Rula at $471M/year growing 100% YoY

Jan-Erik Asplund

Jan-Erik Asplund

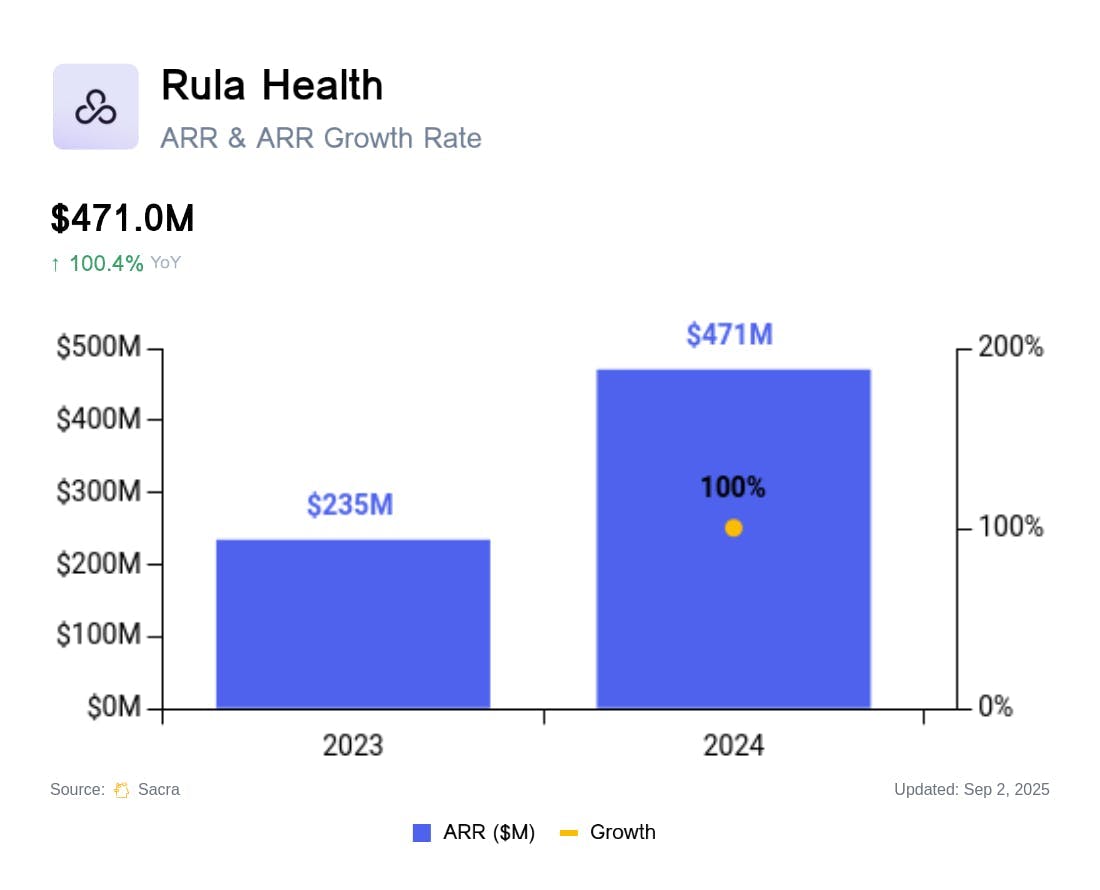

TL;DR: Post-COVID, mental health became the fastest-growing consumer marketplace category, driving the growth of managed therapist marketplaces like Rula, Headway, Alma, and Grow Therapy. Sacra estimates Rula reached $470M in annualized gross revenue in 2024, up 100% YoY. For more, check out our full report and dataset on Rula.

Key points via Sacra AI:

- Since ~70% of therapists don’t accept insurance due to the administrative burden, the first mental health marketplaces like BetterHelp (2013) & Talkspace (2012) charged patients cash ($200-400/month), but hit a ceiling serving the 6.7% of people who pay out-of-pocket for mental health in the U.S—inspiring Rula (2018) and peers like Headway (2019), Alma (2018), and SonderMind (2014) to build managed marketplaces for mental health that handle insurance on therapists’ behalf. Rula serves 15,000+ 1099 contractor therapists who conduct sessions via Zoom and document visits through Rula's web portal, splitting revenue 25% (Rula) / 75% (therapist) while handling all of the eligibility verification, claim submission, and payment collection that keeps solo therapists cash-only.

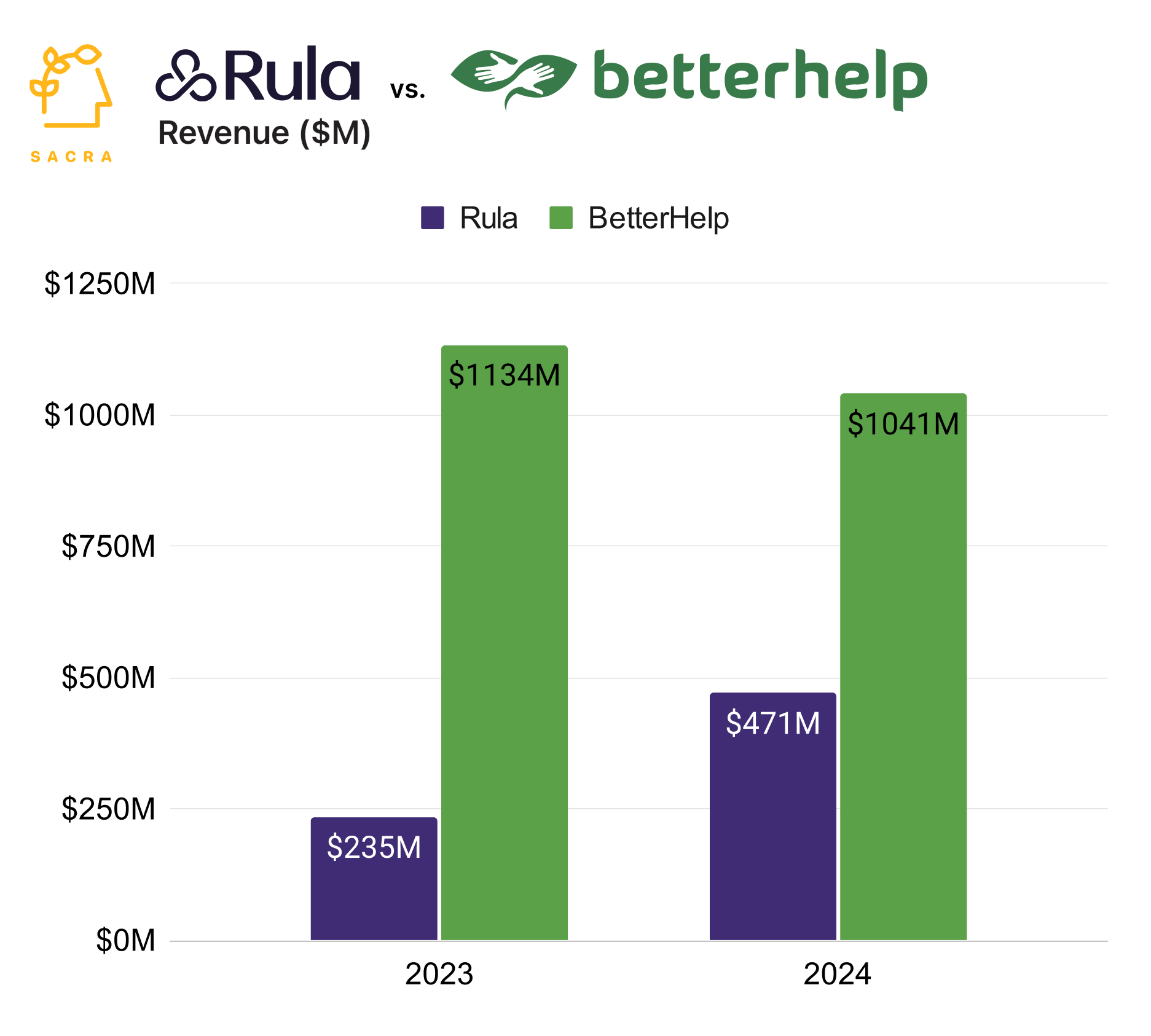

- The fastest growing category of consumer marketplace in 2023 with GMV surging 260% YoY, mental health outpaced overall health (150%), pets (140%), and tickets (55%) as COVID's tripling of mental distress symptoms collided with regulatory changes enabling interstate telehealth, with Sacra estimating that Rula hit $470M in annualized gross revenue in 2024, up 100% YoY, with ~20-25% gross margin. Compare with direct-to-consumer digital mental health platforms BetterHelp (owned by Teladoc Health) at $1.03B revenue in 2024, down 8.75% YoY, Talkspace (NASDAQ: TALK) at $187.6M revenue in 2024, up 25% YoY, with ~45% gross margin, and LifeStance Health (NASDAQ: LFST) at $1.25B revenue in 2024, up 19% YoY, with 33% gross margin.

- Where Zocdoc struggled with churn given the one-off nature of most medical visits, practices already operating near capacity, and doctors scheduling recurring clients off-platform to avoid fees, mental health inverts those dynamics with weekly sessions driving high LTV, solo therapists operating below 50% capacity, and Rula’s management of insurance preventing therapists from moving off-platform. Neck-and-neck with Alma (20,000+ providers) and SonderMind (10,000+) at 15,000+ providers in the category led by Headway (60,000+ providers), Rula competes directly to win therapists onto its platform, while it competes indirectly with AI-powered tools for handling insurance & notes (Camber, Orchid) and 1:1 chat and coaching via LLMs (Slingshot AI, Sonia) that seek to unbundle the marketplace entirely.

For more, check out this other research from our platform:

- Rula (dataset)

- Function Health (dataset)

- Maven Clinic at $268M ARR

- BillionToOne at $153M/yr

- Commure at $105M ARR

- Oura at $225M

- Virta Health at $175M revenue

- Noom at $1B ARR

- Hone Health: the $55M/year D2C testosterone startup

- Sweden’s $215M/year telehealth giant

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Ro and the telehealth capital cycle

- Marc Atiyeh, CEO of Pawp, on building telehealth for pets

- Kathryn Cross, CEO of Anja Health, on the future of stem cell therapy

- Liana Guzmán, CEO of Folx, on the $400B market for LGBTQIA healthcare

- Brendan Keeler, Senior PM at Zus Health, on building infrastructure for digital health