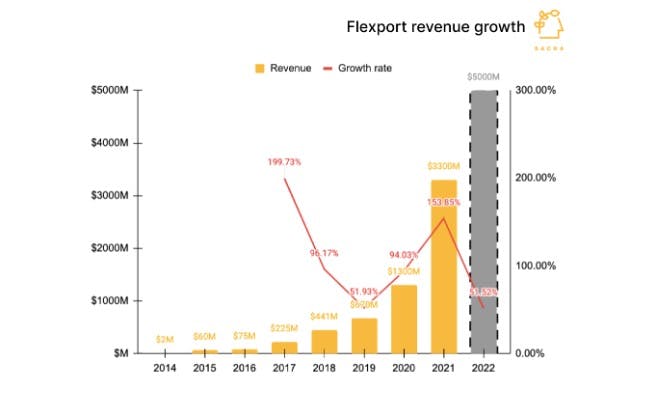

Flexport's $140B vision

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [flexport-140b-vision] TL;DR: We did a report on Flexport—check it out here. Key points from our...

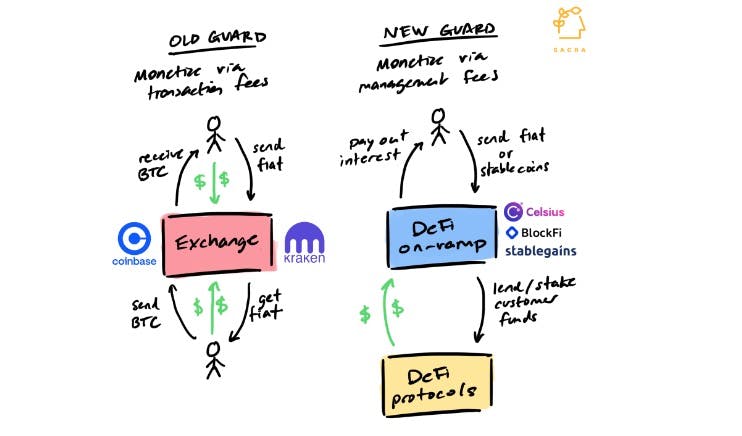

Kraken: the unsexy crypto exchange

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [unsexy-crypto-exchange] TL;DR: We did an interview with David Ripley, the COO of Kraken—check it out...

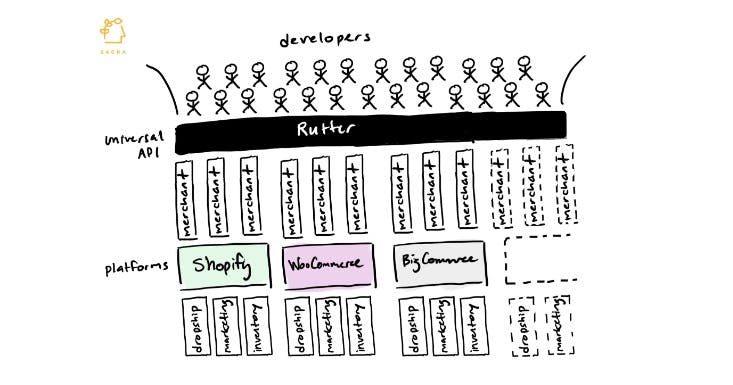

Rutter, Finch, and "Plaid for X"

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [plaid-for-x] Universal APIs serve as middleware that save developers from integrating one-by-one with individual platforms...

Figma, Canva, and the Wasm-enabled startups unseating Adobe Creative Suite

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [wasm-startups-adobe-creative-suite] Gmail launched in 2004, along with Docs and Sheets (created by XL2Web, later acquired...

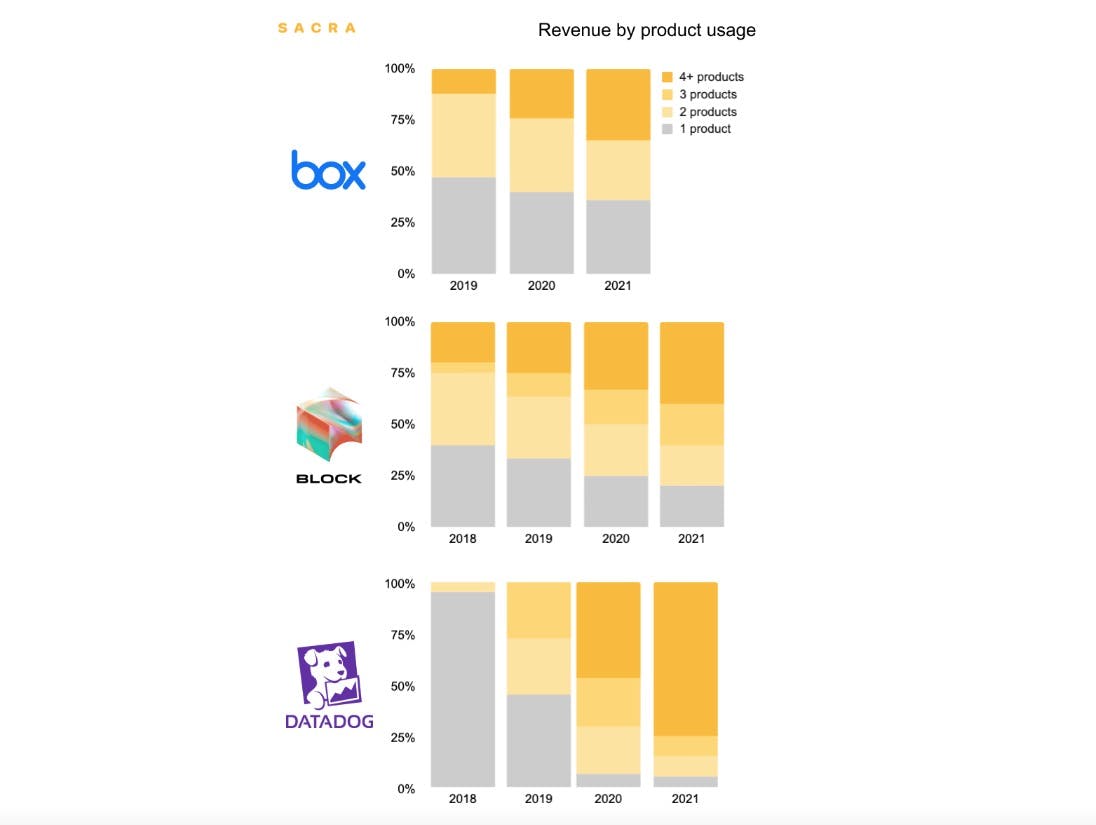

Why Rippling & Ramp raised up rounds in 2022

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [rippling-ramp-up-rounds-2022] Box passed $300M ARR through its 2015 IPO as a single-product company. Later that...

The NFT winter

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [the-nft-winter] With NFT sales down 92% since September, investors and developers alike are now looking...

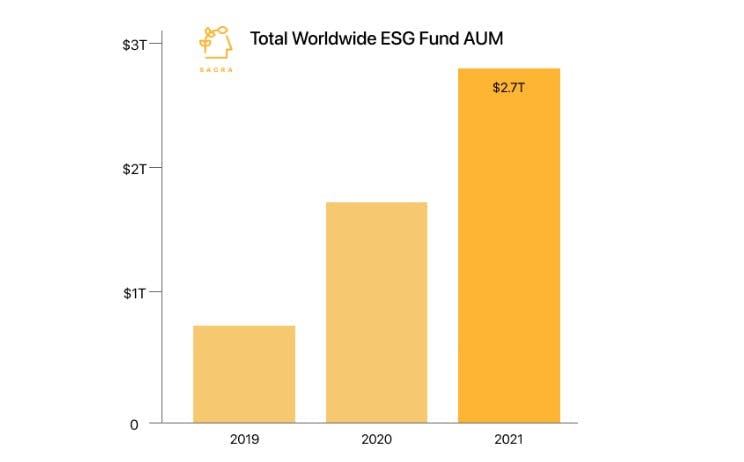

Persefoni, Patch, and the companies betting on ESG

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [companies-betting-on-esg] If rules proposed by the SEC last month become law, about 3,000 of the...

Fast vs. Bolt

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [fast-vs-bolt] The news of Fast’s shutdown leaves Bolt—with its $1.3B raised and $11B valuation—as the...

The Stripe of virtual-first healthcare

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [stripe-virtual-first-healthcare] Over the last several months, we’ve been creating short-form versions of Sacra reports in...

Sacra this week: Runway, Art Blocks, and Duffl

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [runway-art-blocks-duffl] We’re going to be sending our members weekly emails to (1) share all the...

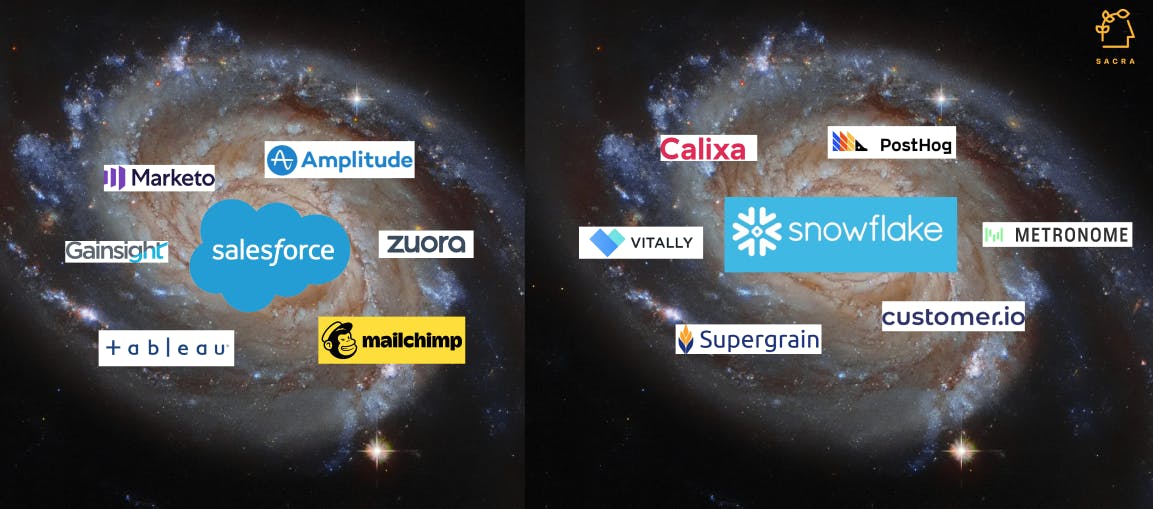

Salesforce, Census, and the end of CRM

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [the-end-of-crm] In sales-driven SaaS, the CRM is the money-maker where deals get closed. Over time,...

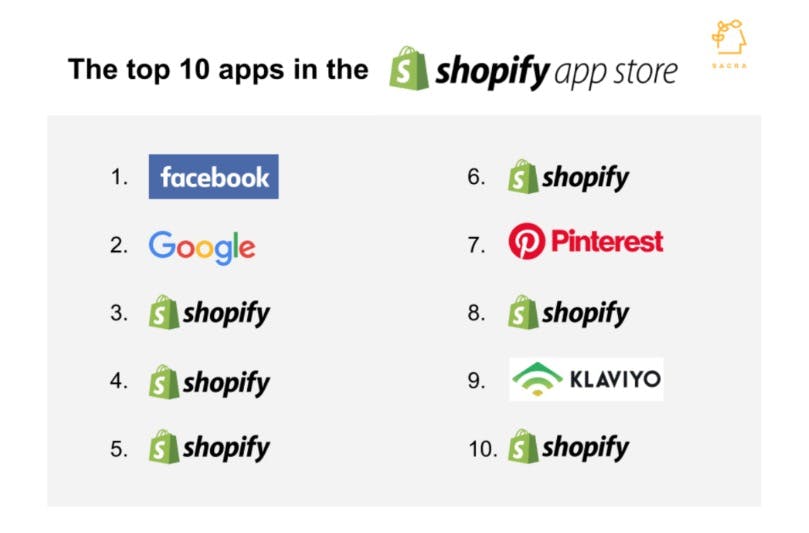

Shopify's unholy alliance

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [shopify-unholy-alliance] Shopify armed the rebels against Amazon through an unholy alliance with the big social...

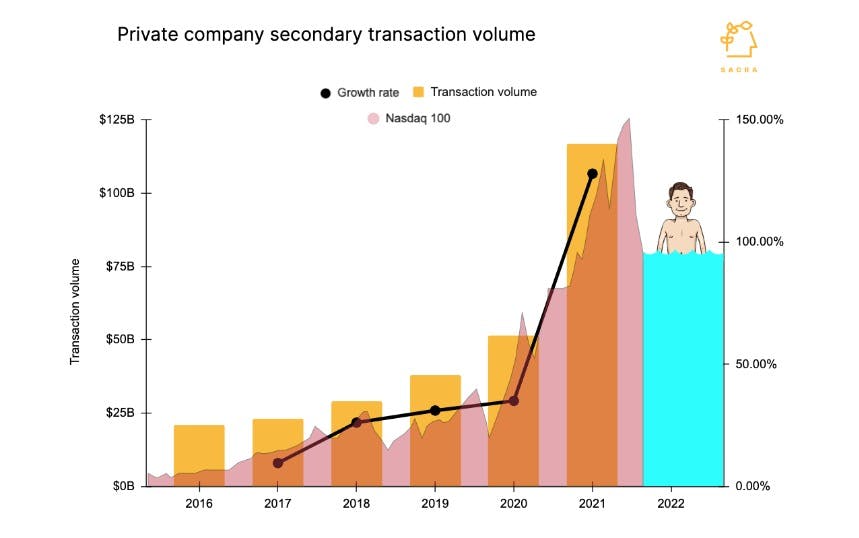

Caplight and swimming naked in the secondary markets

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [swimming-naked-secondary-markets] In the words of Warren Buffet, “You don’t know who’s been swimming naked long...

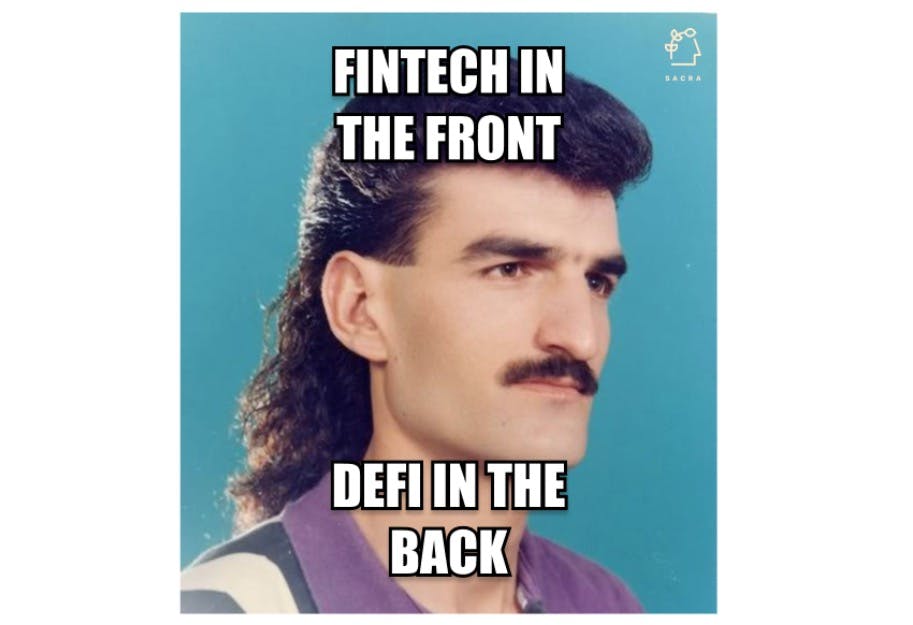

Eco: the DeFi mullet and other novel consumer fintech

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [defi-mullet-novel-consumer-fintech] While crypto and fintech have run on separate parallel tracks, in 2022 we're seeing...

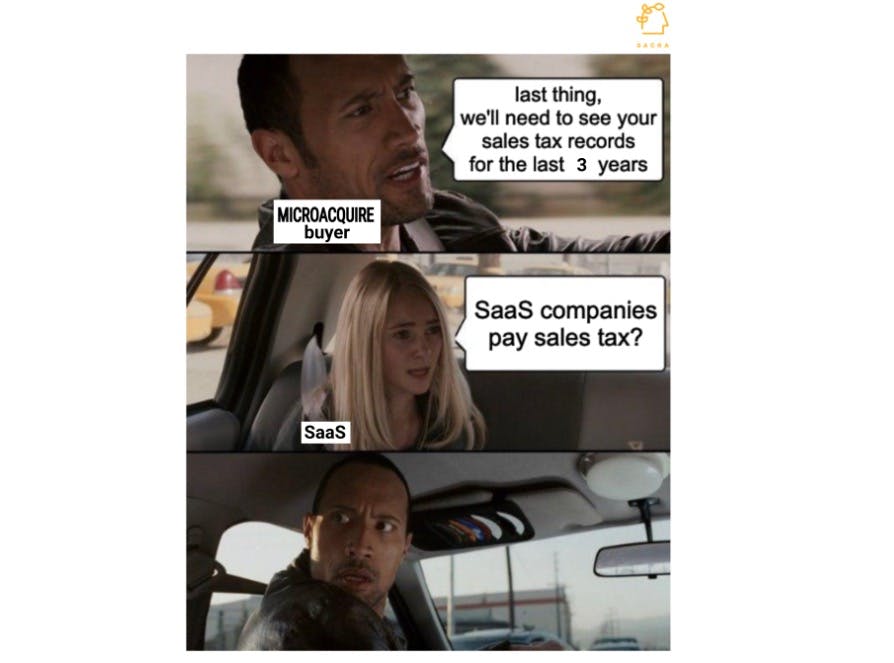

Anrok: SaaS vs. the state

Hi everyone 👋 Sign up to our email list for more weekly private market insights. [saas-vs-the-state] There's a battle raging between internet-native companies with neither a physical footprint nor physical...