Unmentioned Stargate partner

Jan-Erik Asplund

Jan-Erik Asplund

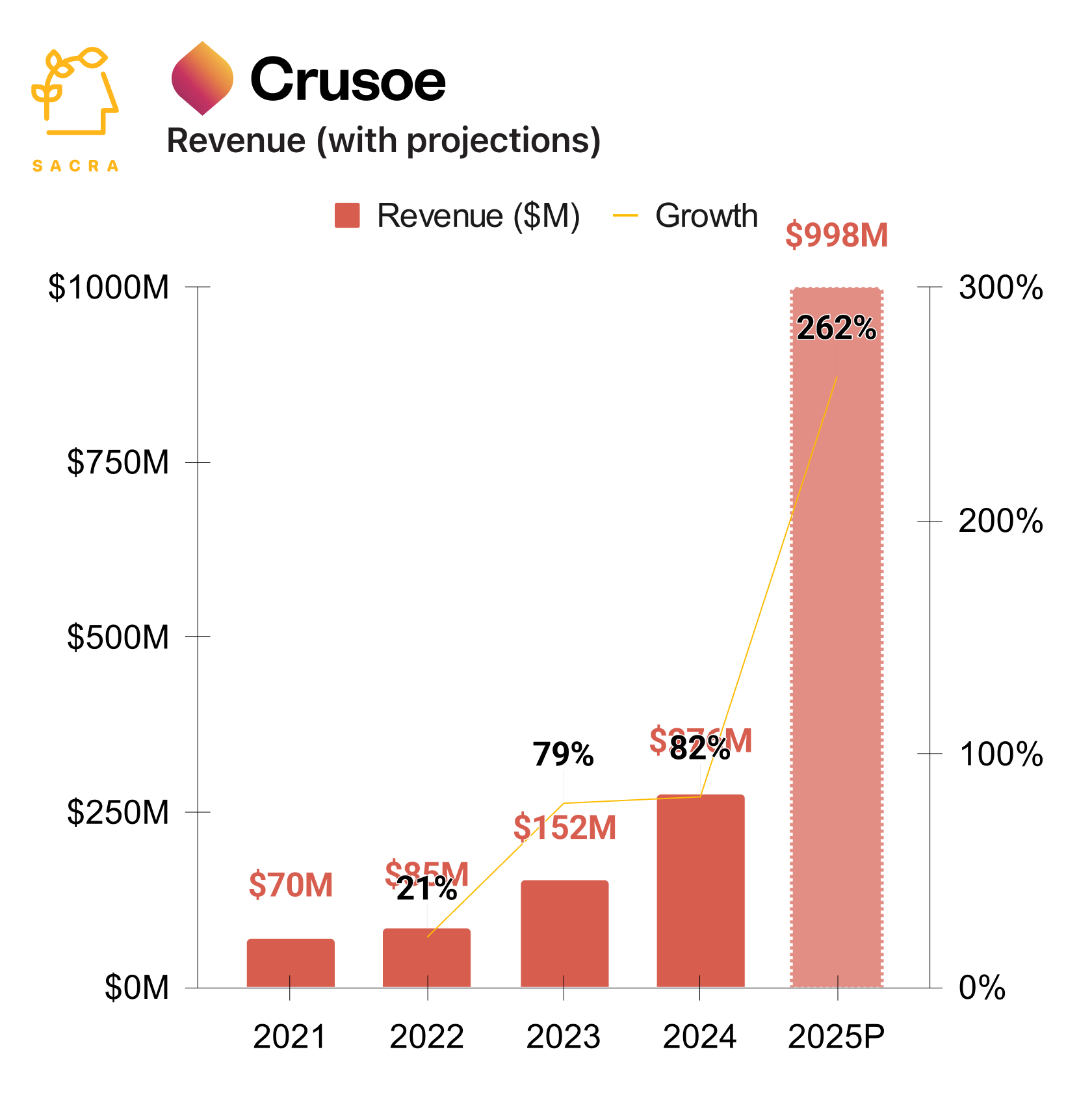

TL;DR: The unnamed infrastructure partner behind the first stage of OpenAI's $500B Stargate project, Crusoe is building a $12B data center in Abilene, Texas that will eventually house the world's largest GPU cluster. Sacra estimates Crusoe generated $276M in revenue in 2024 (up 82% YoY), with the company projecting 262% YoY growth to $998M in 2025. For more, check out our full report and dataset on Crusoe.

Key points via Sacra AI:

- Unmentioned in OpenAI’s recent announcement of their $500B Stargate build-out was Crusoe, the Founders Fund-backed GPU cloud startup that will spend ~$12B through 2026 to build and co-own Stargate’s first data center in Abilene, Texas (with financing from Blue Owl and JPMorgan)—and then lease it to Oracle, which will operate it and rent the compute to OpenAI. Since the original announcement of the Crusoe-Oracle deal in January, the scope of the Abilene campus project has expanded massively—the campus is now expected to bring Crusoe $250M of revenue for 2026, up 25x from $10M in earlier projections for the project, with 700+ MW live by December 2026.

- With the build-out of the Abilene site, Crusoe projects that it will grow revenue 262% to $998M in 2025, up from Sacra-estimated 2024 revenues of $276M—broken out as $887M from its AI cloud business, $100M from cryptocurrency mining via projects with companies like Kraken ($1.5B revenue in 2024, up 128% YoY), and $11M from leasing out its Abilene infrastructure to Oracle. Crusoe's projections would put it roughly 18-24 months behind CoreWeave but on a similar growth trajectory, accelerating to 300% YoY growth, with CoreWeave projecting $8B in revenue in 2025 (up 300% YoY) on the back of their $10B contract with Microsoft after hitting $2B in 2024 (up 330% YoY).

- At scale, CoreWeave ($12B+ raised) and Crusoe ($5B+ raised) can operate flexibly as pure data center infrastructure providers (as in Crusoe's Oracle deal) and as full-stack compute providers (as in CoreWeave's direct GPU rental business)—in addition to offering GPU cloud services—a flexibility that becomes increasingly valuable as AI labs like xAI and OpenAI pursue every avenue to 5-10x their compute capacity in order to train the next biggest models. On the other hand, highly capable open source models like DeepSeek’s R1 offer CoreWeave and Crusoe the potential to avoid revenue concentration and dependence on hyperscalers and AI labs as they mean that AI companies will look to run those open source models on their own compute infrastructure to serve these models at scale.

For more, check out this other research from our platform:

- Crusoe (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Together AI (dataset)

- CoreWeave: the $465M/year cloud GPU startup growing 1,760% YoY

- GPU clouds growing 1,000% YoY

- Samiur Rahman, CEO of Heyday, on building a production-grade AI stack

- Scale (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Chris Lu, co-founder of Copy.ai, on the future of generative AI