Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

Jan-Erik Asplund

Jan-Erik Asplund

Background

Ross Fubini is Managing Partner at XYZ Capital. He is also a co-founder and Partner at Village Global. We talked to Ross to get his perspective on the influence of Palantir & Anduril on the defense tech land grab we're seeing today, the split between software and hardware revenue in defense, and where he sees the opportunities to build a generational defense tech company today.

Questions

- You invest in defense, public safety, and data companies that all sell into governments—local or national—as part of their model. Can you talk a bit about your broader thesis around these kinds of investments?

- SpaceX, Palantir, and Anduril have been held up as models for breaking into selling to the government. How do you assess the impact of these companies on the defense sector, and what lessons can new startups learn from their journeys?

- One thing that came up in looking at Anduril was that there's a lot of, not luck exactly, but SpaceX was funded largely by Elon Musk, and Palantir, similarly, had investors who were deeply committed to the vision and maybe weren't as focused as other investors on the return profile or timeline.

- I'd love to drill into what was there in the team? How do you evaluate teams who are building in this space? How important is prior experience with this kind of go-to market sor understanding procurement? Was that big in looking at the original Palantir team?

- You called Anduril a potential n of 1 company. I'm assuming you don't see Anduril facing competition from a comparable company. Why is that? Is that accurate, and why would that be?

- Does it make sense to invest in picks and shovels? Is that a framework that you would use to think about this market now?

- You mentioned this idea that the best product doesn't necessarily win, but the best product is necessary to keep winning. Can you say more about that?

- It seems like there's a lot of companies that we've observed, like you said, that are selling into many different markets. It seems like it would dramatically complicate the go-to market if you're trying to execute on the very difficult practice of selling to the government, dealing with procurement, and at the same time selling into other markets, like oil and gas logistics, which are also more challenging than your typical SaaS sales, obviously. Is that fair to say?

- What do you see for the next few years? As some of these companies try to build the next autonomous submarine, or the next autonomous widget, and as they look to raise, again, from investors, do you see any problems there for companies that need to raise again? Or maybe their investors aren't seeing the kinds of markups that they expected?

- I've been thinking about the hardware focus, it seems like the software side is beginning to happen. Anduril, obviously, has a software platform at the center of everything that they're doing.

- Would you say one of the core problems is the fact that it's hard to sell the government, or DOD, on a recurring subscription? It's just harder to sell them on that than on buying a hardware package.

Interview

You invest in defense, public safety, and data companies that all sell into governments—local or national—as part of their model. Can you talk a bit about your broader thesis around these kinds of investments?

Probably a couple of different dimensions. First of all, it's personal. Basically, I think that if we have better products that exist from our government, whether that's police departments, DOD or the DMV, we have more respect for the government that leads to more fondness, essentially, for society. I'm just interested in those aspects.

The second is just the TAM on that—on all of those categories—is just so massive. There’s both an opportunity to build new things and a way to get paid for it.

With respect to products, there are opportunities in multiple places. I think about them all around their go-to market motion. A simple taxonomy is something, a dual use motion where you're selling to an enterprise, and also separately, to a government sector. So, airspace intelligence—one of our companies is a great example of this—airspace is tremendously impactful selling to large airlines, like United, Delta, Alaska, within that framework. And also, building a business selling over to the federal side.

Another example of that would be Verkada. Verkada is a tremendously large company selling cameras, access control, and security. But they also sell to the federal government and the broader public market. It’s no different than what Cisco does, one of Cisco's largest lines of business is selling to the federal government. So again, that's a go-to-market motion, that's dual use. The second framing is the DOD side.

There, again, it’s about procurement. But there are things that can only be sold into—whether it's US-based DOD, or allies, are you going into a single armed forces? Are you entering through Homeland Security the way that Anduril did years ago?—and that's a different procurement motion.

Broadly speaking, I would then say that there's an “other” category. And “other” for us is usually something that’s built against some regulatory structure, and there's an opportunity to build a business around that regulatory structure. It could be everything from a company like ours, called Chapter, that's a Medicare broker, which is highly dependent on regulatory structure because Medicare goes to market wildly differently. Or, say, Promise, which is technology for financial products that are sold to the state and local governments and utilities. Again, it's rooted in a bunch of regulatory rules about how it operates, and the way that it goes to market is very bespoke to that environment. That's our different groupings, and then they all have risks and respective trade-offs that we can talk about.

SpaceX, Palantir, and Anduril have been held up as models for breaking into selling to the government. How do you assess the impact of these companies on the defense sector, and what lessons can new startups learn from their journeys?

Let's go slow here on two ideas. The first is, why does anyone give a shit about defense now? And why is American dynamism—which Catherine's doing a great story on—doing well?

There's a confluence of things that are happening. One is Anduril's success, and that relates to whether there's actual economic success, polymers, carnival barker-like skills in talking about the success, and Palantir being a public version of that as well. That means, basically, there's money to be made. That’s one ingredient.

The second ingredient, I think, is technologists being excited about working on this stuff. Actually, there's always been technologists, but it's the people in upstate New York, they're building radar systems that you don't think about that are working for time and materials based on primes and subcontractors. Now, it's much more in the core AI infrastructure, and that really can be traced immediately back to the Ukrainian war. That is the switch: We could talk about whether it was post-Trump, but that was the switch, the reminder of there are good people and bad people in the world, and you want to be fighting literally on the sides of angels, in my view.

The third component is the changing nature of war as has been made vivid. It was already happening, actually, in the world, but Ukraine made it blindingly obvious with all the drone activity. And now, very sadly, the wars in the Middle East and Gaza are making it much, much, much more vivid, the changing nature of warfare. It's no longer a projected concern about swarm drones flying over Taiwan, you can see it happening on the battlefield and all the stories about it. So, it's those three things together that made this an exciting time.

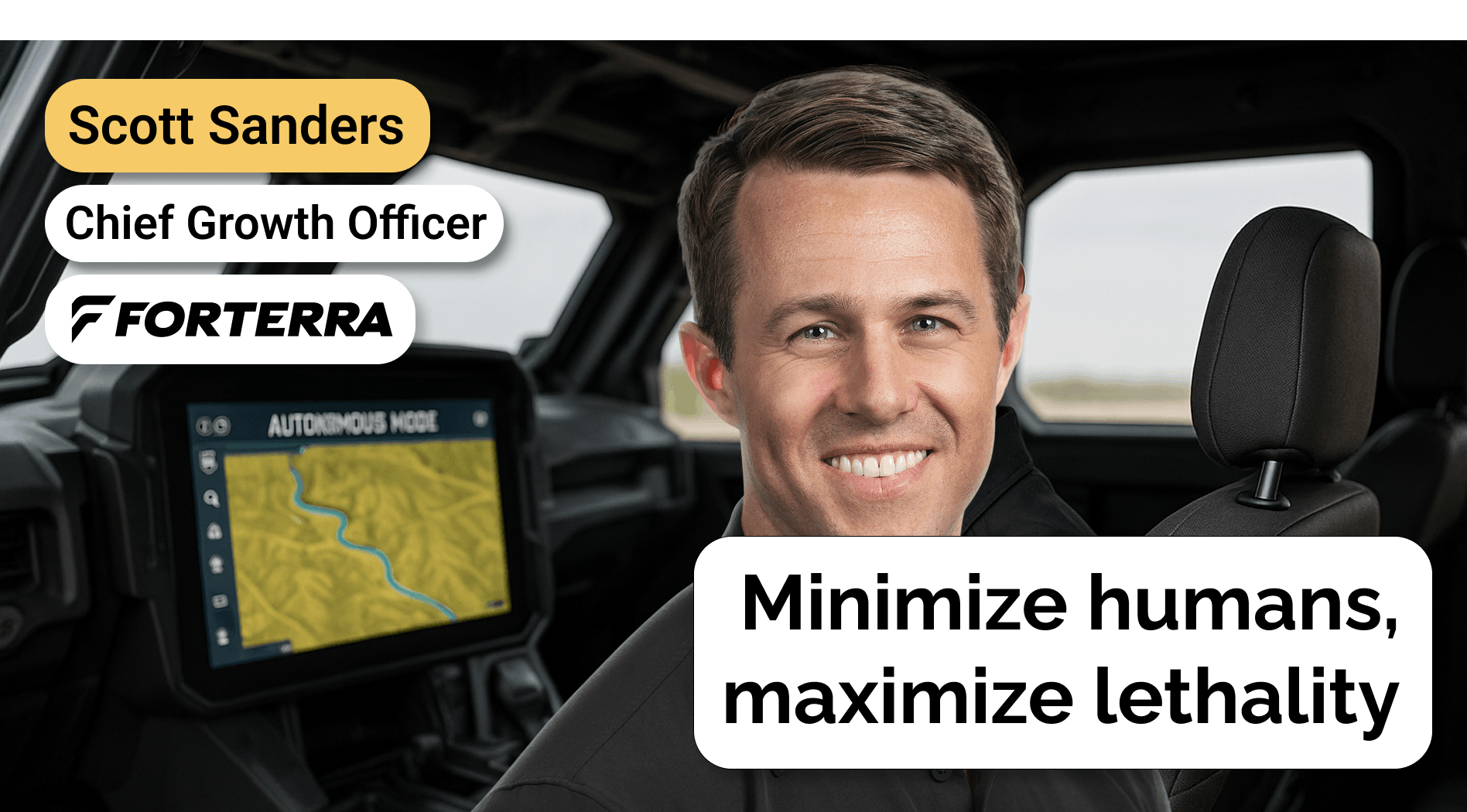

It's funny, who knew that in 2017 Anduril was probably the best investment to do? What's happened is the market has come into this awareness, and that's why there's a lot of excitement that you just talked about, and those things together. The second thing that I heard you talk about was just almost a “why Anduril?” aspect that you'd heard from Scott and others, and I just cannot reiterate how strongly, within DOD—and this is actually true in dual use use cases, or other examples of where you're selling to the government within DOD—just procurement is so hard. So hard.

It's not “a best product wins,” it’s “best product is necessary,” and necessary to keep winning for reasons we can talk about. But the procurement process is so difficult. I'll give you one example to counteract a bias that you and others might have. The bias you might have is that it’s some inside baseball process, some three star general walks a deal in and they're all crooked and dumb. That does happen—that’s mostly not true. It's mostly not true in that there's a lot of good people that are trying to do the right thing, and there's a massive amount of regulations that exist so sketchy things don't happen.

The two things that do happen, and this is the things that are very, very, very difficult, and they're very real. One is that the needs are so often written in a bespoke way that it's very, very, very difficult for someone that isn't doing custom development of hardware and software, to sell a product. And it's the ultimate non-invented here, that their needs are so unique and the whole system is designed to create that phenomena. So, the only solution that can be provided is this very custom solution, so that's a weight.

The second weight in the business is the budgeting cycles are really two years long. So, every enterprise piece of software is either trying to get some predictability, like ‘we land and expand, it's 50K, but eventually they'll pay us a million bucks. It's 10K, but we're going to sell an ocean of it like Atlassian.’ The government just does not work that way, because the meaningful dollars are allocated on two year cycles, and that's when the government's functioning well.

Therefore, these two components mean you have to have a tremendous insight about how to find the problems that are worth solving, to find the requirements for them, build a thing for them and be capitalized to meet that market as it shows up two years later. Right now, because of the first point, there's all this excitement, there's the possibility of building these go-to markets, and there are buyers that want to build these better products for the reasons we just said.

So, that's why there's an opportunity to build Anduril, and Anduril-like but different things I would argue because Anduril's possibly n of 1, or near n of 1. That's what's going on both on the venture view, and on the opportunity and why, and also the difficulty side, if that makes sense.

One thing that came up in looking at Anduril was that there's a lot of, not luck exactly, but SpaceX was funded largely by Elon Musk, and Palantir, similarly, had investors who were deeply committed to the vision and maybe weren't as focused as other investors on the return profile or timeline.

That’s not correct. Or parts of that is correct in my view, and this part I'm actually expert in. I literally got the first pitch for the C, the A and the B of Anduril. I was the first receiver of it for the good and bad, and that's not true. What people saw was something that seems obvious in retrospect, which was the TAM opportunity, this huge size of the market and the team's ability to go and really execute. So, we can talk about what was happening there. But the possibility is, simply said, of building a new prime contractor, and in means of doing that, which products do you start with, and which process? The team was successful in execution, but they saw that opportunity—and I would argue that they were rare to see it—but it was basically a big opportunity, and the team was uniquely designed to be able to go after it.

And then, the fact that they put in big dollars, I can't remember what the seed round was, let's say it was 10 million and we were able to raise subsequent money, that part is not rare. People were writing checks like that just for other categories all the way from silly crypto stuff to very real data infrastructure companies. It's just that what was going on is there's a small number of people that were paying attention to this team, and this market met very clear venture criteria, which is a giant market, unique ability to access it.

I'd love to drill into what was there in the team? How do you evaluate teams who are building in this space? How important is prior experience with this kind of go-to market sor understanding procurement? Was that big in looking at the original Palantir team?

For me, personally, and this is different from Trae, who I think—maybe GC had a nickel in there, but really, Trae was the driver of it—for me, personally, I would've backed Brian Schimpf building a fucking toaster company. Brian's the CEO, and I'd known since he was an individual contributor at Palantir. I think he’s a tremendous, tremendous operator, intellect, builder. Period. That's a personal bias.

The second part, quite simply, I just believed in this personally in the opportunity around the market because of what I've seen in Palantir. The ability of companies to go and penetrate those deals. The ability for a company to go and successfully sell these very large projects, I just had comfort and familiarity with. That's about the investment, really, those were the underpinnings of my thesis. And that's not giving the full credit, Trae being involved, Grimm being involved. I actually didn’t know Palmer at the time I did the investment. I'd met him but didn’t know him. Those were my underpinnings.

The thing in terms of its success, to your point, that’s what the team got uniquely right. What people don't understand about Anduril is in the first two, three years, they had two attributes that they were well-designed for. The first is they had a pipeline of products they could build. So, the Sentry Tower ended up being the same thing. They still have crazy things they invented. We had a firefighting Humvee and a breach device and a bunch of stuff. And then, we had the ability to sell stuff on the range. So, some general sees something and they like it, and they'll pay two million for it, and then, later selling at scale, something that you're selling repeatedly, many, many, many times.

So, the team was really able to generate these products so successfully, and this is where Palmer doesn't get enough credit. He really has some ingenious ideas. It's where Brian doesn't get enough credit, great engineering, great execution. So, we're creating these products that matter. Then, people like Trae—and later everything from our GC, who's our CFO, to the guy that joined from McCain's Chief of Staff team, who name I'm forgetting all of a sudden—those are all people that are able to get us in front of the right buyers initially in Homeland [Security] and later, much later, actually, in DOD, so that we could figure out what to build and sell.

That execution was going on, and all that gets skipped over. People don't realize that they had all the iteration cycles that every other company does until they found Sentry Tower, which was their first product that was working and being bought. That was experimented on in the garage, people said, ‘yeah. I want that.’ In this case mostly the original buyers were Homeland [Security], and then later some other base security and things like that. Then, it went to scale and now we sell a lot of those things.

You called Anduril a potential n of 1 company. I'm assuming you don't see Anduril facing competition from a comparable company. Why is that? Is that accurate, and why would that be?

Two things. One, Anduril's primary competition is the difficulty of displacing these primes, which also has to do with the attribute I said before, its biggest challenge is just changing the world of procurement so that we can get the best products out for the cheapest price. I believe that so wholeheartedly. That's its competition in the world—it's the Boeings and the Raytheons of the world, that just have totally different business structure.

The second thing is about the uniqueness because I think there's lots of opportunity, we've backed lots of companies building in the public sector. Some we've announced, some we haven't, but we've backed lots and lots. Like twenty pretty more key businesses, I would say, there that I think have the potential to be the same or bigger than Anduril. That said, Anduril's ability to build a prime in the way they did, needs this very unique intersection of skills. I think that they did a couple of things that were uniquely smart that are hard to do.

One example would be many of the interesting companies that are getting funded in the DOD right now, they're really hinged on one idea. I don't want to throw stones because maybe they'll all work, but being vague, they're hinged on we're going to build a better autonomous submarine, and fine, Anduril has one of those. Let's ignore that. Build a better autonomous boat. That could work, but you're really betting on one program that needs a certain set of use cases, that wants to buy it how you want—it’s a lot of “ands” stacked together.

Versus Anduril really had this discovery motion, that people don't appreciate, that was powered by its work with customers and by an iteration discovery process under the cover. So, they weren't betting on one contract. That's just not how these companies are getting funded right now. They're getting funded because there's excitement. They're trying to put them in a shoot. Like, ‘I'm building the new blah or this army program.’ And I think that's going to be possible, but very hard to do.

It's not just, "Hey. Here's your credit card, but it’s expense-management aware." It’s about being able to integrate that card into other systems. Think about companies like AtoB that do fuel cards and want to run their own card systems on a modern issuer so they can wire those cards into other systems to drive decisioning and control.

This is part of the expansion of what happens when you want to build a modern closed-loop card. A closed-loop card is like a Starbucks card inside your mobile app. It has different economics, different risk profiles, and different usage profiles, and those are things you can now build on platforms like Highnote.

The ones that win here, in my view, are the ones that can do two things.

One, provide these very rich API sets and therefore, attract very large card programs over time. It's great to be enabling a new startup company, but it's more interesting if you’re enabling a new startup company and they become as big as Uber.

Two is that you can actually go run Uber's new card offering because you're a better solution. That's the opportunity right now.

The last thing I would say is that as a naïve venture person, when they were building Highnote, I used to harass the CEO going, "Who's your ideal customer?”

It turns out once Highnote launched, it was basically everyone that wanted to get live quickly. That just speaks to the amount of pull that's in the market and the amount of energy and enthusiasm, whether that’s people trying to do crypto on top of cards, or fuel cards, or just modern expense management solutions.

Does it make sense to invest in picks and shovels? Is that a framework that you would use to think about this market now?

Yes, but that's really talking my own book because that's the things we do the most of. We've done investments—I can't remember if they're public. Hold on. One second. Let me just check this out. We've done investments in companies like Nominal, which Scott's very familiar with. Nominal.io, they're basically building tools, picks and shovels to help deploy complex hardware systems. We've done investments with, like, Apex Space, which are picks and shovels but for the broader space industry with a big focus on federal. All those examples are ones that I like. We're sort of infrastructure enablers.

Apex is a great example because Apex is going to be happy to work within everybody from a Boeing to an Anduril to a whoever because they're just trying to build better technology so that everything moves faster. I really like that space and I really like that approach, but it's because “talk your own book,” and we know how to do it. I think it's right and smart. I'm sure there are other right and smart things to do, but that's definitely going to work and we've seen that. In those cases often, but not always, it means you can do a really natural dual use solution. Because take Nominal, someone that could sell the Caterpillar building can also sell to the government. And again, one of the big things is the difference in speed here. Make up a number, that government deal might be worth $10 million, but you're going to get 100K now, in two years you get 10. Versus an enterprise deal or a set of enterprise companies, which might be worth half as much, but you're going to get half a million bucks in the first half of the year, a million bucks in the second half of the year. So, smaller dollars but much smoother.

You mentioned this idea that the best product doesn't necessarily win, but the best product is necessary to keep winning. Can you say more about that?

It's because of the difficulty of procurement. There's two aspects: The difficulty of procurement, you might have the best thing, but you just can't survive through the compliance hurdles, the budging hurdles, all those difficulties. The second thing worth mentioning in that best product is, is that best product to actually deploy in the field? You might have the best drone right now, but you don't have the best product that actually works in a contentious environment. So, even your definition of best might not be best relative to an existing system that's already out there. But actually, yours isn't the best because theirs has been hardened through some environment. It might be two hundred times cheaper, but it doesn't fucking work. People die and you can't win.

It seems like there's a lot of companies that we've observed, like you said, that are selling into many different markets. It seems like it would dramatically complicate the go-to market if you're trying to execute on the very difficult practice of selling to the government, dealing with procurement, and at the same time selling into other markets, like oil and gas logistics, which are also more challenging than your typical SaaS sales, obviously. Is that fair to say?

A hundred percent. We have some companies like Manifest, which is a phenomenal company, it's in the security space, it sells both to the government and it sells to enterprise companies, which are totally different go-to markets. We have them organized totally differently, we track them—hell, we look at the slides for the board materials totally differently—because one is this slow burn to a lumpy revenue, and the other is velocity and more traditional inside sales motion. So yes, it is very hard.

One thing to say related to that is also it's a unique set of skills. We've been successful doing these, I think, because we backed so many Palantir founders that have comfort with the public sector and some enterprise exposure. Therefore, they can do those two things. People don't know how to do the public sector at all, so they just don't know how to take advantage of it, in my opinion. So what do you do is then you wait until, ‘hey, we're making—whether it's $10 million or $50 or $500,’ which I've seen all of—then you stand up a federal practice, you get some person, they used to run the federal practice for some product line at Cisco. They're super good. They tell you, ‘here's all the compliance shit you got to go do. Call me in eight months when you're done with FedRAMP and all these other things, and then we'll go build a Fed practice. Roll the clock another two years forward and it'll be the biggest part of your business in some cases, because there's so much money there.’

But the trade of the time in for all the security compliance and the go-to-market cost, people just haven't done it historically, and I think now it's an opportunity because there's more familiarity and confidence for how to do it.

What do you see for the next few years? As some of these companies try to build the next autonomous submarine, or the next autonomous widget, and as they look to raise, again, from investors, do you see any problems there for companies that need to raise again? Or maybe their investors aren't seeing the kinds of markups that they expected?

I think there's going to be a lot of disappointment later. Again, I don't want to throw stones, I want all the companies to be successful and all the venture people to make all the money. That said, I think there's two real hard difficulties ahead. One, is that most partnerships don't understand defense and the public sector. So, you're doing a lot of education right now and maybe I can explain it: ‘We're a great firm, we just hired two people that know a little bit about the public sector. We gave them a mandate or gave them money or however it's working. Yeah, go and write some five and some $10 million checks.’

Well, it goes forward, even if it's going well, the ability to write another big check, or for other multi-stage firm to have enough money that they want to go write a $15 or $30 million check, I think it's going to be hard just because of competence and understanding these businesses. Full stop. Has nothing to do with interest rate, just understanding how to think about whether they're being successful or not. Anduril had this in spades with the people that knew the most about the industry, the people that didn't believe in it, and nobody else understood it. I think that there's not that level of understanding in the broader markets.

Then, you alluded to the second issue, which is they're just capital intensive. They're capital intensive because many of the compelling solutions are in hardware, and that's expensive. And they're capital intensive because of the time it takes to run product teams, plus go-to market teams because of the two-year budgeting cycle. The numbers are bigger and the risks seem higher, so they feel a bit like deep tech. It could work, but they have risks. I think there will probably be a lot of disappointments for those two reasons. I think that's going to be a challenge.

I've been thinking about the hardware focus, it seems like the software side is beginning to happen. Anduril, obviously, has a software platform at the center of everything that they're doing.

But they sell hardware. It works with software—it's like Apple. Apple's making its money from the AirPods in your ears and the phone you own. Everything else is a fucking rounding error.

Again, not totally true anymore because the service is getting pretty big, but still, directionally. We do back some software-only solutions, and I think some of them will work.

But there, you're betting that the software is going to be really valuable, and the efficiency of the software means that you can build a business there. What I see a lot of is people that are not that, they're hardware solutions. Again, because that has more traction. What happens then is that they're not capitalized or they're not able to access enough capital to keep those products all the way to market.

Would you say one of the core problems is the fact that it's hard to sell the government, or DOD, on a recurring subscription? It's just harder to sell them on that than on buying a hardware package.

I think that’s true. There's a lot in that statement that has to change. How budgeting is done, the things that people buy. You make that change and a bunch of sketchy stuff will immediately happen. There are reasons it's designed the way that it is to keep some of the primes and more extractive people from being extractive. So, if you make changes, you open the doors to those challenges too. But yes, I want it to get better, I want us to be better at buying things. Us being like all of us taxpayers, that's the goal.

Disclaimers

This transcript is for information purposes only and does not constitute advice of any type or trade recommendation and should not form the basis of any investment decision. Sacra accepts no liability for the transcript or for any errors, omissions or inaccuracies in respect of it. The views of the experts expressed in the transcript are those of the experts and they are not endorsed by, nor do they represent the opinion of Sacra. Sacra reserves all copyright, intellectual property rights in the transcript. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any transcript is strictly prohibited.