Revenue

$4.00M

2023

Valuation

$1.50B

2024

Funding

$181.00M

2024

Product

Airbyte was founded in 2020 by Michel Tricot and John Lafleur as an open-source data integration platform. The company found product-market fit as a developer-friendly alternative to existing ETL (Extract, Transform, Load) solutions, offering a wide range of connectors for various data sources and destinations.

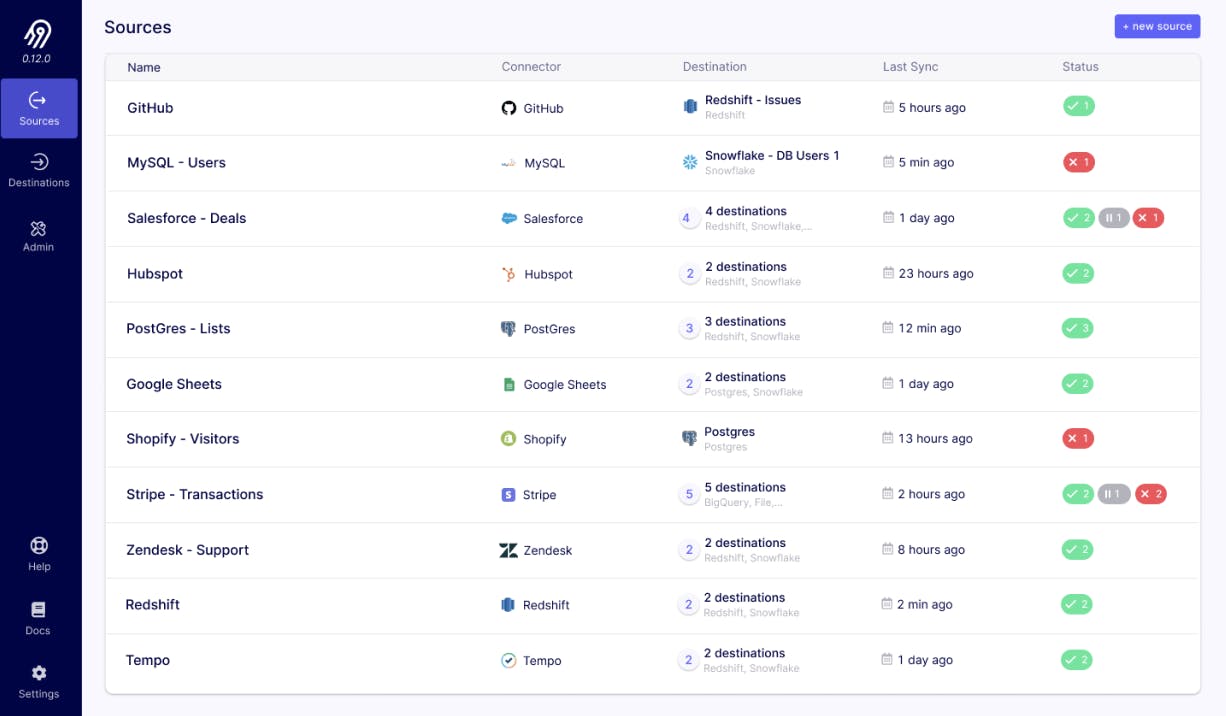

Airbyte's core product is an open-source data integration platform that allows users to move and synchronize data from different sources to destinations. Key features include:

1. Connector Library: Airbyte offers a growing catalog of pre-built connectors for popular data sources and destinations, including databases, APIs, and cloud services.

2. Custom Connector Development: Users can build and contribute their own connectors using Airbyte's CDK (Connector Development Kit).

3. Data Synchronization: The platform automates the process of extracting data from sources and loading it into destinations on a scheduled or real-time basis.

4. Data Transformation: Airbyte integrates with dbt for in-warehouse transformations, allowing users to clean and model their data after it's loaded.

5. Orchestration: Users can manage and monitor their data pipelines through Airbyte's UI or API.

Airbyte's open-source nature and extensibility have made it popular among data engineers and developers who need to build and maintain data pipelines. The platform is used by companies of various sizes, from startups to enterprises, to centralize their data for analytics, business intelligence, and machine learning purposes.

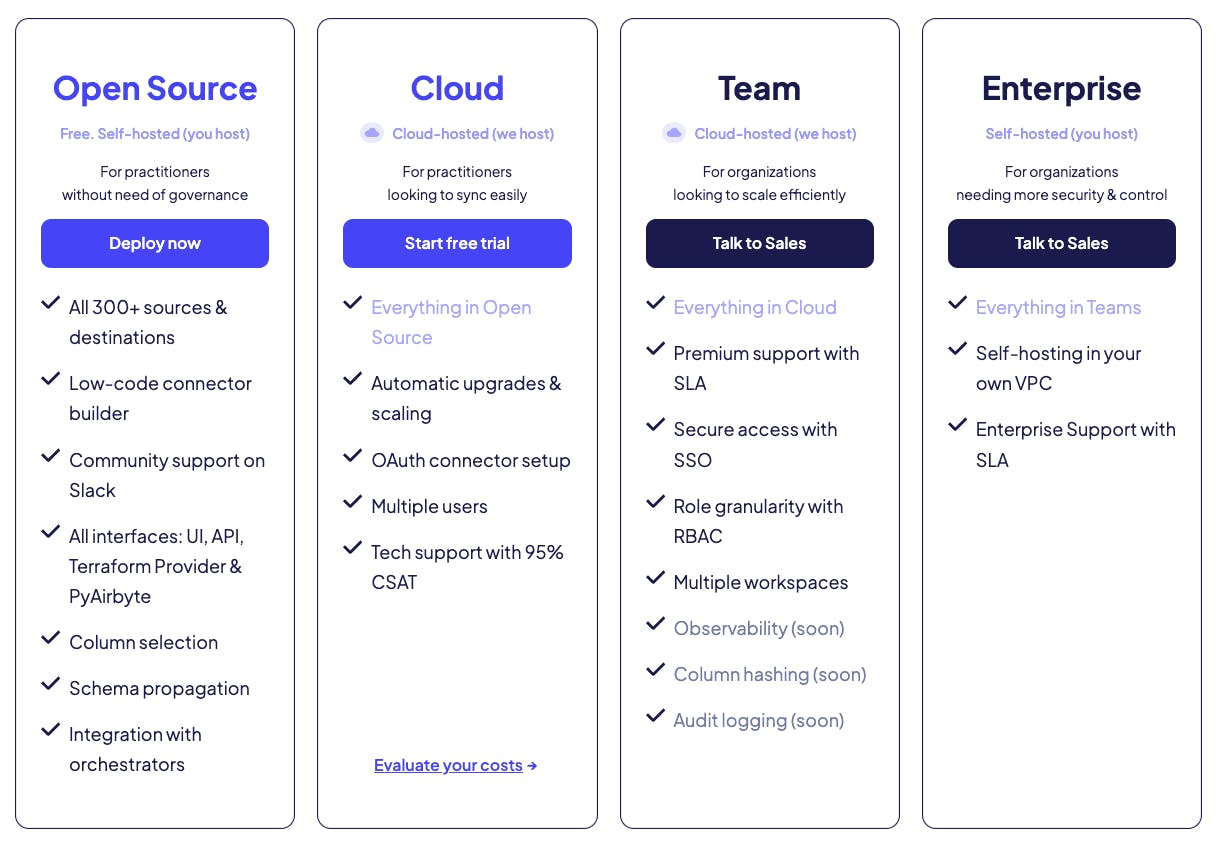

In addition to the open-source offering, Airbyte provides a cloud-hosted version and an enterprise edition with additional features like SSO, role-based access control, and advanced scheduling options. The company has seen rapid adoption, with thousands of companies using their platform and a growing community of contributors helping to expand its connector ecosystem.

Business Model

Airbyte is an open-source data integration platform that generates revenue through a combination of cloud-hosted and self-hosted subscription models.

The company's core offering allows businesses to extract, transform, and load (ETL) data from various sources into desired destinations, simplifying the process of data synchronization and management.

Airbyte's pricing model is based on usage, with customers paying for the volume of data processed through the platform.

The company also offers a free tier for smaller workloads, employing a product-led growth strategy to attract users who may later upgrade to paid plans as their data requirements increase.

Airbyte's strategy of focusing on the long tail of data integrations positions it to capture market share in areas underserved by established players. This approach is particularly attractive to companies dealing with niche or custom data sources that may not be supported by traditional ETL providers.

Competition

Airbyte competes with established ETL providers, open-source data integration platforms, and native data warehouse integrations offered by SaaS vendors.

ETL

In the traditional ETL space, Airbyte faces competition from well-established players like Fivetran ($5.6B valuation) and Stitch. Fivetran has built a $190M annual business by maintaining about 200 high-quality connectors for popular SaaS applications.

They charge customers based on the volume of data synced, which has proven lucrative as companies increasingly move data into cloud warehouses.

Open-Source

Within the open-source data integration space, Airbyte competes with platforms like Meltano (raised $12.4M) and Hevo Data (raised $43M). These companies aim to cover more integrations than Fivetran by shifting connector development and maintenance to their user communities.

Airbyte has gained significant traction in this category, with a community of 9,000+ users as of 2021. However, the quality and reliability of community-maintained connectors can be inconsistent. Airbyte's challenge is to balance the breadth of integrations with ensuring connector quality and reliability.

Native SaaS Integrations

A growing trend in the market is SaaS vendors offering native data warehouse integrations. Companies like Stripe, Salesforce, and Customer.io are building direct connectors to popular data warehouses, potentially threatening Airbyte's value proposition.

These native integrations can offer better performance and reliability since they're built and maintained by the data source owners themselves. They also provide an additional revenue stream for SaaS vendors - for example, Stripe charges $0.03 per transaction for its data warehouse integration.

TAM Expansion

Airbyte has tailwinds from the proliferation of SaaS applications and cloud data warehouses, and has the opportunity to grow and expand into adjacent markets like data integration infrastructure and AI-powered data pipelines.

Data Integration Platform

As companies adopt more specialized software tools, the demand for solutions that can efficiently extract and load data into cloud warehouses will likely increase.

Airbyte's community-driven approach to building and maintaining connectors gives it an advantage in addressing the long tail of data sources that larger competitors like Fivetran may not prioritize.

The company can expand its addressable market by focusing on enterprise-grade features and support, moving upmarket from its current base of smaller companies and individual users. By offering advanced security, compliance, and scalability capabilities, Airbyte could compete more directly with established players in the ETL space while maintaining its open-source roots.

Data Infrastructure Provider

As data integration becomes increasingly critical for businesses, Airbyte has the potential to evolve into a comprehensive data infrastructure provider. This could involve developing additional tools and services around data quality, governance, and observability.

By expanding its offerings to cover more of the modern data stack, Airbyte could increase its value proposition and capture a larger share of enterprise IT budgets.

One promising direction is to build out a platform for managing and monitoring data pipelines across multiple tools and environments. This would address the growing complexity of data architectures and position Airbyte as a central hub for data engineering teams.

AI-Powered Data Integration

The rise of artificial intelligence and machine learning presents both a challenge and an opportunity for Airbyte. As AI capabilities advance, there may be increased demand for intelligent data integration solutions that can automatically map schemas, detect anomalies, and optimize data flows.

Airbyte could leverage its open-source community and existing connector ecosystem to develop AI-enhanced features that streamline the data integration process.

By incorporating machine learning into its platform, Airbyte could differentiate itself from competitors and tap into the growing market for AI-powered data tools. This could include developing capabilities for automated data cleaning, entity resolution, and predictive maintenance of data pipelines.

Risks

1. Open source commoditization: As an open source platform, Airbyte faces the risk of commoditization. While their community-driven approach allows for rapid development of new connectors, it also means competitors can easily replicate and improve upon Airbyte's core offering. This could erode Airbyte's competitive advantage and pricing power over time, especially if enterprise-grade alternatives emerge.

2. Inconsistent connector quality: Airbyte's reliance on community-contributed connectors leads to inconsistent quality across its 200+ integrations. Unlike Fivetran's curated approach, Airbyte cannot guarantee the reliability and maintenance of all connectors. This could frustrate enterprise customers who require consistently high-quality data pipelines, potentially limiting Airbyte's ability to move upmarket.

3. Native integrations from SaaS vendors: As major SaaS companies like Salesforce and Stripe begin offering native data warehouse integrations, Airbyte risks losing market share for its most valuable connectors. These native integrations, often priced competitively, could siphon off high-volume customers who currently drive significant revenue for Airbyte. This trend may accelerate as more SaaS vendors recognize the strategic value of owning their data pipelines.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.