Revenue

$325.00M

2024

Valuation

$5.60B

2022

Growth Rate (y/y)

141%

2022

Funding

$728.00M

2022

Revenue

Note: All data as per publicly available information

Fivetran made an estimated $83M in 2021, and we believe it will make $190M in 2022. It grew at a CAGR of 77% over the last two years. It has a hybrid pricing model with SaaS-style pricing tiers linked to consumption-linked billing. Customers pay for the number of rows of data edited or added to the data warehouse in a month, with higher-priced subscription tiers getting more users, features, and faster syncs. In 2021, it acquired HVR, whose $30M revenue got added to Fivetran’s 2021 revenue. It has 4000+ customers, including JetBlue, Forever 21, Condé Nast, and WeWork.

Valuation

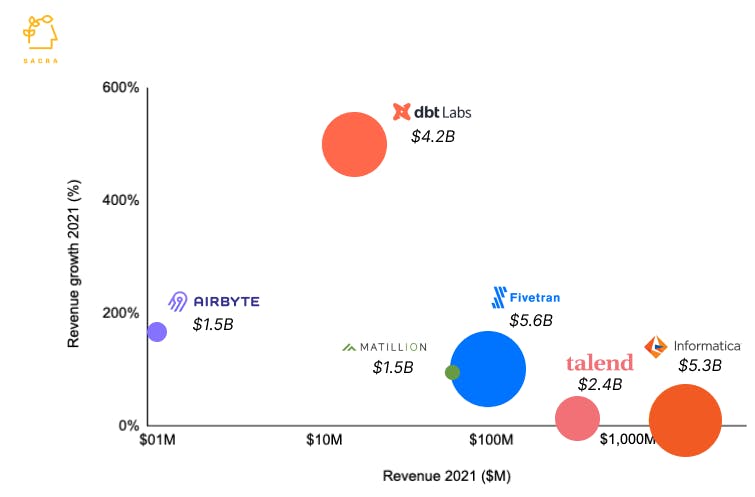

Note: All data as per publicly available information. Size of the bubble indicates valuation. Horizontal axis is in log scale for visual clarity.

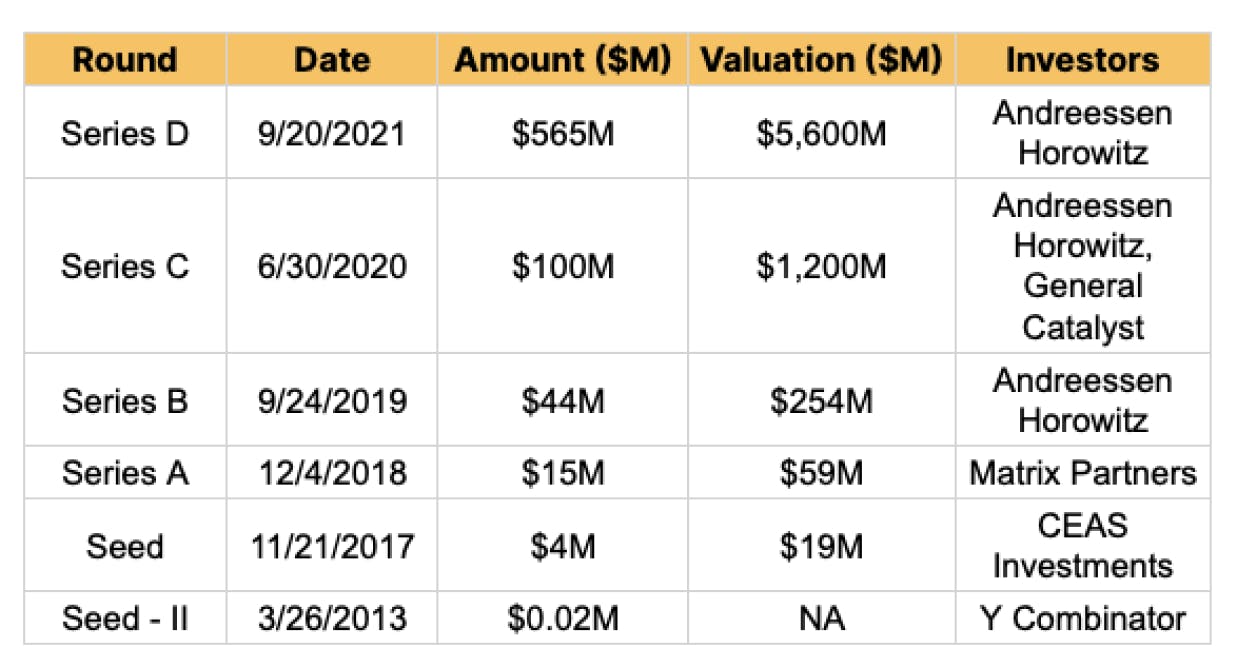

Fivetran has raised $728M from investors such as Andreessen Horowitz, Matrix Partners, and General Catalyst. Its last private valuation was $5.6B, with a revenue multiple of 59x. Companies in the data integration segment have much lower revenue multiples, such as Informatica at 3.7x, Matillion at 26x, and Talend at 7.3x. Fivetran’s high revenue multiple reflects its 100% YoY growth and its wedge into the large enterprise market through HVR's acquisition. Modern data stack companies DBT Labs (280x) and Airbyte (1500x) have very high revenue multiples as investors are pouring money into startups commercializing open-source software after the success of Databricks.

Business Model

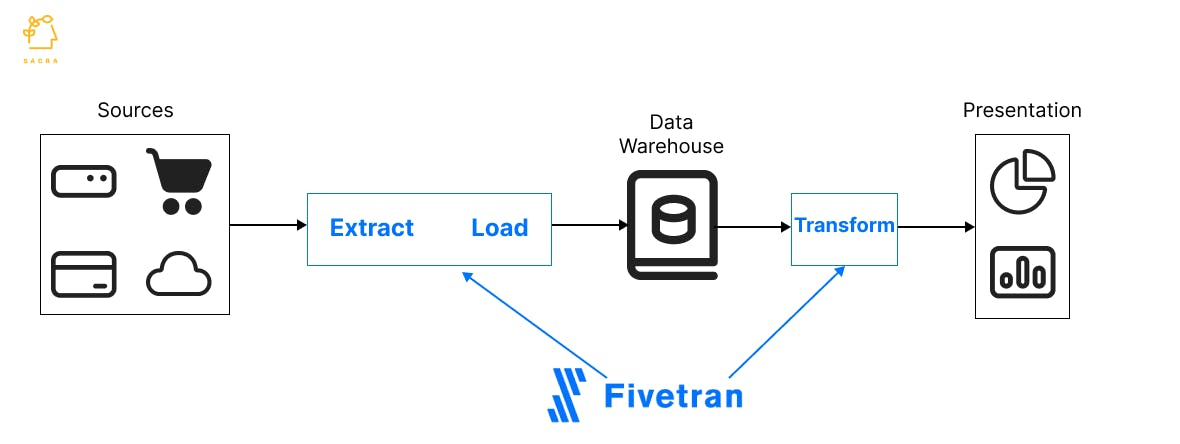

Modern companies use multiple applications like Salesforce for CRM, Stripe for payments, Zendesk for customer support, and cloud databases that capture transactions like flight booking and payments from their websites and apps. To know what is happening in the business, they want to move all the data to a data warehouse where analysts can run queries and build dashboards. For this, the first step is to copy the data from these source systems (called Extraction) and replicate it in the data warehouse (called Loading).

Fivetran is a Plaid-like data pipeline tool that automates the grunt work of ‘extraction and loading’ by moving data from multiple applications and databases to a central data warehouse like Snowflake or BigQuery without any coding.

Before Fivetran, data engineers spent considerable time building these data pipelines by writing code manually. However, it is hard to build pipelines for every possible source application as each has a different schema, data types, and APIs. Also, these connectors got old fast as APIs often changed without notice, breaking the connectors and making the maintenance harder than building them.

Fivetran sells a library of 200+ fully-managed connectors that companies can use in a plug-and-play manner without using developers. It covers popular apps like Stripe, Google Analytics, Salesforce, and Shopify and longtail apps like SugarCRM and Reddit. It monitors all connectors for API changes, schema changes, downtime, etc., sending alerts to customers if any connector is down.

Its SaaS-style pricing converts the fixed cost of hiring expensive data engineers to build/maintain data pipelines to a variable monthly cost. As companies capture more data and send it to their data warehouses, Fivetran makes more money with its consumption-based pricing model. Thus, Fivetran grows with its faster-growing customers.

Product

Fivetran found an initial product-market fit by selling to tech start-ups from its Y Combinator’s network, which were building apps on the cloud and couldn’t use the existing data integration software designed for on-premise data warehouses. By making it easy to send data from point A to point B, Fivetran freed their engineers from writing custom integration code to working on more critical tasks.

Connectors

Fivetran’s core product is the data connectors library that pulls in data from source applications and replicates it into a data warehouse, monitors the connections, and alerts customers when something goes wrong. Its other data replication product, CDC database replication, is used to automate high-volume data movement, typically in the case of connections between Oracle and Snowflake or migration between cloud data warehouses.

Transformations

Fivetran offers two types of transformations - basic SQL transformations and dbt Core, with additional features like version control, lineage graphs, and documentation. Customers use transformations to get their raw data into shape for downstream uses such as visualization or reverse ETL. Along with the connectors, the transformations give data teams control over the entire data pipeline without using data engineering resources.

Powered by Fivetran

By using Powered by Fivetran, companies give a web portal to their end customers for connecting their data sources to the Fivetran instance being run by the company. For instance, a marketing data company can publish a web application to a customer using which they can connect data sources like Google Ads and Google Analytics in a self-service way to Fivetran managed by the data company.

Competition

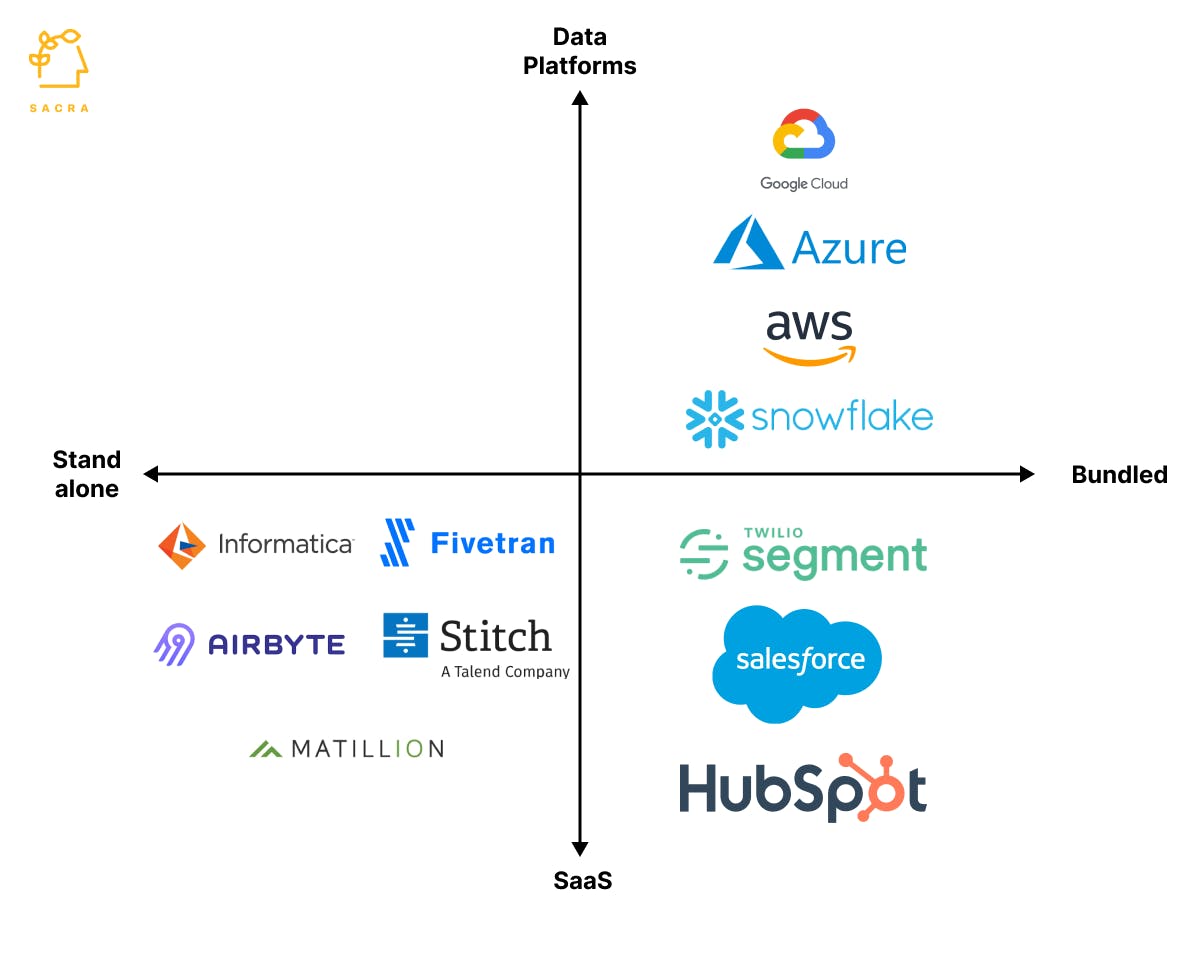

As more companies move their data warehouses to the cloud, legacy data integration companies built for on-prem data warehouses are playing catch-up with cloud-native data integration companies like Fivetran. These cloud-native data integration companies have similar features, making it hard to differentiate them. While data warehouses offering their own ELT pipelines are a threat to Fivetran, a bigger headwind is the bundling of data pipelines by large SaaS apps that can connect with any data warehouse.

Data integration companies

Informatica (market cap: $5.3B) is one of the largest data integration companies, which started with data connectors for on-prem data warehouses. It offers more features than Fivetran, like data quality management, data governance, and cataloging, which makes it appealing to enterprises but too complex for startups and mid-market companies. Another competitor, Airbyte ($1.5B), is taking an open-source community-based approach to sell at 10x cheaper than Fivetran and add 500 connectors in 2022.

SaaS companies

SaaS companies like Segment, Salesforce, and Hubspot offer native connectors that sync data with Snowflake and other cloud data warehouses without using Fivetran. While it is unlikely that all the thousands of SaaS applications will offer such connectors due to the time and cost involved, we are seeing a trend of bigger SaaS companies moving in this direction. They can make more money by rolling it as a feature into their higher-priced tiers. Startups like Y Combinator-backed Prequel are selling out-of-box data connector solutions to SaaS companies taking away the pain of maintaining them. This is a key headwind for Fivetran as most of the data replication volume comes from a handful of SaaS applications. Once they provide native connectors, startups can write custom integrations for low-volume long-tail jobs without using Fivetran.

Cloud data warehouses

AWS Glue, GoogleData Fusion, and MicrosoftAzure Data Factory are native cloud data integration tools that work well when companies want to standardize their operations on a single cloud platform. However, CIOs/CDOs often worry about getting locked into a vendor and want to use different vendors across different data pipeline stages. As these tools are add-ons rather than core products for cloud providers, the UX is basic, with limited connectors compared to Fivetran.

Risks

HVR integration

HVR and Fivetran have different tech stacks, and it may take a long time to integrate HVR fully into Fivetran’s offering. This can delay Fivetran’s enterprise expansion, which is expected to be a major source of future growth

Native data connectors from SaaS companies

As SaaS companies add native data connectors to their offering, with the help of startups like Prequel, companies don’t need to use Fivetran for at least some of the latest SaaS apps. While this doesn't make Fivetran disappear, with its consumption-based pricing, Fivetran loses revenue as these large SaaS companies are the ones that create the most data.

Fundraising

Funding Rounds

|

|

||||||

|

||||||

|

|

||||||

|

||||||

|

|

||||||

|

||||||

|

|

||||||

|

||||||

|

|

||||||

|

||||||

| View the source Certificate of Incorporation copy. |

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.