OpenAI vs. Anthropic vs. Cohere

Jan-Erik Asplund

Jan-Erik Asplund

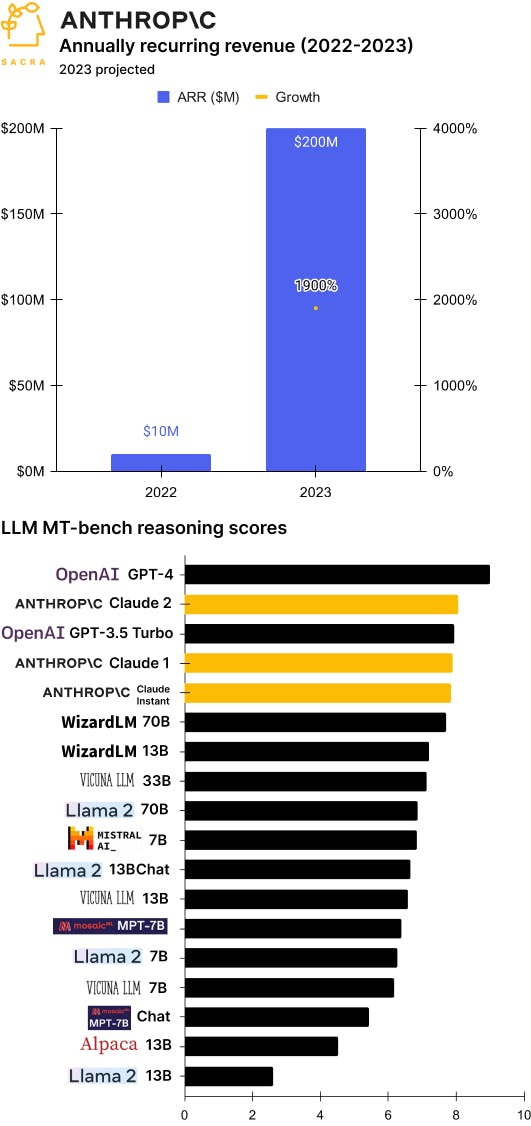

TL;DR: The surprise success of ChatGPT has expanded OpenAI’s consumer ambitions, creating an opportunity for LLM startups like Anthropic and Cohere to go after businesses and enterprise use cases. For more, check out our reports on Anthropic ($200M ARR projected for 2023) and Cohere.

Key points from our report:

- The surface area to attack OpenAI ($1.3B annually recurring revenue) has increased with the expansion of their consumer ambitions amid the surprise success of ChatGPT—with a Jony Ive-designed AI hardware device now in the planning stages. OpenAI’s strategy is to build both platform and killer app, with the long-term goal of using the platform to power better killer apps, while Microsoft Azure is picking up the mantle of serving GPT-* APIs to developers.

- Anthropic hit $100M annual recurring revenue (ARR) midway through 2023, up ~1,900% from only $10M at the end of 2022, with a $4.1B valuation for a forward revenue multiple of 41x. Compare to OpenAI at roughly $1.3B ARR, up 550% from an estimated $200M at the end of 2022 for a 21x multiple, and Cohere, which Sacra estimates to be at about $45M ARR for a 50x multiple on their $2.1B valuation.

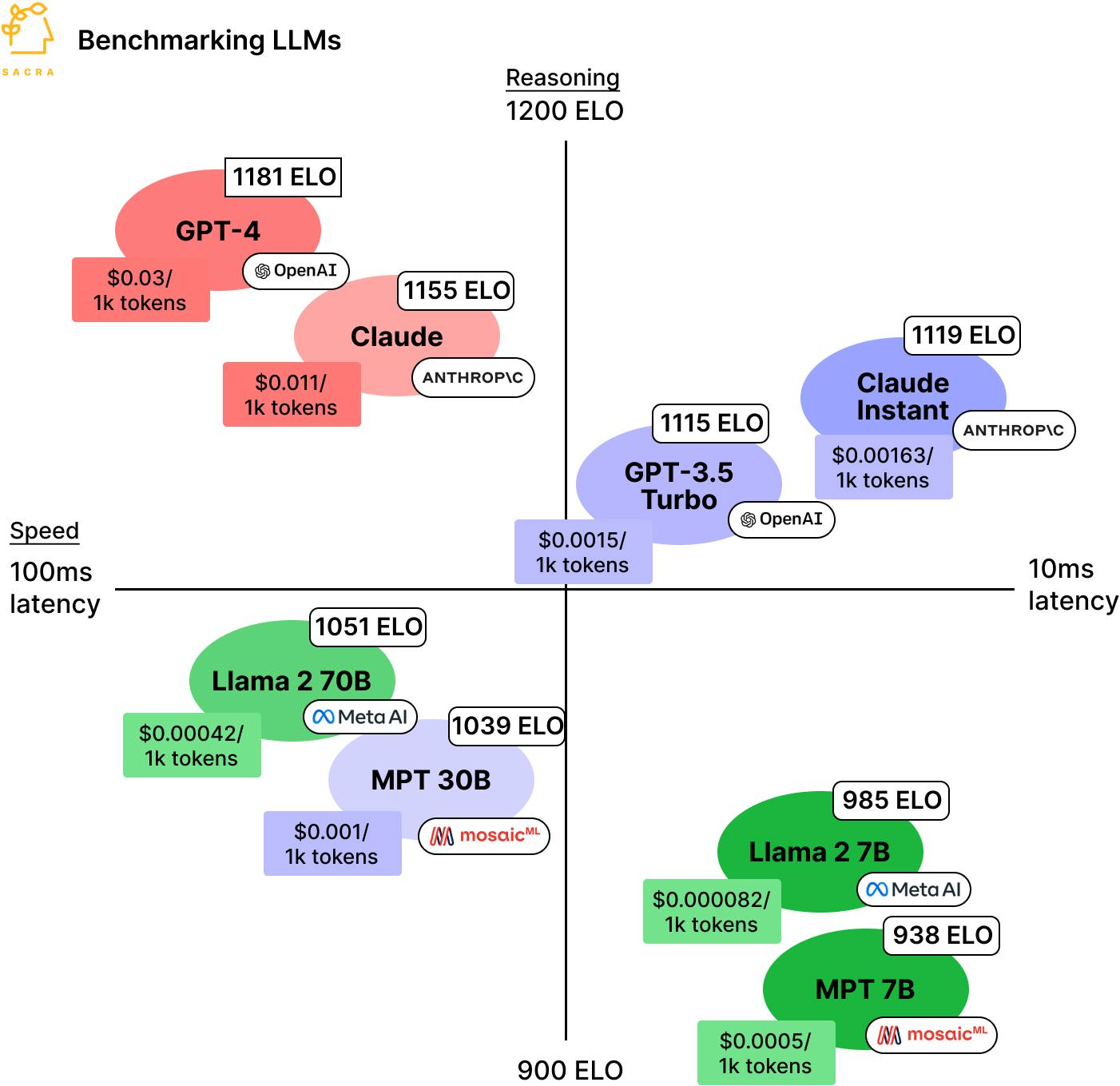

- OpenAI’s GPT-4 is the best LLM for reasoning and complex tasks, but it’s expensive and slow—opening the door for companies like Anthropic (Claude) and Cohere (Command) to target developers with cheaper and faster models. Cohere indexes on fitting more neatly into enterprise use cases—where building with GPT-4 requires enterprises to bring their corporate data into Azure OpenAI Studio, Cohere offers private cloud deployments, on-prem, and is compatible with all the major public clouds.

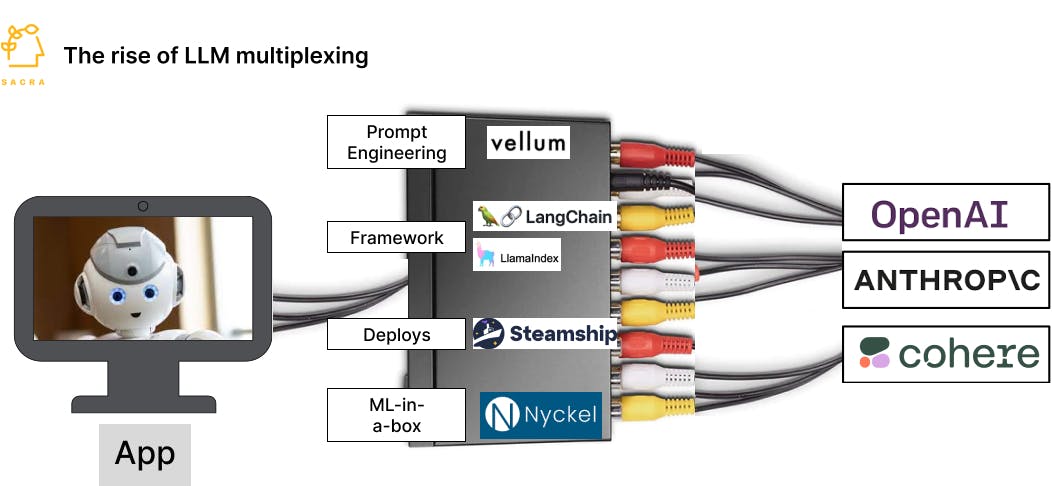

- Developers have become increasingly non-monogamous between models and providers, multiplexing LLMs to choose the best model along dimensions of synchronous vs. asynchronous, cost, and level of complexity of the task. Ramp ($245M annualized revenue in 2022) and DuckDuckGo use both Anthropic and OpenAI under the hood, Scale ($290M revenue in 2022) uses OpenAI, Cohere, Adept, CarperAI, and Stability AI, and Quora’s chatbot Poe lets users choose between models from OpenAI, Anthropic, Meta, and more.

- LLM developer experience tools have become a growing middleware layer to abstract away the need to interact directly with the underlying LLMs. ML developers use tools like Vellum (YC W23) for prompt engineering, LlamaIndex (22.9K Github stars) and LangChain ($10M seed from Benchmark) for model chaining, and Steamship ($6M seed from A16Z) as their “Heroku”, while even non-technical folks can use ML-in-a-box tools like Nyckel (YC W22) for tasks like image classification or object detection.

- As with on-demand companies like Uber and Lyft in the early 2010’s, the initial hype cycle has seen billions invested in the LLMs deemed most likely to win—$14.5B into OpenAI, Anthropic, and Cohere alone—creating capital moats as barriers to future competition. OpenAI has said that it expects be the most capital-intensive startup of all time and to raise as much as $100B in the years ahead to pay for the costs of building, training, and hosting future iterations of GPT-*.

- We’re seeing the competitive pattern in multi-cloud repeat itself in AI, with Anthropic aligning with Amazon/Google and Cohere raising from Nvidia, forming a coalition to counter OpenAI and Microsoft’s partnership. By investing in the top LLM companies, Google/Amazon/Nvidia buy themselves a call option to use their tech to improve their own platforms, protect themself against OpenAI’s dominance, and stay at the forefront of LLM research.

For more, check out this other research from our platform:

- OpenAI (dataset)

- Anthropic (dataset)

- Cohere

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future