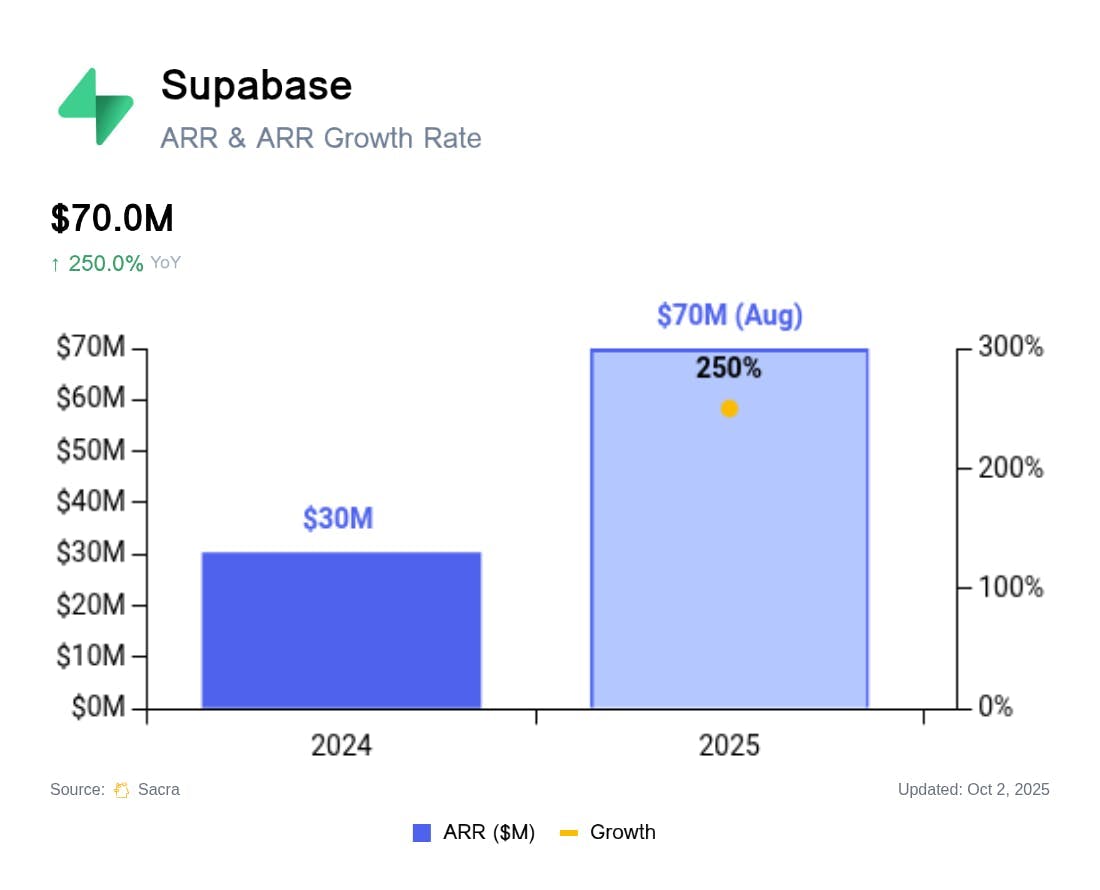

Supabase at $70M ARR growing 250% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Founded in 2020 as an open source alternative to Firebase, Supabase started out as part of the database-as-a-service & backend-as-a-service developer tools trend along with Neon and PlanetScale but found extreme product-market fit in 2024-2025 as the default backend for the vibe coding boom. Sacra estimates that Supabase hit $70M in annually recurring revenue (ARR) in August 2025, up from $30M at the end of 2024 and up 250% year-over-year. For more, check out our full Supabase report and dataset.

Key points via Sacra AI:

- Launched in 2011, Firebase (acquired by Google in 2014) made it easy for developers to build real-time apps like chat, collaborative docs, and multiplayer games with drop-in SDKs connecting application code to API-centric backend services for the database, authentication, file storage, and more—inspiring Supabase (2020) to launch as a Firebase alternative built on an open source stack. With a generous free plan (up to 50K MAUs, 500MB database), Supabase makes it easy for vibe coding apps to provision Supabase accounts and wire up the backend APIs to the app logic to get apps up and running frictionlessly, monetizing on the number of MAUs and storage used for the apps that actually get usage and scale.

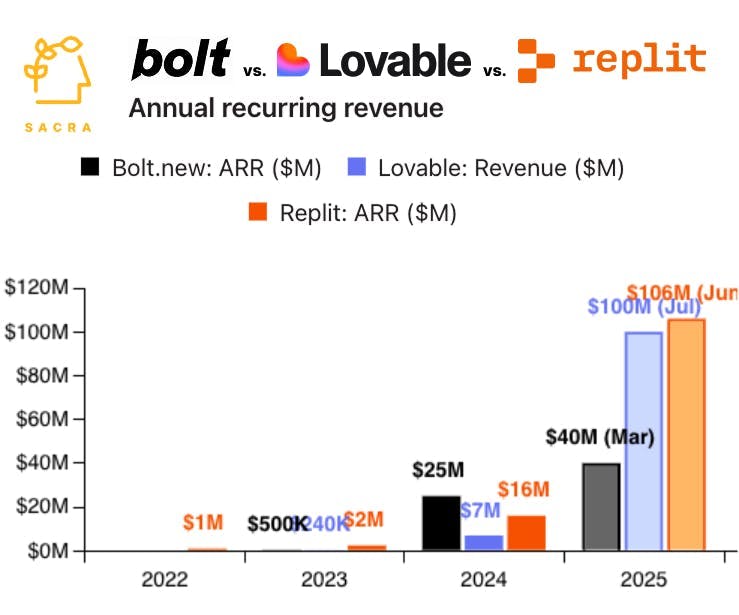

- During the vibe coding boom of 2024-5, Supabase became the default backend integration for both Bolt.new and Lovable, with Sacra estimating that Supabase hit $70M annual recurring revenue (ARR) in September 2025, up from $30M at the end of 2024 and up 250% year-over-year, with user growth up 700%+ YoY and with the company now in talks to raise at a $5B+ valuation for a 71x revenue multiple. Indexed on the growth of one of the fastest-growing AI categories with companies like Bolt.new ($40M ARR in February 2025), Lovable ($120M ARR in August 2025, up from $7M at the end of 2024), Replit ($102M ARR in June 2025, up from $16M at the end of 2024), and Vercel ($200M in ARR in May 2025, up from $144M at the end of 2024), Supabase leads the backend-as-a-service category that includes companies like PlanetScale ($105M raised, A16Z), and Neon ($130M raised, GGV), acquired by Databricks for $1B (estimated $25M ARR for 40x multiple).

- As vibe coding platforms face pressure to improve their gross margins, they are launching their own platform-native databases, authentication, storage, payments, and more, threatening to disintermediate Supabase and change the dynamic from cooperation to coopetition. Bolt Cloud (launched in August 2025) and Lovable Cloud enable vibe coding platforms to monetize MAUs and storage on a recurring basis at high margin, not just app creation which tends to be high churn & low margin, with Lovable Cloud being built on top of Supabase infrastructure and both offering an eventual graduation path to Supabase.

For more, check out this other research from our platform:

- Supabase (dataset)

- Replit (dataset)

- Vercel (dataset)

- $172M/year Heroku of vibe coding

- Vibe coding index

- Why OpenAI wants Windsurf

- Lovable vs Bolt.new vs Cursor

- Bolt.new at $40M ARR

- Claude Code vs. Cursor

- Cursor at $200M ARR

- Cursor at $100M ARR

- Lovable (dataset)

- Bolt.new (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Scale (dataset)

- Cursor (dataset)