Revenue

Sacra estimates Calendly hit $270M in annual recurring revenue (ARR) at the end of 2023, up approximately 46% year-over-year from $185M ARR at the end of 2022.

Calendly's growth accelerated significantly during the COVID-19 pandemic, with monthly growth rates reaching 5-6% in 2020. This propelled revenues from $60M ARR in November 2020 to $70M ARR by year-end 2020, and then to $85M ARR by early 2021.

The company has achieved this growth with remarkable capital efficiency. Before raising a $350M Series B round in 2021, Calendly had raised just $550K in seed funding, resulting in an ARR-to-funding multiple of 109x at ARR of $60M. This places Calendly among capital-efficient success stories like Atlassian and Zapier.

Valuation

Calendly reached a $3 billion valuation in January 2021 through a Series B funding round led by OpenView Venture Partners and ICONIQ Capital. Based on 2021 revenue of $125M and that $3B valuation, Calendly traded at a 24x revenue multiple. The company has raised a total of $350.6M across major funding rounds. The January 2021 Series B was the company's last significant fundraise, with OpenView Venture Partners and ICONIQ Capital as lead investors.

Product

Calendly (founded 2013) replaced the traditional email back-and-forth around scheduling meetings with a shareable link that displays the sender's availability and allows recipients to book a time slot directly,

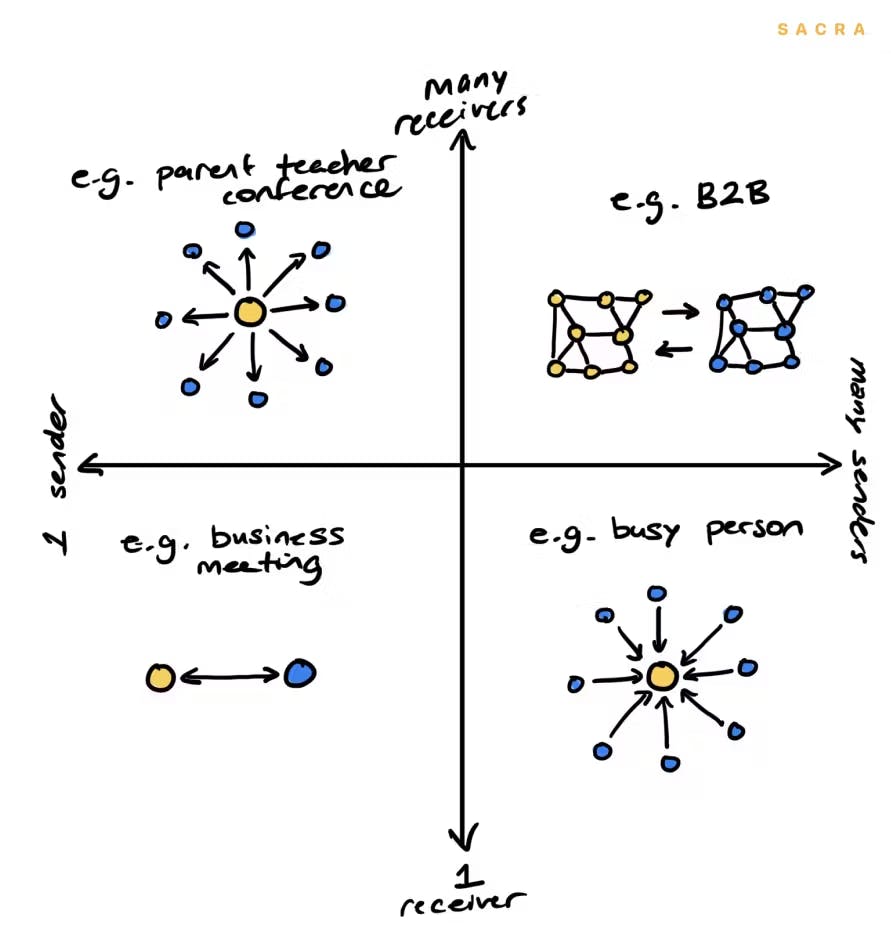

Calendly was founded by Tope Awotona, finding initial product-market fit with teachers scheduling parent-teacher conferences.

The "1-sender-many-receivers" use case allowed teachers to broadcast a single link with live-updating availability, from which parents could choose time slots. Calendly then expanded to "1-sender-1-receiver" and "many-senders-many-receivers" use cases in sales, marketing, and customer success. This shift drove rapid revenue growth: $100K ARR by end of 2014, $1M ARR by end of 2015, and $4.1M ARR by end of 2016.

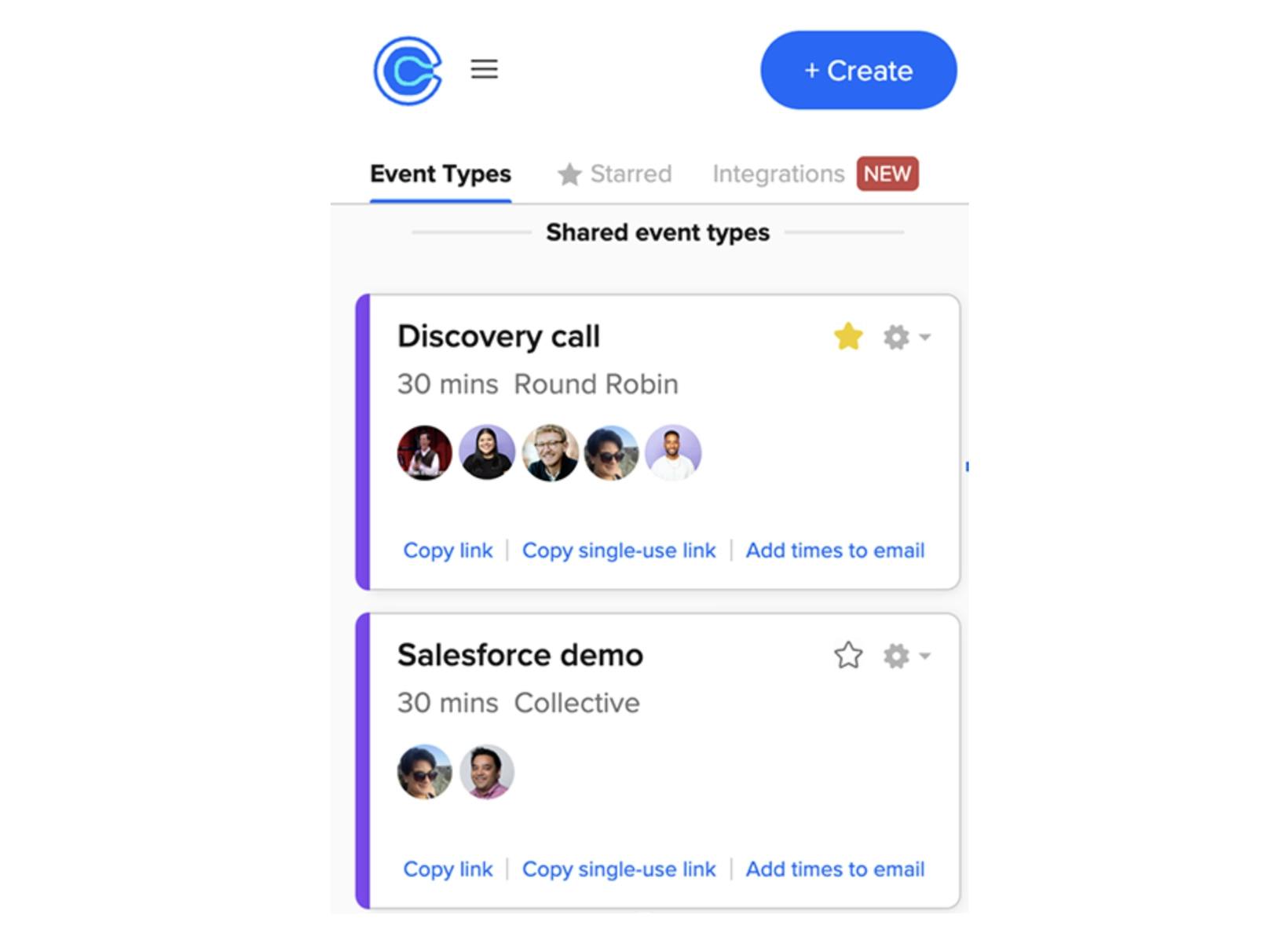

The core product allows users to sync their external calendars and generate a shareable link displaying their availability. Recipients can select a time slot, and Calendly automatically generates calendar invites for both parties. Key features include:

1. Customizable availability settings

2. Integration with popular calendar services (Google, Outlook, etc.)

3. Automated reminders and follow-ups

4. Team scheduling options

5. Integrations with tools like Zoom, Stripe, and Salesforce

Business Model

Calendly is a subscription-based SaaS company that revolutionizes the scheduling process for businesses and individuals. The company's core offering is a user-friendly platform that allows users to share their availability and automate the scheduling of meetings, eliminating the back-and-forth typically associated with finding mutually convenient times.

Calendly's revenue model is primarily based on tiered subscription plans. The company offers a free basic plan to attract users and drive adoption, while monetizing through premium features in its paid plans. These plans are priced on a per-user, per-month basis, with discounts for annual commitments. The paid tiers offer increasingly sophisticated features such as integrations with other software, customization options, and advanced team scheduling capabilities.

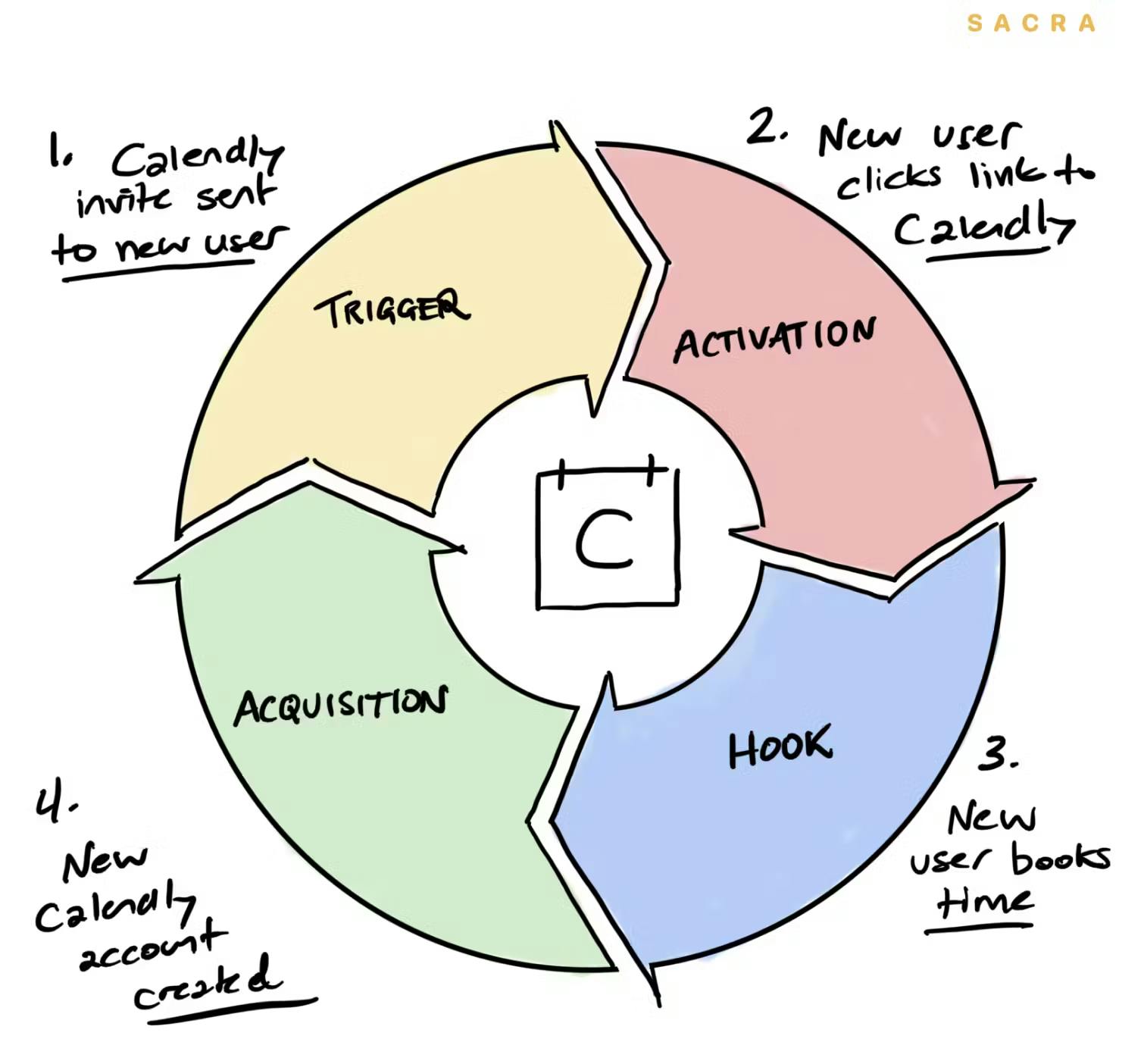

Calendly's viral invite-based acquisition loop, where recipients see the Calendly badge when booking, fueled user growth to 10M+ users and 53% U.S. market share by 2021. The company has since expanded its enterprise offerings, focusing on security, compliance, and procurement flexibility to serve larger organizations.

With the launch of their Enterprise plan in 2023, Calendly is capitalizing on its strong bottom-up adoption in large organizations—with users in 86% of Fortune 500 companies—by giving big companies the ability to manage, synchronize, and secure the myriad individual accounts that proliferate in product-led growth strategies.

Competition

Calendly competes in the scheduling software market across several categories:

Dedicated Scheduling Platforms

Calendly's primary competition comes from dedicated online scheduling platforms. Key players include Acuity Scheduling (owned by Squarespace), Doodle, and YouCanBook.me. These platforms offer similar core functionality to Calendly, allowing users to share availability and book meetings efficiently.

Calendly differentiates itself through its sleek user interface, extensive integrations, and viral growth loop. When a Calendly user sends an invite, recipients are exposed to the product, driving organic adoption. This has helped Calendly capture an estimated 53% market share in the U.S. scheduling market.

However, Calendly lacks strong network effects, as there's little benefit to both parties in a meeting having Calendly accounts. This leaves Calendly vulnerable to competitors who could potentially replicate its growth tactics or develop network effects of their own.

CRMs

Calendly increasingly competes with larger CRM and sales platforms that offer scheduling as part of a broader suite of tools. HubSpot, Salesforce, and Freshworks all provide native scheduling capabilities within their platforms. These companies can offer scheduling features for free or at a low cost as part of their overall package.

Calendly counters this by offering deeper integrations with various business tools and workflows. It's expanding beyond simple scheduling into areas like sales pipeline management, customer onboarding, and analytics. This positions Calendly as a specialized tool that can complement rather than compete with larger CRM platforms.

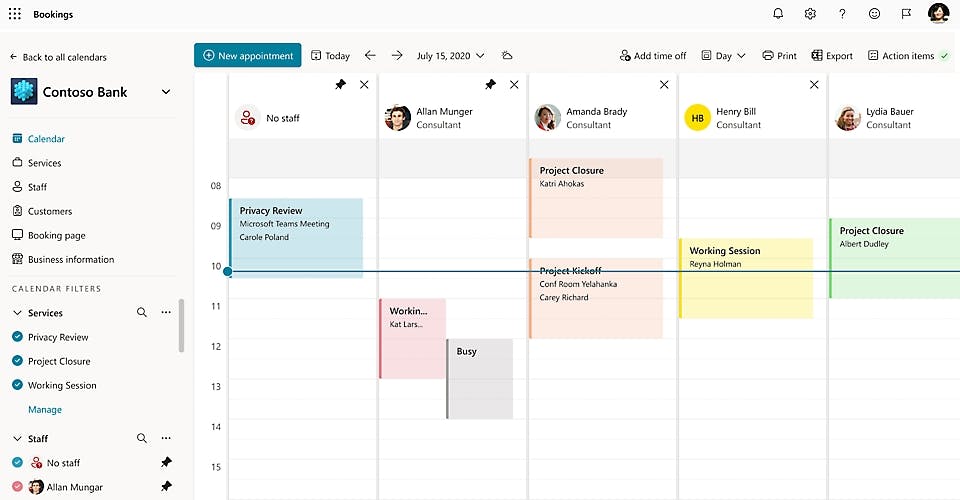

Google/Microsoft

Google (with Calendar) and Microsoft (with Bookings) are weaponizing their bundlenomics and existing usage of GSuite and Office 365 to go after Calendly’s product-market fit among prosumers and SMB/mid-market companies.

Calendly's advantage here lies in its focus and product depth. It offers a range of features tailored to specific use cases like sales, recruiting, and customer success that go beyond basic scheduling. Calendly's integrations with both Google and Microsoft calendars also help mitigate this risk by positioning it as a value-add rather than a direct competitor.

TAM Expansion

The COVID-19 pandemic accelerated the adoption of remote and hybrid work models, leading to a surge in virtual meetings and the need for efficient scheduling solutions. This trend is likely to persist, with many companies embracing flexible work arrangements long-term.

Calendly has a few other key areas for expansion:

Meeting Lifecycle Management

While Calendly has established itself as a leader in scheduling automation, there is significant potential to expand into the broader meeting lifecycle management space. This adjacent market encompasses pre-meeting preparation, in-meeting productivity tools, and post-meeting follow-up processes.

By developing features such as automated agenda creation, real-time note-taking, action item tracking, and integrated follow-up reminders, Calendly can position itself as a comprehensive solution for maximizing meeting effectiveness. This expansion would not only increase the product's value proposition but also open up new revenue streams through premium offerings targeted at businesses seeking to optimize their meeting practices.

Sales Enablement and Customer Success

Calendly's scheduling technology serves as a natural entry point into the sales enablement and customer success markets. By integrating more deeply with CRM systems and developing specialized features for sales and customer-facing teams, Calendly can become an indispensable tool for managing customer interactions throughout the entire lifecycle.

Potential expansions in this area could include AI-powered meeting analytics to provide insights on customer engagement, automated lead scoring based on scheduling behavior, and customized follow-up sequences triggered by meeting outcomes. These enhancements would position Calendly as a strategic platform for improving sales productivity and customer retention, significantly expanding its total addressable market within enterprise settings.

Risks

1. Lack of Network Effects: Unlike many successful SaaS companies, Calendly's product does not inherently create strong network effects. Only the sender needs a Calendly account, not the recipient. This makes user retention heavily dependent on brand strength and product experience alone. Competitors could potentially replicate Calendly's core functionality and viral growth loop, posing a threat to Calendly's market dominance if they can create stronger network effects or stickier features.

2. Enterprise Suite Competition: As Calendly moves upmarket, it faces increasing competition from comprehensive sales and marketing suites like HubSpot and Salesforce. These platforms offer scheduling as part of a broader ecosystem, potentially limiting Calendly's ability to expand its feature set and upsell customers. Calendly must continue to innovate and differentiate its offering to avoid being seen as just a "feature" that larger platforms can easily replicate.

Funding Rounds

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

|

|

|||||||||

|

|||||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.