SpaceX's app layer

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: SpaceX’s success in building cheaper rockets helped them to $4.6B of revenue and a 66% share of the US launch market in 2022. But hitting their next phase of growth means starting to build out the ‘app layer’ of space. For more, check out our SpaceX report and dataset.

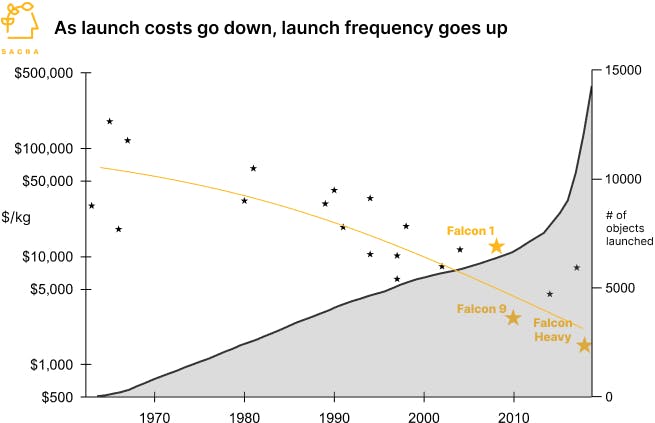

- 1984’s Commercial Space Launch Act legalized private space launches, opening the door for NASA to launch their satellites on rockets like Lockheed Martin’s (NYSE: LMT) Titan IV and Boeing’s (NYSE: BA) Delta II at costs of $30,000-$40,000/kg on each launch. NASA paid Boeing and Lockheed via “cost-plus” contracts that paid all their costs and guaranteed a ~10% profit margin, incentivizing suppliers to overcharge and disincentivizing contractors—which would own a monopoly on private space launches via their United Launch Alliance—from bringing their costs down.

- SpaceX dramatically decreased the cost of launch to $12,600/kg with Falcon 1 and $1,500/kg with Falcon Heavy by using off-the-shelf parts and vertical integration—e.g. building their own onboard radios for $5K versus the industry standard $100K. SpaceX pioneered the usage of outcome-based, fixed-price contracts in launch as a wedge into getting their first NASA contracts, incentivizing them to make their rockets more efficient while protecting NASA from the downside of mission failure.

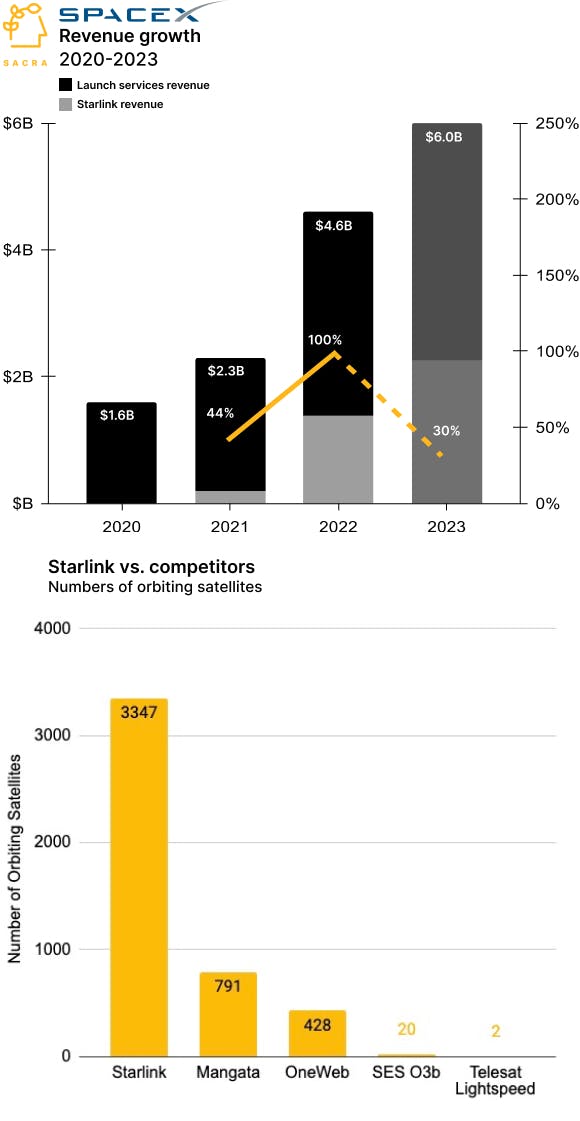

- SpaceX hit $4.6B in revenue in 2022, while halving its losses from the year before—as of Q1’23, they were at $1.5B revenue with $55M profit, on track to generate $6B in revenue for the year. SpaceX handled 66% of all American launches in 2022 and 88% of them through the first half of 2023.

- Since SpaceX’s Falcon 1 became the first privately-funded rocket to reach orbit in 2008, their success has attracted competitors like Blue Origin ($167M raised) and the printing-based Relativity Space ($4.2B valuation), which is aiming to bring per-launch costs even lower—to $10M vs. SpaceX’s $50M. States like Russia and China are also developing their own reusable vehicles to cut down on costs, while more and more rising powers like India, Singapore, Japan and Israel are working to build private-public partnerships around launch.

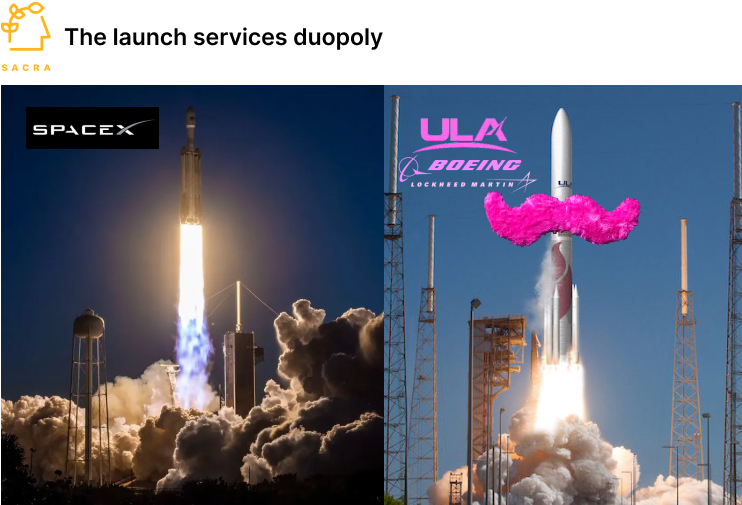

- The launch market is naturally monopoly-resistant given the government’s practice of dual sourcing—Boeing and Lockheed’s United Launch Alliance got 60% of Space Force contracts for 2024, while SpaceX got 40%—laying the groundwork for an “Uber vs. Lyft” duopoly-type market rather than a winner-take-all one. Amid growing demand for launch services, the US Space Force announced earlier this month that it would soon be selecting a third provider, opening up the door for another company like Blue Origin.

- By drastically lowering the cost-to-launch, SpaceX enabled the commercial sustainability of previously-infeasible businesses like satellite internet constellations—SpaceX’s satellite business, Starlink, hit $1.4B in revenue for 2022, up from $222M in 2021. Companies like Globalstar, Teledesic, Iridium and Celestron tried to build 100+ satellite “megaconstellations” during the dot-com boom, but each one went bankrupt due to the high cost of launch—today, SpaceX’s launch business is so dominant that they deliver many of Starlink’s competitors into space.

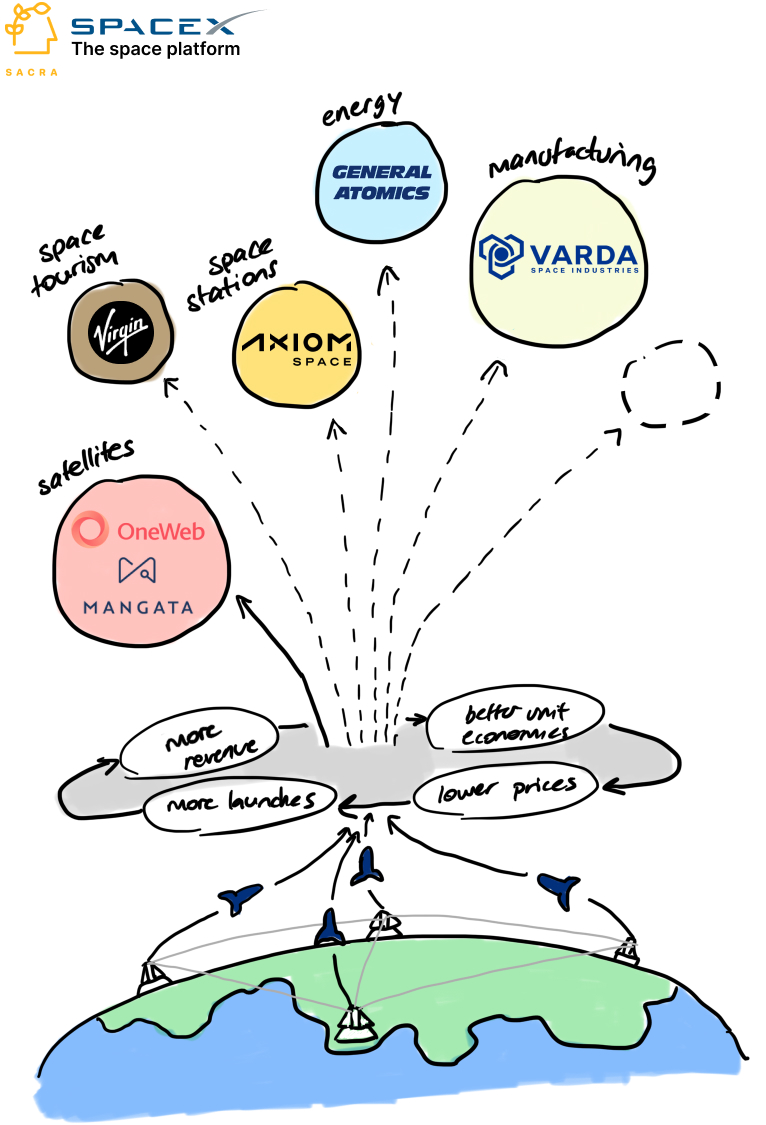

- Just as the Pennsylvania Railroad Company built out an “app layer” of businesses of hotels, telecommunications, steel, coal, and real estate to fund and grow its rail network’s “platform”, SpaceX can use its best-in-class launch services as a platform for higher-margin businesses like space manufacturing ($40B), tourism ($4B), space stations ($10B), and more. The PRR became the largest corporation in the world (circa 1882) because they owned both the rails and a variety of complementary businesses that benefited and solidified that dominance—SpaceX, starting with Starlink, has line of sight into a similar empire in space.

For more, check out this other research from our platform: