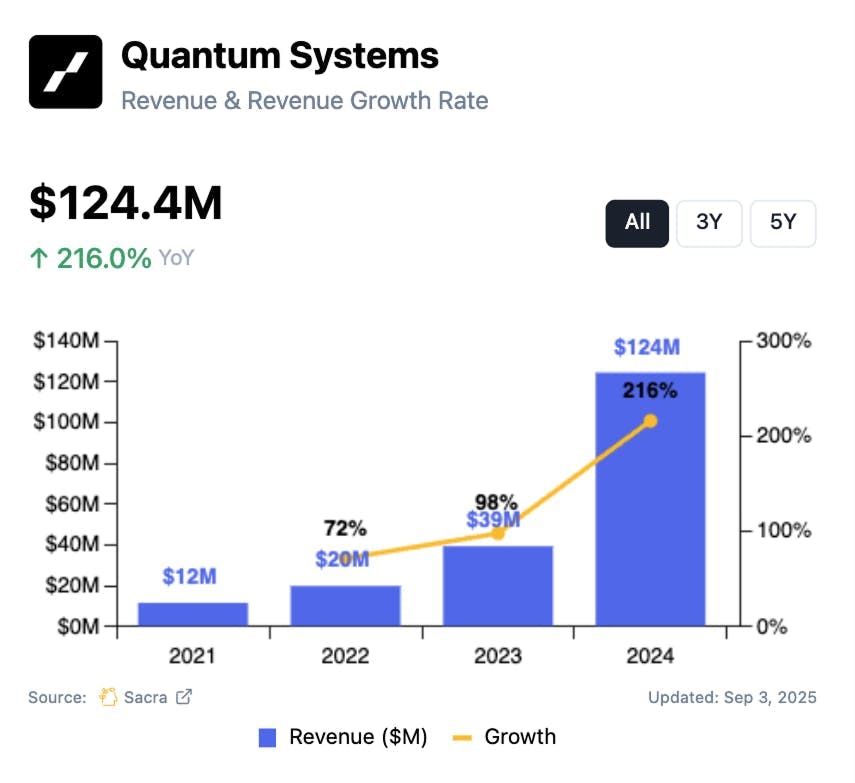

Quantum Systems at $124M/year up 216% YoY

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: After pivoting from civilian surveying drones to defense following Russia's 2014 Crimea annexation, Germany's Quantum Systems became the first European drone company deployed in Ukraine. Sacra estimates Quantum Systems hit $124M in revenue in 2024, up 216% YoY from $39M in 2023 amid demand for battlefield-proven systems growing across NATO and beyond. For more, check out our full report and dataset on Quantum Systems.

Key points via Sacra AI:

- Founded in Germany in 2015 to build surveying drones for agriculture, mining, and infrastructure inspection, Quantum Systems pivoted to defense after Russia's annexation of Crimea, launching its Vector eVTOL platform in 2017—a fixed-wing drone with 3-hour endurance and vertical takeoff for artillery targeting and battlefield surveillance—with 95% of revenue now coming from defense.Quantum Systems bids directly with local entities vs. selling through partnerships with primes, monetizing through six-figure defense contracts (~€100k per Vector system) bundled with multi-year service agreements, with the company now shifting from hardware-only sales to integrated hardware-software subscriptions via its emerging “Mosaic” platform.

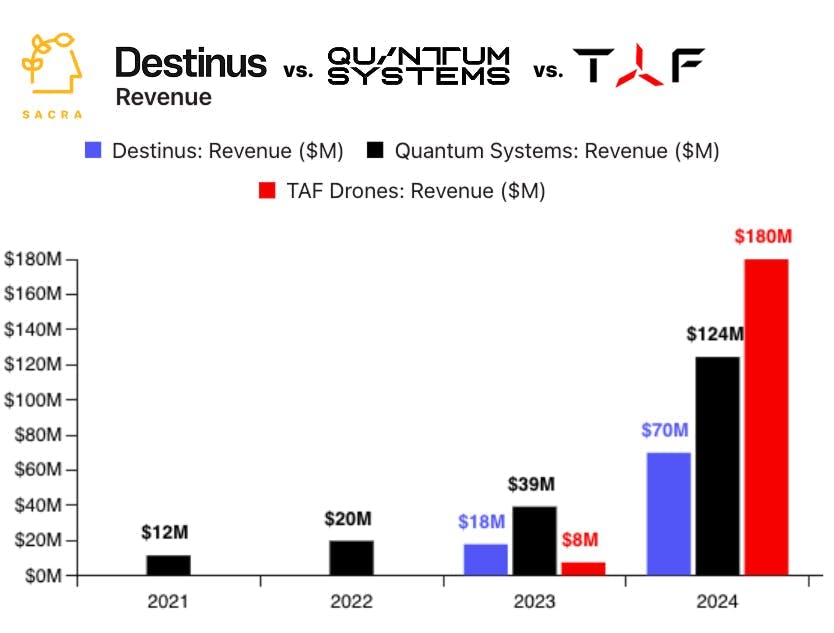

- After becoming the first European drone company to deploy at scale in Ukraine immediately after the 2022 invasion, Quantum Systems has rode the upsurge of demand for drones, selling into Spain, Australia, and the U.S, with Sacra estimating that Quantum Systems hit $124M in revenue in 2024, up 216% YoY from $39M in 2023. Compare to U.S. defense-autonomy leaders Shield AI at $267M in 2024 revenue, up 64% YoY, and Anduril at $1B revenue in 2024, up 138% YoY, and surveillance-focused U.S. counterpart Skydio at $180M in revenue in 2024, up 80% YoY.

- In the U.S, new FAA guidance removing visual-line-of-sight (VLOS) requirements and enabling one operator to supervise multiple drones, expected to come into effect in 2026, is set to unleash a competition to win every commercial drone market—drone delivery, drone first response, drone-in-a-box—pitting consumer drone companies like Manna against defense-focused names like Quantum Systems as they transition out of wartime. Like Anduril with Lattice or Shield AI with Hive, Quantum is building Mosaic, a software-based command platform for unmanned warfare that governments license annually to orchestrate any vendor's drones across services, creating a recurring software business that could drive 60%+ gross margins versus hardware's 30-40%.

For more, check out this other research from our platform:

- Quantum Systems (dataset)

- Bobby Healy, founder & CEO of Manna, on drone delivery for the suburbs

- Ukrainian Dynamism

- Saildrone (dataset)

- Saronic (dataset)

- America First vs. American Dynamism

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook

- Zach Rash & Daniel Singer, CEO & CBO of Coco Robotics, on why ground delivery beats drones

- Orest Pilskalns, CEO of Skyfish, on building autonomous drone infrastructure

- Partnerships lead at Skydio on where value accrues in the drone stack

- UAS product lead at Valmont Industries on scaling drone autonomy in industrial inspection

- Director of Business Operations at Wing on scaling last‑mile drone delivery with DoorDash

- Director of UAS Operations at NV5 on navigating the DJI ban to build a compliant drone fleet

- Enterprise sales director at Skydio on drones as first responders

- Skydio at $180M/year growing 80% YoY

- Scott Sanders, Chief Growth Officer at Forterra, on autonomy for every vehicle