Whatnot at $359M/yr

Jan-Erik Asplund

Jan-Erik Asplund

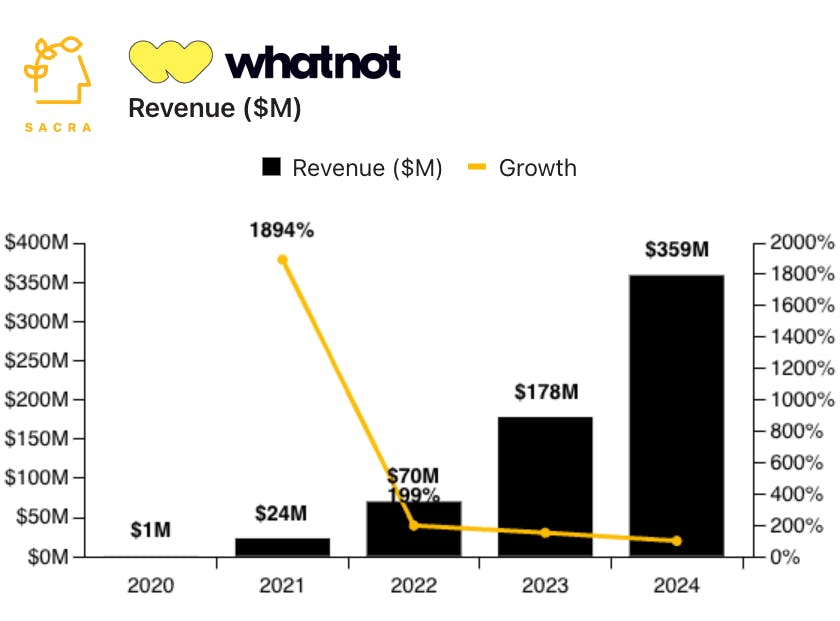

TL;DR: With their entertainment-first design, Whatnot has cracked livestream commerce in the U.S where companies like Meta and Amazon struggled. Sacra estimates that Whatnot grew 102% YoY to $359M in revenue in 2024, now valued at $4.97B for a 14x revenue multiple. For more, check out our full report and dataset.

Key points via Sacra AI:

- Alibaba’s livestream shopping product Taobao Live hit $27B in gross merchandise value (GMV) in 2019 as an mobile-native HGTV —which, combined with the rapid rise of TikTok in the United States (175M downloads in 2020), inspired the launch of Whatnot in 2020 as a TikTok-like livestream ecommerce platform for collectibles like Funko Pops, baseball and Pokemon cards, and sneakers. Whatnot generates an effective take rate of 12.5% on total GMV through the combination of 1) an 8% commission on all sales plus a transaction fee of 2.9% + $0.30 for payment processing, and 2) selling advertising to let sellers boost their streams.

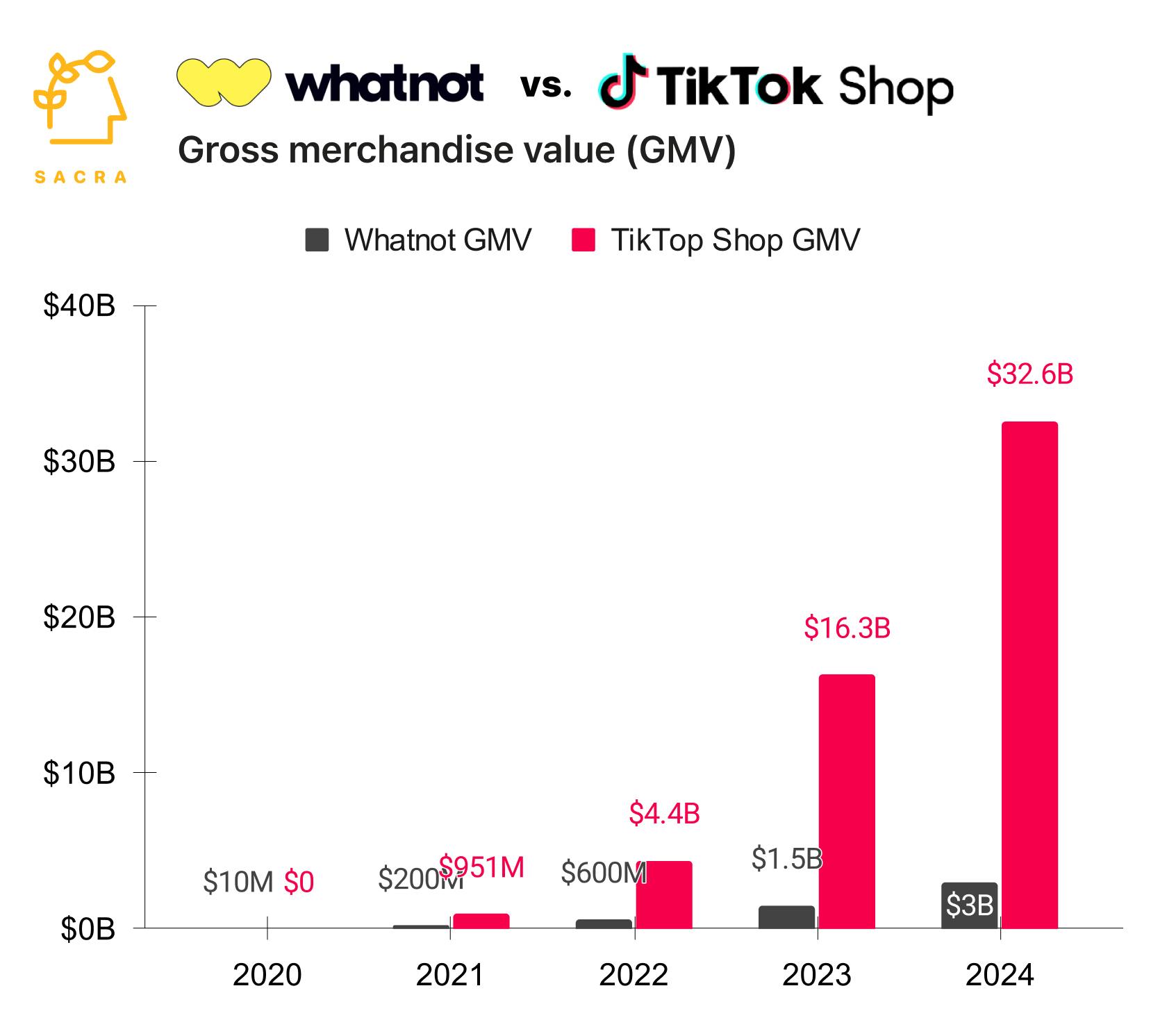

- Hitting $3B in GMV for 2024, Sacra estimates that Whatnot generated $359M in revenue in 2024, growing 102% YoY, raising $265M in a Series E last week valuing them at $4.97B for a 14x revenue multiple. Compare to ByteDance’s international TikTok Shop business, which did ~$33B in GMV in 2024, up 106% YoY from $16B in 2023, though with only 27% of that GMV ($9B) from the United States—livestream commerce adoption in the U.S. is still low relative to overall TikTok usage with TikTok’s US ads business generating $27B from the United States for the year (80% of TikTok’s total revenue).

- As Whatnot expands beyond collectibles into larger TAM verticals, it’s begun to compete against vertical-focused ecommerce retailers, from Shein Live (women’s clothing) to Fanatics Live (sports cards)—and stands to benefit the most if a U.S. ban eliminates live shopping behemoth TikTok Shop. Like TikTok, Whatnot has cracked addictive, compulsive engagement—with the average shopper buying 12 items weekly and sneaker shoppers spending ~$500 monthly—designing for an entertainment-first experience that incidentally enables commerce, versus previous attempts by Meta and Amazon to retrofit livestreaming commerce onto an existing social platform/storefront.

For more, check out this other research from our platform:

- Whatnot (dataset)

- ByteDance (dataset)

- Shein (dataset)

- ByteDance vs TikTok

- AI and the future of video

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- ShipBob: TikTok's $500M/year fulfillment arm

- Rokt: the $480M/year ad network behind Uber & Lyft

- Klaviyo: the $665M/year HubSpot for ecommerce

- Tyler Scriven, CEO of Saltbox, on co-warehousing and D2C ecommerce

- Brian Whalley, Co-Founder of Wonderment, on Klaviyo's product-market fit

- Sampad Swain, CEO of Instamojo, on building ecommerce infrastructure for D2C 2.0