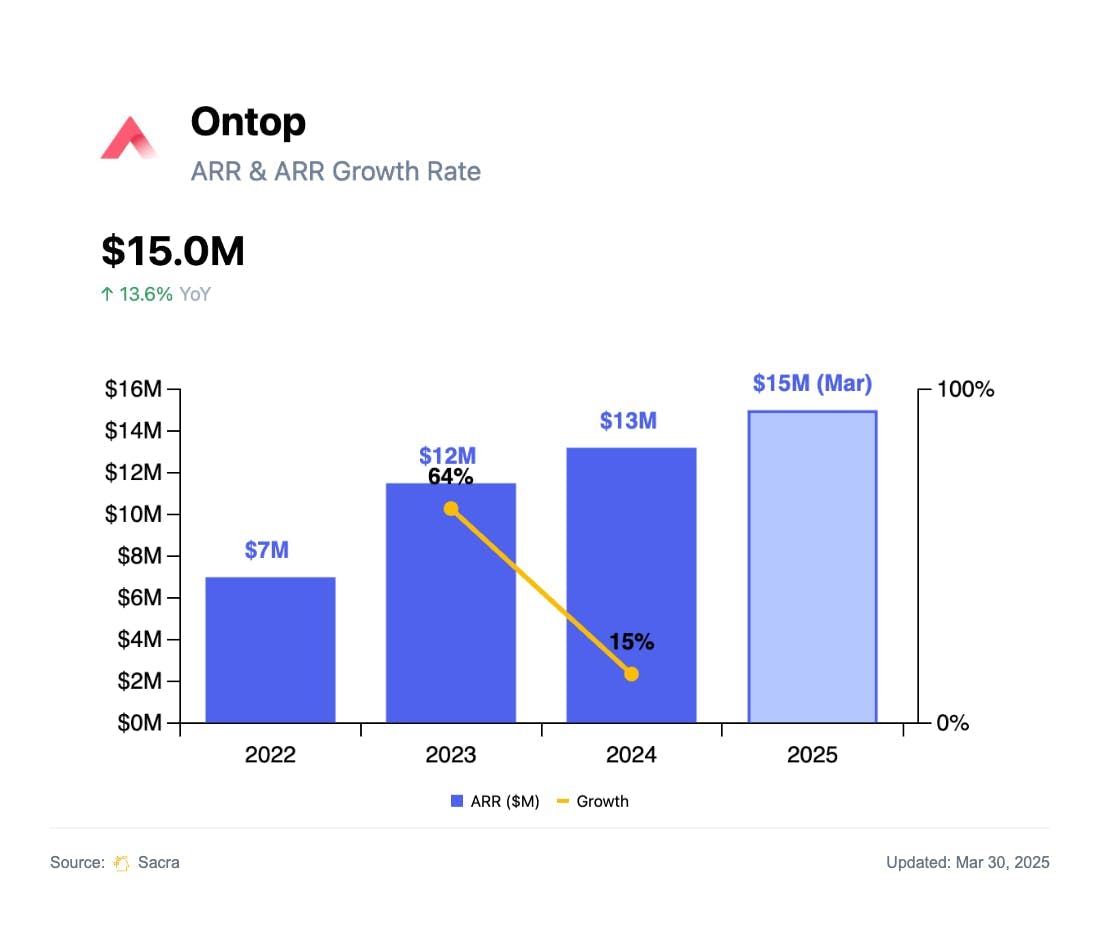

Ontop at $15M annualized revenue

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: With the rise of remote work driving a 63% increase in U.S. companies hiring Latin American talent, Ontop combines compliant contracts, mass payouts, and virtual USD wallets with Visa cards across 150+ countries. Sacra estimates that Ontop hit $15M in annualized revenue in March 2025. For more, check out our full report and dataset on Ontop.

We’ve covered the global payroll and EOR space extensively over the past three years—including interviews with Deel COO Dan Westgarth, Panther CEO Matt Redler, and Plane CEO Matt Drozdzynski—as well as a deep dive on the $1.4T contractor payroll market and the opportunity to build the Cash App for global labor.

Key points on Ontop via Sacra AI:

- The rise of remote work during 2020-21 led to a 63% increase in U.S. companies hiring Latin American talent, but traditional payroll providers required setting up local legal entities and navigating complex currency controls—creating the opportunity for Ontop (2020) to launch as a unified platform combining compliant contracts, mass payouts, and virtual USD wallets with Visa cards for workers across 150+ countries. Unlike EOR incumbents like Deel or Remote who monetize through seat fees, Ontop employs a hybrid business model charging $29/month plus a 1% payment commission per contractor while capturing additional revenue streams from interchange fees on card purchases (1-2%), FX spreads on currency conversions (2-4%), and float yield on pre-funded balances—enabling them to undercut competitors by $200-300 per EOR seat while maintaining similar blended margins.

- With a built-in USD wallet and Visa card that generates interchange and FX revenue alongside standard payroll fees, Sacra estimates that Ontop hit $13M in annualized revenue in 2024, up 15% year-over-year, growing to $15M as of March 2025. The hybrid SaaS-fintech model lets Ontop undercut pure EOR competitors on contractor pricing ($29/month + 1% vs. Deel's higher fees) while maintaining similar gross margins through interchange income—something bank-wire-only incumbents like Remote ($699/month per EOR seat) struggle to match without a native wallet.

- Through strategic product expansion beyond basic contractor payments, Ontop is positioning itself as a comprehensive cross-border workforce platform by launching Ontop+ for ad-hoc payments, an API for enterprise integration, and expanding their contractor compliance stack into 80 countries—creating an end-to-end solution that competes with fragmented point solutions in specialized categories. As India's tech talent exodus accelerates (15% of software developers now work remotely for foreign companies) and Mexico emerges as the fastest-growing nearshore development hub for US companies (29% YoY growth in hiring), Ontop is uniquely positioned at the intersection of two massive shifts: the rise of global distributed teams and the increasing formalization of contractor relationships into EOR arrangements driven by tightening compliance requirements in markets like Spain and Brazil.

For more, check out this other research from our platform:

- Matt Redler, ex-CEO of Panther, on the competitive positioning of Deel vs. Remote vs. Rippling

- Matt Drozdzynski, CEO and co-founder of Plane, on global payroll post-COVID

- Matt Redler, co-founder and CEO of Panther, on building a modern employer of record

- Dan Westgarth, COO of Deel, on the global payroll opportunity

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- René Saul and Fernando Sandoval, co-founders at Kapital, on the fintech opportunity in LatAm

- Kurtis Lin, CEO of Pinwheel, on the rebundling of payroll into every app

- Wingspan's 992x growth in contractor payroll

- The state of the LatAm startup ecosystem

- Ved Sinha, Former VP of Product at Upwork, on gig marketplaces

- Anthony Mironov, CEO of Wingspan, on building financial services for contractors

- Human Interest (dataset)

- Guideline (dataset)

- Gusto (dataset)

- Justworks (dataset)

- Rippling (dataset)