OpenEvidence vs Doximity

Jan-Erik Asplund

Jan-Erik Asplund

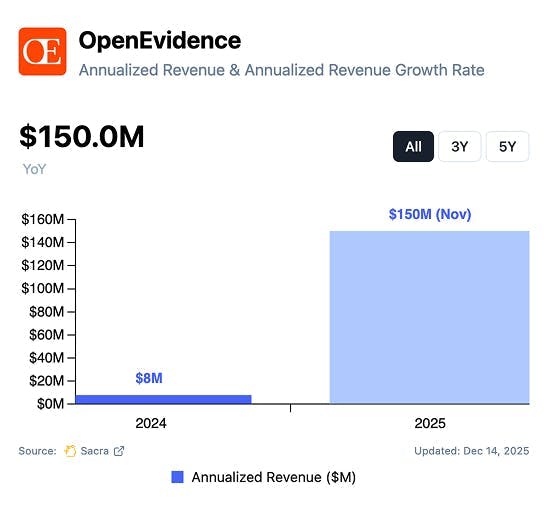

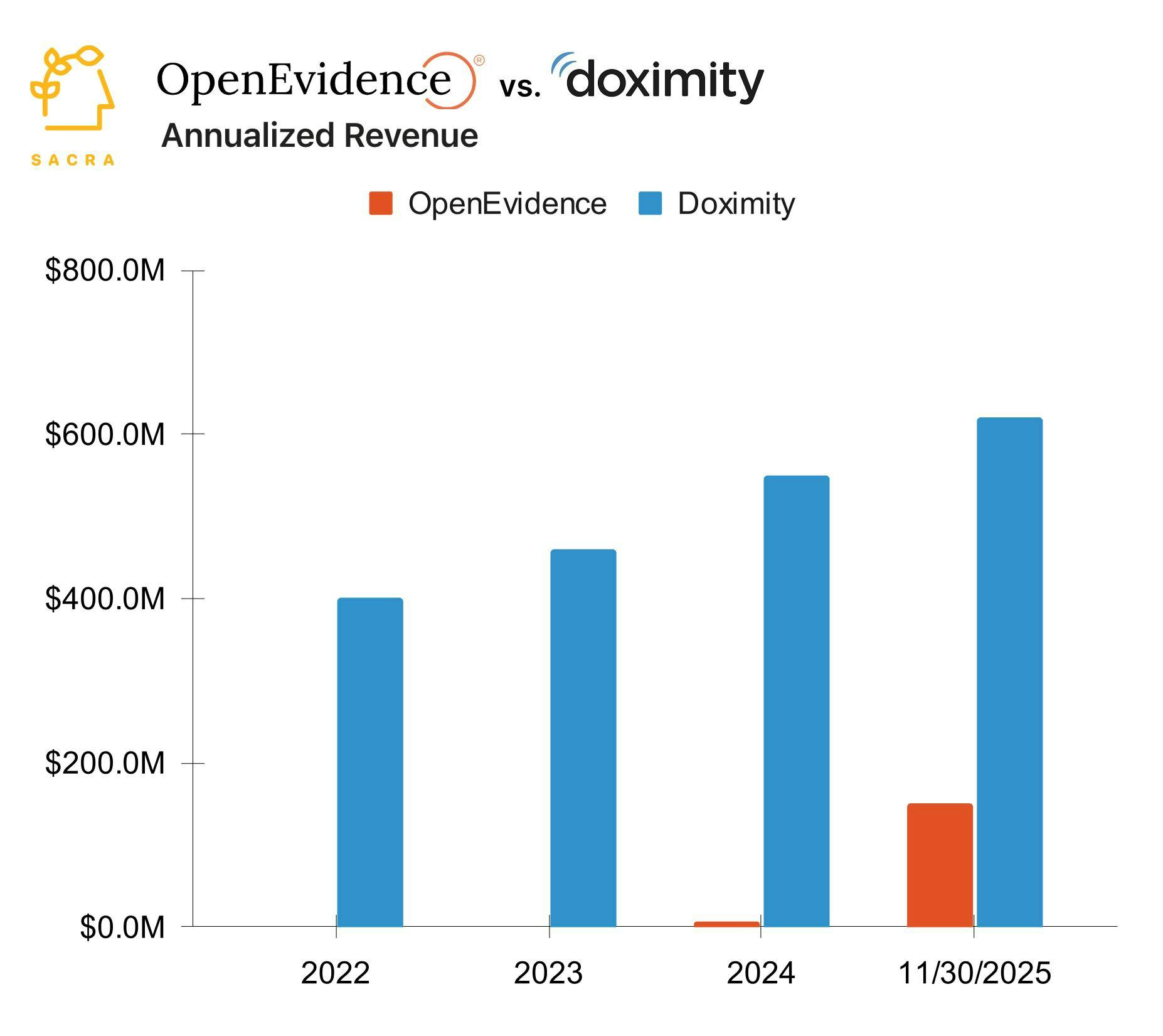

TL;DR: With the launch of AI scribe Visits (August) and HIPAA-secure Dialer (December), OpenEvidence has expanded from clinical search into the $3B+ AI scribe market dominated by Abridge and Ambience and is directly taking on Doximity's core business. Sacra estimates OpenEvidence hit $150M in annualized revenue in November 2025, up ~20x year-over-year. For more, check out our full report and dataset on OpenEvidence.

OpenEvidence is a free AI-powered clinical search engine, like a ChatGPT with exclusive access to top medical journals like JAMA, that is now used by 40% of all U.S. physicians.

We first covered OpenEvidence in June 2025 when they hit $50M in annualized revenue growing 30% MoM, analyzing their disruption of incumbent UpToDate (EURONEXT: WKL) at ~$595M in revenue, up 40% YoY.

Key points from our research:

- By surfacing pharma and med-device ads at $70-150+ CPM to physicians at the highest-intent moment in their workflow (research), OpenEvidence monetizes ~45% of U.S. physicians making 15M clinical consultations per month for a Sacra-estimated $150M in annualized revenue as of November 2025, up ~20x year-over-year and up 3x from $50M in June 2025, reportedly raising $250M at a $12B valuation (80x revenue multiple).

- OpenEvidence continues to double down on owning and dominating clinician attention, giving away core, daily usage physician features for free—AI scribe Visits launched in August 2025 (undercutting the SaaS model of Freed & Suki) and doctor-to-patient calling Dialer in December—to drive engagement to the app, feed back into ad sales and unseat its main competitor for attention share Doximity (NYSE: DOCS, $8.75B market cap) at $620M TTM revenue, up 13% YoY.

- Launched today, ChatGPT Health helps patients research symptoms, prepare for appointments, and get personalized health guidance, setting up dueling visions for AI in medicine between OpenEvidence designing AI for doctors to become faster and more evidence-informed at the point of care versus OpenAI building an AI doctor for patients to self-serve their healthcare needs.

For more, check out this other research from our platform:

- OpenEvidence (dataset)

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Function Health at $100M/year

- Freed (dataset)

- Freed at $13M ARR

- Commure at $105M ARR

- Virta Health at $175M revenue

- Noom at $1B ARR

- BillionToOne at $153M/yr

- Maven Clinic at $268M ARR

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth