Why Grammarly bought Superhuman

Jan-Erik Asplund

Jan-Erik Asplund

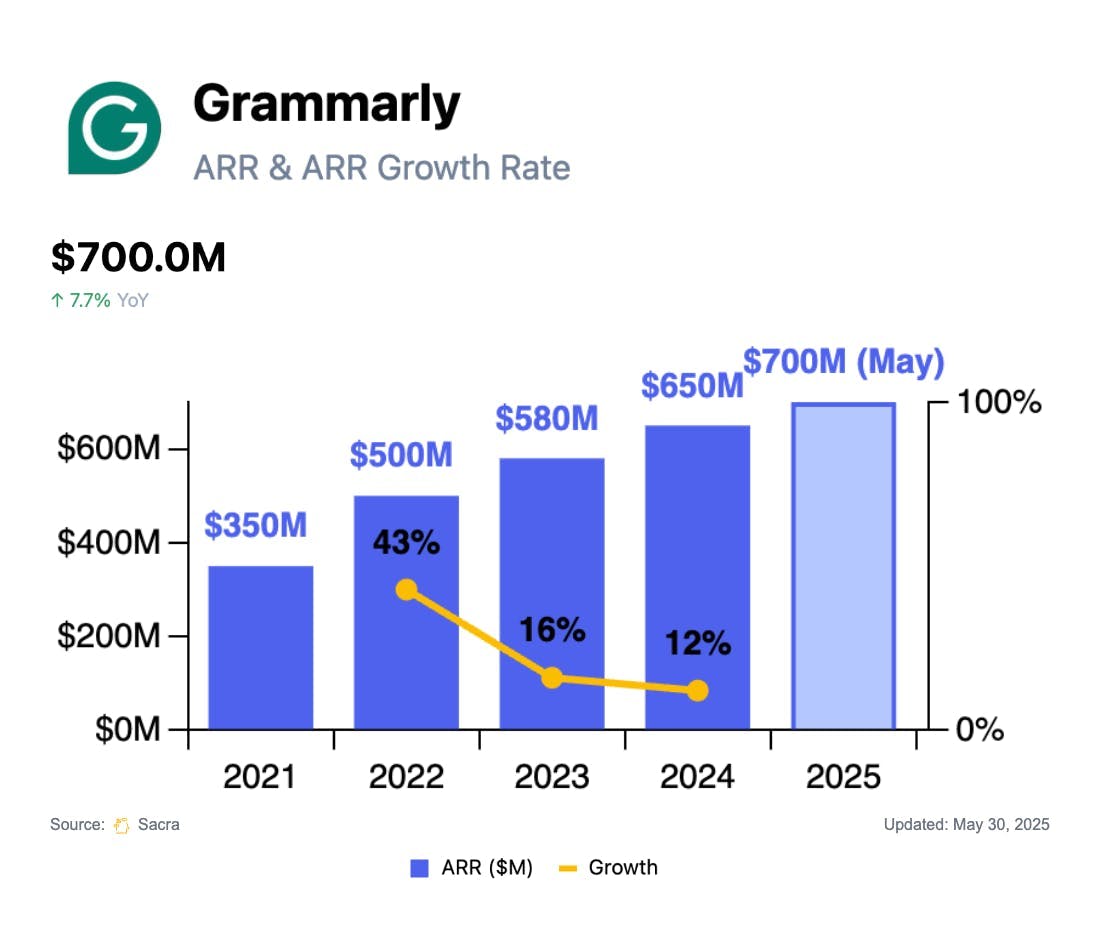

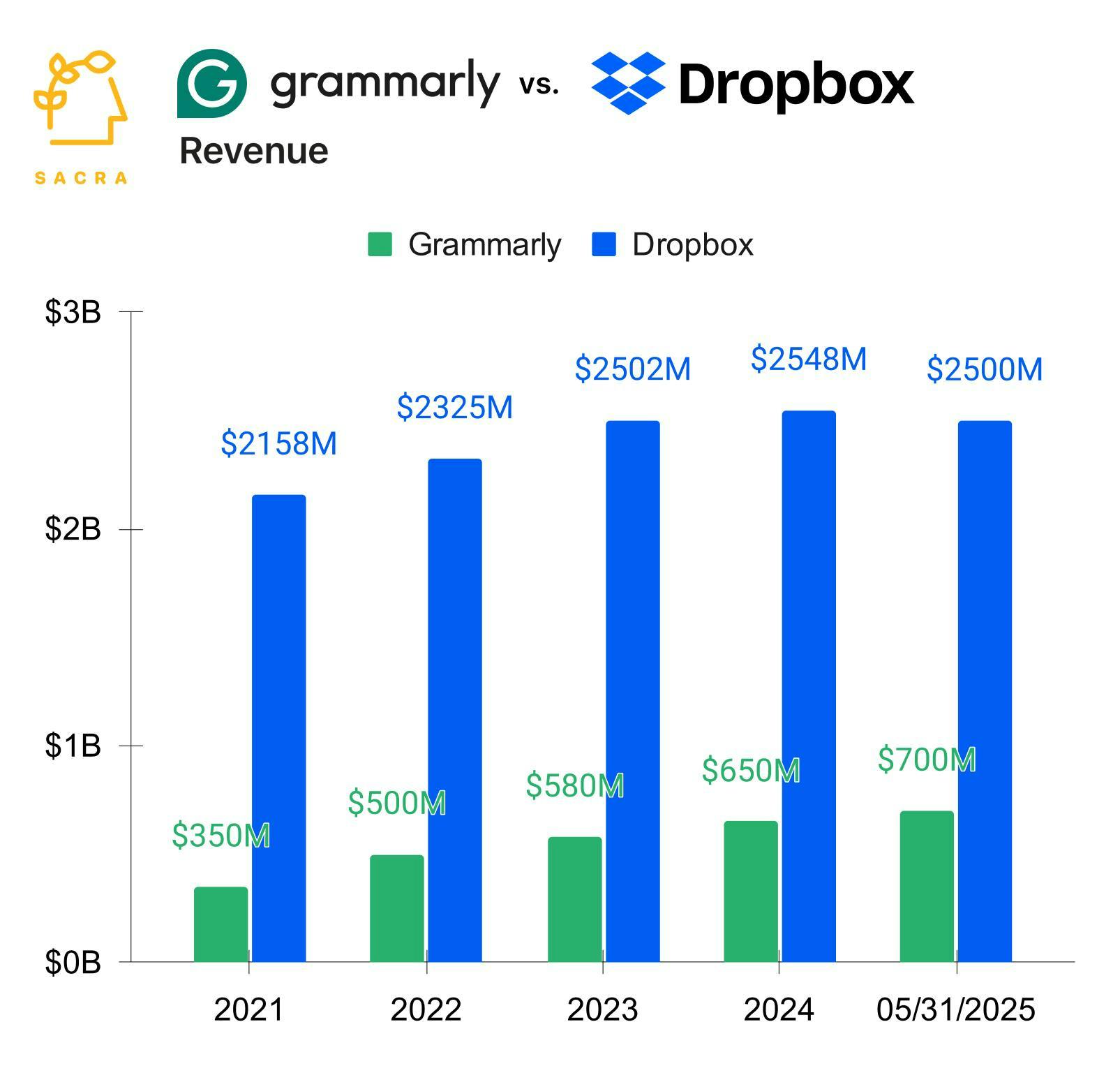

TL;DR: Grammarly’s acquisition of Superhuman marks its next move in a Commure-style roll-up of high-engagement, under-monetized productivity SaaS as it looks to build a full-stack AI suite across email, docs, and beyond. Sacra estimates that Grammarly hit $700M ARR in May 2025, up from $650M ARR at the end of 2024. For more, check out our full reports and datasets on Grammarly and Superhuman.

We last covered Grammarly in June 2025 after it raised $1B from General Catalyst to invest into sales & marketing and acquisitions like Coda (acquired December 2024).

Earlier today, Grammarly announced that it has acquired email client Superhuman ($108M raised, A16Z), last valued at $825M after raising a $75M Series C led by IVP in 2021.

Key points via Sacra AI:

- LLMs have commoditized Grammarly’s core product—collapsing drafting, rewriting, and tone-shifting into a single API—enabling every writing tool & productivity suite to embed writing assistants natively across Microsoft Office 365 (Copilot), Google Workspace (Gemini), Notion (Notion AI) and more, with Grammarly’s growth decelerating from 43% YoY growth at $500M ARR in 2022 to ~10% YoY growth at $650M ARR in 2024.

- In response, Grammarly has shifted from “interface-less” browser extension to productivity suite & platform by tacking B2B productivity apps onto Grammarly’s install base of 40M users, first with its December 2024 acquisition of collaborative docs and Notion competitor Coda and now with email client Superhuman ($35M ARR), two similarly product-centric, under-monetized, high-engagement productivity SaaS companies serving key Grammarly use cases (writing docs & writing emails).

- Profitable and backed by $1B from Hemant Taneja at General Catalyst ($36B+ AUM), Grammarly, led now by Coda co-founder & CEO Shishir Mehrotra (previously Chief Product Officer at YouTube), intends to roll up slides, team chat, sheets and more until it has a full-fledged productivity suite, not unlike what General Catalyst is doing in health care with Commure.

For more, check out this other research from our platform:

- Grammarly (dataset)

- Superhuman (dataset)

- GPTZero (dataset)

- Copy.ai (dataset)

- Jasper (dataset)

- Harvey (dataset)

- Jenni AI: the $5M/year Chegg of generative AI

- AI writing goes enterprise

- Harvey at $50M ARR

- David Park, CEO and co-founder of Jenni AI, on prosumer generative AI apps post-ChatGPT

- Chris Lu, co-founder of Copy.ai, on generative AI in the enterprise

- Grant Lee, co-founder of Gamma, on rethinking the primitives of presentations

- Jon Noronha, co-founder of Gamma, on building AI-powered slides