Chime: the $1.3B/year could-be superapp

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Chime (dataset) built the #1 neobank in the United States by focusing on lower-income consumers looking for early access to paychecks. Now, they have to fend off Cash App, Robinhood, SoFi and others as they look to build a financial one-stop shop for the masses. For more, check out our full Chime report and dataset, our interview with an ex-Chimer on the company’s future, and our other reports on Varo (dataset), N26 (dataset), Revolut (dataset), Monzo (dataset), and Betterment (dataset).

- People hate their banks (see: Bank of America’s NPS score of -24) and yet banks account for $15T in global market cap—an insight that paved the way for the first neobank, Simple (2009), which introduced the idea of a beautifully designed digitally native checking account with no account/overdraft fees. Instead of collecting revenue from fees (banks make $30B+ per year off just account and overdraft fees), Simple monetized off interchange—taking a small cut from merchants with every transaction done with a Simple-branded card. (link)

- Chime (launched 2012) found initial product-market fit marketing to millennials and the 75% of Americans living paycheck-to-paycheck with no-fee accounts and 2 days early access to their wages. Chime doubled its user base during the first year of COVID from 5M to 10M customers by providing early access to their COVID stimulus checks to anyone with direct deposit set up. (link)

- The neobank thesis of Chime, Dave ($153M revenue in 2021), Varo ($101M gross revenue in 2022) et al. posited that by wrapping their underlying banking partner like a Bancorp/Stride in marketing and design focused on a specific customer niche, they could drive lower CAC than a traditional bank ($100 per user, vs. ~$650-700 for a traditional bank) and win away the segment. Most neobank revenue comes from the interchange split between the card network and banking partner (Chime gets ~50 cents for each $100 spent via their Chime-branded Visa card) while roughly ~20% comes from service charges like out-of-network ATM fees. (link)

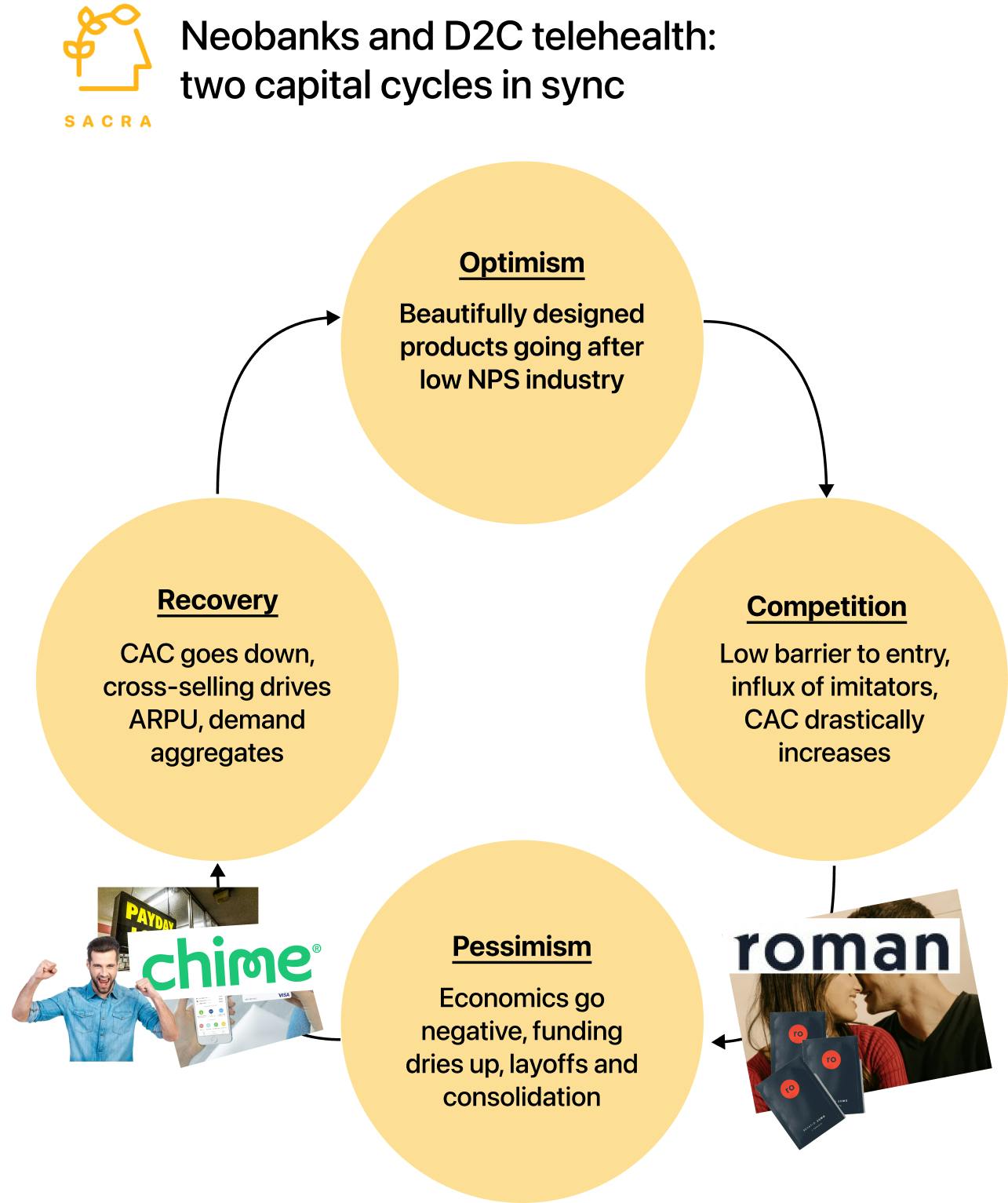

- Chime’s success and low barrier to entry—similar with Roman in the world of erectile dysfunction and D2C telehealth—spawned a slew of competition, driving CAC up while ARPU stayed down/flat—and as a result after $300B+ in VC raised, less than 5% of the now-400+ neobanks around the world have hit profitability, with most earning less than $30 per customer. The typical neobank customer still only uses an average of ~1.5 products from their neobank, compared to ~5 products used by the average customer of a legacy bank. (link)

- Incumbent banks like Chase and Capital One have closed the gap with Chime by investing in improving their own apps—in H1 2022, Chime’s app was downloaded 6.7M times, compared to 7.7M times for Capital One, 6.3M for Chase, and 5M for Bank of America. P2P app Zelle, launched in 2017 and owned by a consortium of BoA, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank and Wells Fargo, surpassed 60M users in 2022—nearly as many as the ~80M on Cash App, which launched 4 years prior. (link)

- Banking-as-a-service platforms like Galileo (acq. for $1.2B by $SOFI) and Synapse (2014) and payroll APIs like Pinwheel and Argyle have given rise to a new competitive set, from fintechs like Cash App (NYSE:SQ) to wallets inside payroll products like Gusto and Deel ($12B valuation). Neobanks like Moven (2020), Australia’s Xinja (2020), the UK’s Dozens (2022), LendUp (2022) and others have shut down, while others like Varo are having layoffs and struggling to get profitable—as a result, total neobank VC funding is down 80% YoY. (link)

- Chime can grow ARPU from the ~$30-$120 of a top interchange-based neobank to the $1,200 of a full-service consumer retail bank like a Bank of America and increase LTV by turning on additional features like crypto, investing, insurance, and most importantly, lending. Brazilian neobank Nubank hit $1.31B in gross revenue in Q3 2022, driven largely by lending income growing 234.7% YoY to $987M, which was more than 3x faster than other income.(link)

- Chime’s lead gives it the chance to build the CNBC of finance superapps, positioned against Cash App’s meme-y, Wall Street Bets-adjacent finance superapp. Zooming out, the opportunity from here is still 100x, with Chime dwarfed by Bank of America on accounts (7M vs. 68M), on revenue ($1.3B vs. $94B), and ARPU (~$120 vs. $1,200). (link)

For more, check out our interview with an ex-Chimer on the company’s future, our full Chime report and dataset, and this other research from our platform: