Revenue

$1.16B

2021

Valuation

$2.90B

2022

Funding

$752.00M

2022

Growth Rate (y/y)

29%

2022

Revenue

We estimate that Workrise’s gross revenue has increased nearly 4X from 2018 to $1.1B in 2021. Workrise placed 15,000 contractors in 2020, compared to 8000 in 2019 and estimated it would place 30,000 contractors in 2021. Placements in renewable jobs increased 400% in 2020 to reach 4,500 out of 15,000, compensating for the slower growth in oil and gas placements at 50% in 2020.

Valuation & Funding

Note: All data is estimated using publicly available information. Size of the bubble indicates valuation.

Workrise has raised $752M from Andreessen Horowitz, Bedrock Capital, Founders Fund and Franklin Templeton. It was last valued at $2.9B at a valuation/revenue multiple of 2.5x. This is similar to some of its competitors such as Indeed (2.3x) and Glassdoor (2.3x).

Business Model

Oil and gas companies need independent contractors for numerous temporary jobs with an average job duration of 6 to 12 months. Before Workrise, these companies relied on traditional staffing agencies to find contractors but faced issues with safety certificate compliances, contracting numerous staffing agencies, and a lack of visibility into the complete contractor pool. For the contractors, it meant high take rates, job opportunities limited by the agency's size, and a slow pen & paper payment process. Workrise disintermediates the traditional agencies through a marketplace with an embedded HR and payroll SaaS.

Workrise onboards contractors and companies by being present in all the major oil and gas basins. It acquired several traditional staffing agencies in the last few years and aggregated their contractors. Companies primarily find contractors through Workrise’s sourcing team. They can also find contractors directly on the marketplace, post jobs, or add their contractors to Workrise.

Workrise handles contractors' payments and takes a cut before depositing it into their bank accounts. It also makes money by offering additional services like next-day payments to contractors.

Product

Workrise comprises two layers: marketplace and workforce management SaaS. SaaS takes care of the contractor lifecycle from contracting to payments. Contractors get a portal which they can use to manage jobs, submit job sheets, upload certificates, and receive payments. Companies also get a portal to onboard contractors, approve job sheets, and manage job postings. The marketplace layer has contractor and company profiles and job listings. Contractor profiles are similar to LinkedIn profiles with a public URL for sharing on email/chats, work experience, ratings for previous work and certificates. Companies can hire a contractor through their profile.

Beyond its core marketplace and SaaS offerings, Workrise has expanded into technology licensing. The company secured exclusive US rights to Shell's "U-lateral" drilling technology and licenses it to energy companies on a per-well basis, handling program contracts and administration integrated into customers' purchasing workflows. Shell's U-lateral method can potentially increase the production capacity of each surface rig by 50% while reducing drilling cost per foot and cost per barrel.

User journey of an independent contractor through Workrise.

Competition

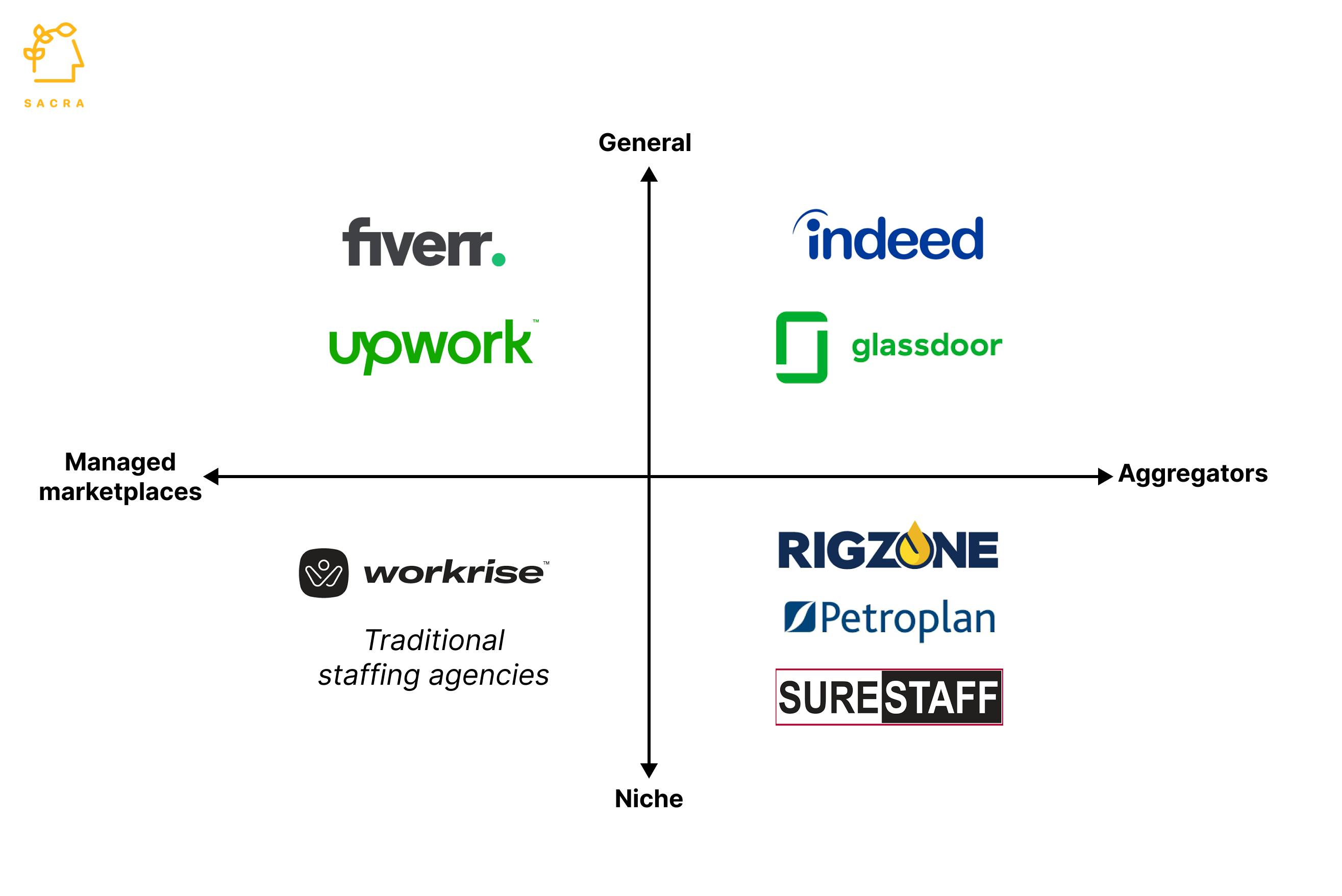

The oil and gas contractor market is highly fragmented with numerous traditional staffing agencies, which are the primary competitors for Workrise. A typical staffing agency has ~100 contractors on average and MSA with the service providers/operators in a basin. Apart from staffing, they also provide management services such as background checks, insurance, and payments.

Workrise also competes with staffing websites such as Rigzone, Petroplan, and Surestaff, providing both gig opportunities and full-time work for the oil and gas industry. Unlike Workrise, these websites only help companies source talent without the workforce management service.

TAM Expansion

Expected rebound in oil and gas jobs

The US's oil and gas industry jobs are expected to rebound after a historic low of 863,000 in 2021 on the back of rising oil prices. It is estimated that over the next five years, 120,000 jobs will be created. This allows Workrise to leverage its network of 25,000 contractors to fill these jobs.

Renewable energy jobs

Renewable energy jobs are expected to grow much faster than the overall jobs market in the US. For instance, wind turbine technician and solar photovoltaic installer jobs are predicted to grow at 60.7% and 50.5%, respectively, and will add 10,000+ jobs by 2029. Workrise is reskilling its contractors through training and certifications to tap into this opportunity. In 2020, it trained 15% of 15,000 placed workers in renewable energy skills.

Technology licensing to operators

Workrise has created a new revenue stream through exclusive licensing of Shell's U-lateral drilling technology to energy companies across the US on a per-well basis. This moves the company beyond staffing and workforce management SaaS into selling operational technology and services directly to operators rather than just contractor services. The U-lateral method can increase surface rig production capacity by up to 50% while reducing drilling costs, giving Workrise a foothold in the operational technology market.

Selling financial services

Apart from jobs, Workrise offers a few additional services to contractors, such as next-day pay and discounted training. These generate additional revenue and increase contractor stickiness. It can use contractor's payroll data to underwrite financial services such as personal loans, cards, and auto insurance.

Risks

Recommitment to oil and gas: Workrise has strategically recommitted to the oil and gas sector after unsuccessful diversification attempts into construction and defense. The company rebranded back to its original name "RigUp" and explicitly stated it is "doubling down" on enabling oil and gas customers to succeed. This concentration in a cyclical industry creates significant risk, as revenue remains dependent on volatile oil prices rather than achieving the predictability of a diversified industrial services platform. While this focus may strengthen its position in core markets, it leaves the company exposed to commodity cycle fluctuations.

Cash intensive scale-up: Workrise signs up contractors and companies by going from basin to basin. Like Uber, its network and matchmaking are limited by geography, so every time it goes to a new basin/geography, it needs to start from scratch. This way of scaling the business is cash-intensive, and Workrise will need to continue to raise funds to fuel its growth, which could be a challenge in the current market scenario.

Reputational damage after layoffs: Workrise has done two significant layoffs in the last couple of years. In 2020, it laid off 100 employees due to the COVID-linked slowdown, and in 2022, it laid off 450 employees as it exited construction and defense verticals. This has dented Workrise's reputation, with low scores on review portals like Glassdoor and Blind. Workrise may struggle to recruit top-tier talent due to this loss in reputation.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.