Sydecar and the new atomic unit of the private markets

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: LP interests in SPVs are the next frontier, taking over from the cap table as the atomic unit of the private markets. Read our interviews with Sydecar CEO Nik Talreja, Tribe Capital co-founder Arjun Sethi, and EquityList CEO Kashish Sharma to learn more.

Get more private company metrics, insights, and analysis in your inbox.

Success!

Something went wrong...

- The first big secondary trading platform, SecondMarket, launched in 2009 and did $100M in transaction volume, growing to $360M in 2010 and $558M in 2011. Most volume was driven by the widespread demand for Facebook stock, which would trade hands at valuations as high as $83.5B on the marketplace. (link)

- After roughly $350M of pre-IPO Facebook shares traded on SecondMarket in 2010-11, the company went over the 500 shareholder limit for a private firm, forcing it to go public earlier than intended. As one employee or early investor split up and sold their highly in-demand allocation of Facebook stock, it would turn into 3-4 new names on the cap table. (link)

- Companies started locking down their cap tables by adding rights of first refusal (ROFRs) and other restrictions after Facebook’s stock fell 50% in its first few months on the public markets. ROFRs give existing VCs the right to match any buy offer made to a private company shareholder, making it impossible for investors to know if they can participate in a deal and difficult to consummate transactions.

- Two new atomic units of value started to emerge with the potential to get around ROFRs and enable execution—system of record for private asset ownership (Carta) and indications of interest (Forge). Meanwhile, Nasdaq bought SecondMarket and launched Nasdaq Private Markets ($40B in volume) to help companies run issuer-centric auctions and tender offers. (link)

- By controlling the underlying system of record of company ownership, Carta (now at $10B in volume) can eliminate uncertainty in execution—but only through partnering with the issuer. Carta sold 409A valuations and cap table management as a wedge. By 2020, they’d captured the ownership graphs of a third of all venture-backed businesses—and $1T+ in equity value. (link)

- Marketplaces like Forge ($639M) and EquityZen (raised $11.3M) looked to get around ROFRs by gathering indications of interest from buyers and sellers and facilitating transactions through forward contracts, but these introduced complexity and counterparty risk. Ops-heavy, reliant on manually brokered transactions between buyers and sellers, and coming with hefty fees (7% to 1% for Carta), this marketplace model struggled to scale. (link)

- As of 2022, tender offers have product-market fit—employee participation in issuer-led liquidity events went from 41% in Q2’21 on Carta to 57% in Q2’2022—but most transactions are limited to insiders. Issuers want to limit access to their cap table because of the rights and information access legally owed to investors on the cap table. (link)

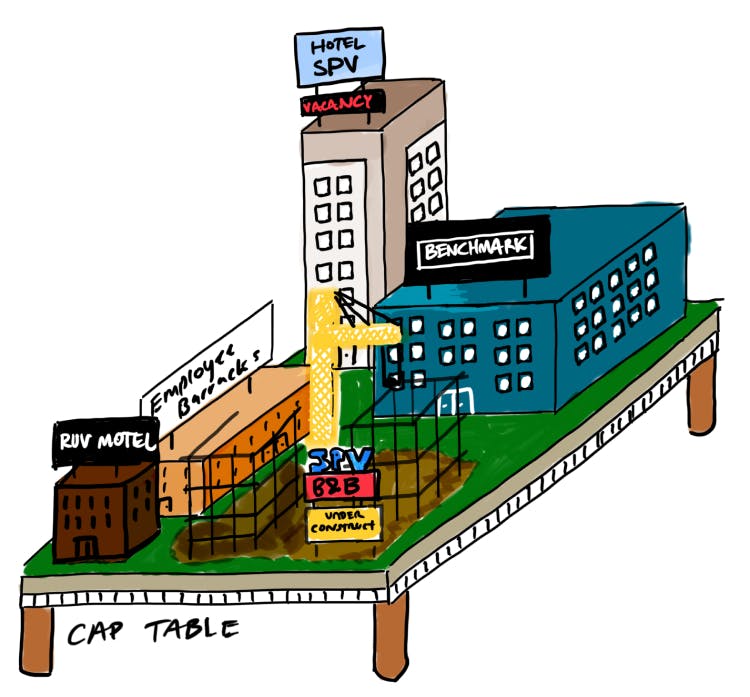

- Now, we’re seeing the emergence of a new atomic unit of value that companies like AngelList, Carta, Sydecar and Allocations are going after—LP interests in funds and SPVs. An SPV is a legal entity used in venture to collect money from a group of investors (LPs) and make an investment in a private company. The SPV sits on the cap table, not its investors, meaning LPs give up their right to any information or access into the company.

- LP interests in funds and SPVs have the potential to unlock private markets liquidity because they sit on top of the cap table and can be traded permissionlessly, without company approval. Getting on or off the cap table requires management to sign off, while trading in and out of an SPV with an LP interest in an underlying company can often be done without the company even knowing about it. (link)

- AngelList’s Transfers product, like CartaX, hasn’t caught fire—but they have $277M worth of volume in RUVs that can be traded down the line when they figure it out. AngelList’s limitation is that their degrees of freedom are bounded by the buy-in of the founders and companies on their marketplace. (link)

- Seeing the importance of being a player in SPV creation and not being disrupted by AngelList, Carta ($7.4B) acquired Vauban (raised $8.6M) in 2022. The UK-based Vauban created 400+ investment vehicles and managed over $1B before its acquisition and gives Carta a piece of international SPV formation—key when 50%+ of SPVs and funds in the U.S. have one or more non-U.S. LP.

- Startups like Sydecar (raised $8.3M), Allocations (raised $7.3M) and Assure (raised $2.2M) are trying to own the SPV creation layer. There are two core approaches here: building a platform investors can use directly to spin up new SPVs to make investments, and creating developer API middleware to enable programmatic SPV creation. (link)

- By indexing on LP interests via automated SPVs, you get an “application layer” with respect to the OS that is the cap table which can enable a wide range of new kinds of transactions. Whoever can own this atomic unit has the opportunity to own the $225B market for pre-IPO liquidity by unlocking secondary trading in funds and privates. (link)