$172M/year Heroku of vibe coding

Jan-Erik Asplund

Jan-Erik Asplund

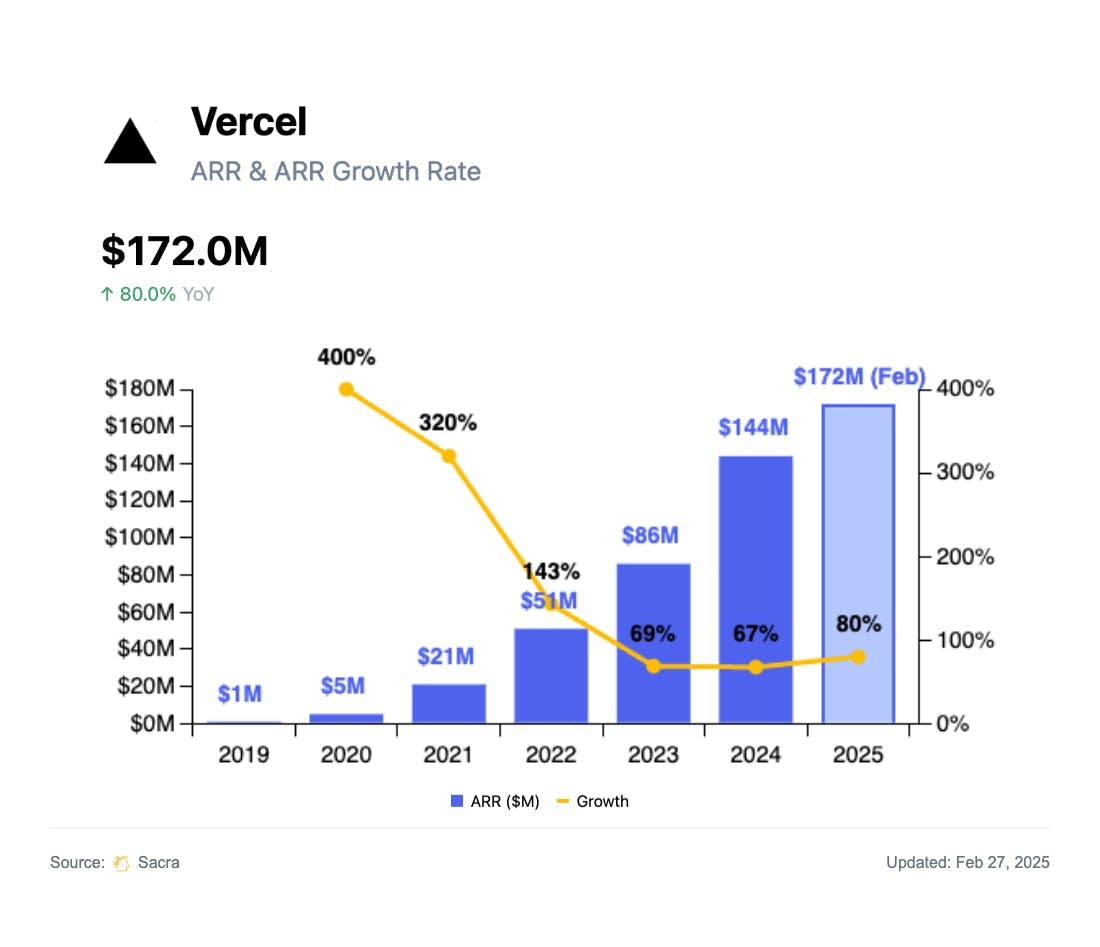

TL;DR: Starting as a platform-as-a-service for deploying & hosting modern JavaScript apps, Vercel has re-accelerated with the launch of its AI app builder v0. Positioned against fast-growing vibe coding products Lovable & Bolt.new with its vertically integrated approach, Sacra estimates that Vercel hit $172M ARR in in February 2025, up 80% YoY. For more, read our full report and dataset on Vercel.

We first covered Vercel in 2022 as a core player in the Jamstack, and followed up in November 2024 and March 2025 as Vercel’s v0 became one of the central tools in the emerging wave of vibe coding tools.

Here’s our Anthropic update with key points via Sacra AI:

- Where Heroku (2007) pioneered the push-button deployment experience for Ruby on Rails apps onto Amazon Web Services (AWS), Vercel (2015) did the same for modern JavaScript apps—centered around in its React framework, Next.js—providing a developer experience layer that automatically provisions AWS storage, compute, and CDN and keeps devs from having to get into the nitty gritty of sysadmin. Vercel enables teams to deploy JS-based apps with minimal configuration—selling speed and simplicity through opinionated defaults—and monetizing through (1) usage-based pricing (compute, bandwidth, storage), (2) per-seat Pro ($20/month/seat) and Enterprise plans, and (3) a separate $20/month subscription for v0, its AI frontend builder.

- The launch of Vercel’s AI app builder v0 in September 2023 caught the wave of AI app builders in 2024 and marked a key inflection point for Vercel, re-accelerating growth to 80% YoY and driving the company to a Sacra-estimated $172M in annual recurring revenue (ARR) by February 2025, up from ~$96M at the end of 2023. Compare to fellow no-code app builders like Lovable, which deploys projects to AWS, at $50M ARR as of April 2025, up from $7M at the end of 2024, and Bolt.new, which deploys projects to Vercel competitor Netlify, at $40M ARR in March, up from $20M ARR at the end of 2024.

- Similar to how horizontal no-code tools Notion, Zapier & Airtable pre-built templates to harvest search demand & onboard users into specific use cases, Vercel is turning v0 into the vibe coding launchpad into customizing pre-built JavaScript apps & components with a push-button “Open in V0” experience across properties that Vercel owns like Shadcn (founder works at Vercel) and Tremor (acquired by Vercel in January 2025). While AI app builders skew toward bursty, short-lived usage, vertically integrated platforms like Vercel (and Google Firebase) are positioned to capture downstream value by bundling AI codegen with hosting—converting early prototypes into ongoing infrastructure spend and anchoring themselves in what’s becoming a default budget line for every product & engineering team.

For more, check out this other research from our platform:

- Vibe coding index

- Lovable vs Bolt.new vs Cursor

- Claude Code vs Cursor

- Cursor at $200M ARR

- Cursor (dataset)

- Lovable (dataset)

- Bolt.new (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Edo Liberty, founder and CEO of Pinecone, on the companies indexed on OpenAI

- Will Bryk, CEO of Exa, on building search for AI agents AI talking heads growing 1024%

- Kyle Corbitt, CEO of OpenPipe, on the future of fine-tuning LLMs

- How AI is transforming productivity apps

- AI and the future of video