Pilot: the $43M per year mechanical bookkeeper

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Pilot ($43M ARR) has hit 60% gross margins acting as human-in-the-loop middleware between the SMB finance stack and the bookkeeping system of record in QuickBooks. To hit their next act, they’ll need to keep building on their lead while avoiding getting squeezed from both sides. For more, check out our full report on Pilot (dataset) and interviews with former Pilot engineer Pete Belknap, inDinero co-founder Andy Su, and Truewind CEO Alex Lee.

Get more private company metrics, insights, and analysis in your inbox.

Success!

Something went wrong...

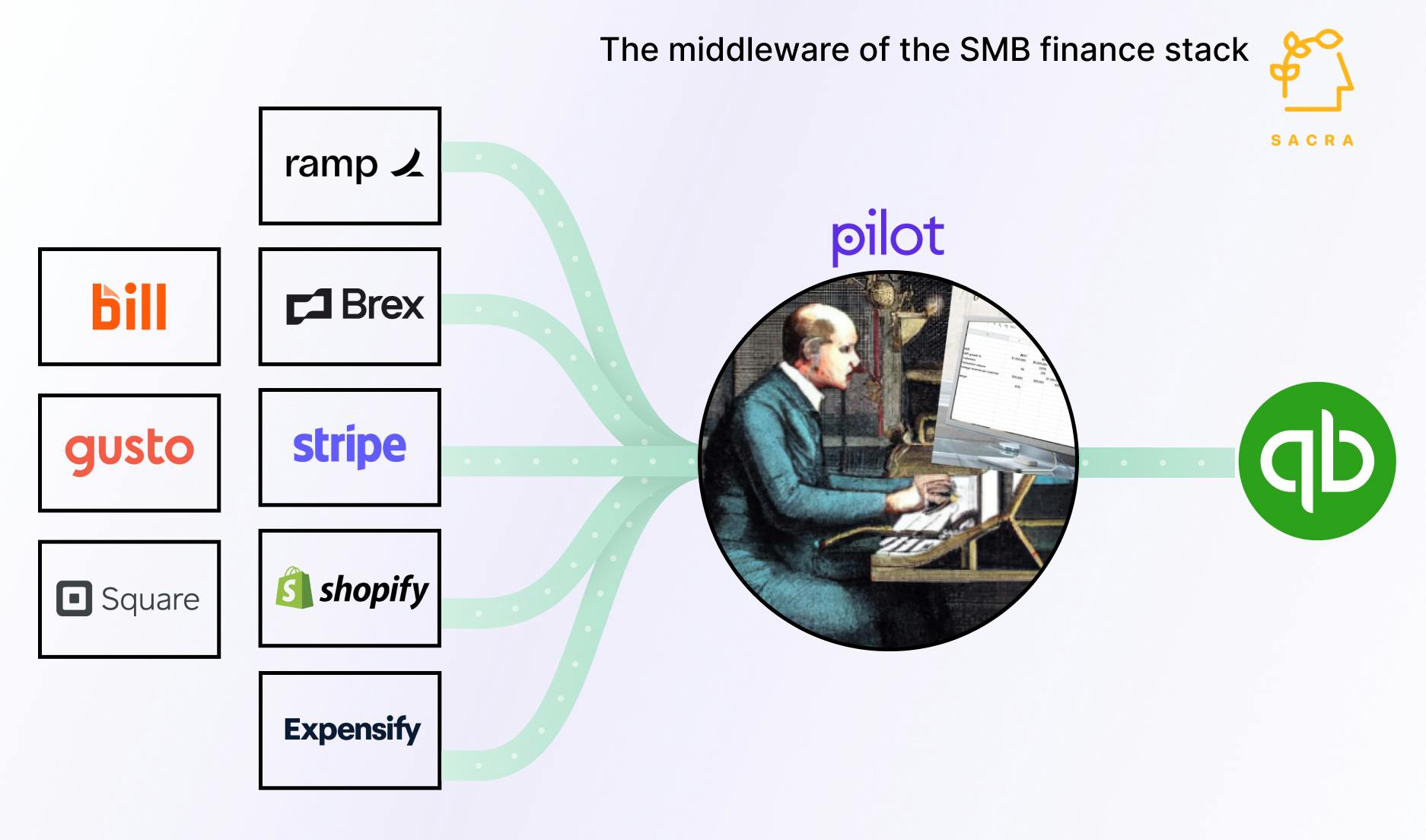

- From paper to digital (scans / photos / PDFs) to open APIs like Stripe, Gusto (dataset) and Plaid (dataset), inDinero (2009), Bench (2012) and Pilot (2016) have ridden the wave of increased access to the SMB data layer to build tech-enabled services for bookkeeping. Tech-enabled bookkeepers serve as middleware that ingest data from source SaaS apps, transform that data into financial statements and deposit those statements into destination app QuickBooks. (link)

- Tech-enabled bookkeepers capture demand online and service it at higher margins than mainstreet bookkeepers (50-60% vs. 25-33%) with a labor model that combines geographical labor arbitrage with productivity & collaboration software for bookkeepers. Both inDinero’s and Pilot's HQs and engineering sit in California with bookkeepers based out of the Philippines and Nashville, Tennessee, respectively. (link)

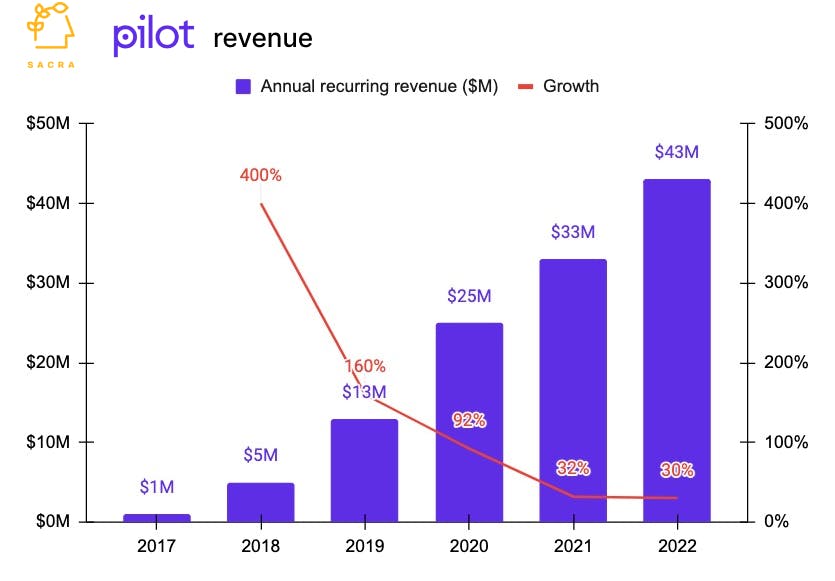

- Sacra estimates that Pilot has $43M in annual recurring revenue (ARR) growing 30% year-over-year with industry leading gross margins at 60%. Pilot positions itself as a premium service focused on bookkeeping accuracy and quality with yearly contracts with cross sell into complementary services like tax, R&D tax credits and fractional CFO. (link)

- As middleware, Pilot is being squeezed on one side by QuickBooks as the SMB finance system of record and on the other side by the workflow tools that operators use daily like Ramp (finance), Gusto (HR) and Stripe (revenue). The workflow slice that Pilot owns—collaboration between bookkeepers and controllers/finance/founders—to reconcile transactions and close the books, though critical, lacks a high frequency of engagement. (link)

- The low quality of the financial data layer and reliance on data aggregators like Plaid ($13.4B valuation, $250M revenue in 2021) continue to hamstring Pilot's efforts to automate bookkeeping for startups more completely. AI- and GPT-powered bookkeeping companies like Truewind (YC W23), Zeni (raised $47.5M) and Digits (raised $97.5M) have the thesis of replacing strict if-else rules engines for bookkeeping with pattern-matching systems that can deal with inaccurate or incomplete information. (link)

- As a vertically integrated service with their own bookkeepers, Pilot has significant operational overhead in scaling compared to a labor marketplace approach, but that gives them more control over quality and margins. Compare this with tech-enabled services companies like Carta, which has its own valuation analysts, while SOC-2 companies like Secureframe, Vanta and Laika have a marketplace model. (link)

- Like Segment (acquired by Twilio for $3.2B), Pilot's upside case as a customer data platform (CDP) for finance lies in its ability to drive automation and interoperability in the finance stack such that Pilot reconfigures the stack to sit at its center. Segment first commoditized marketing automation tools like Braze (NASDAQ: BRZE) and Iterable, then it drove customers to its own native solutions like Twilio Engage. (link)

- Every SMB needs bookkeeping and accounting and today they spend some $60B/yr on it, meaning Pilot today is a leader with only 0.4% penetration into a massive opportunity. Pilot's lead with top unit economics enables it to compound its advantage on bookkeeping automation using its treasure trove of company & bookkeeping workflow data and develop new products for cross sell to drive ARPU. (link)

For more, check out our interviews with former Pilot engineer Pete Belknap, inDinero co-founder Andy Su, Truewind CEO Alex Lee, our full Pilot report and dataset and this other research from our platform:

- Charly Kevers, CFO at Carta, on progressive price discovery and investor relations

- Taimur Abdaal, CEO of Causal, on the primitives of financial modelling

- Sam Li and Austin Ogilvie, co-CEOs of Laika, on the compliance-as-a-service business model

- The future of Plaid's $250M screen scraping business

- Gusto (dataset)

- Plaid (dataset)

- Rippling (dataset)