Netskope at $500M/year growing >30%

Jan-Erik Asplund

Jan-Erik Asplund

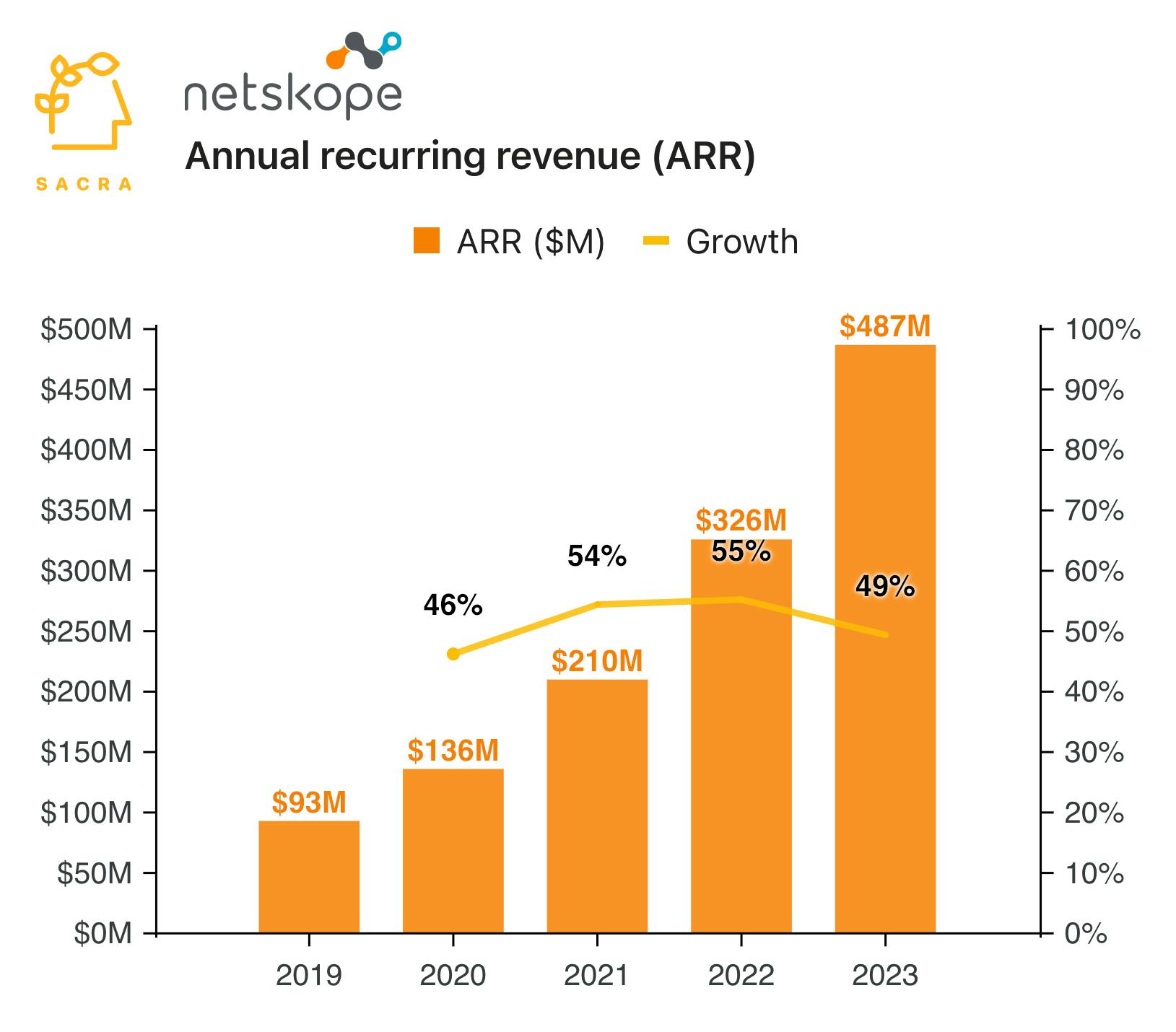

TL;DR: In 2024, Netskope hit $500M in annual recurring revenue, growing >30% year-over-year through the worst SaaS downturn in years, powered by cybersecurity's resistance to budget cuts and accelerating migration to cloud software in the enterprise. For more, check out our full report and dataset on Netskope.

Key points from our update:

- As companies started moving from on-prem software to SaaS in the early 2000s, the virtual private networks (VPNs), on-prem web proxies, and traditional hardware firewalls companies were using to protect their external traffic created high latency and management complexity. Zscaler (NASDAQ: ZS, founded 2007) and Netskope (founded 2012) found product-market fit by consolidating these tools, nixing the hardware component, and bundling them together in one cloud platform, creating a single interface from which companies could manage all the apps being accessed, assess areas of risk, and create granular control policies.

- Sacra estimates that Netskope hit $487M in annual recurring revenue (ARR) at the end of 2023, up 49% year-over-year, with roughly 2,750 customers for $177K average revenue per customer (ARPC). Compare to Palo Alto Networks (NYSE: PANW) at $8B ARR, up 15% year-over-year with 85,000 customers for $941K ARPC, and their direct competitor Zscaler (NASDAQ: ZS) at $2.2B ARR, up 32% year-over-year with ~7,700 customers for $285K ARPC.

- Both Zscaler and Netskope are growing 30%+ YoY through the worst SaaS downturn in years (the median SaaS company is growing 12%) with 1) cybersecurity’s resistance to budget cuts, 2) continued enterprise migration to the cloud, and 3) the rise of generative AI as a data exfiltration risk surface. 87% of companies report that their spend on cybersecurity will increase in the next 12 months, and 51% expect to add more vendors, benefiting best-of-breed point solutions like Zscaler and Netskope as they go up against Cisco (NASDAQ: CSCO) and Palo Alto Networks.

For more, check out this other research from our platform:

- Netskope (dataset)

- Israel's YC of cybersecurity

- Rubrik: the Netflix of data backups

- Zachary Friedman, associate director of product management at Immuta, on security in the modern data stack

- Sam Li and Austin Ogilvie, co-CEOs of Laika, on the compliance-as-a-service business model

- Christina Cacioppo, CEO of Vanta, on the value of SOC 2 compliance for startups

- Shrav Mehta, CEO of Secureframe, on building a TurboTax for security compliance

- How Vanta, Secureframe and Laika are arming the rebels of B2B SaaS

- Rubrik (dataset)

- BigID (dataset)

- Snyk (dataset)

- Lacework (dataset)

- Noname Security (dataset)

- Cribl (dataset)