Why Meta bought Limitless

Jan-Erik Asplund

Jan-Erik Asplund

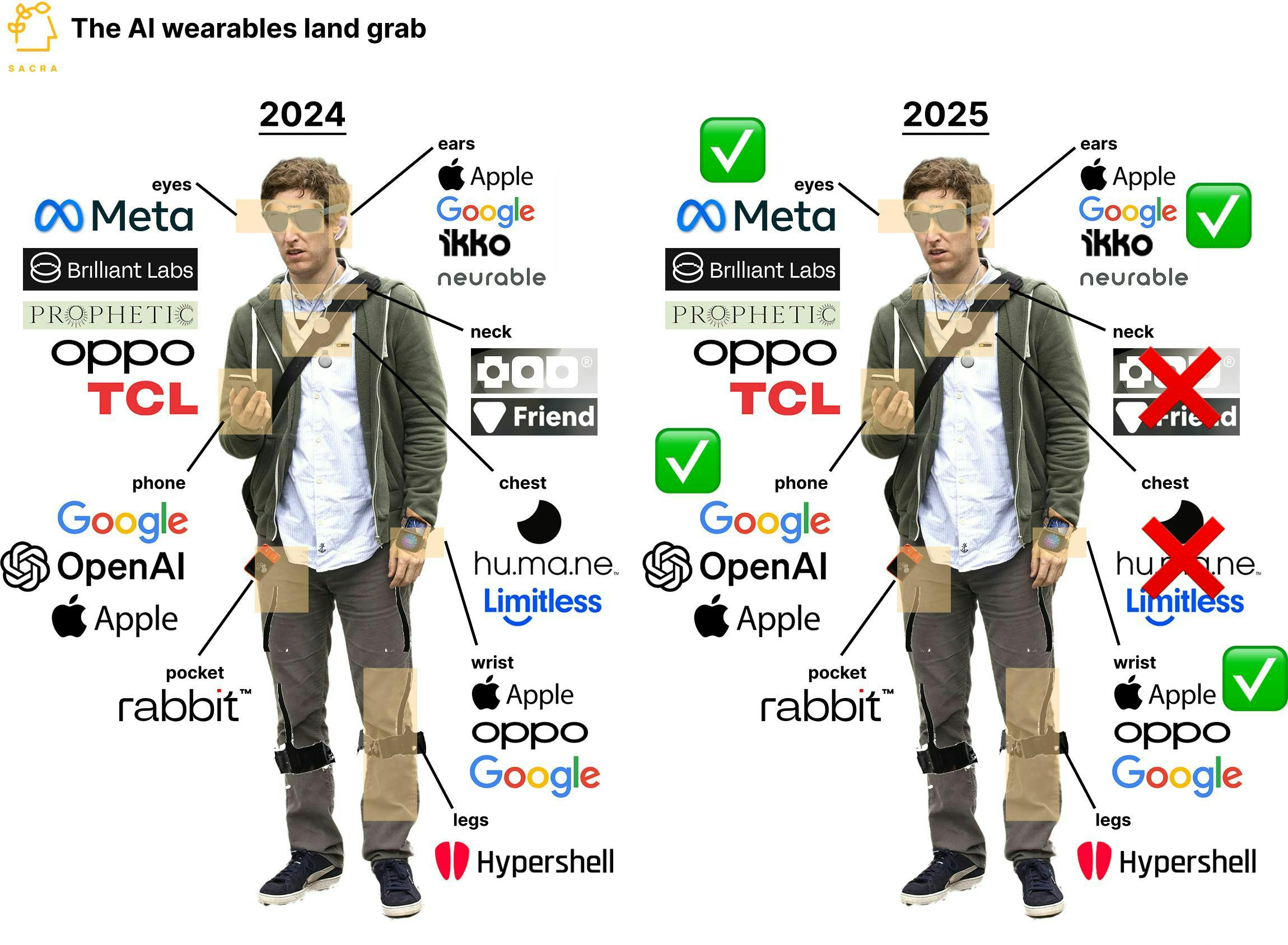

TL;DR: The AI pendant category has collapsed, with Humane sold to HP, Friend pivoting to software, and now Limitless getting acqui-hired by Meta, and the chest & neck AI wearable form factor is being absorbed into existing hardware like smart glasses and earbuds rather than surviving as a standalone category. For more, check out our full report on Limitless (dataset).

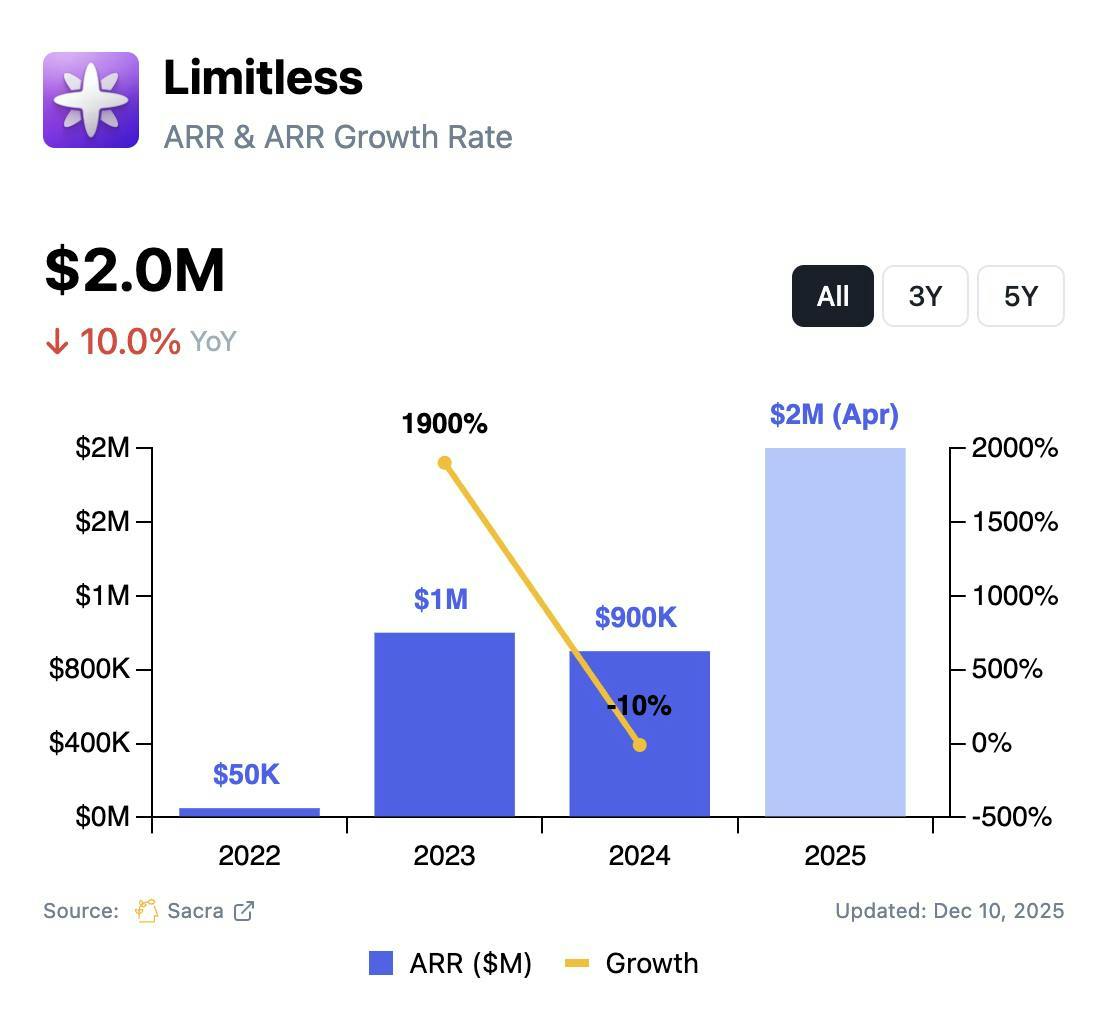

Launched in November 2022, Limitless started out as Rewind ($33M raised, A16Z), an always-on desktop screen and audio recorder that used OCR and local LLMs to give users full-text search over everything they'd seen, said, or heard on their computer. Rebranding to Limitless in April 2024, the company pivoted to a $99 meeting-focused AI pendant.

A week ago, Meta acquired Limitless and wound down hardware sales, absorbing the team into Reality Labs to work on AI-enabled wearables like Ray-Ban Meta smart glasses.

Key points via Sacra AI:

- The 2023-2024 AI pendant thesis—that LLMs could unlock a screenless, microphone and/or camera-centric form factor worn on the chest or neck—drove $241M in investment to Humane (valued at $850M as of March 2023) for its $699 AI Pin, a voice-operated device with a laser palm display & camera that delivered just ~10,000 orders against a 100,000-unit goal amid reviews citing slow responses, overheating batteries, and a fire-risk recall. In February 2025, HP acquired Humane's AI software, IP, patents, and team for $116M (an 86% markdown from peak valuation) to form a new in-house innovation lab called HP IQ, while discontinuing the AI Pin entirely.

- Where Humane’s AI Pin went horizontal as an assistant, phone, camera, real-time translator & more, the Friend (founded 2023, $2.5M raised) pendant focused solely on the AI companion use case ($348K in sales as of September 2025) before shifting focus to their web-based chatbot in October 2025. Shifting strategy from vertically integrated hardware plus software to pure software, Friend is betting on the more well-defined product-market fit of cross-device AI companion apps defined by sycophantic foundation models like ChatGPT 4o (900M weekly active users), AI character chat like Character.ai (acquired by Google for $2.7B) & Replika (founded 2015, 30M+ users) and AI journaling & therapy apps like Rosebud AI ($6M raised, Bessemer), Slingshot AI ($93M raised, A16Z), and Wysa ($30.5M raised, W Health Ventures).

- Meta's December 2025 acquisition of the Limitless pendant & immediate winding down of the hardware product signals the death of the category and that the future AI pendant experiences will live inside glasses (Meta Ray-Ban), earbuds (Apple Airpods), watches (Apple Watch), and phones (Apple, Google, OpenAI). In B2B video call recording, the invisible call recording approach using system audio of Granola has begun to prevail over the previous-generation meeting bot approach of Otter ($100M ARR in March 2025) & Fireflies (~$15M ARR in May 2025), reducing the social friction & awkwardness that was unavoidable with Limitless whose terms required notice & consent from anyone being recorded.

For more, check out this other research from our platform: