Addepar at $275M/year

Jan-Erik Asplund

Jan-Erik Asplund

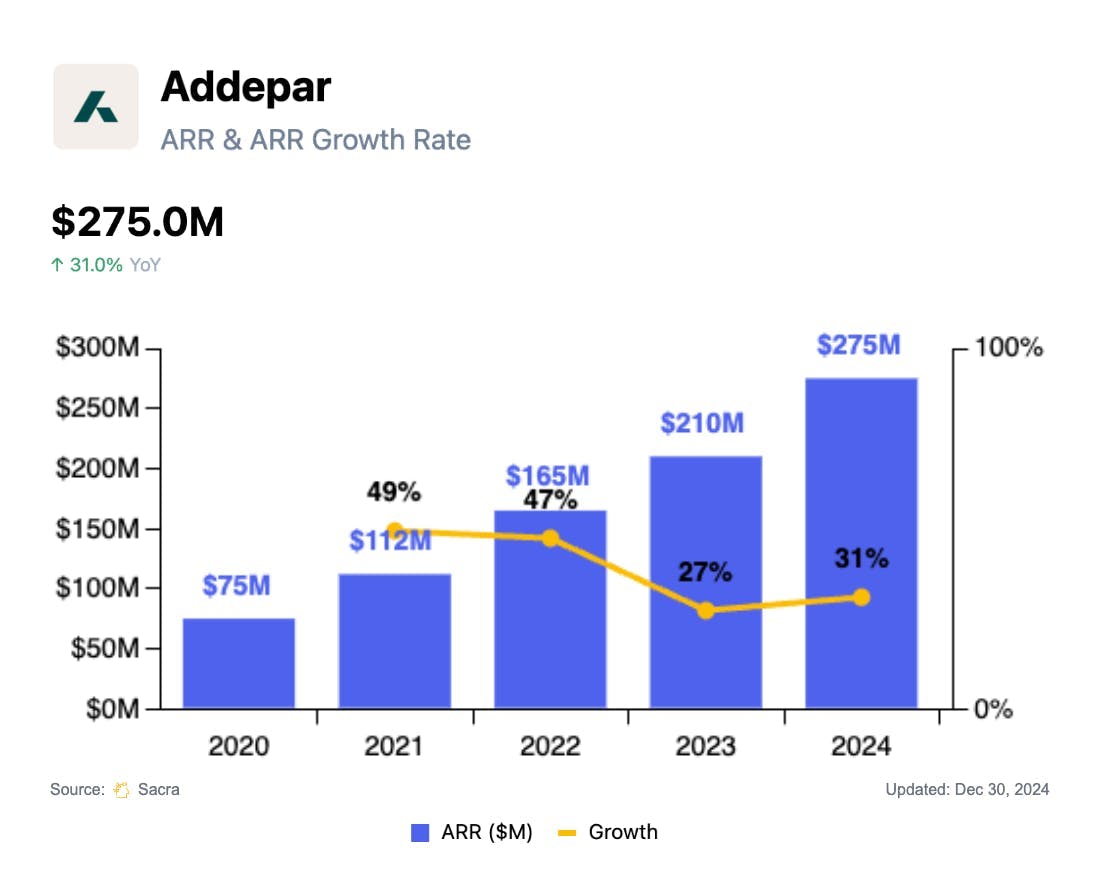

TL;DR: Founded in 2009 by Palantir veterans Joe Lonsdale and Jason Mirra, Addepar began by building a wealth management dashboard for family office managers to monitor all their holdings—public, private, liquid and illiquid. Driven by record AUM inflows and their expansion into $1-5B registered investment advisors (RIAs), Sacra estimates Addepar hit $275M ARR in 2024, up 31% YoY. For more, check out our full report and dataset on Addepar.

The RIA back office is becoming increasingly digital, as we discussed with Savvy CEO Ritik Malhotra in our interview with him and in our report on the companies building the "Mint for the 0.1%".

To learn more, we did a deep dive into Addepar ($721M raised, Valor Equity Partners), one of the longest-running startups in this space.

Key points via Sacra AI:

- Family funds began piling into private equity and real estate in the early 2000s—but when the 2008 financial crisis hit, legacy reporting platforms like Advent Axys (1983) and Schwab PortfolioCenter (2003) failed to show managers all of their private, illiquid holdings and where they were exposed—inspiring Addepar (2009) to build an alt-focused product that turns unstructured data from PDFs, emails and fund reports into a single portfolio dashboard.Like most wealth management products sold into family offices and RIAs, Addepar monetizes through a tiered 8–30bps fee on AUM, with large firms paying less, and drives ACV expansion via paid modules for billing, rebalancing, client reporting, and most recently, native trading.

- By bolting on multi-custodian native trading (Addepar Trading) and scenario modeling (Addepar Navigator) onto its alt-asset dashboard, Addepar has been able to go upmarket into $100B+ RIAs and private banks that need a single system for rebalancing, forecasting, and reporting across multi-custodian alt-heavy portfolios, with Sacra estimating that Addepar hit $275M ARR in 2024, up 31% YoY. Among the RIAs that are Addepar’s main growth market in the years ahead, Addepar has 2.7% market share today—compare to Envestnet’s Tamarac at 18% market share with $1.34B in revenue in 2024, up 9.5% year-over-year, acquired by Bain Capital for $4.5B in November 2024.

- Addepar's deal with Itaú Private ($180B AUM, Brazil) proves out Addepar’s ability to localize to multi-currency, tax-lot regimes outside the U.S—giving it a template to expand aggressively into European and Gulf wealth hubs where private-bank assets dwarf the entire U.S. RIA pool. The upside case for Addepar is that by continuously ingesting new types of priced private assets—like LP interests, crypto wallets, and art collections—into its 250K-asset library, it can offer the most accurate valuation logic on the market, compounding its dataset with every client onboarded.

For more, check out this other research from our platform:

- Compound, Savvy, and the Mint for the 0.1%

- Vieje Piauwasdy, Director of Equity Strategy at Secfi, on the future of QSBS

- Dave Thornton, co-founder of Vested, on unlocking startup employee equity

- Tim Flannery, co-founder of Passthrough, on building TurboTax for private fund investing

- Ritik Malhotra, CEO of Savvy, on the rise of tech-enabled wealth management

- Nik Talreja, CEO of Sydecar, on powering the future of secondary trading

- Sydecar and the new atomic unit of the private markets

- Jordan Gonen, CEO of Compound, on software-enabled wealth management