Anthropic at $316M ARR

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: With the launch of Claude 3 Opus, Anthropic has cemented itself alongside OpenAI, Mistral and Google as one of the small handful of LLM companies that matter. For more, check out our reports on Anthropic (dataset) and OpenAI (dataset).

Key points from our research:

- Anthropic positioned itself as the large language model (LLM) for businesses with their mid-2023 update to Claude, adding a 100K token context window (versus the 8K of OpenAI’s GPT-4) so companies could do the now-standard process of RAG plus zero-shot prompting to retrieve proprietary data and inject it into their prompts. Ex-OpenAI employees and effective altruists Dario and Daniela Amodei founded Anthropic in 2021, mimicking the structure of OpenAI with a non-invested “Long-Term Benefit Trust” that sits atop and chooses members of their board.

- With Anthropic’s March launch of Claude 3 Opus, OpenAI’s GPT-4 has competition for its crown as the state of the art LLM for B2B, with Perplexity CEO Aravind Srinivas deeming Opus the best LLM on the market. Claude 3 Opus scored a 84.9% on the HumanEval code generation benchmark and costs $75/million output tokens whereas GPT-4 scored a 67.0% and costs $120/m—Anthropic's faster and cheaper Claude 3 Haiku scored a 75.9% and costs $1.25/m for output whereas GPT-3.5-Turbo scored a 48.1% and costs $1.50/m.

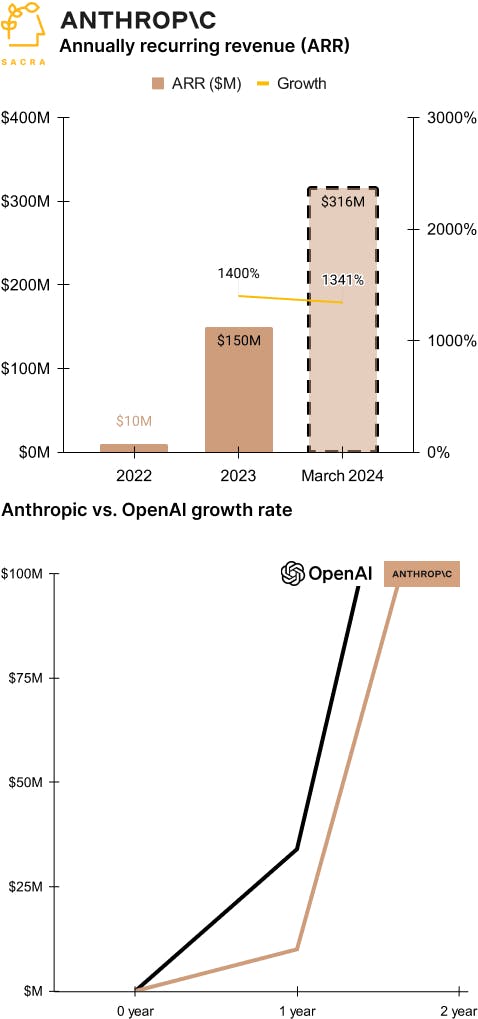

- Sacra estimates that Anthropic is at $316M annual recurring revenue (ARR), up 1,341% year-over-year from $22M ARR in March 2023 with a 61x forward revenue multiple on their last valuation of $18.4B, monetizing like OpenAI both with its developer tools API via usage and offering a prosumer chat experience on subscription. Anthropic is growing at a comparable rate at the same revenue scale to OpenAI, which hit $2B ARR at the end of 2023, up 900% from an estimated $200M at the end of 2022 with a 40x multiple on their $80B valuation.

- Anthropic’s 50-55% gross margins fall short of pure SaaS companies’ median 75% gross margins, but are comparable to the 60% gross margins of AWS with its high infrastructure and compute costs and oligopolistic market structure with competition from Google Cloud Platform and Microsoft Azure driving down prices. Like AWS which launched higher-margin services like Elastic Block Store (~65% gross margins) and data transfers (~80%), Anthropic can use its developer penetration to sell other services that developers need like company-specific training and fine-tuning.

- Between OpenAI, Anthropic, Mistral, and Google (Gemini), there exist now a small handful of companies in the race to divvy up the LLM market and levy the foundational tax of the AI era a la AWS’s tax on compute in the web era. The alignments of the cloud providers are replicating themselves in this LLM race—Microsoft invested ~$13B in OpenAI and has now partnered with Mistral, while Anthropic, after partnering with Google in 2023, now has a $4B deal with Amazon.

For more, check out this other research and follow these companies from our platform:

- OpenAI vs. Anthropic vs. Cohere

- Anthropic (dataset)

- OpenAI (dataset)

- Scale (dataset)

- Hugging Face (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Photoroom (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Cohere

- Copy.ai

- Rembrand

- DataRobot

- OpenAI

- Nyckel

- Perplexity

- Groq

- Truewind

- Midjourney

- Harvey