OpenAI governance by force

Jan-Erik Asplund

Jan-Erik Asplund

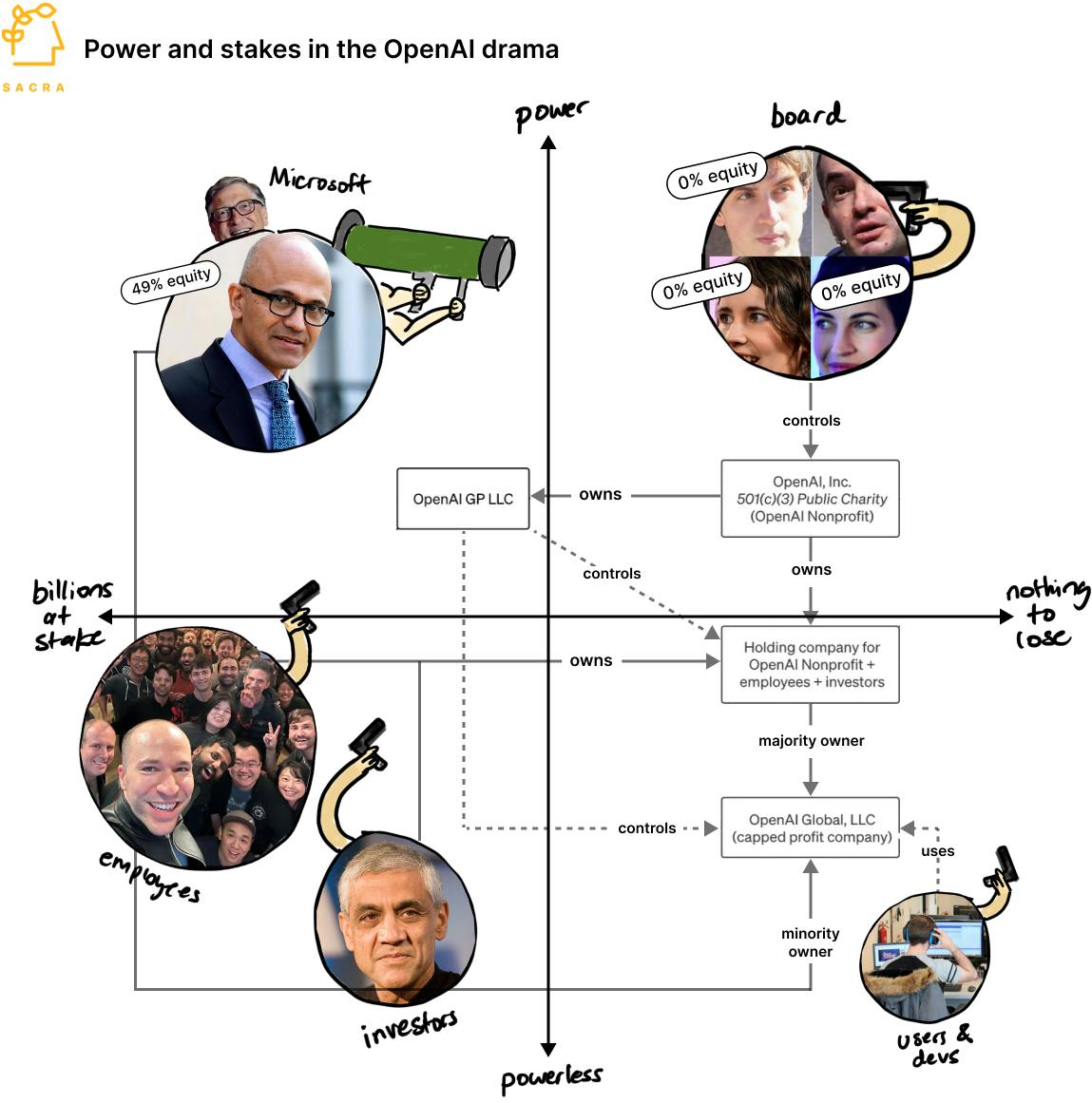

TL;DR: Two weeks ago, a power struggle at OpenAI laid bare the tangle of incentives behind the $86B organization’s complex corporate structure. The future of OpenAI now depends on whether a refreshed board can solve its own alignment problem—or whether this will happen again. For more, check out our report and dataset on OpenAI.

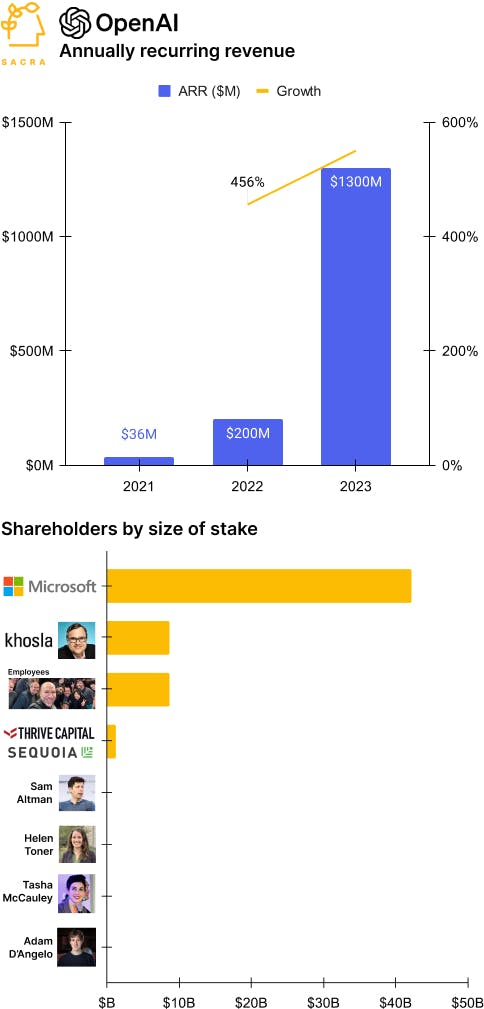

- The surprise consumer success of ChatGPT and the compute needed to support it put OpenAI on track to build the most capital-intensive startup in Silicon Valley history: so far, they’ve raised roughly $13.3B en route to $1B of (unprofitable) revenue in 2023. Compare to Uber (NYSE: UBER) which raised about $1.5B before hitting the $1B in revenue mark, and WeWork (OTCMKTS: WEWKQ) which raised $6B before getting there.

- This level of capital investment and cash burn necessitated a deep-pocketed, long-term partner like Microsoft—making it the single most influential stakeholder in OpenAI despite its minority ownership in the for-profit entity and lack of board seat in the controlling non-profit board. By investing into OpenAI Global LLC—OpenAI’s “capped profit” subsidiary—Microsoft has leverage over OpenAI and exposure to its upside and IP rights while keeping at an arm’s length from any controversies and potential antitrust issues.

- Early investors like Khosla Ventures who put in $50M and Reid Hoffman invested at OpenAI’s $1B valuation for paper returns of 86x as of Thrive’s planned $86B tender offer, with Khosla’s stake alone worth $4.3B, returning the fund twice over. Later investors like Thrive (the biggest OpenAI investor besides Microsoft) Sequoia, Bedrock, Andreessen Horowitz and Tiger who came in during OpenAI’s 2021 secondary have paper returns of 4.3x.

- OpenAI’s technical staff, 90% of whom threatened to resign, make $925K/year (~33% cash) minimum with appreciation of the equity component directly linked to CEO Sam Altman’s fundraising prowess. An OpenAI engineer with 2 years of tenure would have roughly $8M of profit participation units (PPUs) available to sell into a tender priced at $86B—many senior staff would have significantly more.

- Instead of taking equity, Altman has monetized his position through investments in AI companies like Speak AI ($63M raised) and Cerebras ($715M raised) and through side deals with Microsoft to buy electricity from Helion ($375M investment) and AI hardware from Humane (led Series A, 14.93% equity). Helion (Sam Altman’s biggest ever single investment) signed the deal with Microsoft 3 months after the announcement of Microsoft’s $10B investment into OpenAI in January 2023.

- Developers have raised $5B+ to build startups on top of OpenAI in 2023 alone, making an ecosystem bet on OpenAI as the latest platform shift—now, it’s even more clear that they need to design for optionality between OpenAI and competitors. Akin to multicloud where developers diversify between Azure/Google Cloud/AWS for better reliability and cost optimization, developers are increasingly multiplexing LLMs from OpenAI, Cohere, Azure, and Google Cloud.

- The bull case for OpenAI is that swapping in Bret Taylor and Larry Summers as board members turns OpenAI from a non-profit with a for-profit arm into a de facto typical growth startup that happens to be heavily mission-driven. The bear case is that—without any structural changes in place to address the misalignment coming from a non-profit board in control of a for-profit business—history is destined to repeat itself, this time as farce.

For more, check out this other research from our platform:

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Eoghan McCabe & Des Traynor, CEO and CSO of Intercom, on the AI transformation of customer service

- Edo Liberty, founder and CEO of Pinecone, on the companies indexed on OpenAI

- OpenAI (dataset)

- Oscar Beijbom, co-founder and CTO of Nyckel, on the opportunites in the AI/ML tooling market

- Anthropic (dataset)

- Cohere