$12.5M/year Anduril of the seas

Jan-Erik Asplund

Jan-Erik Asplund

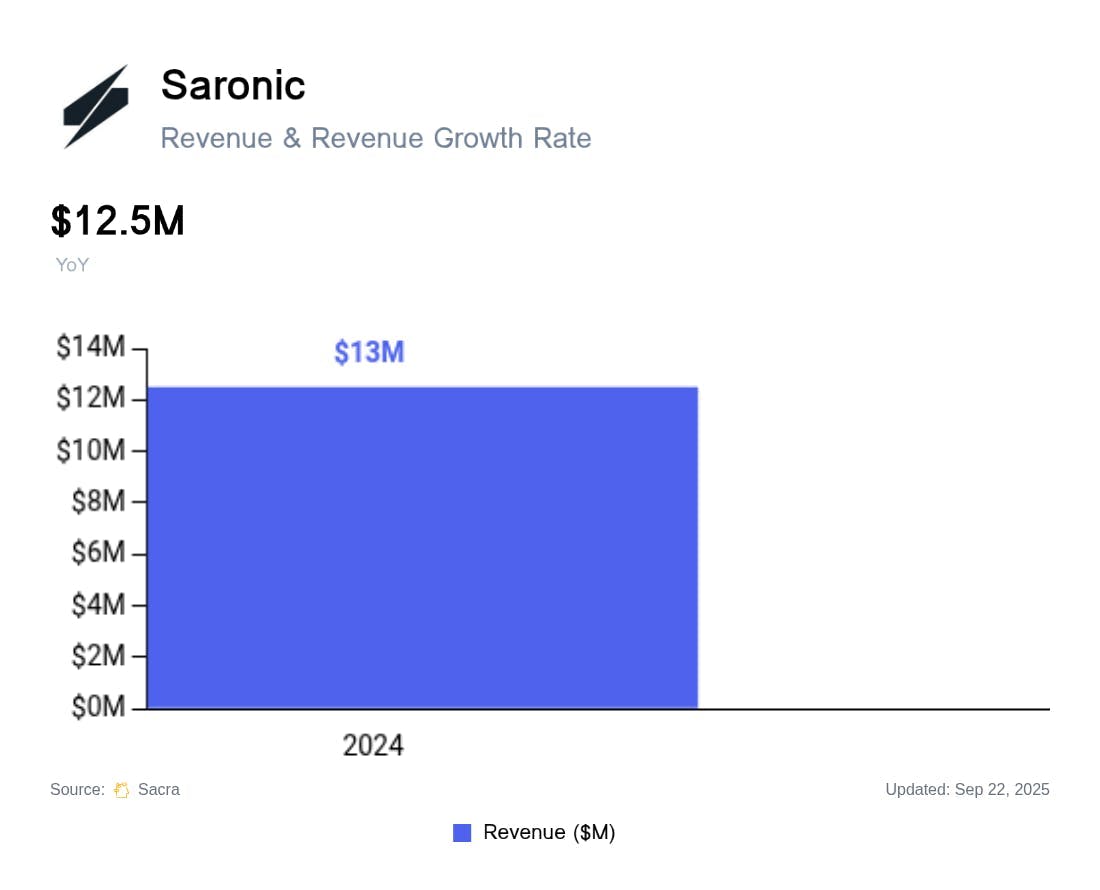

TL;DR: With China’s shipyards outproducing the U.S. Navy 100x and Ukraine proving $250K sea drones can sink warships, Saronic is positioning as the “Anduril for the seas,” with autonomous surface vessels sold on fixed-price contracts rather than cost-plus. Sacra estimates Saronic generated $12.5M in revenue in 2024. For more, check out our full report and dataset on Saronic.

Key points via Sacra AI:

- China’s shipyards outproduce the U.S. Navy by more than 100x, making it near-impossible to win on sheer output, while Ukraine’s use of $250K sea drones to sink Russian warships demonstrates that large platforms are increasingly at risk—inspiring Saronic (2022) to launch as an “Anduril for the seas”, building autonomous surface vessels ranging from 6-foot scout boats (Spyglass) to 150-foot hunter-killers (Marauder) that can swarm, surveil, and strike without risking human sailors. Like Anduril & Shield AI, Saronic flips the traditional business model of cost-plus, monetizing through fixed-price military contracts for complete autonomous systems (starting at ~$400K for its Spyglass USV), with the company acquiring Gulf Craft's Louisiana shipyard in April 2025 to scale production from prototypes to hundreds of vessels monthly.

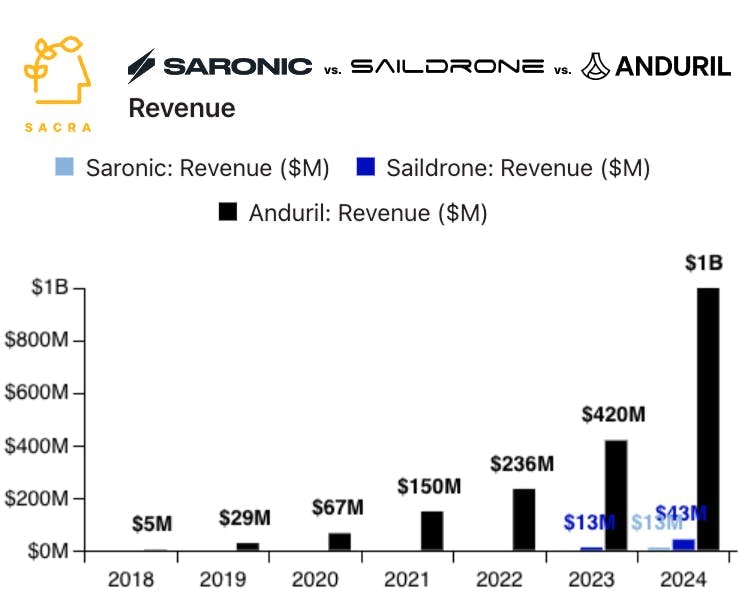

- On the back of successful contracts with USSOCOM and the Navy to meet their needs for expendable maritime drones, small unmanned vessels and river-patrol vehicles as the military gameplans for Taiwan invasion scenarios, Sacra estimates that Saronic generated $12.5M in revenue in 2024, with the company projecting $400M in revenue for 2025 off the back of large programs like its $392M long-term Navy contract ($197M already committed as of July 2025). Compare to leader on the scientific data gathering side of autonomous vessels Saildrone at $43M in 2024 revenue (up 231% YoY), defense-autonomy platform Shield AI at $267M in revenue in 2024 (up 64% YoY), next-gen defense prime Anduril at $1B in revenue in 2024 (up 138% YoY).

- With ~35% of all Pentagon contracts being awarded to ~5 primes without a competitive process, the Navy's push for 1,000+ new small USVs—along with the Trump administration’s calls for “Restoring America’s Maritime Dominance” and doing so with cost-efficiency—creates a rare opening for new entrantslike Saronic that can sell USVs at $400K to $1.2M each vs. legacy prime programs with Leidos (NYSE: LDOS) or L3Harris (NYSE: LHX) where vessels are bundled into multi-year, multi-hundred-million-dollar contracts. While still early, Saronic is already laying the groundwork for global expansion—opening a Sydney office to support AUKUS field tests (Australia navy budget: ~$16B), hiring two retired Royal Navy admirals to lead UK engagement (~$14B), and pitching swarming USVs in Japan (~$44B), Singapore (~$23B) , and the UAE (~$10B).

For more, check out this other research from our platform:

- Saronic (dataset)

- Saildrone at $43M/year growing 231% YoY

- Saildrone (dataset)

- America First vs. American Dynamism

- Anduril (dataset)

- Anduril at $1B/yr

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook