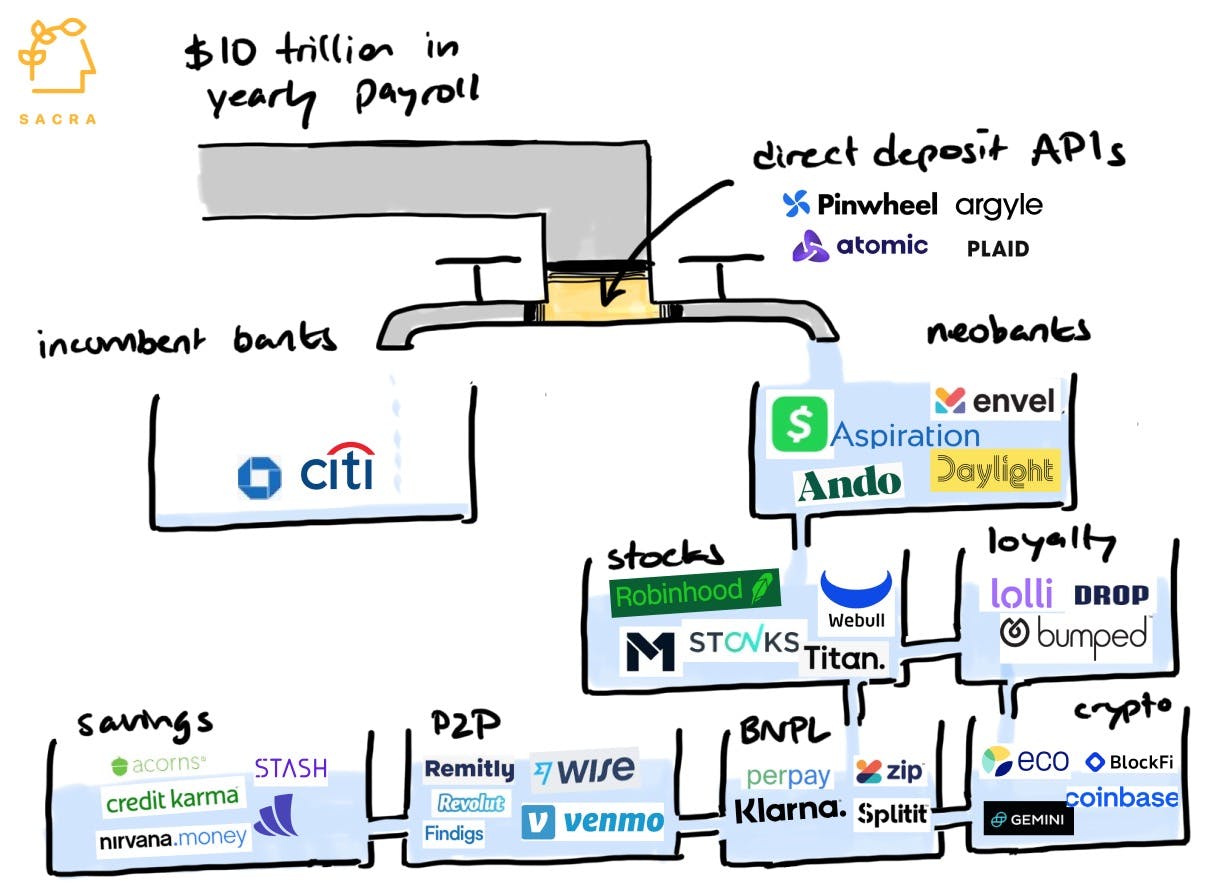

Pinwheel, Argyle, Atomic, and the direct deposit switching APIs funding $10T to neobanks

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Direct deposit switching APIs like Pinwheel are redirecting the $10T of payroll deposited in incumbent banks towards neobanks and novel vertical finance apps. Read our interview with Kurt Lin, CEO of Pinwheel, and check out our coverage of Mercury (dataset), N26 (dataset), Revolut (dataset), and Monzo (dataset) for more.

Check out our weekly email for more insights like this into private companies.

Success!

Something went wrong...

- Incumbent banks make 10x more from direct deposit customers than other customers, which makes owning customer’s paychecks the holy grail of retail banking. Banks are happy to pay $600-$750 in CAC to acquire direct deposit customers with a lifetime value of over $4500. (link)

- For neobanks like Chime ($25B), Varo ($2.5B), and Current ($2.2B), direct deposit customers can bump up LTV by 30x-40x. A neobank with an average direct deposit of $1,000 per customer per pay cycle can increase transaction volume by $260 million and revenue by $2.6M, even if only 10,000 customers switch. (link)

- Chime found initial product-market fit offering 2 days early paycheck access with $100 in fee-free overdraft to direct deposit customers and spent millions in ads convincing American customers to switch. However, until January 2020, only 4% of them had their direct deposits in a neobank, a side account for deals and freebies while maintaining primary accounts with incumbent banks. (link)

- Customers preferred sticking with their existing bank rather than go through the agony of filling paper forms and coordinating with employers/payroll providers to switch to a new bank. Digital direct deposit switching is one of the most demanded features with 40% to 50% of customers declaring it as ‘extremely valuable.' (link)

- Then came API-based direct deposit startups like Pinwheel ($500M), Argyle (raised $77M), and Atomic (raised $68M), which in a Plaid-like manner, act as a pipeline between the payroll providers like ADP (NASDAQ: ADP) and Gusto ($10B) and banks. Instead of filling paper forms, customers can search their payroll provider/employer within the app and switch direct deposit in just a few clicks. (link)

- Neobanks gained a 7% share of direct deposits from the incumbent banks in 2020 by providing anyone with direct deposits early access to COVID stimulus checks and easy in-app switching. Both Chime and Varo doubled their user base in 2020 with Chime reaching 10M and Varo 2M users. (link)

- While incumbent banks like Chase (NYSE: JPM) are fighting back by offering a $600 bonus and 2 days early paycheck access to direct deposit customers, they don’t want to cannibalize their primary checking account product. Chase offers early paycheck access only to its 1.4M Secure Banking account customers, just 2% of its 57M customers. (link)

- By making it easy to pull money from paychecks, Pinwheel and others are creating a whole new set of competitors for incumbent banks and neobanks. These include niche fintechs like Perpay (4M+ users), mega fintechs like Block (NYSE: SQ), and payroll companies like Gusto and Deel ($12B). (link)

- Direct deposit switching APIs allow novel vertical fintechs to underwrite their services to people who might not otherwise be able to get them—like Perpay, which offers BNPL to customers with sub-550 FICO scores. By using APIs like Pinwheel to verify users' income and pull money directly from their paychecks, Perpay and other fintechs can get customers from previously marginalized customer bases. (link)

- In its Q4 2021 earnings call, Block mentioned using Pinwheel’s API to grow Cash App’s direct deposit users to 1.5M, who bring in 6.5 times more cash inflows than its P2P users. On the back of these direct deposits, Block is creating a closed-loop payment network between its 2M Square sellers and 44M Cash App users where it pockets the 3% Visa/Mastercard fees, improves user stickiness, and increases LTV. (link)

- Payroll companies like Gusto and Deel are offering their own products like Gusto Wallet and Deel Card that are essentially neobanks vertically integrated with payroll. With clear visibility into contractor’s working hours and access to business’ vendor payment accounts, they can leverage direct deposit APIs to move the money into their virtual wallets. (link)

- With fractional direct deposit switching offered by Pinwheel and others, the notion of the primary direct deposit account has become obsolete. With customers splitting their paychecks across multiple accounts, incumbent banks, fintechs and vertical finance apps will be competing on the quality of their value-add services. (link)

For more, check out our full conversation with Kurtis Lin, CEO of Pinwheel and read this other research on our site:

- Mercury (dataset)

- N26 (dataset)

- Revolut (dataset)

- Monzo (dataset)

- Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance

- Jeremy Zhang, CEO of Finch, on building a universal API for employment systems

- Bo Jiang, co-founder and CEO of Lithic, on the key primitives in card issuing

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop