Maven Clinic at $268M ARR

Jan-Erik Asplund

Jan-Erik Asplund

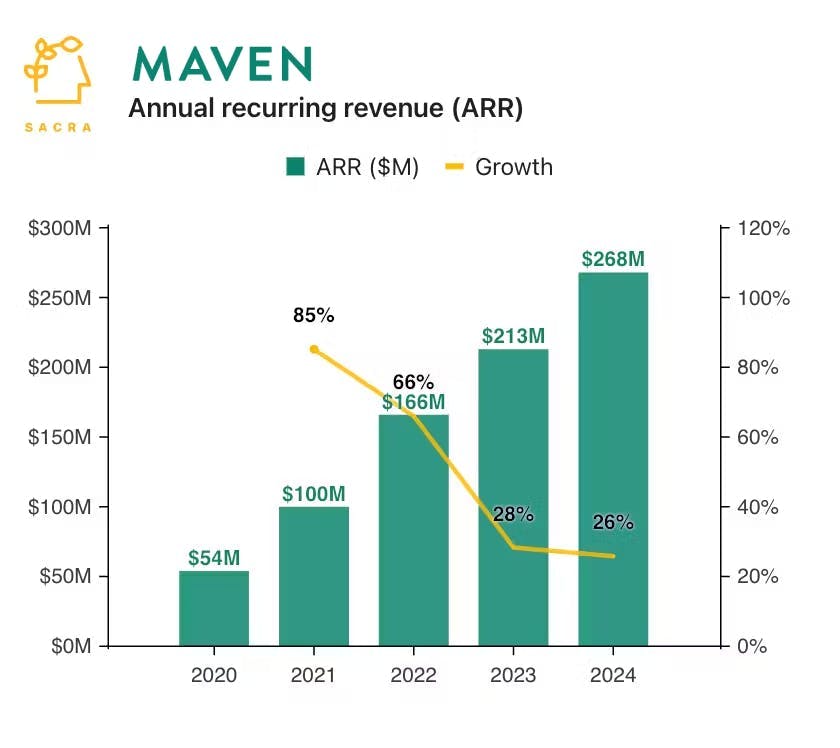

TL;DR: Sacra estimates that Maven Clinic will hit $268M of ARR in 2024, up 26% YoY, with their women’s health benefit offering now covering 17 million people globally. After doubling down on fertility, Maven has now won their biggest customer ever in Amazon, who switched away from incumbent Progyny (NASDAQ: PGNY) for 2025. For more, check out our full report and dataset on Maven.

Key points via Sacra AI:

- In 2015, as Apple and Facebook introduced egg-freezing-as-a-perk, Maven Clinic launched as a telehealth provider that offers maternity and fertility care as a benefit to health plans and large employers, delivering care through a network of 1,000+ 1099 providers across 30+ specialties, from OB-GYNs to lactation consultants. Maven’s value proposition to employers hinges on helping them attract the best talent—43% of Fortune 500 companies offered fertility benefits in 2023, up from 27% in 2020—while saving employers $100K in replacement costs per employee who churns post-pregnancy and ~$15K on each avoided IVF cycle (with Maven costing $700-$950 per enrolled member with a $20-40K platform fee).

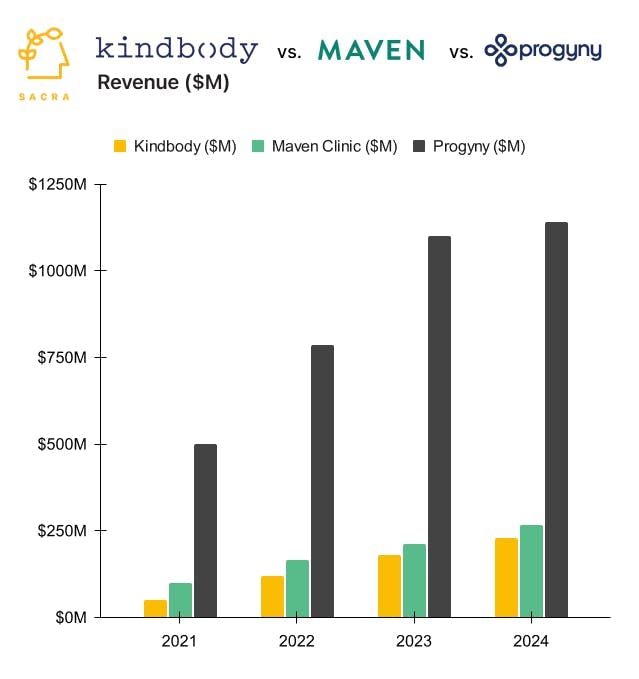

- Sacra estimates Maven is on track to hit $268M of ARR in 2024, up 26% YoY, valued at $1.7B (6.9x forward revenue) valued at $1.7B as of their October Series F for a 6.9x forward revenue multiple, with roughly 117,000 enrolled members for $2.3K in average revenue per user. Compare to the fertility benefits incumbent Progyny (NASDAQ: PGNY) at $1.14B in trailing twelve months gross revenue (up 2% YoY) valued at $1.24B for a 1.08x multiple (with 20% gross margin), and vertically-integrated fertility clinic Kindbody at an estimated $225M in revenue for 2024, up 25% YoY, valued at $1.8B as of their 2023 Series D for a 10x multiple on their 2023 revenue of $180M (with ~60% gross margin).

- Maven's asset-light model combining coaching, content and telehealth has enabled them to go global (175 countries)—without sacrificing retention (98% customer retention) and effectiveness (20% improvement in post-pregnancy employee retention)—and win multinationals like Amazon and AT&T that want one platform for women's health benefits across their workforce. After becoming a fertility benefits administrator (and the biggest in the world at 17.5M covered lives), Maven now sells itself as a full-stack benefits manager like the more IVF-centric Progyny and Kindbody—unlike them, however, Maven is also aggressively expanding along the full lifecycle of family health needs across their provider network, with their pediatrics product doubling to 3M lives in 2024 and menopause growing 300% YoY to 550 clients.

For more, check out this other research from our platform:

- Maven Clinic (dataset)

- Kindbody (dataset)

- Virta Health (dataset)

- Noom (dataset)

- Hone Health: the $55M/year D2C testosterone startup

- Ro and the telehealth capital cycle

- Brendan Keeler, Senior PM at Zus Health, on building infrastructure for digital health

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Andy Hoang, CEO of Aviron, on the unit economics of connected fitness

- Strava: the $265M/year Whole Foods of social networks

- Aviron and the Xbox of connected fitness

- Oura (dataset)