Truth Social: the GameStop for the alt-right

Jan-Erik Asplund

Jan-Erik Asplund

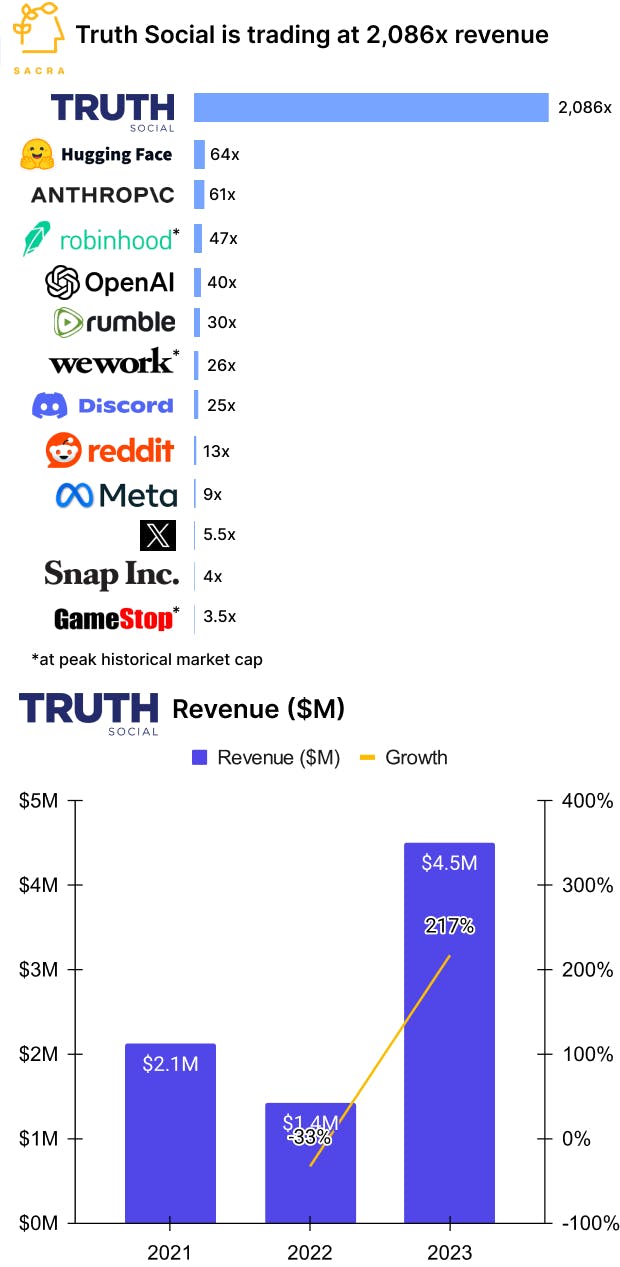

TL;DR: “Free speech” social media platforms found product-market fit hosting conversations banned on mainstream platforms, and they’re now benefiting from a GameStop-esque effect that is bidding up not just Truth Social (NASDAQ: DJT, 2,086x revenue multiple) but Rumble (NASDAQ: RUM).

Key points from our research:

- As rumors swirled of a Peter Thiel takeover of Twitter in 2016, the anti-corporate Russian-born Eugen Rochko launched Mastodon as a decentralized, open-source protocol anyone could use to launch a Twitter clone with their own moderation standards and code of conduct. After Elon Musk’s acquisition of Twitter completed in October 2022, Mastodon’s user base grew from 200K monthly active users (MAUs) to 2.5M amid fears of the platform radicalizing, with the company ending the year with $353K in revenue (up 488% from 2021) via an average donation size of $35 from 9,603 people.

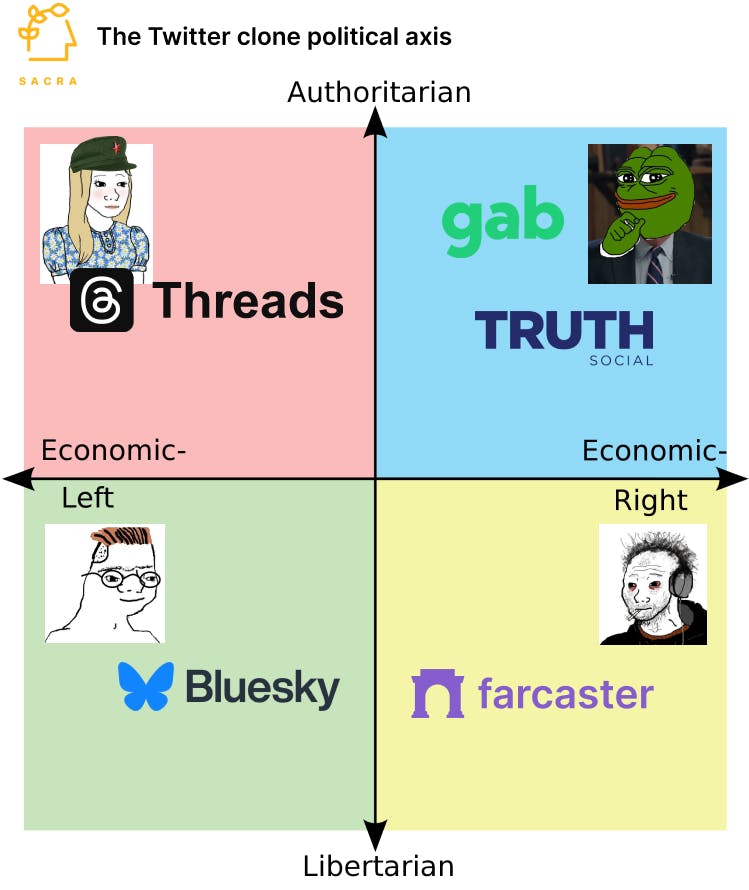

- Gab (2016) found product-market fit as Twitter for conversations about Hillary Clinton, the 2nd Amendment, and Colin Kaepernick, adding 60,000 new users after Twitter’s wave of far-right user bans in 2016, including popular provocateur Milo Yiannopoulous (Gab’s #1 account as of 2018 with 45,000 followers). Donald Trump launched Truth Social into a waitlist of 300,000+ after being banned from Twitter post-January 6th, with drag queen storytime, QAnon, and Bill Gates’s connection to COVID vaccines as the top discussion topics and Fox personalities like Sean Hannity and Dan Bongino coming aboard.

- Both Gab and Truth Social built on forks of Mastodon, repurposing the left-leaning protocol’s FOSS (free and open source) social networking code while discarding the federated elements that allow Mastodon instances to connect to others in the “fediverse”. GoDaddy, Stripe and PayPal deplatformed Gab after a Gab user killed 11 people at a Pittsburgh synagogue, forcing them to rebuild their infrastructure on a new stack of “free speech” friendly tools: Epik for web hosting, 2nd Amendment Processing for payments, and BitMitigate for CDN.

- Gab and Truth Social have struggled to grow ad revenue as a result of their niche audiences and objectionable content (to mainstream advertisers), resulting in ARPUs of $4.01 and $4.19 respectively compared to $10 per MAU for Twitter, $35 for Instagram, and $45 for Facebook. That has forced the ecosystem of free speech alternatives to platforms like Rumble ($81M in 2023 revenue) for YouTube, Scored for Reddit, GiveSendGo for GoFundMe, and MeWe for Facebook—and towards a revenue mix that leans more towards non-ad sources like premium subscriptions, the sales of vitamins, supplements and apparel, and tipping.

- Truth Social (NASDAQ: DJT) went public on Tuesday via SPAC, climbing to a $9.3B market cap by Wednesday afternoon for a 2,086x multiple on just $4.5M in 2023 revenue in a memetic frenzy reminiscent of GameStop’s (NYSE: GME) 2021 run, powered by /r/The_Donald diaspora (now hosted on Scored) and /r/wallstreetbets. On Monday, the advice on /r/wallstreetbets was to buy calls anticipating a price jump after the ticker on the SPAC officially switched from $DWAC to the eponymous $DJT—the next day, the top posts on the subreddit showed off 8x to 15x gains on those investments.

- To escape the low-ARPU dynamics of niche advertising, two strategies are emerging for the free speech social media platforms: 1) Truth Social’s big tent, “internet-native Fox News” strategy that hinges on bringing in big brand advertisers like Ford and Nestle, and 2) Gab’s “decentralized Infowars (~$50M revenue)” approach of monetizing its audience through aggressive cross-selling of branded products and services. While Truth Social’s aim is to expand beyond advertising Mike Lindell’s MyPillow and Mike Huckabee’s homeschooling books by bringing on the other 50% of Americans, Gab is monetizing its core base via pro memberships to their platform (Gab Pro), a marketplace for “free speech” merchants (Gab Marketplace), and censorship-resistant peer-to-peer payments via Gab Pay (1.9% + $0.15 per transaction).

- Ironically, Elon Musk’s ownership of Twitter may be the biggest headwind for alt-tech social media—by loosening Twitter’s moderation, he’s killed the deplatforming threat that drove their growth, with Gab usage declining from 4.3M MAUs at their peak to 1.2M, Truth Social declining from 9M to 1M, and Mastodon declining from 2.5M to 1M. Messaging apps like Discord ($600M revenue in 2023, up 35%), Telegram (900M MAUs, up 29%), and Signal have benefited from the desire for free speech platforms, monetizing with subscriptions and in-app purchases.

For more, check out this other research from our platform: