Airwallex at $100B TPV

Jan-Erik Asplund

Jan-Erik Asplund

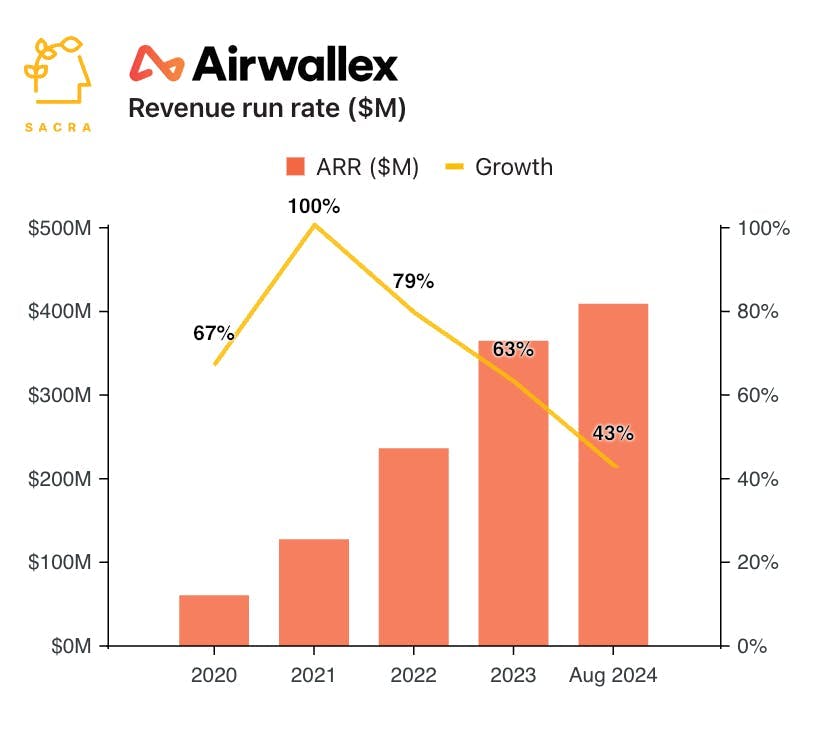

TL;DR: Sacra estimates that Airwallex hit $100B in annual transaction volume in 2024, up 73% year-over-year, for a revenue run rate of $500M. Now, the Aussie cross-border payments company is going global, taking on Wise, PayPal, and Visa. For more, check out our full report and dataset on Airwallex.

When Brex pays a reimbursement out into a remote employee’s local currency or Rippling processes an international bill payment, they’re using a company that’s little-known in the US: Airwallex.

We wanted to learn more about the Melbourne-based Airwallex, which recently surpassed $100B in transaction volume and announced that it plans to go public in 2026.

Key points from our research via Sacra AI:

- Airwallex (2015) used cheap cross-border payments between Australia and China as a hook to capture SMBs’ business banking accounts, growing from $5M in payments volume in 2017 to $10B in 2020. To jumpstart their payments network, Airwallex partnered with local banks in Australia to use their interbank payment rails, allowing them to undercut legacy B2B forex companies by 50-80% on fees while charging a 0.2% margin on top—today, Airwallex increasingly uses its internal network of accounts to transfer funds.

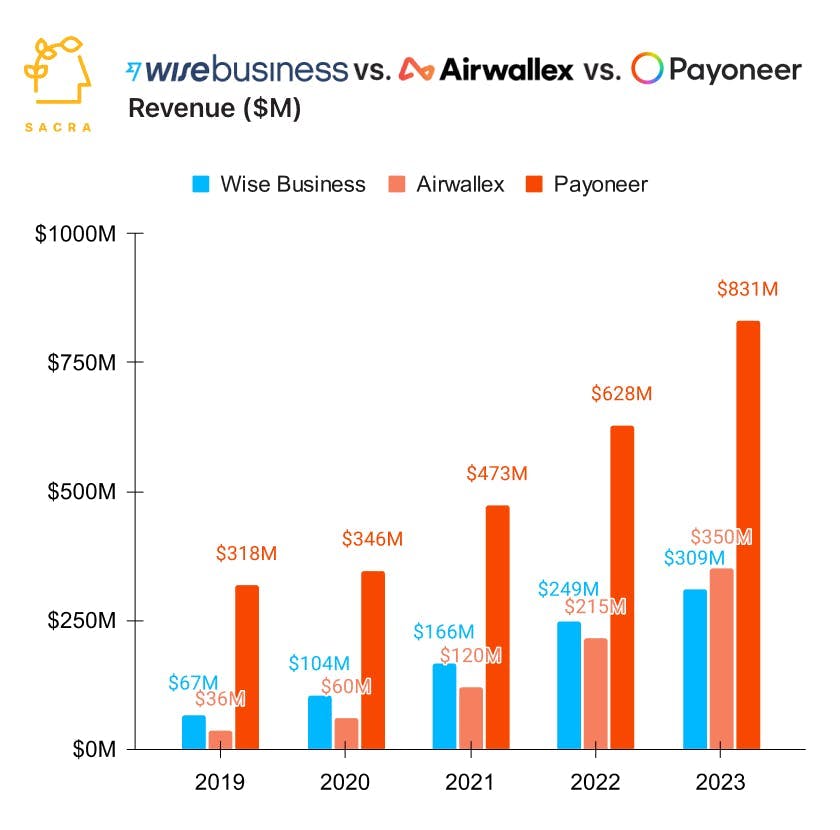

- COVID brought a surge in cross-border payments, helping Airwallex grow to $30B in annualized volume in 2021 and $100B as of July 2024 (up 73% YoY), with 100,000 customers for about $1M in payments volume per customer and a revenue run rate of $500M (up ~80% YoY). Compare to SMB-focused global payments company Payoneer (NASDAQ: PAYO) at $952M in annualized revenue (up 16%YoY) off $75B in volume (up 22%YoY) with 5M customers for about $15K in volume per customer, and London-based competitor Wise’s (LON: WISE) Business unit at $310M in revenue (up 25%YoY) off $41B in volume (up 12%YoY) with 625K customers for about $66K in volume per customer.

- Airwallex is pushing aggressively into Europe, the UK, and the Americas as an embedded finance platform—60% of revenue now comes from its API and products like Payments for Platforms (a la Stripe Connect)—to get distribution into the highly saturated fintech ecosystem of the West and the 100M+ SMBs it serves. Greater transaction volume across more geographies means deeper liquidity in their internal payments network, giving them the ability to serve larger enterprises and get a bigger share of the $100T+ market for cross-border B2B payments.

For more, check out this other research from our platform:

- Airwallex (dataset)

- Ramp (dataset)

- Brex (dataset)

- Kapital (dataset)

- The neobank capital cycle

- Brex: the $400M/year anti-Amex

- Stablecoins > Visa

- Stablecoin diplomacy

- Bhanu Kohli, CEO of Layer2 Financial, on stablecoin-backed payments for platforms

- Farooq Malik and Charles Naut, co-founders of Rain, on stablecoin-backed credit cards

- Fernando Sandoval, co-founder of Kapital, on stablecoins for cross-border payments