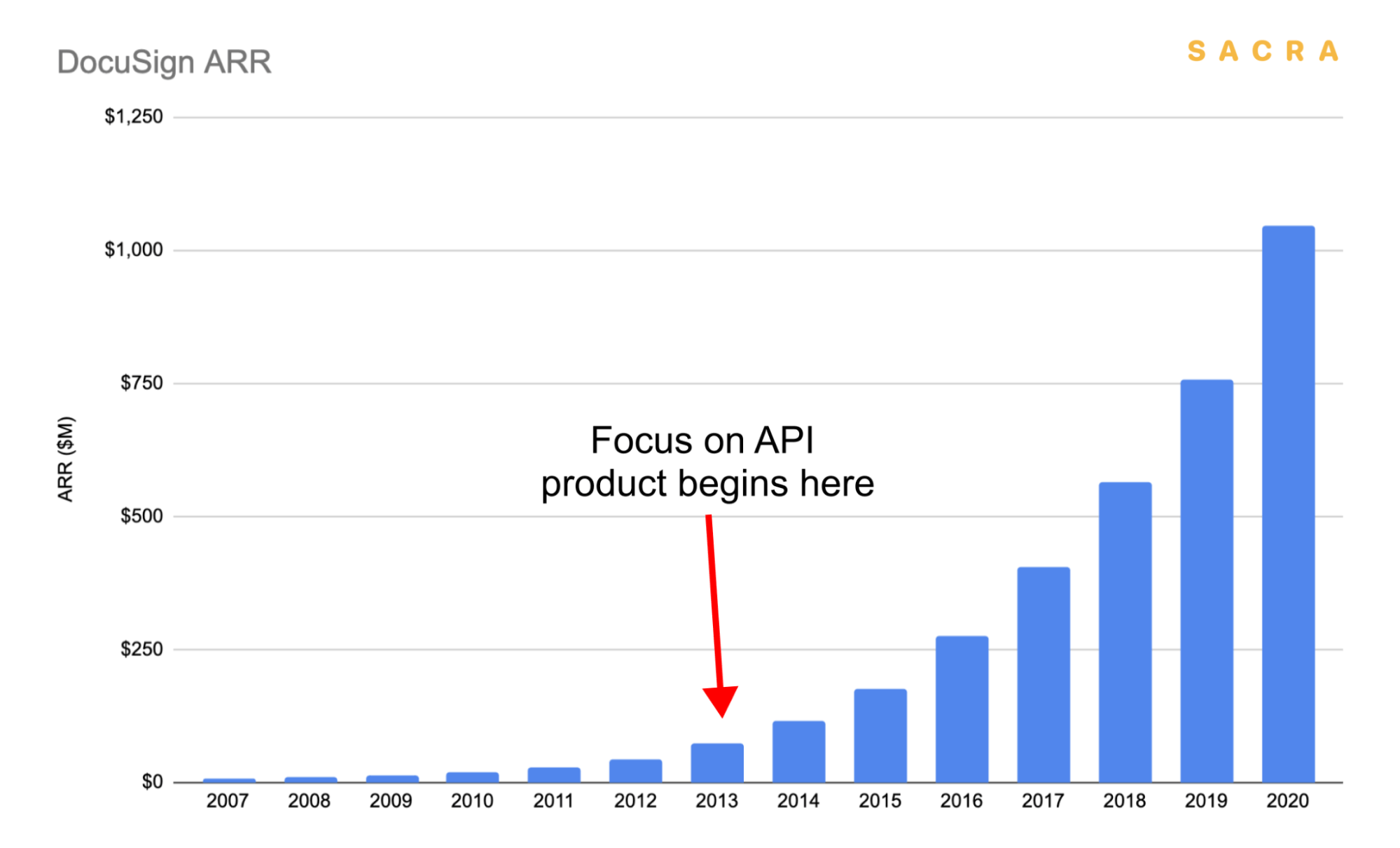

DocuSign grew ARR at just 43% year-over-year through its first ten years—Calendly, once growing at a similar rate, saw heavily acceleration during COVID-19.

When the recipient sees how easy it is to set up your availability and allow others to book time with you through Calendly, they’re more likely to try out the product for themselves. Calendly being free helps this loop work even faster, as does the stickiness of the phrase that has become commonplace: “Just book time on my Calendly.”

Today, Calendly has about 53% market share in the U.S. scheduling market. Click for bigger version.

Thanks to this growth loop, Calendly today has a 50%+ share of the market for scheduling, beating out the Squarespace-owned Acuity Scheduling and a host of other, smaller contenders—most of which were founded before Calendly.

2. Why Calendly’s lack of network effect could be its downfall

While Calendly’s organic growth loop helped it grow and quickly gain a dominant share of the scheduling market, that rapid path to success could also be looked at as a vulnerability.

Calendly was able to emerge years after the first wave of scheduling apps and shoot to 50%+ market share because the barriers to entry in the market were low and they had a clever growth loop built into their product. But there’s nothing proprietary about that loop, and no real network effects in the product—and few barriers to entry to stop another company from replicating Calendly’s path to success.

Calendly’s competitors tend to focus on a single use case—Calendly’s strength is that it has found penetration into all types of scheduling.

The lack of network effect in the product is Calendly’s biggest weakness. If two people want to meet, there’s little-to-no benefit to both of them having a Calendly account. Only the person sending the invite needs to have one. This means that Calendly’s user retention depends entirely on the strength of their brand and their product experience.

The silver lining is that none of the other dedicated scheduling tools like Calendly—Calendar.com, Setmore, TimeTrade, etc.—have developed compelling network effects either, and in comparison to those tools, Calendly has the edge on awareness, feature differentiation, and product.

Still, there is a risk that one of them could create a product around scheduling that does develop network effects—for example, by capturing the consumer use case that’s been difficult for Calendly to crack due to the transactional nature of the product. These other companies could also pose a threat to Calendly on price and feature differentiation.

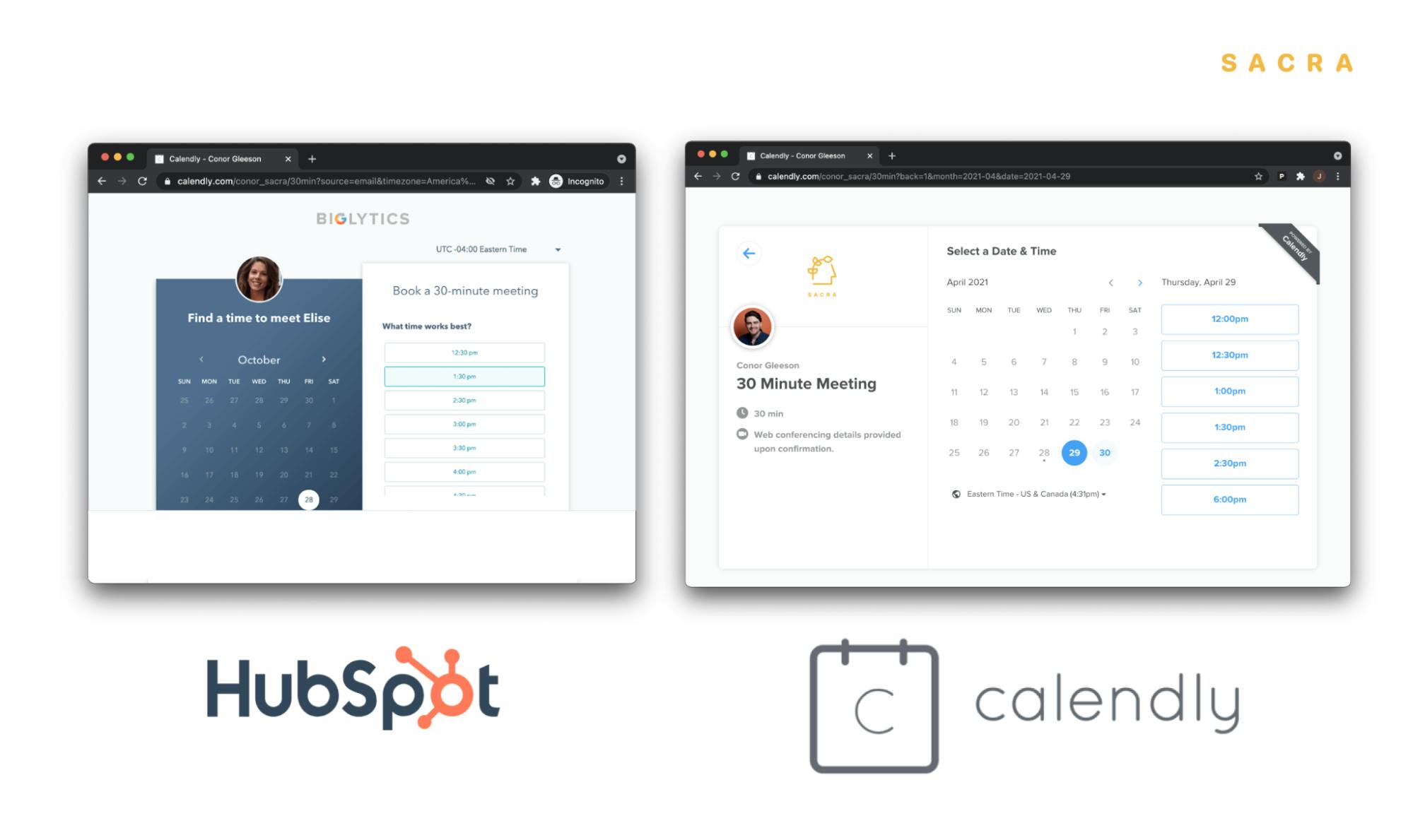

The other big competition for Calendly is sales and marketing suites like HubSpot, Freshworks and Drift.

These are competitive because they are aimed at the same kinds of customers that Calendly’s premium plans are for. All have their own scheduling tools that do what Calendly does—provide workflows around scheduling for sales, marketing, success and recruiting use cases.

HubSpot’s scheduling tool is effectively a Calendly clone.

Because tools like HubSpot and Drift bundle their scheduling workflows into their suite versus selling it as a stand-alone product, they also have the advantage of being able to offer it for free.

While Calendly cannot offer its more advanced workflows for free, it does have three core advantages: its product experience and UX, its broad base of existing users, and its organic growth loop that allows it to “land” in organizations cheaply.

Ultimately, while companies like HubSpot and Drift may be able to give away their own scheduling product for free, Calendly is working on doing the inverse—giving away the sales and success workflows that HubSpot and Drift sell to their customers.

With features like Stripe and Salesforce integrations, embeds, triggered events, pooled team availability, group events, customizable event notifications and reminders and metrics and reporting, Calendly is quietly building a tool that is not just for setting up calls with prospective customers but actively managing and improving a sales pipeline, and not just for scheduling calls with new users but for actively nurturing and onboarding to maximize retention.

They are getting deeper and deeper into HubSpot and Drift’s territory—sales, success, marketing and recruiting workflows—via these kinds of vertical-specific features and 3rd-party integrations.

And because Calendly is free and can land in organizations cheaply, it’s less heavy lifting for their sales team to get companies paying for the product’s more advanced workflows—it already has buy-in in many teams from its dominance of the scheduling market.

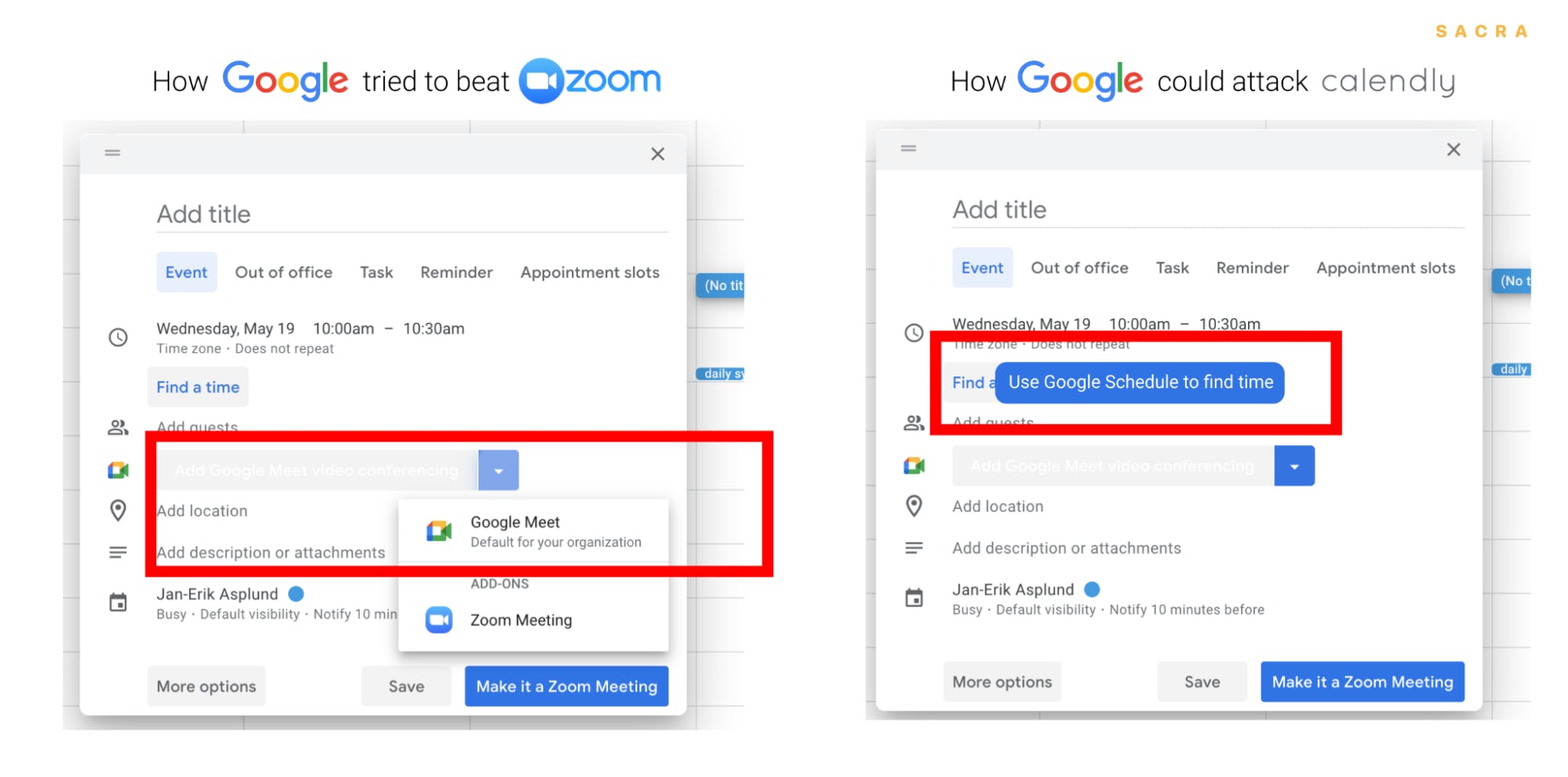

There is also the possibility that Google and Microsoft Outlook—who run the infrastructure below the majority of calendars managed on Calendly—could choose to enter this market if it gets to the point that it looks big enough that winning would be worth it.

Google Calendar defaults to Google Meet when you try to add a video conferencing call to an event—a setting which can only be turned off by your GSuite administrator.

They’d also have the advantage of using their already-ubiquitous products as distribution here—witness how Google tried to beat Zoom (and its popular Google Calendar Chrome extension) by auto-generating Hangout links for new Calendar invites and forcing users to take an extra click to embed a Zoom link.

That said, Google’s experience here is just the latest example of why going “up the stack” and building a compelling product with consumer appeal is much easier said than done.

3. How Calendly can integrate backwards to become the DocuSign of scheduling

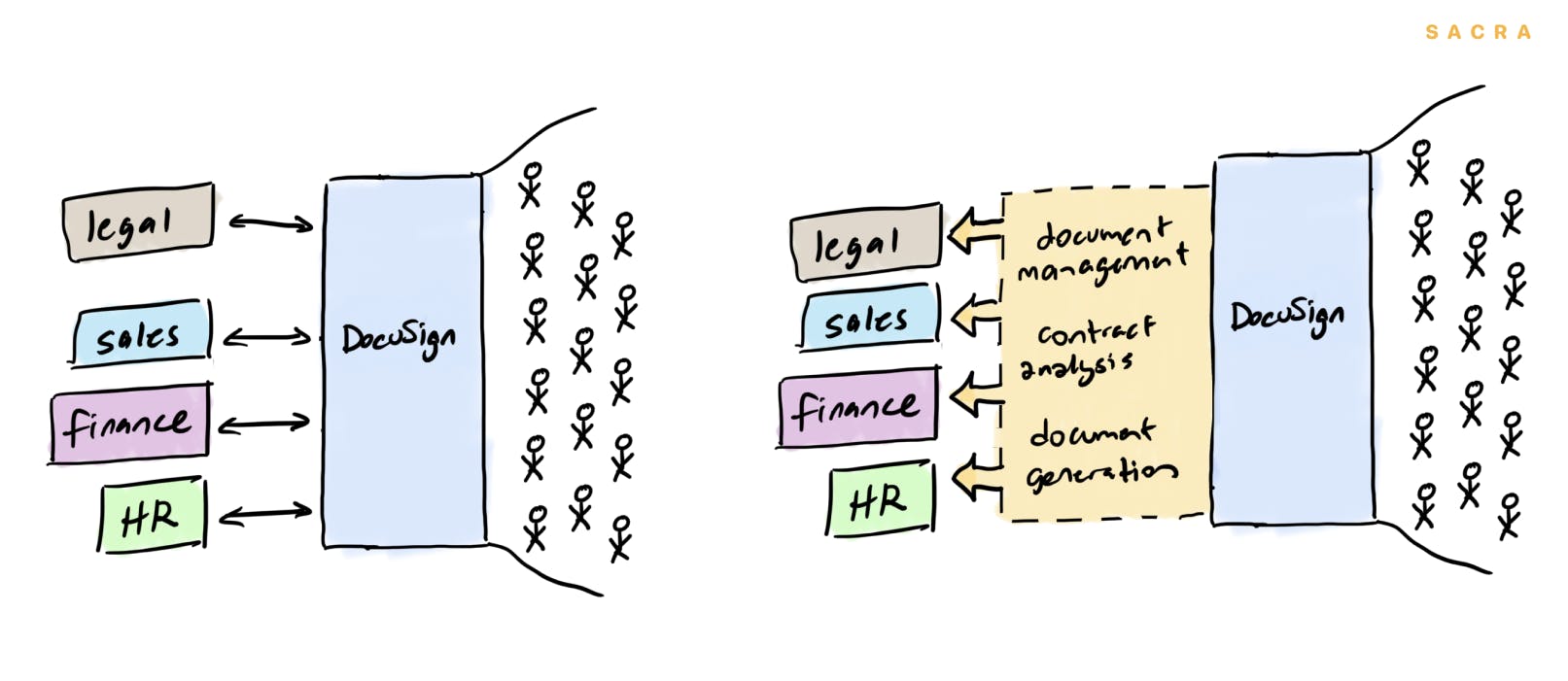

Like Calendly, DocuSign started off as a product with no network effect and therefore low switching cost. It was able to grow to $100M ARR despite that vulnerability on the strength of its web and mobile e-signature products. But moving “backwards” into the much more valuable world of enterprise contracting workflows is how they built a huge, $1B+ ARR business. And today, Calendly has a parallel opportunity.

DocuSign went from helping its customers get documents signed to offering solutions all throughout the process of managing documents.

E-signatures was a hugely powerful atomic unit for DocuSign because of how it digitizes trust. The e-signature is the ultimate stamp of authenticity on business transactions both big and small, and owning it (with 70% of the market) gave DocuSign line of sight into a variety of other adjacent use cases around trust. They announced a focus on building out their API in 2014, worked on solutions for document management, contract analysis, and document generation, and sold those into the enterprise.

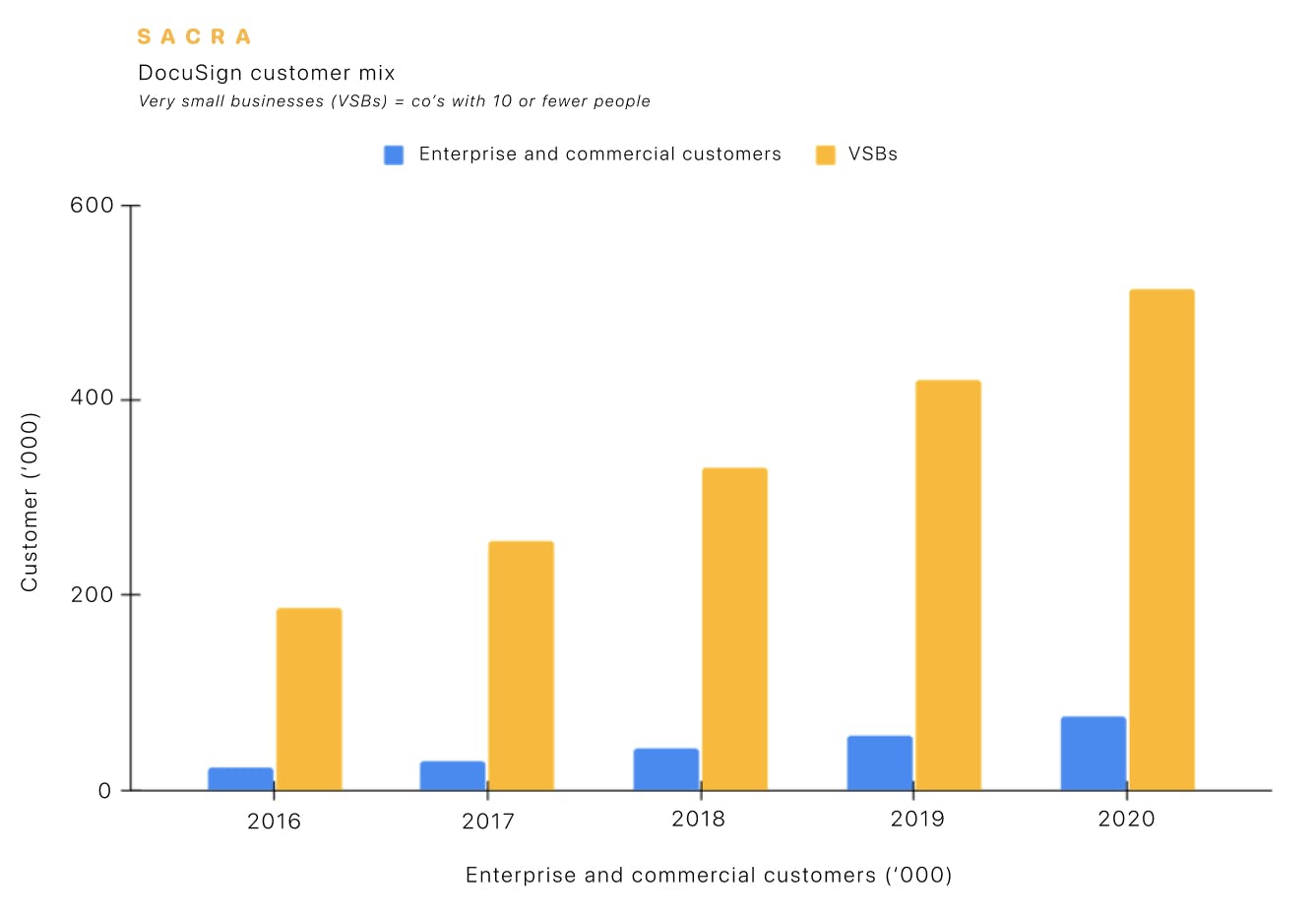

Today, enterprise and SMB customers represent less than 13% of DocuSign’s customer base: 87% are very small businesses of less than 10 employees.

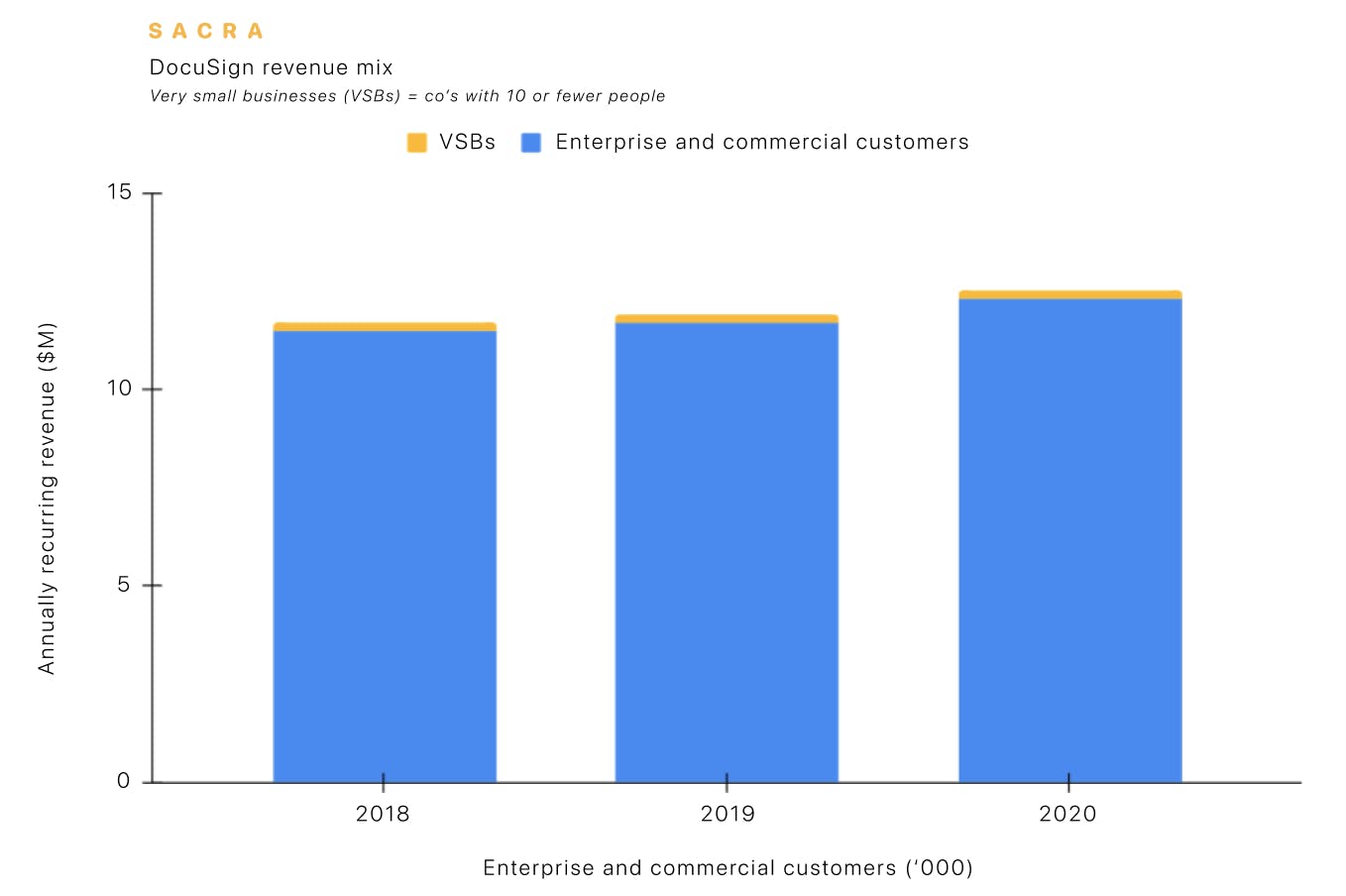

88% of DocuSign’s revenue comes from enterprise and commercial customers, however, and only 11% from VSBs.

Today, while small agencies and firms of fewer than 10 people (the kinds of customers who continue to widely distribute DocuSigns to new people and continue to drive the growth loop) represent 87% of DocuSign’s total customer base and bring in $124M ARR, enterprise and commercial customers are a much bigger market for DocuSign, at $922M ARR.

Calendly represents a critical conduit between users and customers.

Today, Calendly has a similar opportunity to leverage the atomic unit of the meeting—a stamp on the customer relationship the way the e-signature is a stamp on the transaction—to integrate backwards and build solutions for the various sender-and-receiver use cases their product serves today.

Calendly is already integrating backwards into their product’s different markets with their pro and premium features.

The size of the opportunity here, like with DocuSign, will likely take time to be obvious. The fact that total revenue from e-signatures was just $1M in total in 2006—three years after DocuSign was founded—made it very hard for some to see it as a potentially high-growth business. But as the product found adoption and e-signatures became commonplace, the market grew. By 2010, it was $30M. By 2014, it had hit $250M, and by 2018, it was $1B.

DocuSign’s growth took off around the same time the company announced it was focusing on its API products.

What people missed along the way was that DocuSign’s TAM wasn’t e-signatures: it was all of the efficiency improvements DocuSign could drive inside organizations when the atomic unit of trust—the contract—was digitized. And managing document workflows, analyzing agreements and generating contracts turned out to be a much larger business than e-signatures alone.

As time is digitized, it becomes increasingly transactional—and for some, sending a Calendly link approaches rudeness.

The “moral outrage” around Calendly is really a repeat of what happened when DocuSign first took off.

By integrating into the other tools in the enterprise contracting stack via their API and moving backwards into deeper workflows as a result, DocuSign was able to drive far higher revenues from an enterprise customer base, they brought their net dollar retention rate to 115%, and they found significantly expanded pricing power—factors pivotal in growing to $1B ARR and beyond.

Calendly, like DocuSign, has the opportunity not just to solve one delimited problem (scheduling) but to move backwards into a set of highly valuable workflows around sales, success, marketing and recruiting.

DocuSign’s deeper integration into enterprise workflows drives higher ARPU.

Like DocuSign, Calendly is a key touchpoint for companies, and part of an extremely valuable set of processes inside an organization—arranging to meet with a customer, negotiating a deal, closing, and booking revenue. Where DocuSign used e-signatures as a wedge, Calendly uses scheduling as a wedge.

Because so much of the work of sales and marketing and success and recruiting goes through Calendly, there are many places where Calendly can “move backwards” and add value to the teams using it: automatically scoring leads as meetings are arranged, for example, or providing a potential hire with information about the company from within the Calendly event.

In doing so, Calendly both expands their TAM and drives higher ARPU, because solving workflow problems in sales and success and marketing and recruiting—like DocuSign did with contracts—means Calendly can charge higher prices. One day, their revenue and customer mix could look more like DocuSign’s—where the original wedge of scheduling drives a large amount of usage and helps along the product’s viral growth loop, but the lion’s share of the revenue comes from enterprise solutions.

The future of Calendly

Calendly has built a very valuable business in a market few people believed would be so valuable.

The fact that they hit $60M ARR and 10 million users before raising any more than $550,000 makes their story even more impressive.

Today, Calendly is doing $85M ARR. The product is synonymous with scheduling and has a dominant position in its market. Over the next few years, we’re likely to see Calendly’s ambitions grow even bigger, and like DocuSign did, Calendly may end up turning its small, “just a feature”-type use case into a much bigger company than anyone might have expected.

Appendix

Disclaimers

- Sacra has not received compensation from the company that is the subject of the research report.

- Sacra generally does not take steps to independently verify the accuracy or completeness of this information, other than by speaking with representatives of the company when possible.

- This report contains forward-looking statements regarding the companies reviewed as part of this report that are based on beliefs and assumptions and on information currently available to us during the preparation of this report. In some cases, you can identify forward-looking statements by the following words: “will,” “expect,” “would,” “intend,” “believe,” or other comparable terminology. Forward-looking statements in this document include, but are not limited to, statements about future financial performance, business plans, market opportunities and beliefs and company objectives for future operations. These statements involve risks, uncertainties, assumptions and other factors that may cause actual results or performance to be materially different. We cannot assure you that any forward-looking statements contained in this report will prove to be accurate. These forward-looking statements speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

- This report contains revenue and valuation models regarding the companies reviewed as part of this report that are based on beliefs and assumptions on information currently available to us during the preparation of this report. These models may take into account a number of factors including, but not limited to, any one or more of the following: (i) general interest rate and market conditions; (ii) macroeconomic and/or deal-specific credit fundamentals; (iii) valuations of other financial instruments which may be comparable in terms of rating, structure, maturity and/or covenant protection; (iv) investor opinions about the respective deal parties; (v) size of the transaction; (vi) cash flow projections, which in turn are based on assumptions about certain parameters that include, but are not limited to, default, recovery, prepayment and reinvestment rates; (vii) administrator reports, asset manager estimates, broker quotations and/or trustee reports, and (viii) comparable trades, where observable. Sacra’s view of these factors and assumptions may differ from other parties, and part of the valuation process may include the use of proprietary models. To the extent permitted by law, Sacra expressly disclaims any responsibility for or liability (including, without limitation liability for any direct, punitive, incidental or consequential loss or damage, any act of negligence or breach of any warranty) relating to (i) the accuracy of any models, market data input into such models or estimates used in deriving the report, (ii) any errors or omissions in computing or disseminating the report, (iii) any changes in market factors or conditions or any circumstances beyond Sacra’s control and (iv) any uses to which the report is put.

- This research report is not investment advice, and is not a recommendation or suggestion that any person or entity should buy the securities of the company that is the subject of the research report. Sacra does not provide investment, legal, tax or accounting advice, Sacra is not acting as your investment adviser, and does not express any opinion or recommendation whatsoever as to whether you should buy the securities that are the subject of the report. This research report reflects the views of Sacra, and the report is not tailored to the investment situation or needs of any particular investor or group of investors. Each investor considering an investment in the company that is the subject of this research report must make its own investment decision. Sacra is not an investment adviser, and has no fiduciary or other duty to any recipient of the report. Sacra’s sole business is to prepare and sell its research reports.

- Sacra is not registered as an investment adviser, as a broker-dealer, or in any similar capacity with any federal or state regulator.