Wingspan's 992x growth in contractor payroll

Jan-Erik Asplund

Jan-Erik Asplund

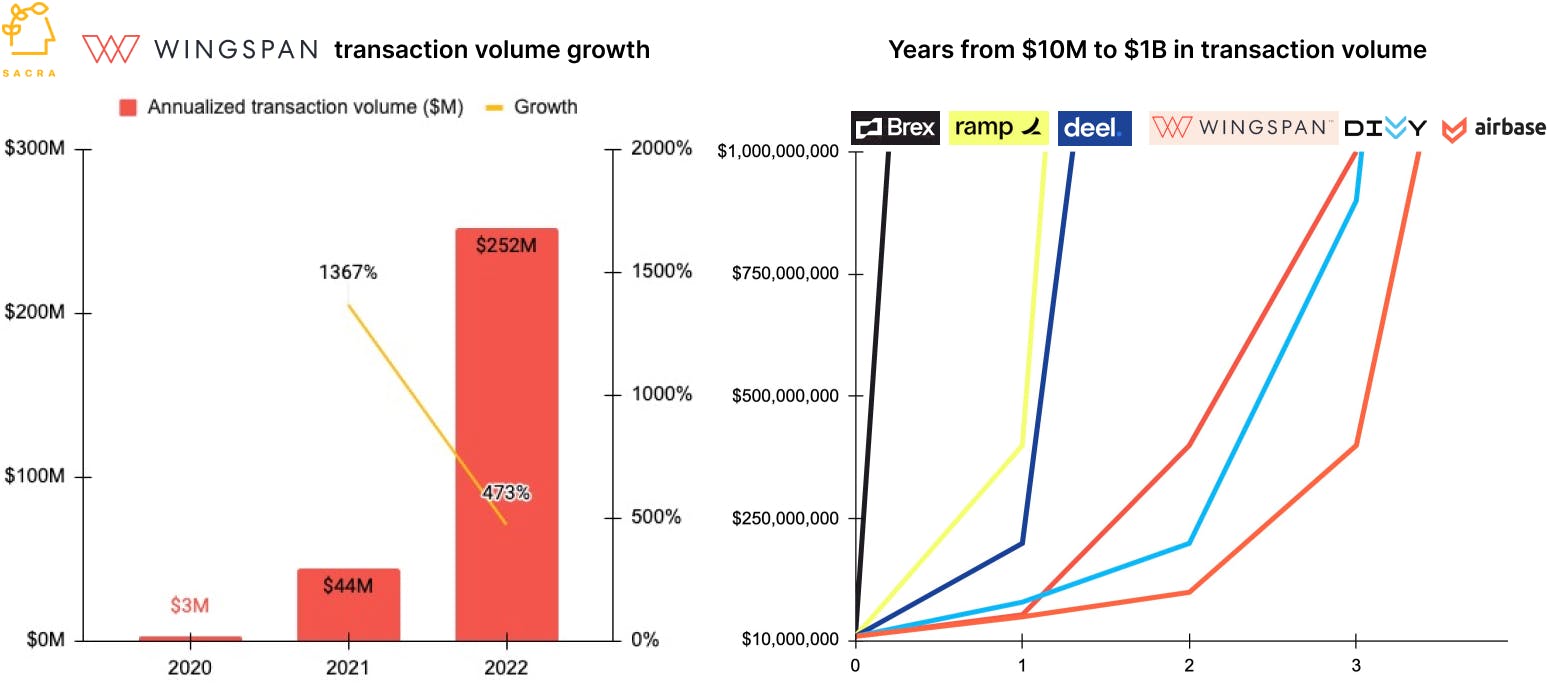

TL;DR: Wingspan has grown its transaction volume by 992x over the last 3 years, riding the twin tailwinds of remote work and the rise of the independent contractor. Now, they’re going up against Rippling, Deel, Bill.com, ADP, Gusto, Ramp, Brex, and others in the race to own the contractor wallet. For more, check out our interviews with Anthony Mironov, CEO of Wingspan and Matt Drozdzynski, CEO of Plane (fka Pilot).

We first interviewed Wingspan CEO and co-founder Anthony Mironov in 2022, later mentioning Wingspan in our report on contractor payroll. Since then, they’ve raised a $14M Series A led by Andreessen Horowitz and grown their transaction volume by 6x, bringing their total volume growth over the last 3 years to 992x.

Key points from our research:

- The growth of the gig economy via Uber (2009), Postmates (2011), and Instacart (2012) gave rise to Stripe Connect (2012), an API for tech companies to pay large numbers of gig workers on 2-sided marketplaces programmatically. In 2022, businesses built on Stripe processed $817B in total volume, up 26% year-over-year, with 100+ companies handling $1B+ in payments each year. (link)

- Wingspan ($23.5M raised) launched in 2019 to bring the same capability to onboard, pay, and support large numbers of contractors to unsexy, non-tech companies like insurance claims services like CIS Group ($1.4B in revenue) and staffing firms like BELAY Solutions ($250M in revenue), a 100% remote, leading virtual staffing solutions company that works with more than 6,000 people. These companies would traditionally pay their contractors via legacy payroll products like Paycom (NYSE: PAYC), Paychex (NASDAQ: PAYX) or ADP (NASDAQ: ADP) that weren’t designed to pay a thousand contractors at once, or through or AP automation tools like Bill.com (NYSE: BILL) not designed to pay individuals or process employment documents. (link)

- In April 2020, Wingspan was doing about $500K in annualized transaction volume—in May 2023, they hit $450M, up 992x and 6.1x year-over-year from 2022. Compare to Brex doing $17.5B in annualized transaction volume at $400M revenue (growing 67%) and last valued at $12.3B, Ramp at about $5B in annualized transaction volume and last valued at $8.1B, or ADP at $2.7T of gross payments volume in FY’21 and a market cap of $90B. (link)

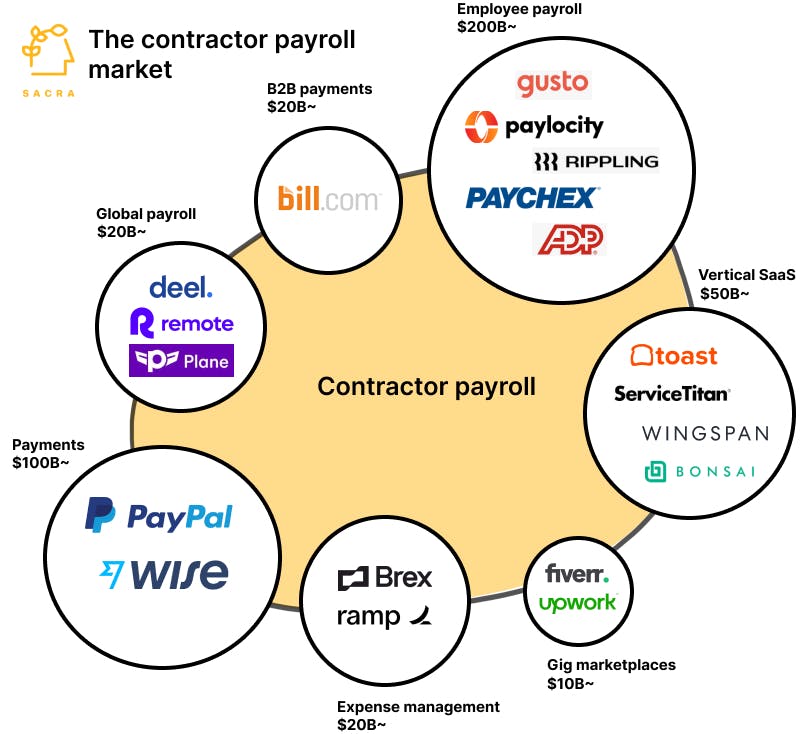

- Paying contractors currently exists as a hotly contested feature across the fiercest pre-IPO battlegrounds including modern payroll—Gusto ($260M revenue in 2022), Rippling ($135M revenue in 2022), and Deel ($295M revenue in 2022)—and expense management—Ramp ($1.4B raised) and Brex ($400M revenue in 2022)—each of which has a multiproduct approach to eating up all of the use cases around paying people and businesses. However, a breakpoint still exists between payroll & HR and finance that creates ambiguity when paying contractors—both “people” and “vendors”—that’s left these companies unable to capture contractor payroll as an atomic unit. (link)

- Between the rise of the independent contractor and remote work, contractor payroll's addressable market is large, growing—60M+ American workers do some freelance labor every year, with $1.4T being paid out to them—and networked, with freelancers invoicing 4-16 clients every year. Within this set of workers they serve, Wingspan has the opportunity to break off pieces of ADP’s $16.5B per year business to move into the adjacent markets around contractor payroll—from payroll to PEO/EOR, workforce management, retirement, compliance, talent acquisition, and more. (link)

For more, check out this other research from our platform:

- Anthony Mironov, CEO of Wingspan, on the convergence in back-office SaaS (2023)

- Anthony Mironov, CEO of Wingspan, on building financial services for contractors (2022)

- Matt Drozdzynski, CEO and co-founder of Plane, on global payroll post-COVID

- Dan Westgarth, COO of Deel, on the global payroll opportunity

- Rippling (dataset)

- Wingspan (dataset)

- Justworks (dataset)

- Gusto (dataset)

- Brex (dataset)