SpaceX vs Verizon vs AT&T

Jan-Erik Asplund

Jan-Erik Asplund

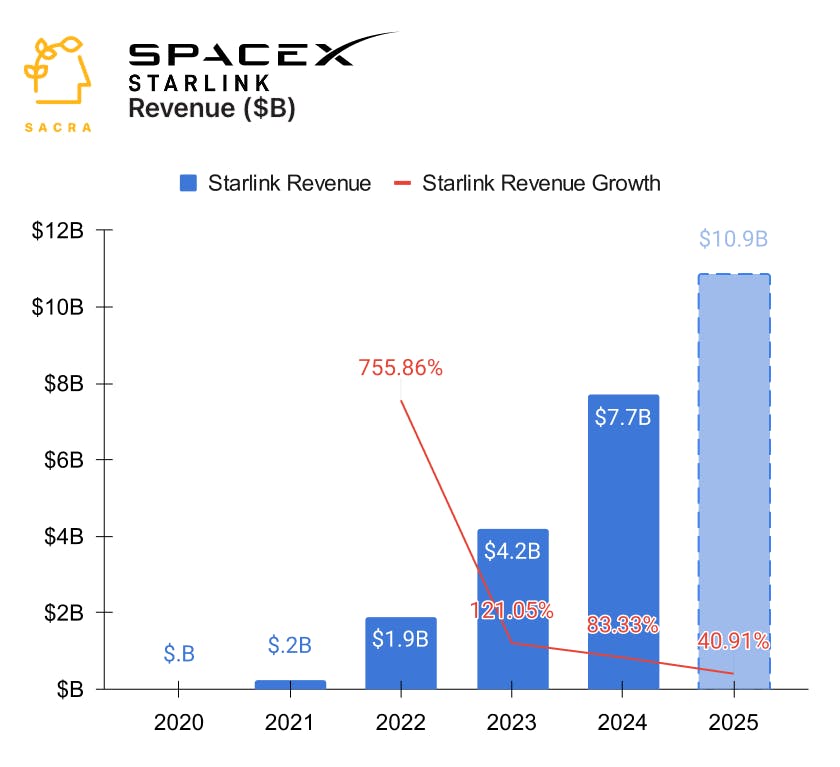

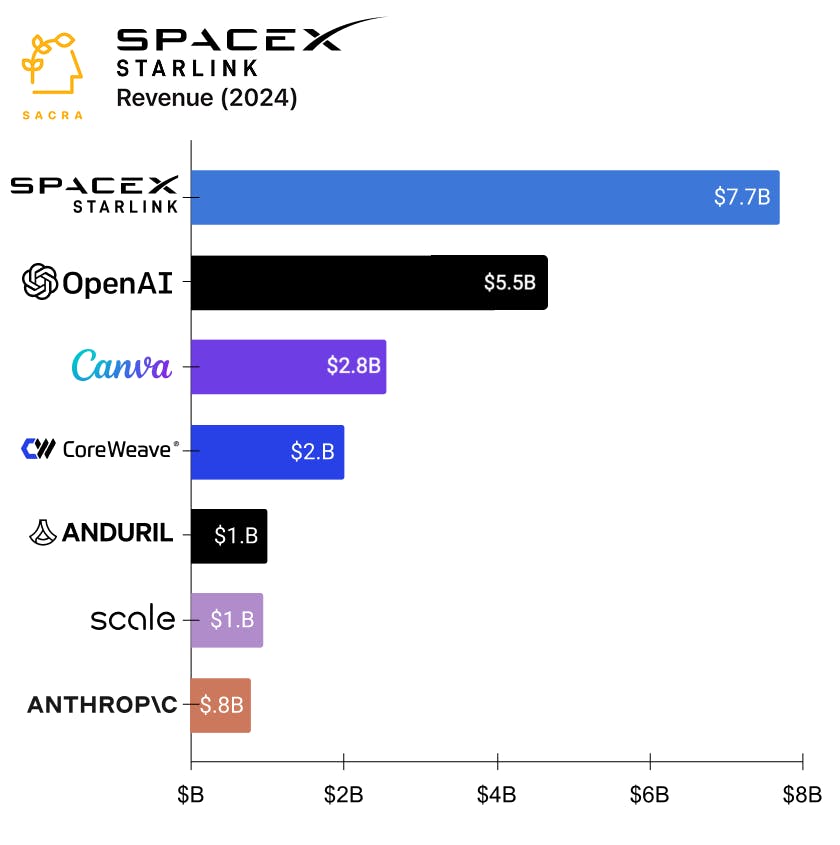

TL;DR: SpaceX's $17B EchoStar acquisition cements Starlink as the undisputed satellite mobile leader and positions it to launch its own mobile phone service powered by Starlink’s satellite constellation. Starlink has become SpaceX's cash cow, growing from $7.7B in revenue in 2024 (up 83% YoY) to a projected $10.85B in 2025 (up 41% YoY), representing 70% of SpaceX's total revenue. For more, check out our full report and dataset on SpaceX.

Key points via Sacra AI:

- Last week, SpaceX announced that it is paying $17B ($8.5B cash, $8.5B stock) to the telecom EchoStar to purchase access to two sets of radio frequencies used by satellites to communicate with mobile phones, allowing Starlink to expand its mobile offering from texting in dead zones without cellular connectivity (which it offers today via its partnership with T-Mobile) to voice & video. SpaceX’s purchase expands its access from a 5 MHz slice of spectrum borrowed from T-Mobile to a dedicated 50 MHz slice made up of the AWS-4 (2000-2020 MHz & 2180-2200 MHz) and H-Block (1915-1920 MHz & 1995-2000 MHz) bands, a tenfold jump in spectral width that makes it feasible for Starlink to handle continuous, higher-bandwidth connections rather than just occasional text traffic.

- Off the strength of its success selling satellite internet to consumers, Starlink has become SpaceX's major cash cow with the business projected to grow from $7.7B in revenue in 2024 (up 83% YoY), making up 58% of SpaceX's total estimated revenue, to $10.85B in 2025 (up 41% YoY) at 70% of SpaceX’s total revenue. Residential internet subscriptions are the biggest contributor to Starlink revenue (about 31%), followed by Starshield & other government sales (24%), residential hardware sales (13%), B2B subscriptions (8%), and RV subscriptions (8%)—with phone service as a net new revenue line that turned on in July 2025, sold to customers either bundled into T-Mobile’s premium plans or as a $10/month add-on, with SpaceX compensated through wholesale terms with T-Mobile.

- In the near-term, Starlink anticipates partnering with AT&T & Verizon to sell satellite voice, text, and data as premium add-ons to their existing customer bundles, but in the long term, Starlink is positioning itself to compete head-on as the only carrier offering global-by-default coverage without needing partnerships across 300+ international carriers like AT&T with Vodafone (Europe) and Verizon with Telstra (Australia). Even as Apple, Verizon, and AT&T consider partnering with Starlink, they're simultaneously hedging their bets by investing in potential competitors—Apple put $1.5B into Globalstar (NASDAQ: GSAT), while Verizon and AT&T have inked future deals with AST SpaceMobile (NASDAQ: ASTS, $4.89M revenue) and Amazon's Blue Origin-adjacent Project Kuiper (NASDAQ: AMZN) as counterweights to Starlink.

For more, check out this other research from our platform:

- SpaceX (dataset)

- Starlink at $4.1B/year growing 121%

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook

- Anduril (dataset)