Mirakl vs. Amazon vs. Walmart

Jan-Erik Asplund

Jan-Erik Asplund

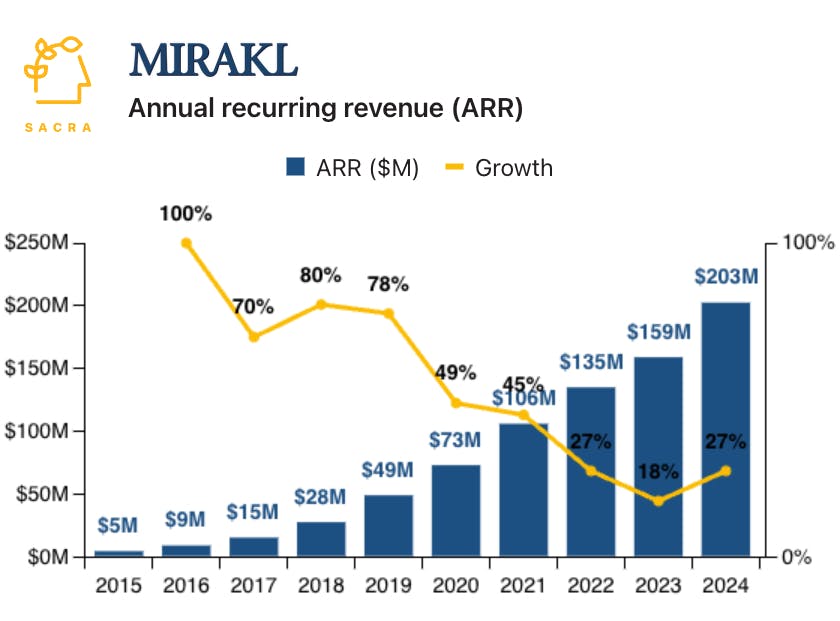

TL;DR: Amazon’s third-party sales generate $360B per year, 60% of all their retail revenue. Sacra estimates that Mirakl, which helps traditional retailers launch their own third-party marketplaces, hit $203M in annual recurring revenue (ARR) in 2024, growing 27% YoY. For more, check out our full Mirakl report and dataset.

Key points via Sacra AI:

- Amazon’s third-party marketplace has grown bigger than its first-party storefront at $360B of revenue (60% of all sales, up from 26% in 2007)—creating the opportunity for Mirakl (founded in France in 2012) to enable traditional retailers like Macy’s and Nordstrom to launch their own third-party marketplaces. Mirakl generates a ~2% effective take rate on its customers' marketplace GMV through (1) a platform fee paid yearly for access to their SaaS platform, and (2) a variable take rate on GMV—the exact mix is negotiable per customer, with larger marketplaces opting to pay a larger SaaS fee (~$450K on the high-end).

- As Mirakl has pushed into B2B marketplaces (growing 2x as fast as B2C) and picked up customers like Cencora (pharmaceutical wholesaler, $316B revenue) and United Natural Foods (food distributor, $31B revenue), Sacra estimates that Mirakl hit $203M annual recurring revenue (ARR) at the end of 2024, growing 27% YoY, with $555M raised in their 2021 Series E at a $3.5B valuation and a 33x multiple on $106M in 2021 ARR. Compare to the LatAm-focused VTEX (NYSE: VTEX), which hit $226M of trailing twelve months revenue in Q3’24, up 21% YoY from $186M in Q3’23, valued at $1.1B or a 4.9x multiple.

- With Mirakl Ads (2022), Mirakl’s 10,000 third-party sellers can buy ad slots across their 450 retailers, allowing Mirakl to capture a slice of retail’s highest-margin revenue stream, with advertising generating 70-80% margins versus traditional retail's 24%. Walmart’s 150,000 third-party sellers are responsible for 93% of items sold on Walmart.com, and generate ad revenue representing ~$2B of Walmart’s $6.7B operating income—Amazon, on the other hand, has 2M third-party sellers generating $48B per year in advertising revenue and $140B in all seller services revenue (including commissions, fulfillment, and shipping).

For more, check out this other research from our platform:

- Mirakl (dataset)

- Back Market (dataset)

- ManoMano (dataset)

- Bloom & Wild (dataset)

- Andrew Yates, CEO of Promoted.ai, on when marketplaces should layer on ads

- Andrew Yates, CEO of Promoted.ai, on driving marketplace ARPU with personalization

- Ved Sinha, Former VP of Product at Upwork, on gig marketplaces

- Ameet Shah, partner at Golden Ventures, on the economics of vertical SaaS marketplaces

- Sean Frank, CEO of Ridge, on the state of ecommerce post-COVID

- Rokt: the $480M/year ad network behind Uber & Lyft