Banking-as-a-Service: Monetization, Competition, and Growth in the Fintech Fastlane

Nan Wang

Nan Wang

Market

Banking as a Service (“BaaS”) is still in its infancy. Through our primary research, we understand that most seed to Series B BaaS platforms have a handful of customers and support at most a couple of billion dollars of payment volume. (whereas Marqeta facilitated $60B transaction volume in 2020). Given the recent raise between $40 – 110M, BaaS players have the next 12 – 24 months to build a default platform for anyone who wants to issue cards. The current gap in the market is that no single provider is fast speed to market, easy on pricing and modular.

Product

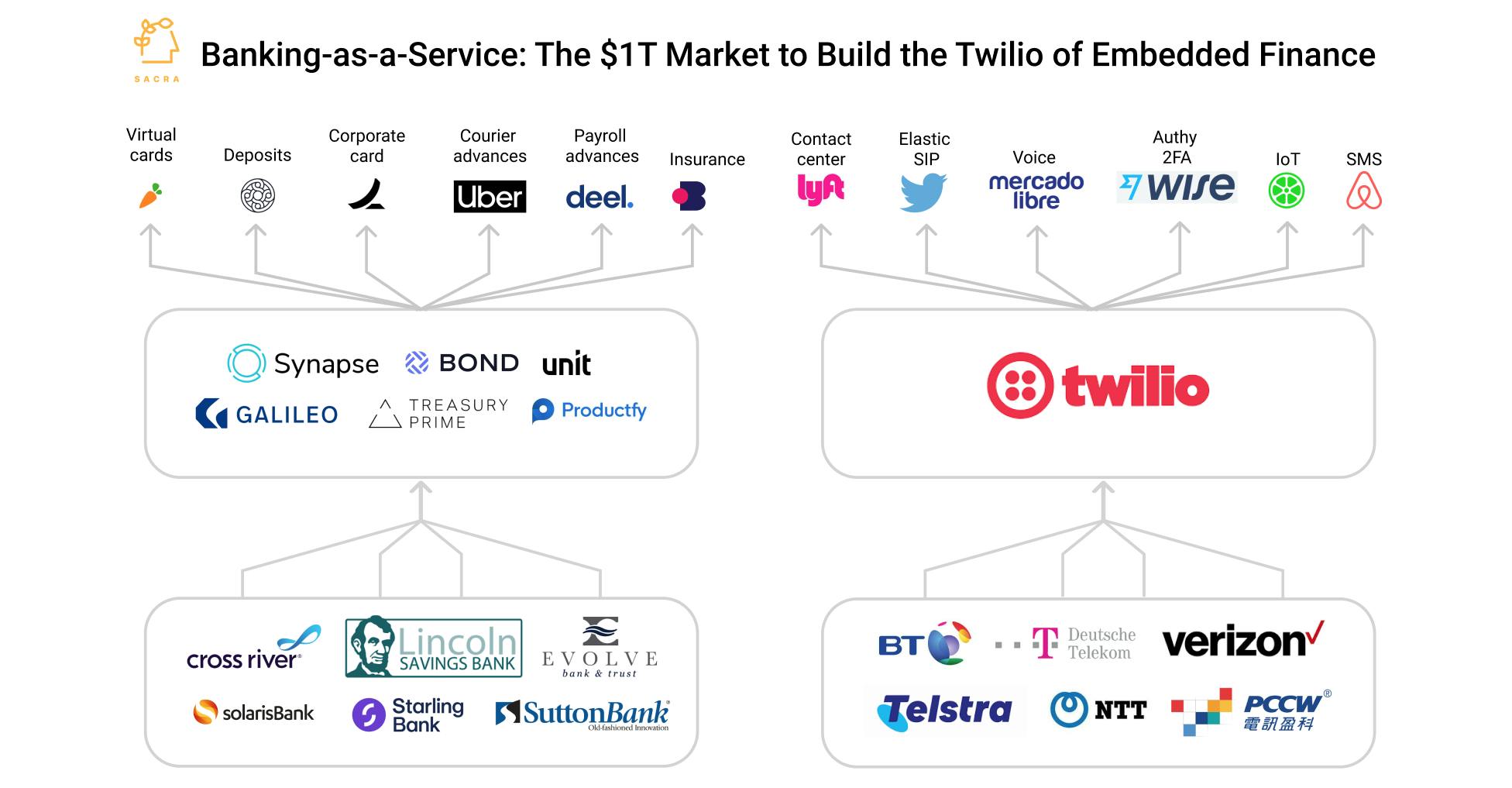

In the past, the only way to issue a card was to become a bank yourself. Now, banking as a service (“BaaS”) platforms make it easier for Fintech (e.g. Chime, Klarna and SoFi) and digital brands (e.g. Walmart, Apple, Uber, DoorDash) to offer financial products.

Sometimes the term issuer processor is used interchangeably as BaaS, but card issuing and processing is only a function within BaaS. BaaS is an abstraction layer over existing banks that aim to be a processor, payment company, lending and cryptocurrency, by aggregating all of them into a single platform. BaaS providers would tell companies what KYC information to capture. They would then provide the underlying banking platform to open up bank accounts, issue a branded physical or virtual card.

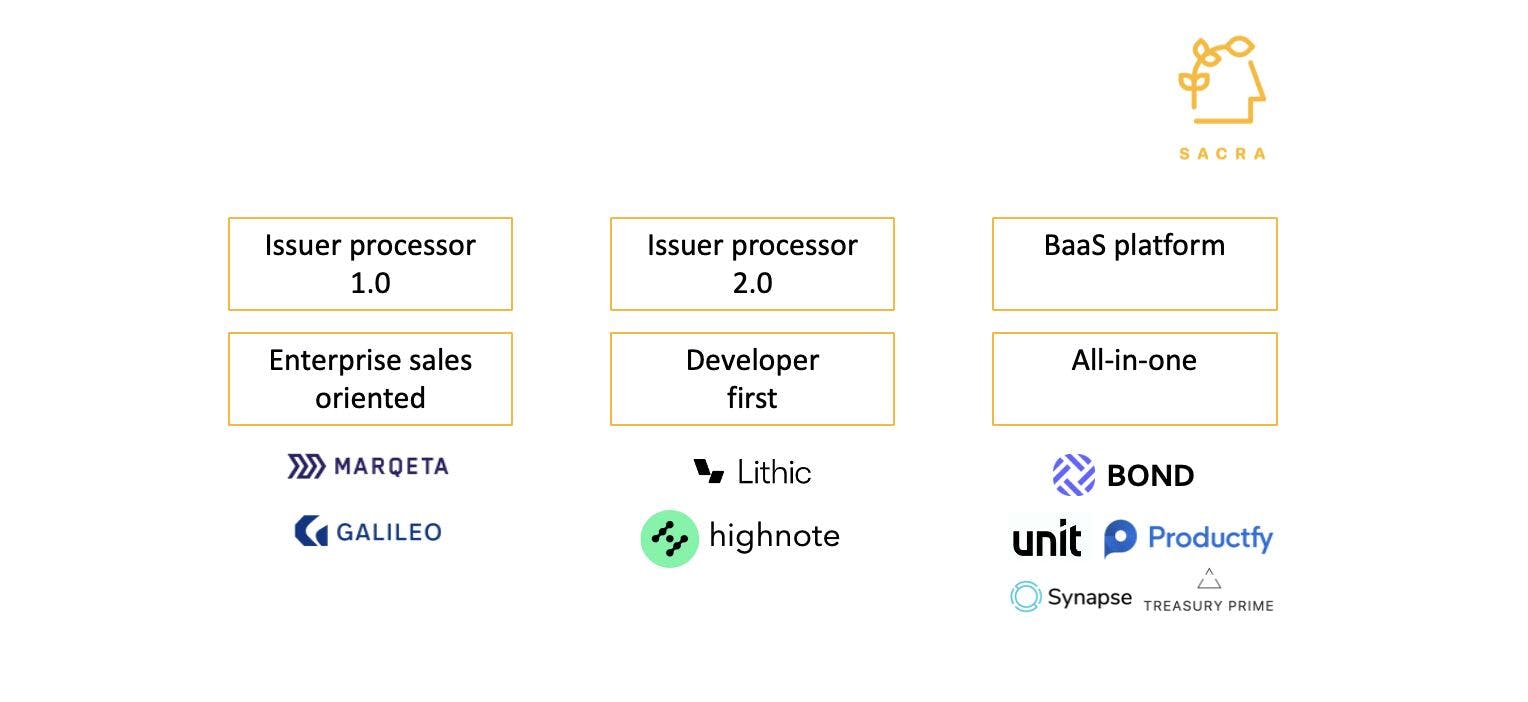

In contrast with legacy payment processors such as, TSYS and First Data (Fiserv), we categorize the current card issuing landscape into three broad buckets.

- Issuer processors 1.0 include Marqeta and Galileo, which provide API-first card issuing and processing.

- Issuer processors 2.0 serve the long tail of developers instead of focusing on enterprise sales, such as Lithic and Highnote (formerly Bay1).

- All-in-one BaaS platforms include Bond, Unit, Productfy, Treasury Prime, Synapse and Synctera. These platforms offer full BaaS features such as technology processes, compliance and operational heavy-lifting. They assemble banking license providers, card networks and third-party issuer processors, e.g. Treasury Prime partners with Alloy for KYC, Bond integrates with i2c for processing. The value proposition is that Fintech and brands can outsource heavy-lifting to the BaaS providers and focus on building their businesses.

BaaS is a design and an architecture challenge at the same time. The hurdle comes down to the technology, the regulations and making the experience as consumer-friendly as possible. The technology is challenging because the platforms have to plug into a bank system that's very old school, with old file feeds and legacy architecture. The BaaS platforms have to translate that into a modern API for FinTech's to build off of.

Monetization

Generally, BaaS platforms monetize through a variety of

- Interchange split per transaction

- Per account fee per month

- Subscription fee

BaaS platforms primarily make money on interchange split based on card usage, in certain verticals with less volume, there could be platform fees on per account per month fees to lock in revenue. The pricing decision is to balance the card spent versus per account per month x no. of users.

Most sponsoring banks for BaaS are Durbin exempted and benefit from a higher interchange. However, this is a source of regulatory risk. Other interchange headwinds include lower revenue share as volume scales and customer concentration risks. Interchange tailwinds include expansion into credit (higher interchange) and better growth in commercial (2.5% B2B vs 1.35% consumer).

Interchange rates vary due to changes in transaction volume type, such as average transaction size, merchant classifications and consumer vs commercial classification.

Broadly speaking, consumer debit interchange is 1.35% and commercial transaction charges 2.5% interchange. Using B2B as an example, to facilitate one transaction,1.5% would go to the FinTech, which leaves 1% for BaaS, the bank, card network and issuing bank to share. Fintech gets the largest portion of the interchange because firstly, they own the consumer relationships; secondly, they bring new deposits that banks wouldn’t otherwise get.

The card network could take 0.5%, which would tier down over time as scale grows. The issuing bank could take 0.2% and trend down too as volume scales up. The program manager might take 0.25%. So in the end, BaaS platforms are running on thin margins until they reach scale.

Competition

BaaS and the issuer processor markets are hotly competitive. Companies compete on developers’ mindshare, customer base and capital raise.

Three things that matter are:

- speed to market: Fintechs and brands prioritize speed when they choose BaaS because Fintechs want to launch products quickly to iterate and control costs. Sponsor banks actually set the upper constraint since banks’ compliance and regulatory requirement determine the speed of approval.

- price: some BaaS pricing structures are hidden in T&C and difficult to understand.

- modularisation / scalability: Fintech/brands do consider how well the BaaS platform would scale as they grow. Does the Fintech/brand need to migrate off the platform eventually because the BaaS has a fully integrated walled garden approach?

The gap in the market currently is that no issuer processor or BaaS platform is fast to market, easy on pricing and scalable.

- Stripe is fast and easy on pricing but they are dogmatic about use case and fund flows, e.g. you can’t bring your own KYC services, or pick your own bank.

- Galileo is modular, i.e. they can work with any bank but their pricing is difficult to understand and they are not fast to market.

- Marqeta sits somewhere in the middle, they are not particularly fast, not particularly easy on pricing but they have built a solid enterprise solution for Square, DoorDash and Klarna to scale.

Growth

It’s likely BaaS sector would sustain high double-digit growth for at least the next 5 years, driven by a mix shift from cash to card, market share gain and TAM expansion from embedded finance.

- Top-line growth: Marqeta saw ~90% 3-year CAGR, benefiting from growth acceleration in its customer base. The near-term addressable payment flows include B2B, consumer spending and payouts. Longer-term payment flows include credit and cross-border payments.

- Market share gain: Instead of using one card for everything, payment behavior could shift to generating multiple virtual cards for each service. It's could enable better expense management and financial planning for companies.

- TAM expansion: When traditional retailers, car dealers and your local basketball team start to embedded finance into their businesses, the TAM for BaaS would expand because the number of potential customers would increase. The use case for traditional retailers is also more vanilla, prepaid/debit card, as opposed to Fintechs, who plan to provide full financial services.

Embedded finance does not use card issuing to make money, but provides automation and richer feature set within the app for better retention. For example, companies can build virtual cards to empower/control spending, or automate workflows and make things easier for the customers. Embedded finance potentially opens a world of multiple cards for multiple apps, served by both all-in-one BaaS platforms and point solutions.

Key questions

- What’s the company’s ability to attract homerun customers? How strong is the technical team and the confidence to scale with payment volume and future use cases? BaaS is a payment business, based on card spent and the success of customers. Partnering with high-quality, fast-growing customers can make a material contribution to revenue.

- How the power dynamics would change as Fintech or brands scale and its impact on interchange split? The degree of variability depends on the use case and is based on contract-by-contract negotiation. There could be some natural tension between Fintech who owns the consumer relationship, and BaaS, who wants to take a cut of interchange.

- How financially healthy are the BaaS customers? E.g. do they compete in the same vertical? Are they aggressively subsidising user acquisition such as volume growth is unsustainable?

- Platform economics. What platform offers the best economics for developers and what enables them to do that?

- Interchange split is a thin margin business so needs a large volume. How to upsell?

- Cost model with the suppliers: BaaS needs to share interchange with card networks, issuing banks and other third-party providers. Who has the most cost-effective supply-side integration and why is it sustainable?