$115M/year Chime of Canada

Jan-Erik Asplund

Jan-Erik Asplund

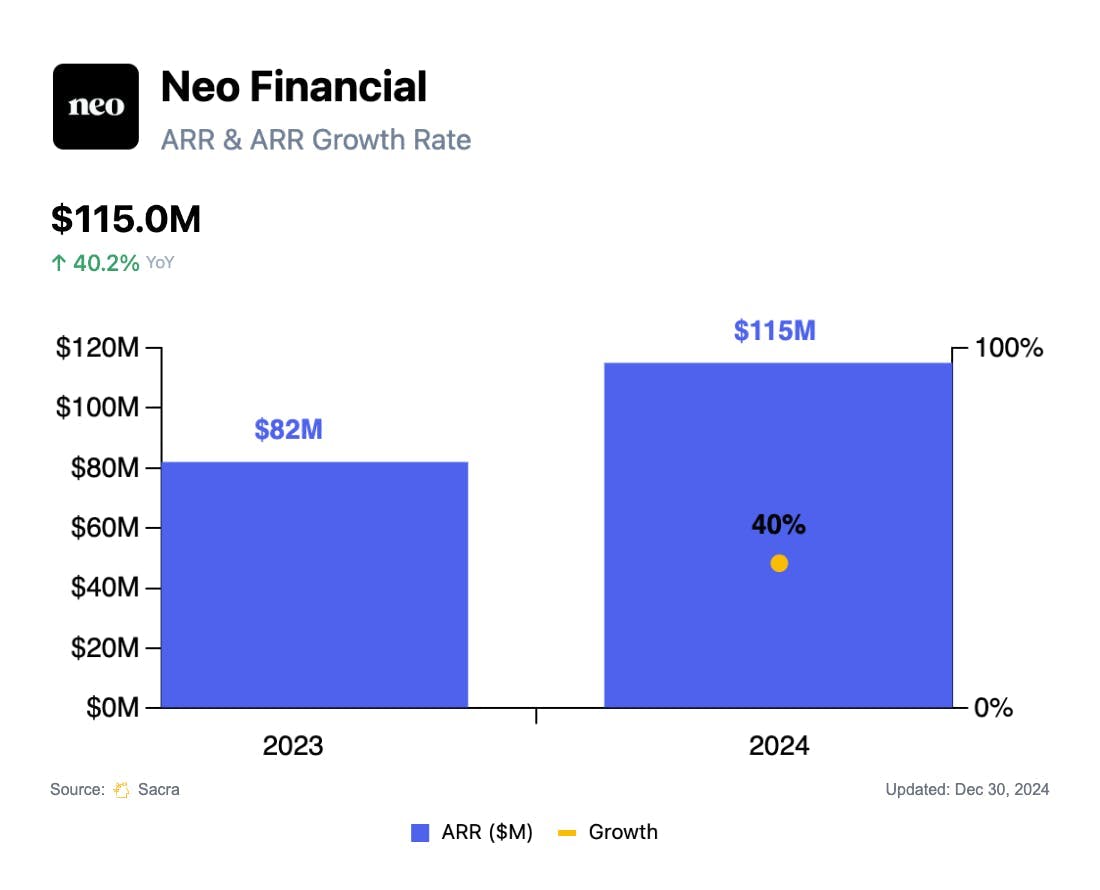

TL;DR: Founded in 2019 as Canada’s answer to Chime, Neo Financial is building a vertically integrated consumer finance platform to compete with the Big Six banks—starting with a high-cashback Mastercard and expanding into savings, investing, mortgages, and BaaS. Sacra estimates Neo Financial hit a $115M revenue run rate in 2024, growing ~40% YoY. For more, check out our full report and dataset on Neo Financial.

Key points via Sacra AI:

- Rakuten (1997) launched as a deals marketplace & marketing platform where merchants offer cash-back rewards that only trigger when a purchase actually happens—which along with the rise of modern, digitally-forward neobanks like Chime (2013), Nubank (2013), and Monzo (2015)—inspired the founding of Neo Financial (2019) as a Canadian challenger bank with its hook around merchant-funded rewards. Neo Financial launched with a no-fee Mastercard offering 10–25% instant cashback, partnering with 10,000+ local and national merchants for customer acquisition & monetizing primarily via 1.5–1.8% interchange on card spend, plus merchant commissions, interest on credit balances and deposits, and fees from mortgages, investing, and white-labeled card programs.

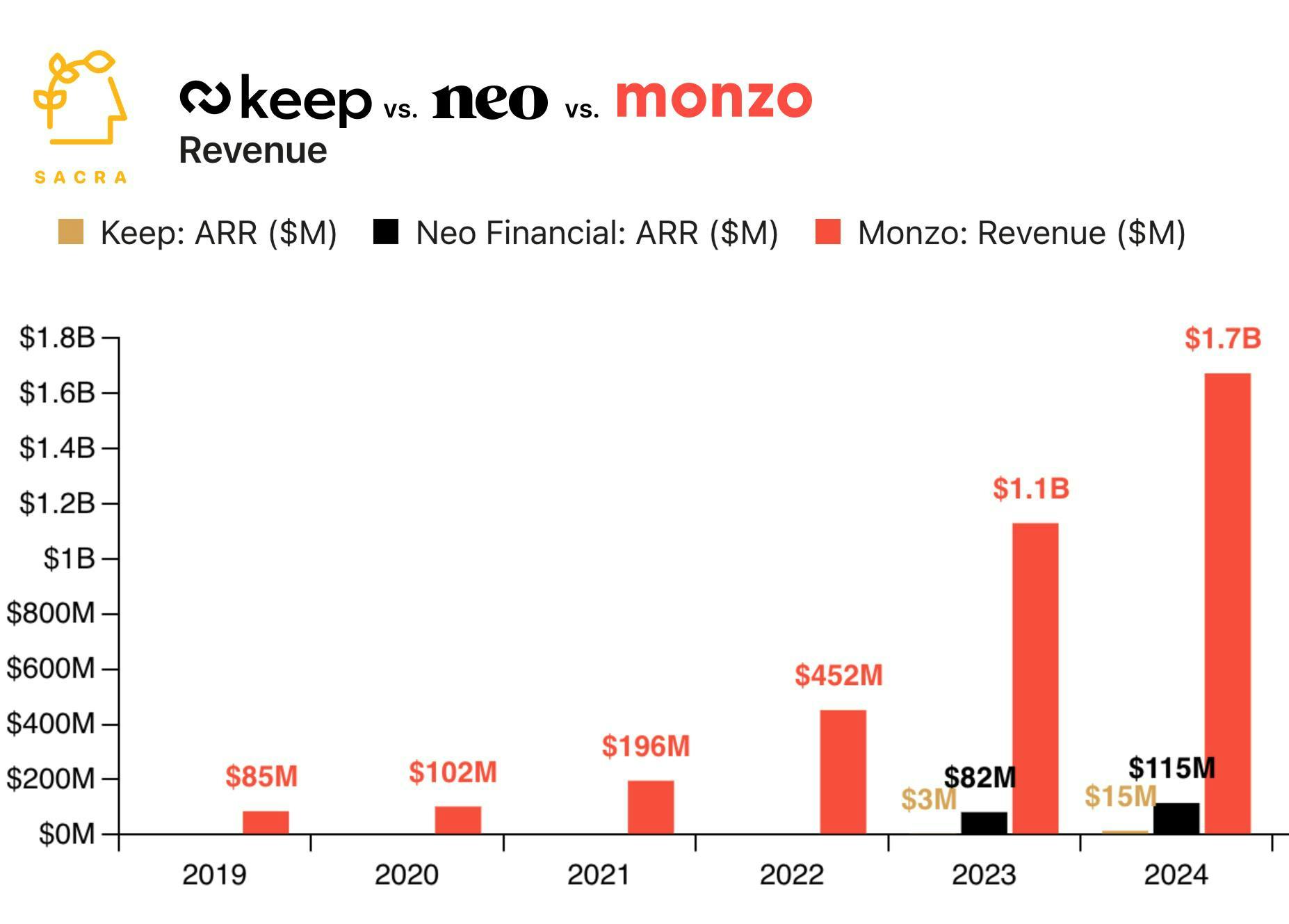

- Riding the wave of 4-5 % interest rates to drive deposits growth and rolling out Neo Mortgage nationwide for $200M in home-loan originations in its first year, Sacra estimates Neo Financial reached $115M in revenue run rate at the end of 2024, up ~40% YoY, raising an $82M Series D in November that valued the company at ~$510M for a 4.5× revenue multiple. Compare to Canadian B2B neobank Keep at $14M in annualized revenue in 2024, up 383% YoY; Monzo at $1.67B revenue in 2024 (up 48% YoY), valued at $5.9B for a 3.5× multiple; N26 at $486M revenue in 2024 (up 40% YoY), valued at $6B as of 2023 for a 17.3× multiple on $347M in revenue; Revolut at $4.0B in revenue in 2024, up 75% YoY from $2.3B in 2023; and Chime at $1.7B in revenue in 2024, up 31% YoY.

- With Revolut withdrawing from Canada and few home-grown startup challengers (Koho, Wealthsimple), Neo Financial’s deep local ties are key to user acquisition in a market where 90%+ of consumers bank with the Big Six—with Hudson’s Bay and Tim Horton’s deals for co-branded cashback, deals with Concentra / Equitable for CDIC-insured deposits, and a partnership with ATB Financial for card funding. The absence of digital-first challengers in Canadian consumer finance has opened a lane for Neo to bundle together credit cards (Neo Mastercard), high-yield savings (Neo Cash), ETF portfolios (Neo Invest), secured credit (Neo Everyday), mortgages (Neo Mortgage), tax-refund advances, and white-labeled BaaS card programs into a single vertically integrated super-app.

For more, check out this other research from our platform:

- Neo Financial (dataset)

- Keep at $14M/year growing 383% YoY

- Keep (dataset)

- Mercury (dataset)

- Brex (dataset)

- Ramp (dataset)

- Kapital (dataset)

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Fernando Sandoval, co-founder of Kapital, on tropicalizing Brex for LatAm

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop

- Bo Jiang, CEO of Lithic, on the power of the cards as a digital payment rail

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market

- Mercury: the unbundling of Silicon Valley Bank