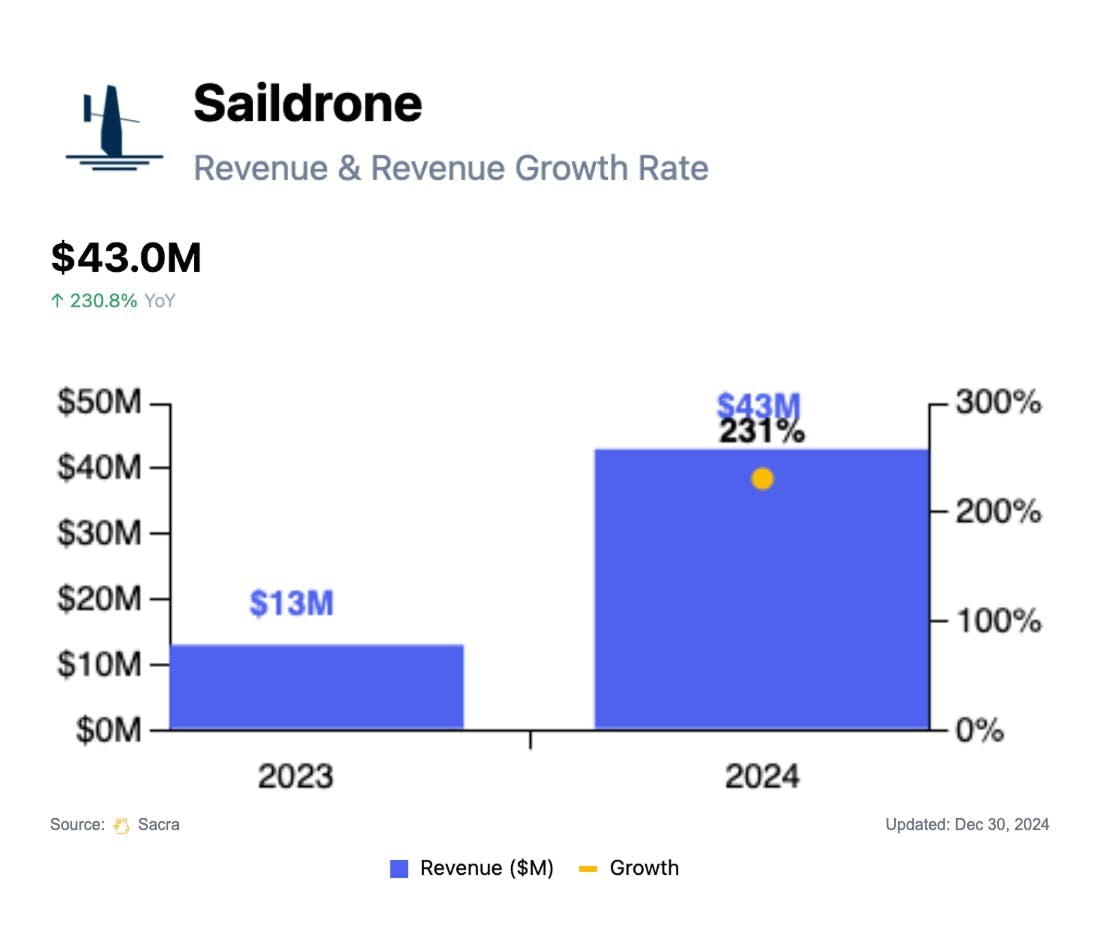

Saildrone at $43M/year growing 231% YoY

Jan-Erik Asplund

Jan-Erik Asplund

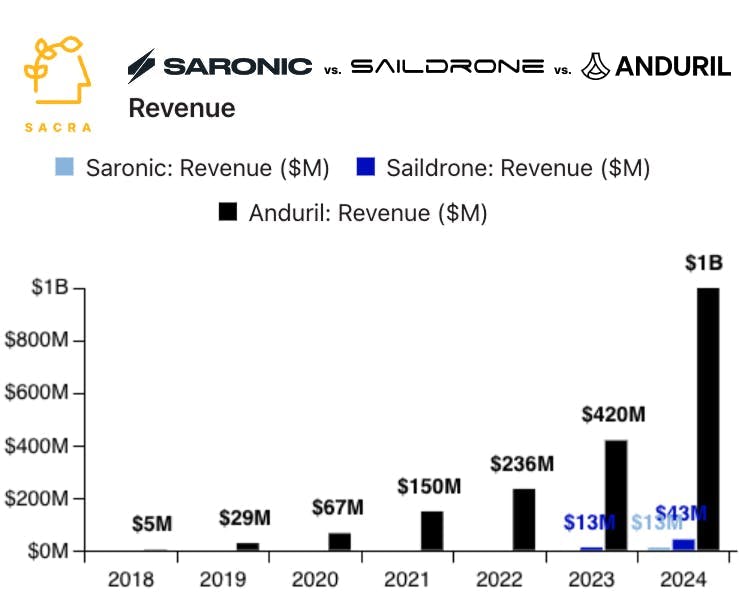

TL;DR: The Pentagon is pouring billions into maritime autonomy, driving demand for companies like Saildrone (long-distance surveillance), Saronic (fast attack boats), and Anduril (heavyweight undersea strike vehicles). Sacra estimates Saildrone reached $43M in revenue in 2024, up 231% YoY from $13M in 2023, capturing both climate science budgets (NOAA, NASA) and defense contracts. For more, check out our full report and dataset on Saildrone.

Key points via Sacra AI:

- Saildrone (founded in 2012) is a dual-use ocean robotics company that builds long-range, unmanned, wind- and solar-powered drones that collect & transmit data on weather, ocean conditions, seafloor terrain, and surface vessel activity—commercializing its autonomous platform by operating its own fleet and selling fixed-price data and mission services across climate science, offshore energy, and naval surveillance. While traditional oceanographic research vessels burn $35,000/day in fuel and crew costs to collect data, Saildrone's wind-and-solar-powered vehicles sail for 365 days on <100W of power, charging science agencies ~$2,500/day for data collection and increasingly, signing defense customers (US Navy 5th Fleet, Danish Armed Forces) on multi-year subscriptions for maritime domain awareness.

- Riding an upsurge of demand from the US Navy for help monitoring Iranian activity in the Arabian Sea and patrolling for human traffickign & narcotics, Sacra estimates that Saildrone hit $43M in revenue in 2024, up 231% YoY from $13M in 2023, valued at $600M for a 14x revenue multiple. Compare to maritime autonomy competitor Saronic at $12.5M revenue in 2024, valued at $4B for a 320x revenue multiple, defense-tech leader Anduril at $1B revenue in 2024 (up 138% YoY), valued at $30.5B for a 30x multiple, and aerial drone startup Shield AI at $267M revenue in 2024 (up 64% YoY), valued at $5.3B for a 19.8x revenue multiple.

- The unmanned-maritime drone market is sorting into three mission-driven segments—ultra-endurance surveillance drones with 6 months sailing time (Saildrone), fast, hybrid attack-and-recon boats with ~4 week loiter time (Saronic), and heavyweight undersea strike vehicles (Anduril’s Dive-LD & Dive-XL) that slot into the Navy’s big-ticket submarine budget. By selling first into research organizations like NOAA, USGS, and NASA, Saildrone financed its early R&D before selling the same, fixed-price system into the Navy—allowing Saildrone to leapfrog the 3-to-5 year procurement grind when commissioned to build direct for the military and giving it full degrees of freedom over product & pricing rather than being guided by Pentagon decisions & budgets.

For more, check out this other research from our platform:

- Saildrone (dataset)

- Saronic (dataset)

- America First vs. American Dynamism

- Anduril (dataset)

- Anduril at $1B/yr

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook