Anduril: the $342M/year Nintendo of American dynamism

Jan-Erik Asplund

Jan-Erik Asplund

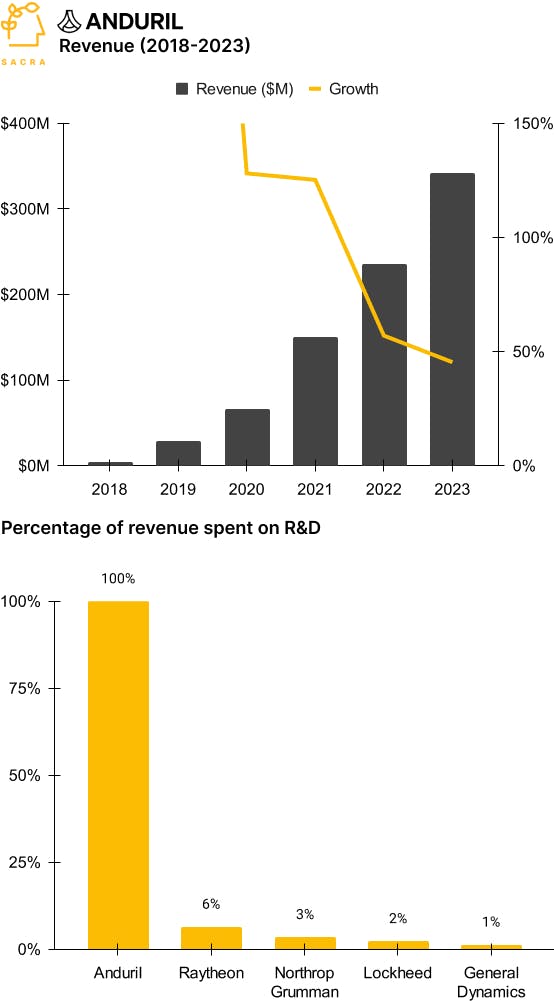

TL;DR: Anduril got to an estimated $342M in revenue in 2023 by repurposing the ML and computer vision tech behind autonomous cars towards national defense. To build the next Lockheed Martin, they’ll have to overcome the government’s moral aversion both to profit margins greater than 15% and the SaaS business model. For more, check out our Anduril report and dataset.

- The mid-2010s rise of DNNs (deep neural networks) that can be trained in hours rather than weeks and run on a single GPU at the edge instead of ~100s enabled the rise of self-driving car programs like Tesla’s Autopilot that need each node in the network to analyze its surroundings and make decisions. After selling Oculus VR to Meta (NASDAQ: META), Palmer Luckey started Anduril (2017), hiring key ML and computer vision engineers away from autonomous driving projects and repurposing their advances towards building border-protecting drones and sentry towers.

- Like SpaceX, Anduril flipped the traditional business model of defense sales—instead of bidding on Department of Defense (DOD) requests for proposals (RFPs), Anduril takes on the R&D costs upfront, selling pre-developed products into the Pentagon and undercutting bigger defense contractors on price. Where traditional defense contracts are cost plus, Anduril’s approach was to build first and then sell, reducing execution risk for their customers and creating a different set of incentives around cutting costs.

- Sacra estimates that Anduril’s revenue hit $236M in 2022 (up 57% from $150M in 2021) in 2022 and is on track for $342M (up 45%) in 2023 for a 25x EV/sales multiple on their market cap of $8.5B. Compare to SpaceX at $4.6B in revenue in 2022, up 100% year-over-year with a 30x EV/sales multiple on a $137B market cap, Lockheed Martin (NYSE: LMT) at $66B (down 1.58%) in revenue with a 1.5x multiple on a $100B market cap, and Raytheon (NYSE: RTX) at $67B (up 4.17%) in revenue with a 1.5x multiple on a $100B market cap.

- Anduril’s research-first model puts more capital at risk upfront, with 100%+ of their revenue going to R&D every year since their inception—compare that to public aerospace companies like Lockheed with huge war chests that spend just ~2% of revenue on R&D. In 2021, Anduril spent about 25% of what the top defense contractors spend on R&D while at 0.2% of the revenue scale—like SpaceX, to save money, they’re using off-the-shelf parts wherever possible to cut down on costs.

- The government’s moral aversion to defense contractors making profit poses a risk to Anduril’s stated goal of 40-50% margins—in its case against defense contractor TransDigm (NYSE: TDG), the Office of the Inspector General defined acceptable, “reasonable profit” as being a profit margin below 15%. The Pentagon requested a refund of about $20M from TransDigm, which ultimately agreed to refund the DOD $16M of those “excess profits”.

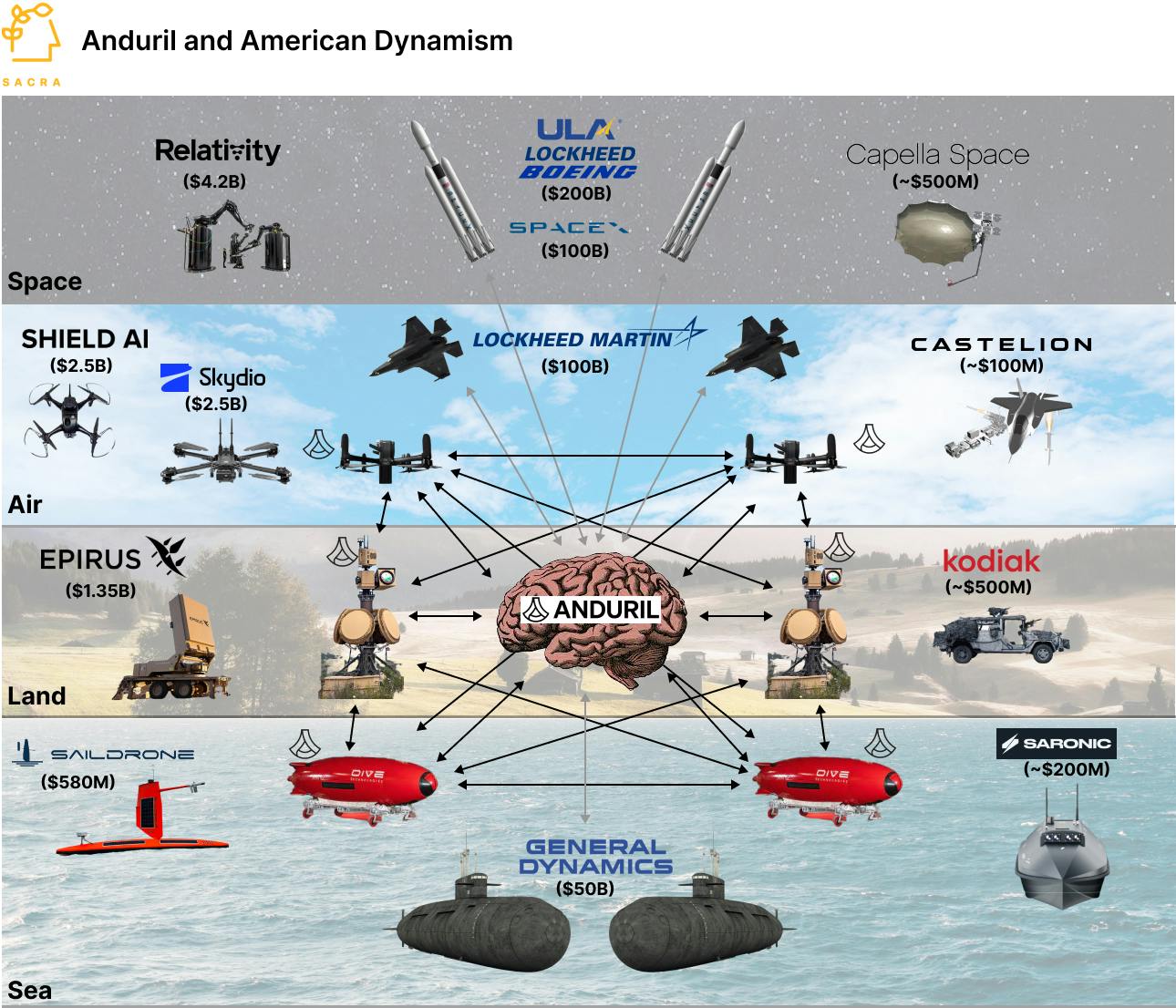

- Anduril’s bottom-up disruption comes from cheap, vertically-integrated hardware and software networks that are more practically useful than costly megaprojects like Lockheed’s $1.7T F-35, ala Nintendo’s strategy for competing against $300M AAA games indexed on graphics. Modern warfare, as evinced by the conflict in Ukraine, is more about this kind of nimble, unmanned, asymmetric battle—not the combined arms of armored vehicles and tanks that was central to American military hegemony in the 20th century.

- Growing global instability and deglobalization across Ukraine, Taiwan and elsewhere is driving an increase in military spending, with the US allocating $727B to the DOD in 2022 and total allied military spend hitting $1T. Anduril further stands to be a massive beneficiary of the reshaping of defense markets around AI, which is poised to be the major conflict modality of the 21st century as nuclear weapons were for the 20th.

For more, check out this other research from our platform: