Swappie at $213M revenue

Jan-Erik Asplund

Jan-Erik Asplund

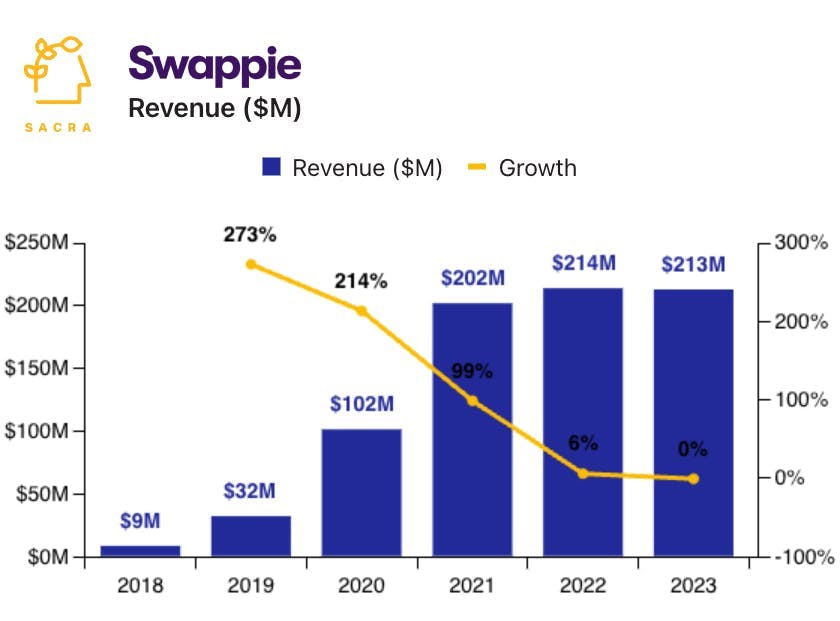

TL;DR: Smartphones are the biggest category of refurbished electronics, and 62% of all refurbished smartphones are iPhones, creating the opportunity for Swappie to build the vertically-integrated Carvana of iPhones—buying, refurbishing, and reselling iPhones around the world. Sacra estimates that Swappie hit $213M in revenue in 2023, with growth plateauing amid longer phone replacement cycles and tightening inventory. For more, check out our full report and dataset on Swappie.

Key points via Sacra AI:

- As pricing on new iPhones climbed from $199 (circa 2010) to $750 (circa 2016), Swappie emerged as a vertically-integrated secondhand iPhone refurbisher and store, buying iPhones from consumers and B2B partners, repairing them in-house, and shipping them worldwide in 1-3 days. Contra Back Market’s asset-light marketplace approach, Swappie keeps 100% of the resale price and their vertically-integrated operation ensures high reliability (<5% of devices have to be returned), but results in ~20% gross margins with the high operational costs of running their own iPhone repair facility.

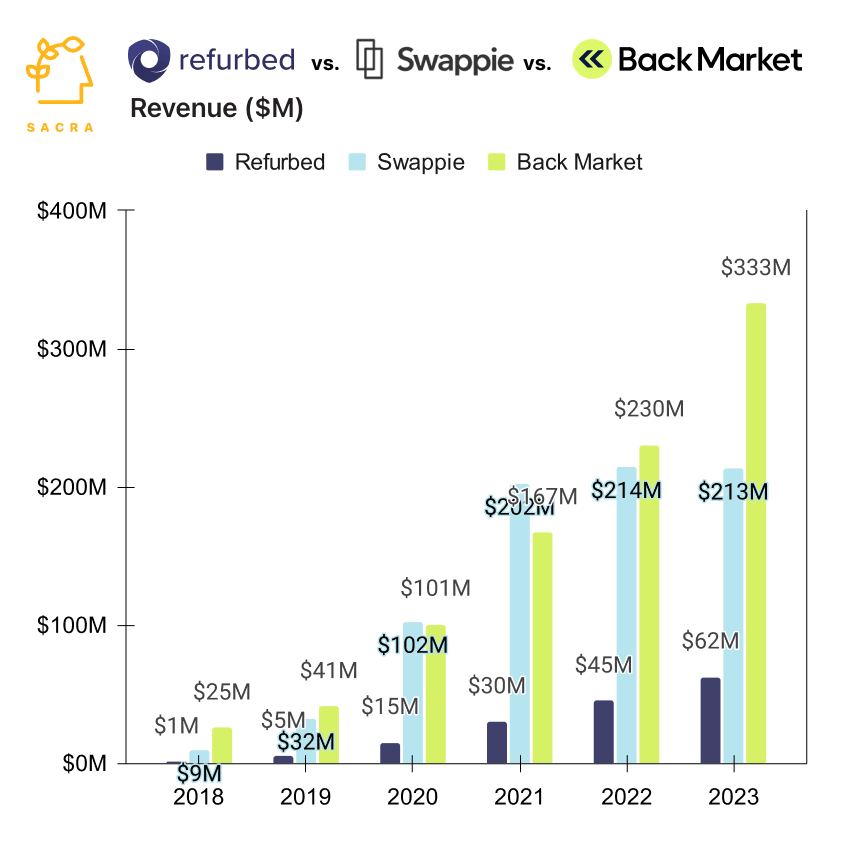

- After doubling from $102M to $202M in revenue in 2021, growth has plateaued amid industry headwinds including longer smartphone refresh cycles (now 40 months), increased device durability, and tightening refurbished inventory supply, with Swappie flat at $213M in revenue at the end of 2023. Compare to refurbished electronics marketplace Back Market, which grew from $230M in 2023 to $333M in 2024 (25% YoY) as they aggressively expanded into laptops, gaming consoles, tablets, and other non-smartphone electronics, as well as the Vienna-based Refurbed ($62M revenue in 2023) and Singapore-based Reebelo ($6.5M revenue in 2022).

- With 43% of European consumers owning secondhand phones, Swappie has focused on owning the refurbished iPhone category across the continent, expanding from Finland, Sweden, Denmark and Italy to 17 countries across Europe as of 2024. Despite Android dominating the European smartphone market overall at 66% adoption vs. the iPhone’s 33%, the dynamics are flipped in the secondhand market—as of 2024, iPhones have grown to represent 62% of all refurbished smartphone sales, vs. 18% for Samsung and 10% for other Android OEMs.

For more, check out this other research from our platform:

- Swappie (dataset)

- Back Market (dataset)

- $415M/yr refurbished iPhone marketplace

- ManoMano (dataset)

- Andrew Yates, CEO of Promoted.ai, on when marketplaces should layer on ads

- Andrew Yates, CEO of Promoted.ai, on driving marketplace ARPU with personalization

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplaces

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- Rokt: the $480M/year ad network behind Uber & Lyft