Vibe coding's backend

Jan-Erik Asplund

Jan-Erik Asplund

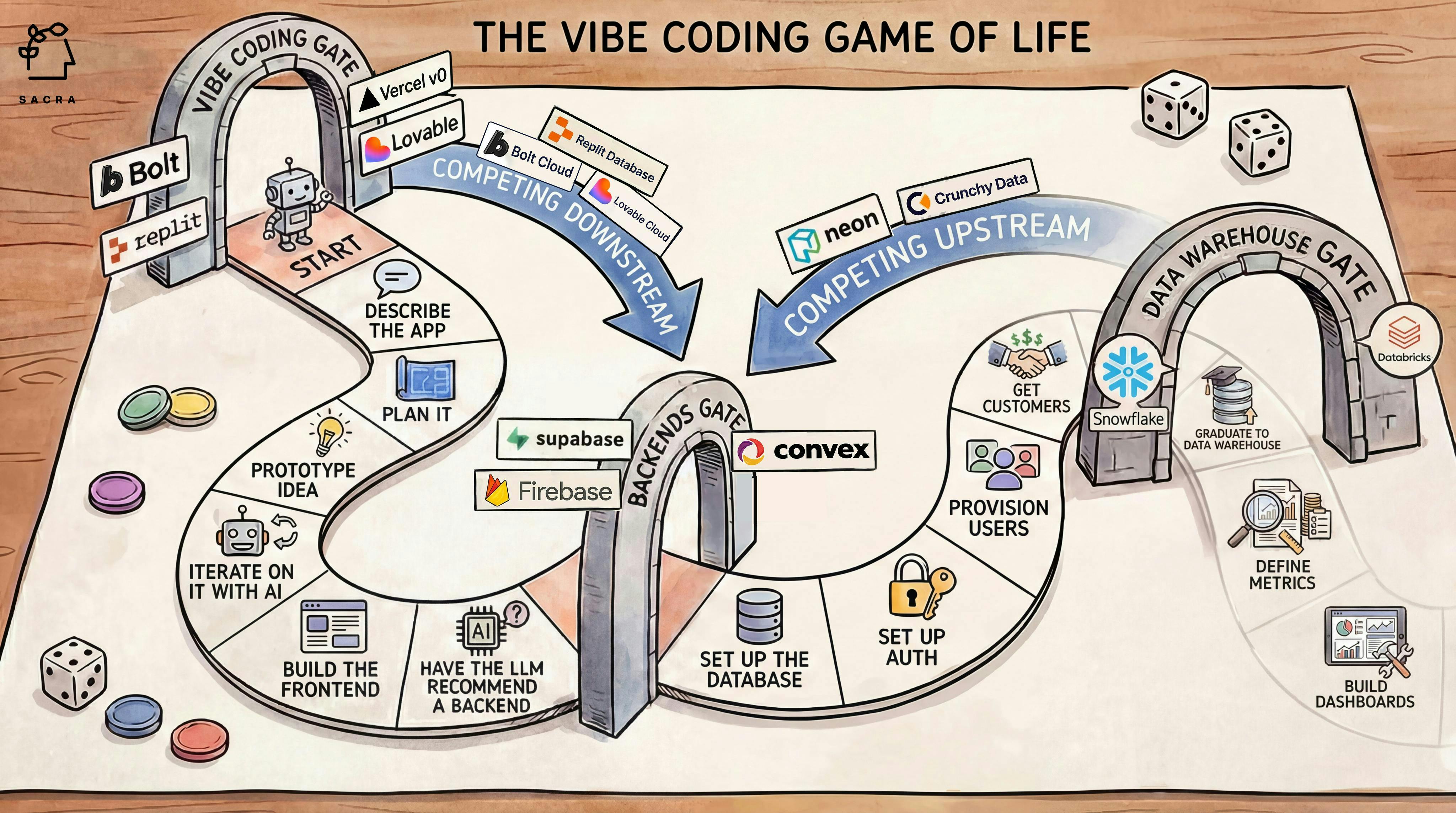

TL;DR: Firebase created the backend-as-a-service category in 2011 by letting developers replace server provisioning with drop-in SDKs, and now vibe coding is driving a massive resurgence as every AI-generated app needs a database, auth, and storage, pushing Supabase to $70M ARR (up 250% YoY) and triggering $2B+ in M&A as Databricks ($5.4B ARR) acquired Neon for $1B and Snowflake acquired Crunchy Data. For more, check out our reports on Supabase (dataset), Convex, Neon, and PlanetScale.

Key points via Sacra AI:

- Launched in 2011, Firebase made it easy for developers to build realtime apps like chat, collaborative editing, and multiplayer games with drop-in SDKs for connecting app code to API-centric database, authentication, and storage services—growing over time into a full platform spanning Cloud Firestore (2017), Cloud Functions (2017), and Crashlytics (acquired from Twitter, 2017) after its 2014 acquisition by Google and subsequent incorporation into Google Cloud Platform (GCP). Parse (founded 2011), another backend-as-a-service company, was acquired by Facebook for $85M in 2013 as part of the company’s plan to build out a developer platform to compete with AWS and Google, but in 2016, it announced Parse would shut down as Facebook’s focus shifted toward the increasingly lucrative business of mobile ads (from $471M/year in revenue in 2012 to $22B/year by 2016).

- During the 2010s movement away from monolithic server-rendered apps towards mobile & single-page applications (SPAs) & frontend frameworks, Firebase was at the leading edge of a broader unbundling of the backend into composable API services via companies like Cloudinary (founded 2012) in media storage, Auth0 (founded 2013, acquired by Okta for $6.5B in 2021) in authentication, and PlanetScale (founded 2018) in databases. Outsourcing core backend services to 3rd-party SaaS went from niche to the norm over this period, setting the stage for services that went even further like Supabase (founded 2020 as an open-source Firebase) & Neon (founded 2021) that stitch database, auth, storage, and serverless functions back into integrated layers built on open source Postgres or MySQL.

- When AI vibe coding tools like Bolt.new ($40M ARR, growing 4,900% YoY as of March 2025), Lovable ($300M ARR, growing 3,471% YoY as of 2025), and Replit ($253M ARR, growing 2,352% YoY as of October 2025) exploded in late 2024, the LLMs they used for generating code were organically recommending users install Supabase as a 1-stop shop to quickly spin up databases, auth, and storage for their apps, driving Supabase from an estimated ~$13M ARR in 2023 to $70M in September 2025 for a two-year CAGR of 165%. Auth adds a key monetization driver for Supabase to monetize MAU (50,000+ MAU transitions from free to paid plans) on top of database compute, storage & bandwidth with strong retention dynamics indexed on app stickiness versus the high churn seen at the vibe coding layer that monetizes app creation.

- Supabasenow faces pressure as 1) vibe coding platforms including Bolt Cloud (launched August 2025), Lovable Cloud, and Replit (powered by Neon) launch platform-native databases to capture recurring revenue & expand gross margin from app usage rather than just creation, and 2) opinionated backend startups like Convex ($36.4M raised, A16Z) that compete to win as most "vibe-coding native" where Convex feels akin to Retool (UI-first in design) like Supabase is to Airtable (DB-first). Rather than compete as a bundled backend, PlanetScale ($105M raised, A16Z) focuses purely on winning as the most reliable & performant database, competing with Supabase both by offering a graduation path for scaling customers off of Supabase and by powering databases as infrastructure for direct competitors like Convex.

- The race to own the application database layer triggered $2B+ in M&A in 2025, with Databricks ($5.4B ARR, up 71% YoY) acquiring Neon for $1B and Snowflake acquiring Crunchy Data, as both warehouse giants recognized that millions of apps starting on Supabase may never purchase a separate warehouse because Supabase sits upstream and could expand downstream into analytics. Databricks itself grew by starting upstream of the data warehouse with managed Spark (2016) and expanding downstream via Databricks SQL (2021) to reach $4B ARR with only ~$1B from warehousing, while Snowflake started downstream with the warehouse and struggles to shift left, motivating its Crunchy Data acquisition to get an application database offering before the next generation bypasses it.

For more, check out this other research from our platform:

- Supabase (dataset)

- Replit (dataset)

- Vercel (dataset)

- Airtable (dataset)

- Zapier (dataset)

- Retool (dataset)

- $172M/year Heroku of vibe coding

- Vibe coding index

- Why OpenAI wants Windsurf

- Lovable vs Bolt.new vs Cursor

- Bolt.new at $40M ARR

- Claude Code vs. Cursor

- Cursor at $200M ARR

- Cursor at $100M ARR

- Lovable (dataset)

- Bolt.new (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Scale (dataset)

- Cursor (dataset)