Skydio at $180M/year growing 80% YoY

Jan-Erik Asplund

Jan-Erik Asplund

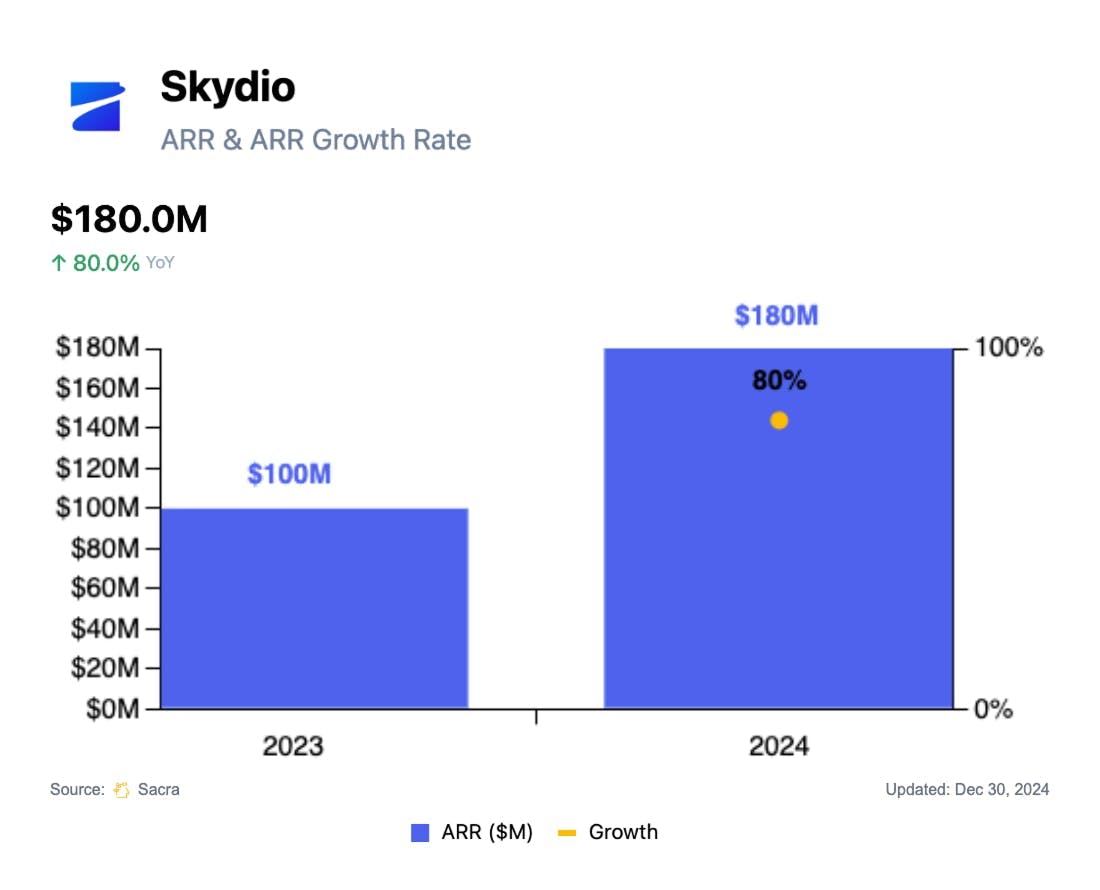

TL;DR: With federal buyers moving away from China's DJI, California’s Skydio is well-positioned to capitalize as a domestic drone producer that can help satisfy the aims of Trump's "Drone Dominance" executive order. Sacra estimates Skydio hit $180M in revenue in 2024, up 80% YoY from $100M in 2023. For more, check out our full report and dataset on Skydio.

Key points via Sacra AI:

- Founded in 2014, Skydio makes self-flying drones that use AI-powered obstacle avoidance to perform complex missions—like inspecting bridges, patrolling military bases, or scanning crash scenes—finding early product-market fit with first-responder agencies and industrial inspectors who lacked in-house pilots. Replacing $80K/year human pilots with robots that can fly themselves 24/7/365, Skydio monetizes through both hardware and software, selling each drone for $20-30K and then layering on $1K-per-user annual SaaS licenses for autonomy, 3D Scan, and fleet-management software with energy, manufacturing, and public safety as its biggest customer verticals.

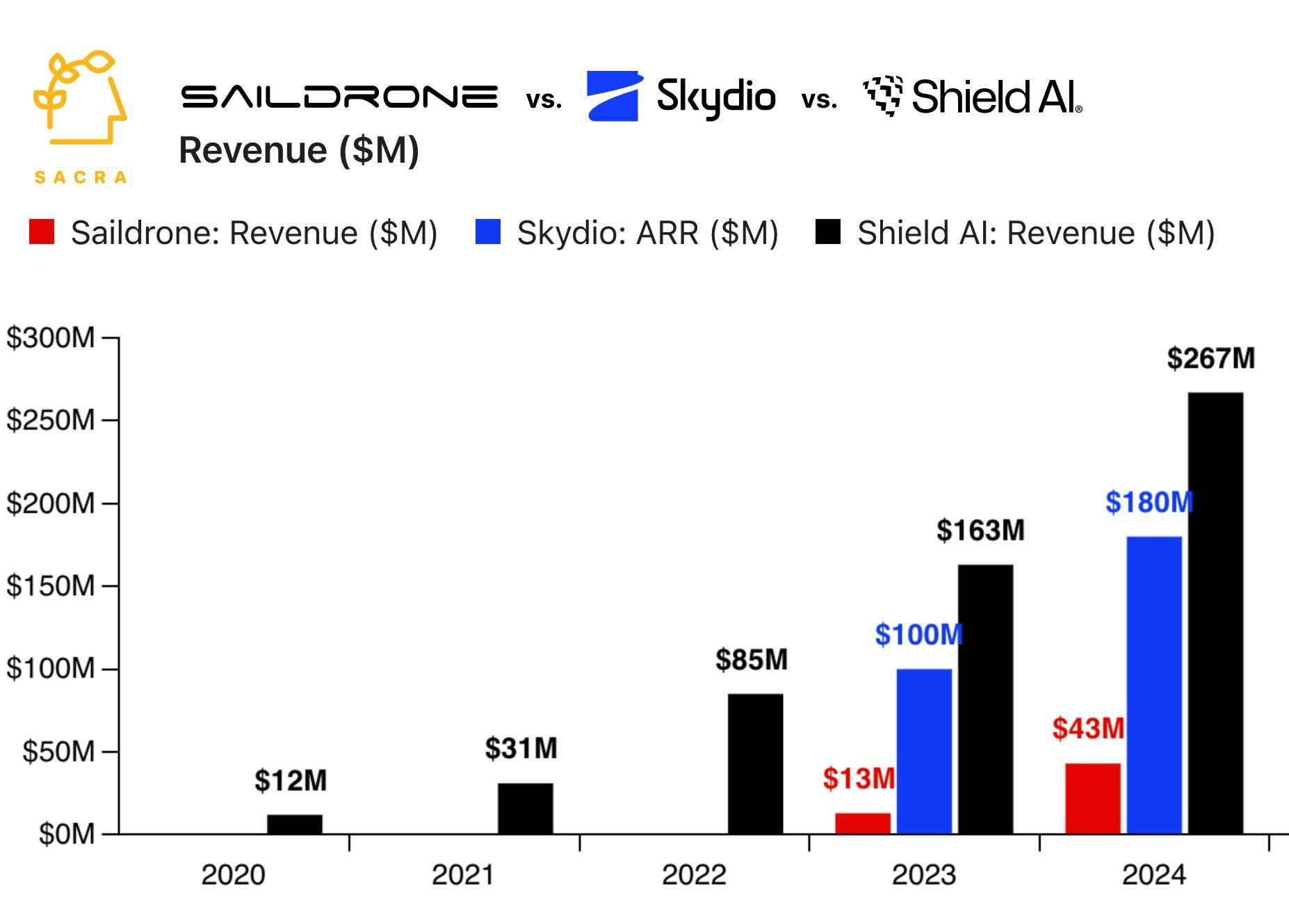

- With Skydio as the biggest pure-play small drone maker on the DoD’s list of approved domestic drone vendors—which banned China’s DJI (90% commercial market share) from all defense-related procurement, driving demand for domestic drone makers—Sacra estimates that Skydio hit $180M in revenue in 2024, up 80% YoY from $100M in 2023. Compare to Anduril at $1B in 2024 revenue (up 138% YoY) valued at $14B and Shield AI at $267M in 2024 revenue (up 64% YoY), both targeting autonomous military drones.

- As Blue List procurement restrictions expand outwards from the DoD to all defense contractors (Oct 2024) to any federally funded agency (late 2025), Skydio is positioned to be the domestic DJI replacement that helps fulfill Trump’s Drone Dominance executive order about supporting the U.S.’s domestic drone capabilities. Inside the U.S. market, domestic autonomous drone makers are clustering into lanes based on use cases: (1) monitoring for defense, utilities, and public safety (Skydio, Teal Drones), (2) high-end engineering and inspection workflows (Wingtra, Skyfish, Freefly), (3) heavyweight ag-spray and logistics (Guardian Agriculture, Skyfront), and (4) dock-based autonomy (Easy Aerial, Brinc)—all racing to capture demand previously served by DJI.

For more, check out this other research from our platform:

- Skydio (dataset)

- Orest Pilskalns, CEO of Skyfish, on building autonomous drone infrastructure

- Saildrone (dataset)

- Saronic (dataset)

- America First vs. American Dynamism

- Anduril (dataset)

- Anduril at $1B/yr

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook