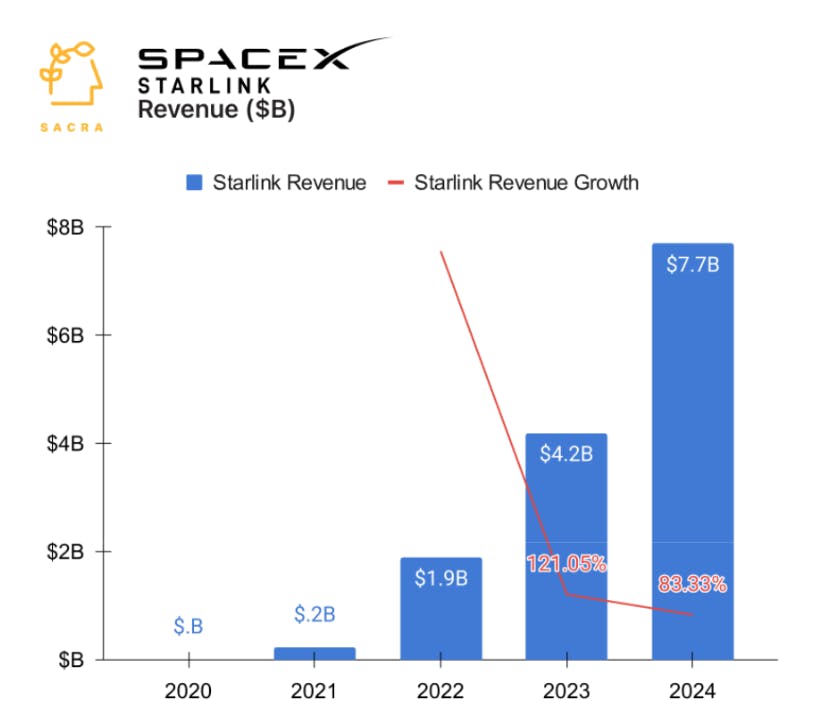

Starlink at $4.1B/year growing 121%

Jan-Erik Asplund

Jan-Erik Asplund

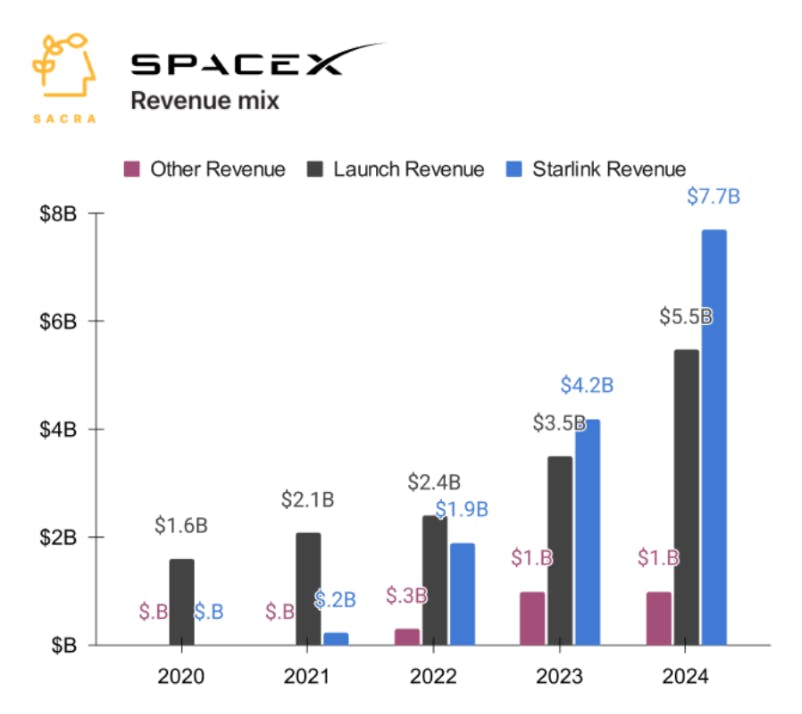

TL;DR: United Airlines, Starlink’s first major global airline customer, is accelerating its rollout of Starlink WiFi across its fleet, with ~350 planes live by the end of 2025. Sacra estimates Starlink generated $7.7B in revenue for 2024 (up 83% YoY), about 58% of SpaceX’s total revenue, as it eats market share from satellite providers across residential, maritime, aviation, and defense. For more, check out our full SpaceX report and dataset.

Key points from our research:

- United Airlines, Starlink's first major global airline customer, announced last week that it is accelerating its Starlink WiFi rollout across its fleet, with ~350 regional planes (out of ~1,000 total) expected to be live by the end of 2025—a deal Sacra estimates will generate $120M/year in revenue for SpaceX. Starlink’s United deal follows similar deals with JSX, Hawaiian Airlines and Qatar Airways, and will fully rip-and-replace United’s mix of current internet partners—Viasat (NASDAQ: VSAT) for the 737 Max and other large planes and Gogo for regional jets—which provide internet by connecting to single satellites 22,000 miles above Earth, creating high latency and necessitating strict throttling of services like Netflix.

- Since picking up 10,000 users in public beta in 2021, Starlink's growth has exploded, hitting 1M users in 2022, 2.3M in 2023, and 4.6M in 2024, now generating an estimated $7.7B in revenue (up 83% YoY), or 58% of SpaceX's total estimated revenue of $14.2B. Residential represents Starlink’s biggest customer segment (4.4M households at ~$2,000 ARPU) but its lowest by overall market share (~0.2%), while these big partnerships are helping it gaining ground in valuable markets like maritime (~$34,000 ARPU, 0.7% market share) and aviation (~$300,000 ARPU, 0.7% market share).

- While Gogo ($400M revenue in 2023, down 2% YoY), Viasat ($1.12B revenue in Q3'24, down 8.4% YoY) and Intelsat ($2.1B revenue in 2023, up 1% YoY) serve ~17,000 combined aircraft (40x Starlink's current ~430 installations), Starlink's network of 7,000 low-earth-orbit (340 miles above Earth) satellites positions them to continue to eat market share by enabling 20-40ms high-bandwidth connections (~23x faster than Viasat's ~700ms Mbps) for watching YouTube, listening to Spotify, and FaceTiming in the air. We're still in the early days of Starlink's major partner deals—Carnival (NYSE: CCL) launched Starlink across their entire fleet in 2024, Maersk ($51B revenue in 2023) has a fleet-wide rollout in the works, and a $2B+ deal with the Pentagon has 100 satellites in space to support allied military operations in places like Ukraine.

For more, check out this other research from our platform:

- SpaceX (dataset)

- Relativity Space

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook

- Anduril (dataset)