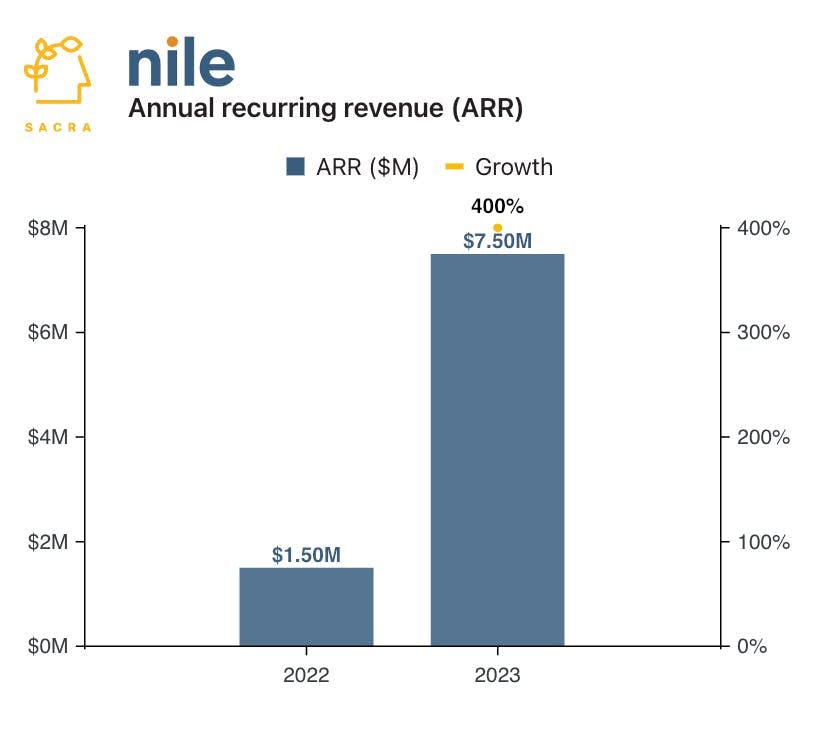

Nile at $7.5M ARR

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Sacra estimates Nile reached $7.5M in annual recurring revenue (ARR) in 2023, up 400% YoY, by converting the upfront capex of enterprise networking into a recurring, managed subscription. Unlike Cisco, which gets 92% of its $54B in revenue from sales to channel partners, Nile’s direct-to-business model enables competitive pricing and ~80% gross margins. For more, check out our full report on Nile and our model of their revenue mix, COGS, and opex.

Key points via Sacra AI:

- Enterprise networking used to mean either buying Cisco ($54B/year in revenue) hardware upfront and hiring an IT team to run it, or complete outsourcing to a managed service provider (MSP)—creating an opportunity for ex-Cisco CEO John Chambers to launch Nile (2022) as a fully-managed network-as-a-service with hardware included. Customers pay either a flat rate per square foot or per user (~$100K average contract value), and Nile handles everything: installing the hardware on-site for free, running software updates and security patches, and managing network performance, with performance-based SLAs that compensate customers for any downtime.

- Rather than go up against Cisco in ruggedized, high-density environments like warehouses and data centers, Sacra estimates Nile hit $7.5M in annual recurring revenue (ARR) in 2023 in just over 12 months by targeting startup offices and college campuses where the deployment playbook is simple and well-established (one access point per ~3,000 sq ft). Sales into MSPs and other channel partners accounted for 92% of Cisco's $57B in 2023 revenue, 98% of Juniper's $5.6B in 2023 revenue, and 90% of HPE Aruba's $5.3B in 2023 revenue, structurally blocking these incumbents from selling managed services that compete directly with their key distribution partners.

- Unlike traditional networking where vendors like Cisco and Juniper lose 25-30% of customer spend to the 20,000 domestic MSPs that set up and maintain their hardware, Nile’s direct-to-business model and standardized commodity hardware enables ~80% gross margins at scale versus 60-65% for incumbents. Networking giants like Cisco and Juniper have historically modernized through acquisition, with Cisco buying Meraki for $1.2B in 2012 and Juniper buying Mist for $405M in 2019, suggesting Nile could be an attractive acquisition target, particularly with Chambers' history of investing in startups like Cisco later acquired like Andiamo (2004), Nuova Systems (2008), and Insieme (2013).

For more, check out this other research from our platform: