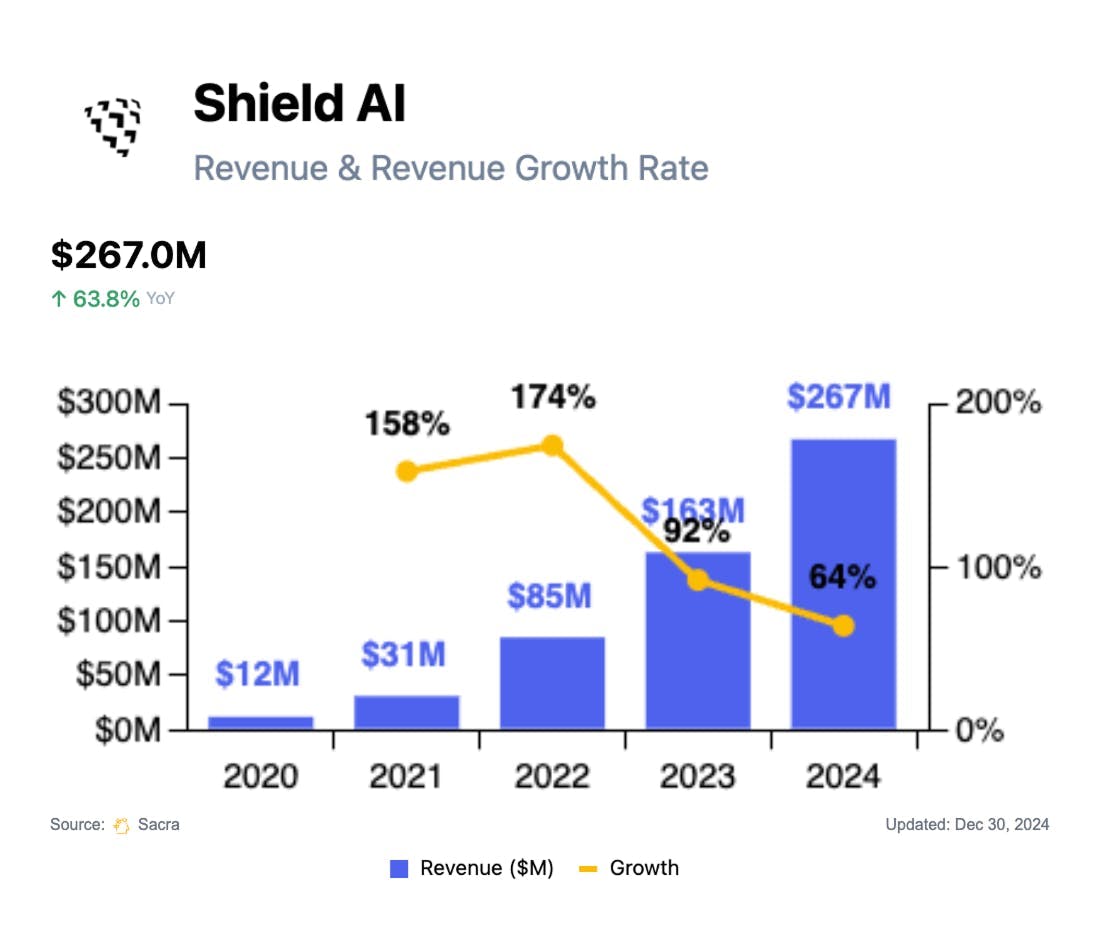

Shield AI at $267M/year growing 64% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: In a defense autonomy market flooded with drone startups and rising Pentagon budgets—$300M+ earmarked for low-cost autonomous systems in 2026—Shield AI stands out as the U.S.’s leading military-focused pure-play drone startup. Sacra estimates Shield AI hit $267M in revenue in 2024, up 64% YoY from $163M in 2023. For more, check out our full report and dataset on Shield AI.

Key points via Sacra AI:

- Circa the early 2010s, getting real-time aerial surveillance in places like the South China Sea or eastern Ukraine required $40M drones, long runways for takeoff, and stable communications—rare assets in conflict zones—inspiring Shield AI (2015) to build vertical-takeoff drones (V-BATs) that can fly 13+ hour surveillance missions and return autonomously even when comms go dark. Like Anduril, Shield AI front-loads its own R&D and sells complete, off-the-shelf systems under fixed-price contracts like its $1M V-BAT, signing multi-year deals such as a $198M contract with the US Coast Guard to replace legacy drones like the $80M MQ-9B SeaGuardian and manned flights ($115K per mission) with off-the-shelf autonomy.

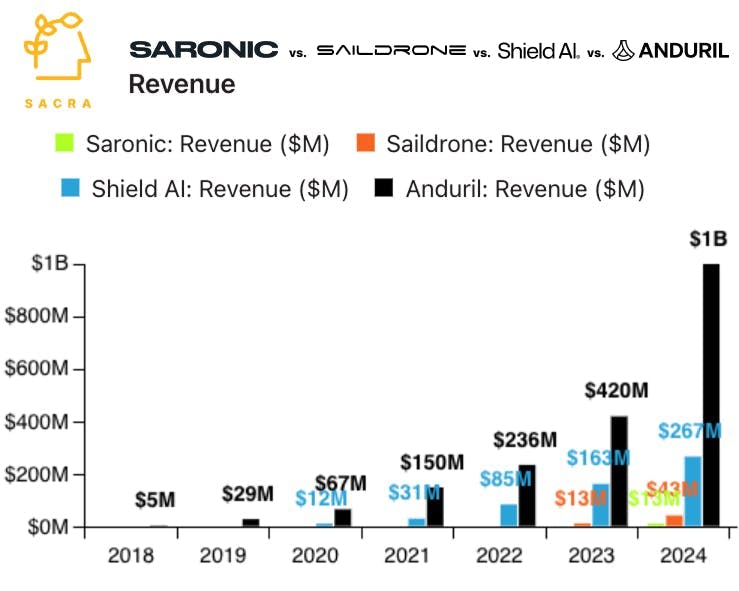

- Amid escalating GPS jamming in Ukraine and rising maritime tensions in the Indo-Pacific, demand has surged for autonomous drones with demonstrated success in combat—driving new contracts for Shield AI with the Romanian Navy (~$30M), Japan’s naval forces, Greece, Canada, and other allies, pushing Sacra-estimated annual revenue to $267M in 2024, up 64% YoY from $163M in 2023. Compare to defense-autonomy platform Anduril at $1B in 2024 revenue (up 138% YoY), maritime drone startups Saildrone at $43M (up 231% YoY) and Saronic at $12.5M in revenue in 2024, and legacy prime Lockheed Martin (NYSE: LMT) at $72B TTM revenue (up 1% YoY).

- While Shield AI’s revenue has been dominated by physical drone sales, the company is diversifying now, with partners like Airbus, Kratos, and L3Harris licensing its “Hivemind” autonomy software for handling take-off, navigation, and landing without GPS, pilots, or communication, creating the upside of a software business that can drive 60%+ gross margin. With $9.4B in investment committed to autonomous drones for the next fiscal year between the Pentagon’s discretionary budget and billions in new mandatory spending from Trump’s “One Big Beautiful Bill,” 2026 is set to be a key year for startups selling into DoD, with Shield AI well-positioned as the U.S.’s leading pure-play drone startup to win in the key categories of 1) small unmanned aerial systems and 2) long-endurance aerial systems for surveillance.

For more, check out this other research from our platform:

- Shield AI (dataset)

- Scott Sanders, Chief Growth Officer at Forterra, on autonomy for every vehicle

- Saildrone (dataset)

- Saronic (dataset)

- America First vs. American Dynamism

- Anduril (dataset)

- Anduril at $1B/yr

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook