$415M/yr refurbished iPhone marketplace

Jan-Erik Asplund

Jan-Erik Asplund

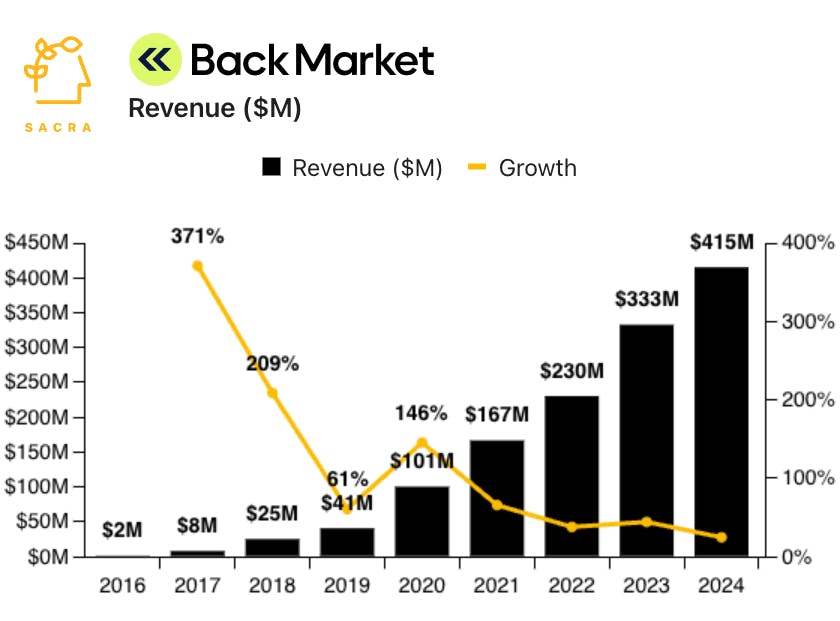

TL;DR: Sacra estimates Back Market grew revenue to $415M in 2024, up 25% YoY. As refurbished smartphone inventory tightens, Back Market is partnering up with OEMs like Sony and carriers like Verizon and Bouygues to expand into new product categories and sell into new markets. For more, check out our full report and dataset on Back Market.

Key points via Sacra AI:

- Founded in 2006, Gazelle ($123M raised, Venrock) hit $100M in revenue by 2013 buying used iPhones, refurbishing them, and re-selling them, but struggled with inventory management—inspiring Back Market’s (2014, $1B raised, Sprints Capital) asset-light marketplace that connects consumers looking to buy used electronics with 2,700 vetted professional refurbishers. Back Market provides refurbishers with a marketplace with access to 15M consumers, customer support, and quality control protocols to help them capitalize on increasing demand for secondhand phones (195M units sold in 2023, up from 56M in 2014) while generating revenue (1) through a 10% commission on all sales and ~$55 monthly fee, and (2) via a 2% commission and ~$0.50 service fee from consumers.

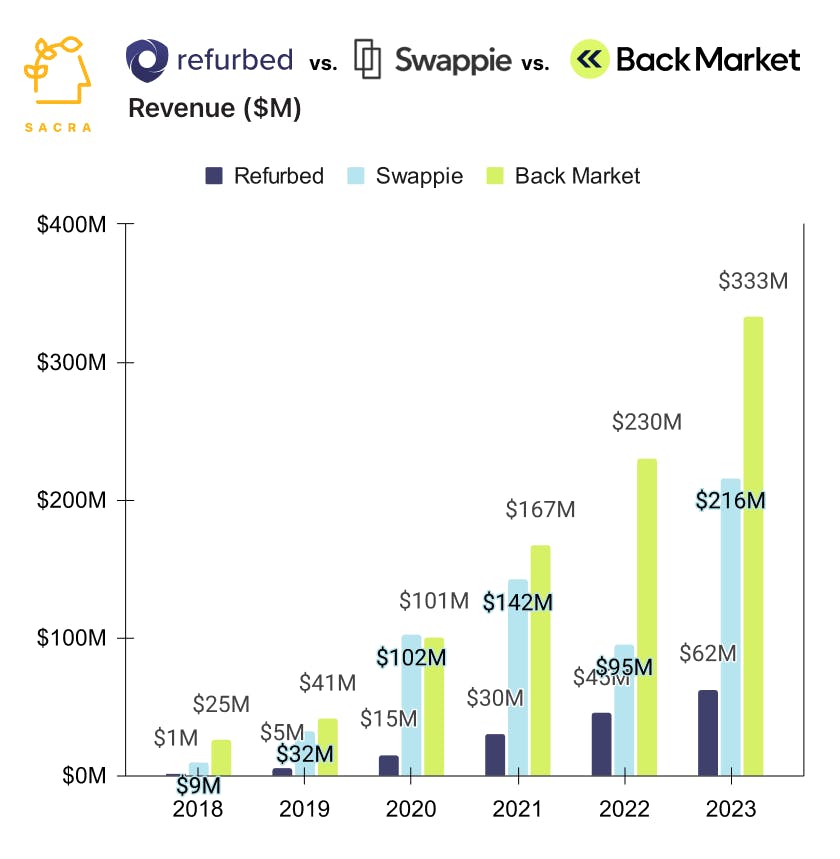

- Sacra estimates that Back Market's revenue grew from $333M in 2023 to a projected $415M in 2024 (25% YoY) off about $2.9B in GMV, outpacing direct competitors like Finland-based Swappie ($216M revenue in 2023) Vienna-based Refurbed ($62M revenue in 2023), and Singapore-based Reebelo ($6.5M revenue in 2022). Smartphones represent ~70% of all goods sold on BackMarket, which generates about 68% of revenue from seller commissions, 14% from consumer fees, and 18% from their growing add-on services business, including insurance, warranties, ads, and revenue share from deals to sell refurbished phones through carriers like Bouygues and Verizon.

- Smartphones are getting more durable with smaller changes in each iteration, extending refresh cycles (40 months) and tightening refurbished inventory, forcing Back Market to (1) push hard into laptops, tablets, gaming consoles and the other ~12 devices owned by the median Western household, and (2) partner with companies like Sony as their exclusive trade-in partner to capture new refurb inventory at the point of checkout online and in brick-and-mortar stores. As US customers hold onto phones for longer, refurbished supply that would be sold into emerging markets is constrained—creating the opportunity for Back Market to expand geographically, with the UK its fastest-growing market as of 2024 and large device markets like Mexico, Brazil, India, Canada, the UAE, and Saudi Arabia still on the roadmap.

For more, check out this other research from our platform:

- Back Market (dataset)

- ManoMano (dataset)

- Bloom & Wild (dataset)

- Andrew Yates, CEO of Promoted.ai, on when marketplaces should layer on ads

- Andrew Yates, CEO of Promoted.ai, on driving marketplace ARPU with personalization

- Ved Sinha, Former VP of Product at Upwork, on gig marketplaces

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplaces

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- Rokt: the $480M/year ad network behind Uber & Lyft