Revenue

$700.00M

2025

Valuation

$5.60B

2025

Growth Rate (y/y)

70%

2025

Funding

$902.00M

2025

Revenue

Sacra estimates Airwallex hit a revenue run rate of $600M in 2024, up 71% from $350M in 2023.

Valuation

As of 2024, Airwallex is reportedly raising money at a $6B valuation.

Based on the Series E extension Airwallex raised in 2023 at a $5.6B valuation, when they were doing $350M in revenue, Airwallex was valued at 16x revenue.

The company has raised over $902M in total funding to date, with significant backing from prominent investors. Key strategic investors include Tencent, Sequoia Capital China, and Salesforce Ventures, with notable participation from Lone Pine Capital and Square Peg.

Product

Airwallex was founded in 2015 in Melbourne, Australia by Jack Zhang, Lucy Liu, Max Li, and Xijing Dai. The founders came up with the idea while running a coffee shop and experiencing the high costs and inefficiencies of making international payments for coffee bean imports.

Airwallex found initial traction as a cross-border payments platform for SMBs, using cheap cross-border payments between Australia and China as a hook to capture SMBs’ business banking accounts, growing from $5M in payments volume in 2017 to $10B in 2020. Soon, it began selling a cross-border payments API into startups and digital marketplaces.

Early customers included e-commerce marketplaces like JD.com that required mass global payout disbursement services.

To jumpstart their payments network, Airwallex partnered with local banks in Australia to use their interbank payment rails, allowing them to undercut legacy B2B forex companies by 50-80% on fees while charging a 0.2% margin on top—today, Airwallex increasingly uses its internal network of accounts to transfer funds.

Business Model

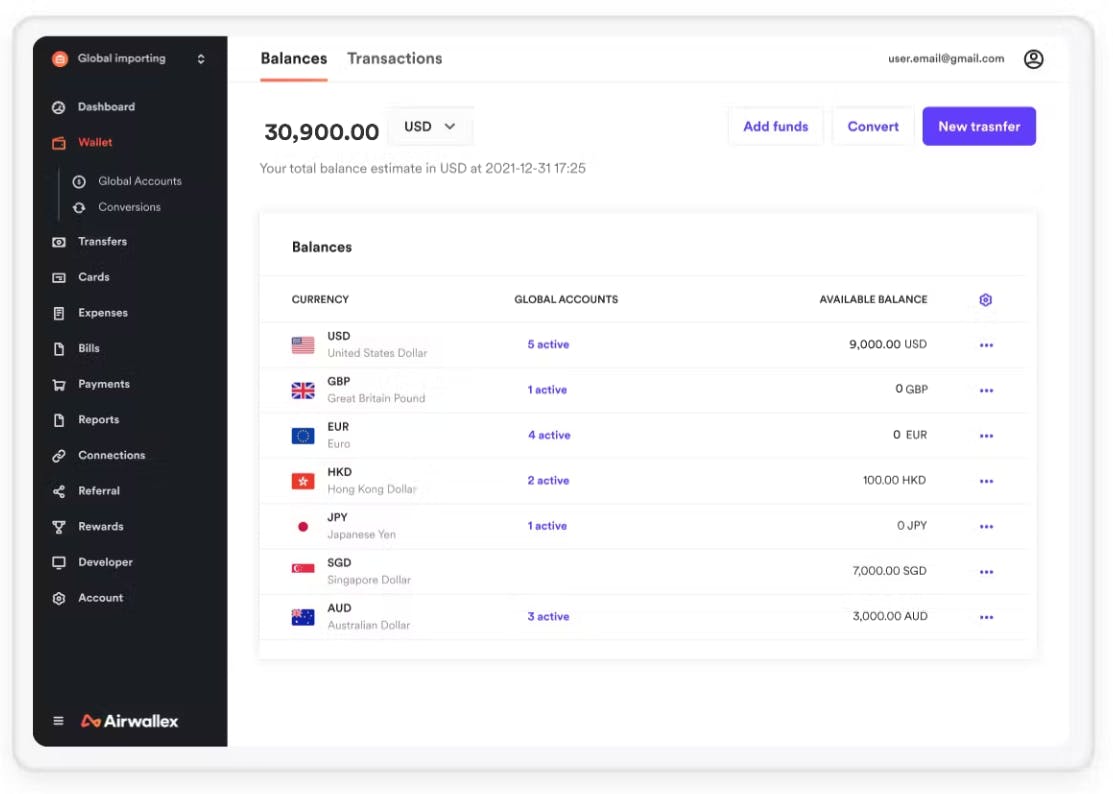

Airwallex generates the majority of its revenue from its take rate on transaction volume, which passed $100B on an annualized basis in 2024, with a smaller amount coming from the fees paid by platforms to access embedded finance services like card issuing.

Customer-wise, Airwallex's revenue comes from two main streams:

1. Cross-border payment services (60% of revenue): Serving high-growth startups and marketplaces like JD.com with payments acceptance and other services

2. Business account products (40% of revenue): Offering global virtual banking to SMBs.

For cross-border payments, the company charges a percentage fee on the transaction amount, typically lower than traditional banks. Additionally, Airwallex offers a SaaS-style platform with tiered pricing based on usage and features, allowing businesses to scale their services as they grow.

The company's business model is centered around reducing friction in global financial operations. By building its own proprietary infrastructure, Airwallex can offer faster, cheaper, and more transparent international transactions compared to traditional banking systems.

This infrastructure-first approach gives Airwallex a significant competitive advantage, allowing it to process about 93% of transactions through its own network rather than relying on SWIFT.

Competition

Airwallex competes in the global cross-border payments and financial services space for businesses, facing competition from both established players and newer fintech entrants.

Traditional banks

Airwallex's biggest competition comes from large multinational banks like Citibank that have long dominated cross-border payments for businesses.

These banks leverage the SWIFT network for international transfers, which Airwallex aims to improve upon with its proprietary infrastructure. While Airwallex uses SWIFT for about 7% of transactions, it processes 93% through its own network, allowing for faster and cheaper transfers in many cases. Traditional banking players here have the advantage of established relationships and regulatory compliance.

Fintechs

In the fintech space, Airwallex faces competition from companies like Stripe, particularly its Stripe Connect product for marketplaces and platforms.

Both offer global payment acceptance, payouts, and financial services for businesses operating internationally.

Other notable competitors include Wise (formerly TransferWise) for international transfers, though Wise focuses more on consumer and small business transfers rather than Airwallex's emphasis on larger businesses and platforms.

Payoneer also competes in cross-border payments for businesses but has traditionally focused more on freelancer payouts rather than Airwallex's broader suite of financial services.

Embedded finance

As Airwallex expands into offering more embedded finance solutions, it increasingly competes with companies like Marqeta in areas such as card issuing. Airwallex's advantage here is its ability to offer these services alongside its core cross-border payment capabilities, providing a more comprehensive solution for global businesses.

Airwallex's competitive strategy centers on its proprietary global financial infrastructure, which allows it to offer faster, cheaper, and more flexible solutions compared to traditional banks. Its focus on serving digital-native businesses and platforms also differentiates it from some competitors.

TAM Expansion

As Airwallex generates greater transaction volume across more geographies, it increases the liquidity in their internal payments network, giving them the ability to serve larger enterprises and get a bigger share of the $100T+ market for cross-border B2B payments.

Global cross-border payments growth

The global B2B cross-border payments market, estimated at greater than $10 trillion in total payments volume in 2023, represents a massive opportunity for Airwallex.

As the company continues to expand its geographical reach, launching in Europe and the Americas, it can tap into new markets and increase its share of global transactions.

Furthermore, Airwallex's platform approach, offering additional services like domestic and international accounts, multicurrency cards, and FX, positions it as a "global virtual bank" for tech-focused companies, potentially capturing a larger portion of clients' financial operations.

Lending, crypto, and other products

Airwallex is poised to expand into several adjacent markets that complement its core offerings. The company is developing a credit solution, set to launch later this year, which will allow it to enter the lucrative lending market. This move could significantly increase revenue per customer and create stronger ties with existing clients.

The company is also exploring opportunities in the crypto space, recognizing its growing importance in the digital economy. By developing crypto-related products, Airwallex can cater to the increasing demand for cryptocurrency services among its business clients, potentially opening up new revenue streams.

As Airwallex continues to build out its suite of financial services, it could explore expansion into areas such as tax management, subscription management, and expense management. These additions would transform Airwallex into a comprehensive financial operating system for businesses, increasing customer stickiness and lifetime value.

Risks

Key risks for Airwallex include:

1. Regulatory complexity: As Airwallex expands globally, it faces an increasingly complex regulatory landscape across multiple jurisdictions. While Airwallex has secured licenses in major markets, ongoing regulatory changes and scrutiny in the fintech sector could strain resources and slow expansion.

2. Bank partnerships: Airwallex still relies heavily on partnerships with nearly 100 banks worldwide to facilitate its global payments infrastructure.

This dependency exposes the company to potential disruptions if key banking relationships sour or if banks decide to compete directly in cross-border payments.

3. Commoditization of cross-border payments: As more fintech companies and traditional banks improve their cross-border payment capabilities, Airwallex's core offering risks becoming commoditized, potentially leading to pricing pressure and reduced margins.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.