Airtable at $375M ARR

Jan-Erik Asplund

Jan-Erik Asplund

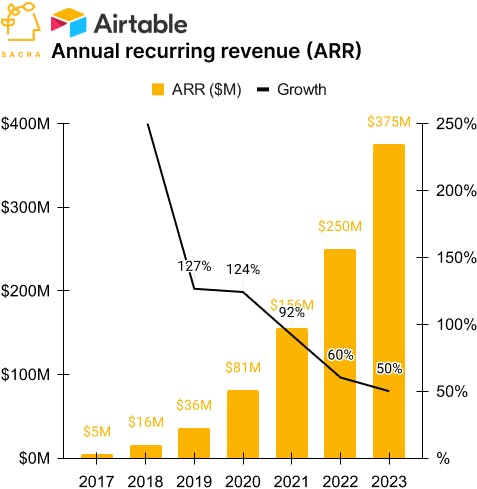

TL;DR: Last fall, incorrect reports that Airtable’s revenue was merely $148M ARR after 7 years and $1.4B raised triggered a wave of hand-wringing about their $11.7B valuation. Today, Sacra estimates that Airtable is at $375M ARR, up 50% YoY, with a valuation range of $2.3B to $5.3B given the multiples of comps like Asana (NYSE: ASAN), Smartsheet (NYSE: SMAR) and Monday.com (NASDAQ: MNDY). Check out our Airtable dataset for more, as well as interviews with early Airtable employees Zoelle Egner and David Peterson.

Key points from our research:

- In September 2023, Twitter erupted in hand-wringing over Airtable’s valuation based on incorrect reports that they were at $148M ARR growing 14% year-over-year—Sacra estimates that Airtable hit $375M annual recurring revenue (ARR) at the end of 2023, up 50% YoY with roughly 166,000 paying companies as customers. Compare to Asana (NYSE: ASAN) at $600M annualized revenue at the end of 2023, up 34% YoY, with 147,000 customers, Monday.com (NASDAQ: MNDY) at $757M of annualized revenue, up 38% YoY, with 186,000 customers, and Smartsheet (NYSE: SMAR) at $987M of annualized revenue, up 23% YoY, with 120,000 customers.

- Today, Smartsheet ($6.1B market cap) trades at 6x forward revenue, Asana ($3.9B market cap) trades at 7x, and Monday.com ($10.3B market cap), which operates more profitably, trades at 14x—a similar range of multiples with Airtable’s $375M would put their market cap in the $2.3B to $5.3B range. During the peak COVID bubble in December 2021, Airtable raised $735M at $11.7B on $156M ARR in December 2021, a 75x forward revenue multiple, while Monday.com traded at a 36x multiple on their $382M in forward revenue ($13.6B market cap), Asana traded at a 31x multiple on $448M in forward revenue ($13.9B market cap), and Smartsheet traded at a 22x multiple on $440M in forward revenue ($9.81B market cap).

- From December 2022 to September 2023, Airtable laid off 40% of their team (487 people) to reduce burn and narrow their focus on selling efficiently into the enterprise segment where they’ve had 100% year-over-year revenue growth and 170% net dollar retention—compare to 130% for Asana's biggest customers and 120% for Monday.com's. While Airtable does compete with Asana, Smartsheet and Monday.com on project management, as a no-code app builder that serves use cases horizontally across an entire organization, it's a category leader with far less competition for seat expansion.

For more on Airtable, check out this other research from our platform:

- Airtable (dataset)

- Retool (dataset)

- Airtable: The $7.7B Roblox of the Enterprise

- Startup CEO and founder on Airtable use cases and process

- Zoelle Egner, early Airtable employee, on customer success for product-led companies

- David Peterson, early Airtable employee, on the future of product-led growth

- Marketing agency chief operating officer on Airtable use cases and alternatives

- Ravi Parikh, CEO of Airplane, on building an end-to-end internal tools platform

- Zapier: The $7B Netflix of Productivity