Anduril at $1B/yr

Jan-Erik Asplund

Jan-Erik Asplund

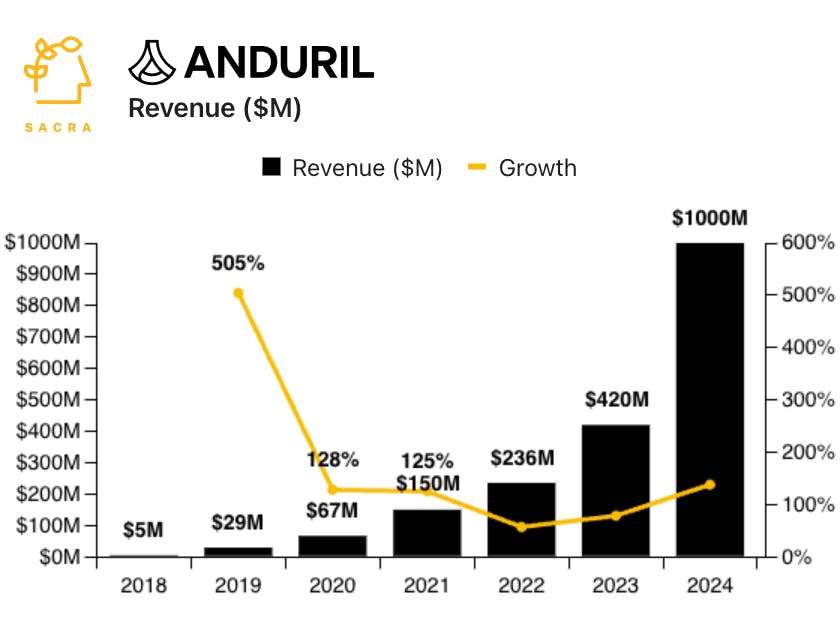

TL;DR: With a $1B manufacturing facility announced in January in Columbus, Ohio and a new $250M counter-drone contract with DoD, the once-scrappy border surveillance startup Anduril is getting closer to competing head-on with the traditional prime contractors in defense. Sacra estimates Anduril's revenue reached $1B in 2024, up 138% YoY, now valued at $14B for a 14x revenue multiple. For more, check out our full report and dataset on Anduril.

Key points via Sacra AI:

- Announced earlier this month, Anduril’s new $1B "Arsenal" factory in Columbus, Ohio (5M square feet, ~8x their combined existing manufacturing capacity) will allow it to 100x its output of drone and anti-drone systems including its Bolt-M drones (launched October 2024), Roadrunner drone defense systems (December 2023), and Barracuda-M autonomous air vehicles (September 2024) from hundreds to tens of thousands every year. Starting with Sentry surveillance towers for border security, Anduril has continued to expand product lines into autonomous air vehicles, uncrewed submarines, and rocket motors, with a focus on lightweight, software-connected systems for modern warfare that can be built from largely off-the-shelf, commercial components using 95% fewer specialized tools and undercutting the primes on price by ~90%.

- With drones showing strong product-market fit in modern warfare, inflicting 80% of all frontline Russian casualties in Ukraine, demand has surged to Anduril for both its drone and anti-drone systems—with Sacra estimating new contracts and deliveries accelerating Anduril's revenue to $1B in 2024, up 138% from $420M in 2023, raising $1.5B at a $14B valuation in their August Series F for a 14x revenue multiple. Compare to traditional defense contractors like Lockheed Martin (NYSE: LMT) at $71B in trailing twelve months (TTM) revenue, up 5.5%, with a market cap of $107B for a 1.5x revenue multiple, newer defense tech companies like Palantir (NYSE: PLTR) at $2.64B in TTM revenue, up 19% YoY, with a market cap of $182B trading at 69x revenue, and upstarts like Scale AI at $950M in ARR in August 2024, up 64% YoY, and Shield AI at $267M in revenue in 2024, up 64% YoY.

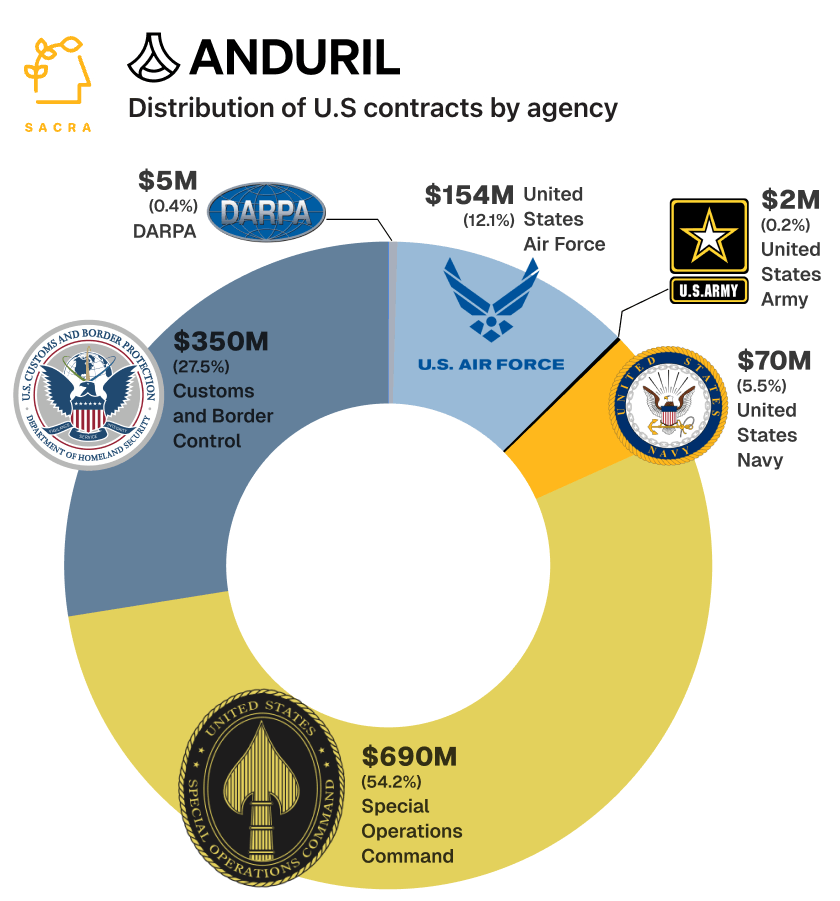

- A “defense consortium” between Anduril, Palantir, SpaceX, OpenAI and Scale AI—the Silicon Valley War Cabinet—looks to compete with Lockheed and Raytheon head-on for big defense contracts by bundling Anduril’s hardware and manufacturing scale with their partners’ capabilities in intelligence, transport and AI. Few companies stand to benefit as much as Anduril from the new Trump administration—which is eyeing Anduril co-founder Trae Stephens for a top DoD post—with the potential to grow their 0.2% share of defense spending ($1.2B in US contracts) and challenge the ~80% of major contracts historically won by Lockheed and Raytheon.

For more, check out this other research from our platform:

- Anduril (dataset)

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook