Strava: the $265M/year Whole Foods of social networks

Jan-Erik Asplund

Jan-Erik Asplund

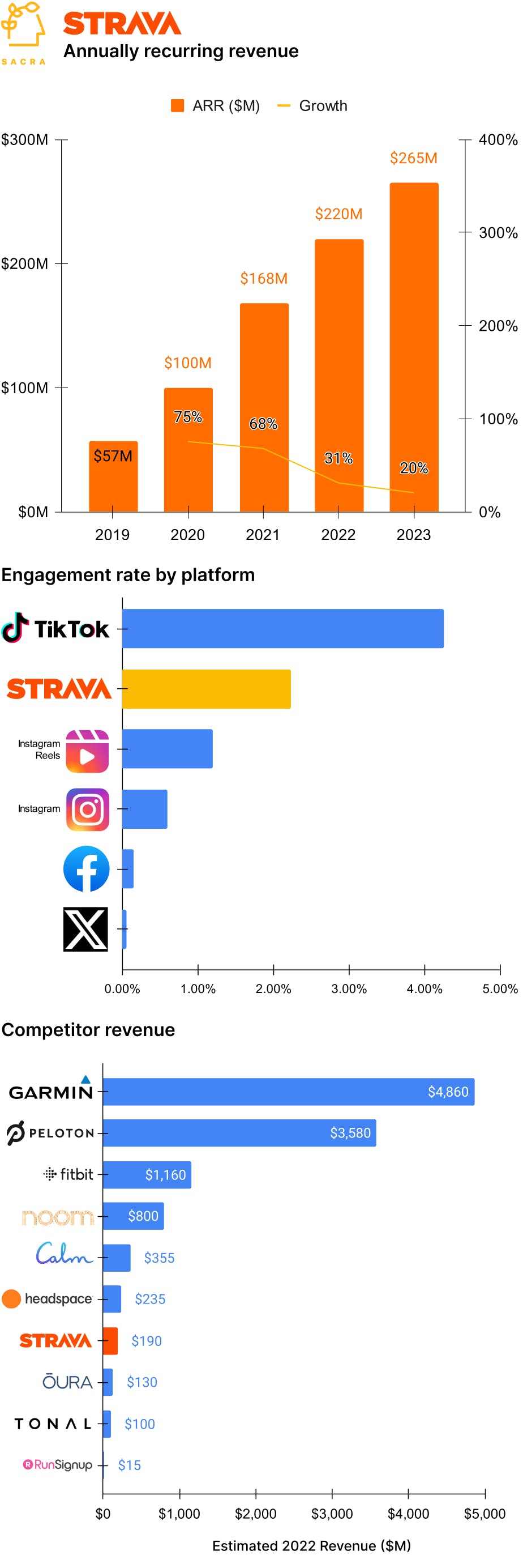

TL;DR: Sacra estimates that Strava hit $265M in annual recurring revenue (ARR) this year with their asset-light fitness social layer. Now, they’re launching features like DMs and Stories to make Strava the Whole Foods of social networks. For more, check out our datasets on Strava and RunSignup.

Key points from our report:

- In 1895, Curtis Veeder kicked off the era of the quantified self with the invention of the Cyclometer—a mechanical device that counted the rotations of a bicycle wheel and transmitted that data to an analog, bike-mounted odometer. Over time, the professionalization of athletics drove iterative improvements to the cyclometer, including torque sensors for measuring power output, crank arm magnets for measuring speed, and GPS for tracking routes.

- Fitness tracking hit the mainstream with the launch of the Nike+iPod Sports Kit in 2006, which used a small pedometer tucked in your shoe and a receiver plugged into an iPod Nano to track your exercise time elapsed, distance traveled, pace, and calories burned. In 2010, the Nike+ app eliminated the need for the separate pedometer and receiver by using the GPS and accelerometer embedded in the early generation of iPhones to track your workouts.

- In 2009, Strava launched their combination fitness tracker and “proof of workout” social layer, indexed on interoperability with all 3rd-party hardware and software, pulling users away from apps like Nike Run Club, RunKeeper, and MapMyRun with the ability to like & comment on your friends’ workouts and discover & compete against them to own local segments. Today, Strava makes 90% of its revenue from paid premium subscriptions (2% of registered Strava users are on premium plans, vs. 0.005% of Twitter accounts paying for Twitter Blue), through ads via sponsored challenges, and by selling aggregated user data to city governments and urban planners.

- Sacra estimates that Strava hit $265M ARR in 2023 with 100 million users and a $1.5B valuation as of their $110M Series F in November 2020 led by TCV and Sequoia. Compare to Fitbit at $1.16B in revenue in 2022 with 120M registered users and a $2.1B valuation (acquired by Google), Oura at ~$130M in revenue in 2022 with ~1M smart rings sold and a $2.55B valuation, and Noom at $400M in revenue in 2020 with 45M users and a $3.7B valuation.

- COVID was initially a big tailwind for Strava—total activities logged grew to 21.5M per week (33% growth) in 2020 and 37M per week (38% growth) in 2021 as Strava went from a niche app for hardcore runners and cyclists to the mainstream as lockdowns and gym closures drove everyone outdoors for cardio. The NYC Marathon hosted its marathon virtually on Strava that year as total activities logged grew 33% to 1.1B with 2 million new users joining every month, tracking not just cycling and running but everything from canoeing to inline skating to Nordic skiing.

- Broad reopenings slowed Strava’s growth—activities logged grew just 8% in 2022 to 40M per week as they laid off 15% of their staff and their CEO stepped down—but their asset-light model limited their downside while Peloton saw revenue decline 28% from $936M to $678M amid cratering hardware sales. Average rides per month per subscriber at Peloton fell from 22 in 2021 to 16.4 as of 2022—Strava, meanwhile, has grown consistently from 30M activities per week in 2020 to 37M in 2021 to 40M in 2022.

- Breaking out of the limitations of running and cycling, Strava has expanded into indoor and outdoor activities more broadly to minimize the effects of seasonality, including alpine skiing (up 379% year-over-year in 2022), snowboarding (up 180%), rock climbing (up 95%), weight training (52%), and swimming (up 41%). Constantly shipping more content to make the platform interesting for this many kinds of activities, including working with brands to create sponsored challenges, drives higher headcount and costs than a software pure play—see Epic Games which over-indexed on the smash success of Fortnite and has seen revenue decline 9% in the last year.

- While the biggest social networks are seeing engagement decay as they skew more towards supernodes like celebrity and meme accounts, Strava’s proof of workout mechanism feeds more bottom-up organic participation a la Reddit, with 15x higher engagement than Facebook and 45x that of Twitter. Strava posts get comments, kudos, and shares at a rate of 2.23% per post vs. 0.15% and 0.05% for Facebook and Twitter respectively.

- Strava’s ownership of the sweat social graph gives them line of sight into ecommerce via gear sales (see TikTok’s $4.4B in GMV in 2022), ads (see TikTok’s $13.2B of ad revenue in 2023), and events & payments (see Eventbrite’s $261M revenue in 2022 and RunSignup’s $400M of volume). Strava can drive high average revenue per user (ARPU) thanks to its relatively affluent user base that’s 1.8x more likely to go on winter sporting holidays and 90% more likely to purchase premium versions of products.

- Just as Whole Foods’ (acquired by AMZN for $13.7B) counter-positioning against Walmart (NYSE: WMT) and Kroger (NYSE: KR) enabled it to carve out a small (less than 2% market share) but differentiated niche in the $1.5T grocery market, Strava’s upside case lies in creating a niche social network with a strong brand moat and high ARPU as the wholesome option among the mass of junk food social networks. Whereas 33% of female TikTok and Instagram users reported feeling bad about themselves weekly, 83% of people who use Strava are more motivated to go exercise because of using the app.

For more, check out this other research from our platform: