Revenue

$4.90B

2023

Growth Rate (y/y)

7%

2023

Funding

$5

2024

Revenue

Sacra estimates Epic hit $4.9B in revenue in 2023, growing 7% from $4.6B in 2022.

The company's revenue has grown significantly from $500M in 2007, driven by widespread EHR adoption following the 2009 HITECH Act's $27B federal incentive program.

Epic generates revenue primarily through software licensing and maintenance fees from large healthcare providers, with the average customer relationship lasting 10+ years.

Major implementations can cost $650M+ for large health systems, with additional annual maintenance fees in the millions.

The company maintains high profitability with estimated EBITDA margins above 30% and operates debt-free.

Epic dominates the large hospital market with a 39% share of U.S. hospital beds. Its customer base includes 2,400 hospitals and 225 million patient records, representing two-thirds of the U.S. population.

The company has expanded beyond its traditional large academic medical center focus to include smaller community hospitals, international markets, and new verticals like dental practices and retail health.

Product

Epic was founded in 1979 by Judy Faulkner in Madison, Wisconsin, starting as a database management system for healthcare organizations operating from a basement office.

Initially, the system focused on managing external factors like scheduling and patient information to make hospital records more efficient.

Epic found product-market fit as an integrated electronic health records system for large academic medical centers and children's hospitals, with early success at organizations like Kaiser Permanente.

The product unified previously fragmented hospital workflows into a single comprehensive system.

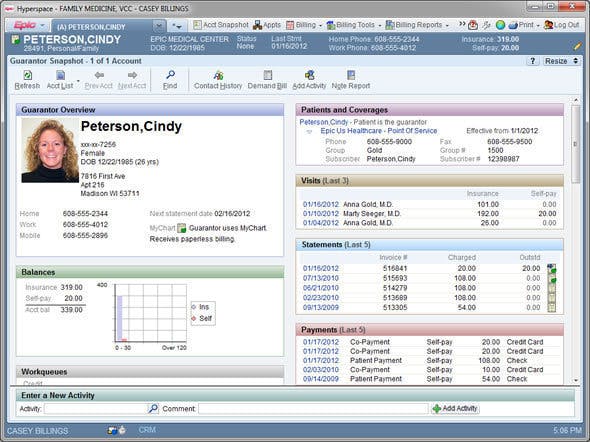

At its core, Epic's electronic health record system manages a patient's entire medical journey. When a patient schedules an appointment, their information flows through Epic as they move from registration to the exam room, where doctors record diagnoses and prescribe medications.

The system then handles billing and follow-up care coordination. Nurses, physicians, and administrative staff all work within Epic to coordinate care delivery.

The system has expanded to include specialized modules for different medical departments: emergency rooms use ASAP for patient tracking, surgeons use OpTime for procedure scheduling, oncologists use Beacon for chemotherapy planning, and patients use MyChart to access their records and communicate with providers.

All these components share data through Epic's Chronicles database, enabling seamless information flow across departments and facilities.

Business Model

Epic generates revenue through large upfront implementation fees ranging from $1-500M+ depending on facility size, plus annual per-user licensing fees averaging $1,500 per provider.

Epic's core competitive advantage comes from its integrated suite of healthcare applications built on a single codebase and database, allowing seamless data sharing across departments and facilities using Epic.

This contrasts with competitors who often cobble together acquired products. The company's software handles everything from scheduling to clinical documentation to billing, making it extremely sticky once implemented.

The business follows a land-and-expand model where Epic typically enters through large academic medical centers and hospital systems, then expands to their affiliated clinics and practices.

Competition

Epic operates in the electronic health records (EHR) market, where it holds approximately 33% market share of U.S. hospital beds and generates $3.8B in annual revenue. The competitive landscape breaks down into three main segments:

Traditional EHR vendors

Oracle Cerner represents Epic's closest competitor with 24% market share, though it has struggled with implementation issues, particularly in government contracts. MEDITECH maintains 17% share, primarily serving smaller hospitals. Allscripts and CPSI round out the major players but focus on specific niches like independent physician practices.

Enterprise tech challengers

Large technology companies have attempted to enter healthcare records but achieved limited success. Google and Microsoft's personal health record initiatives failed to gain traction. Amazon's Haven healthcare venture was shuttered. These companies now focus on providing cloud infrastructure and specialized tools rather than competing directly in core EHR functionality.

Digital health startups

Venture-backed companies are targeting specific workflows within healthcare delivery rather than attempting to replace entire EHR systems. Companies like Wheel (telehealth), Axle (home health), and Pillar (health coaching) build on top of existing EHR infrastructure. The new federal data sharing rules have spawned companies like 1up Health and Human API that aggregate patient data across systems.

The market dynamics heavily favor Epic's integrated approach. While startups can innovate in targeted areas, the complex requirements of hospital operations - from scheduling to billing to clinical documentation - create significant barriers to entry for new comprehensive EHR vendors. Healthcare organizations' risk aversion and high switching costs further entrench incumbent positions.

TAM Expansion

Epic has tailwinds from healthcare digitization and increasing data interoperability requirements, with opportunities to expand into adjacent markets beyond their core electronic health record business.

Their $3.8B current revenue represents just a fraction of their potential as they push into new verticals and business models.

International expansion and cloud transformation

Epic's move into international markets like the Netherlands, Denmark, and UAE demonstrates significant growth potential beyond their U.S. base. Their development of cloud hosting capabilities and data centers positions them to capture smaller healthcare providers previously unable to afford traditional Epic implementations. This shift to cloud-based delivery could dramatically expand their serviceable market while improving margins through economies of scale.

Data monetization and research platforms

Epic's Cosmos database, containing 5.7 billion patient encounters, positions them to become the dominant player in healthcare data analytics and research. Their ability to aggregate and analyze de-identified patient data across health systems creates opportunities in drug development, clinical trial recruitment, and population health management. The research and pharmaceutical industry represents a multi-billion dollar opportunity separate from their traditional provider-focused business.

Platform expansion and ecosystem development

Epic's Health Grid initiatives are expanding their reach into adjacent healthcare verticals. Their payer platform connects insurers with provider networks, while Discovery facilitates clinical trial management. These moves position Epic to become a comprehensive healthcare platform rather than just an EHR vendor. By facilitating connections between different healthcare stakeholders, Epic could capture value from transactions and data flows across the entire healthcare ecosystem, similar to how Stripe evolved beyond pure payments processing.

Risks

Erosion of closed ecosystem advantage: Epic's historical strength in maintaining a closed, tightly integrated system faces mounting pressure from federal regulations mandating increased interoperability and data sharing.

New rules empowering patient data ownership and prohibiting information blocking could weaken Epic's ability to maintain its walled garden approach. This regulatory shift, combined with the rise of cloud-based healthcare solutions, threatens to commoditize core EHR functionality and reduce switching costs for healthcare providers.

Post-pandemic digital health acceleration: The rapid adoption of virtual care and digital health solutions during COVID-19 has created an ecosystem of nimble competitors targeting specific healthcare workflows.

While Epic's monolithic architecture excels at complex hospital operations, it may struggle to adapt quickly enough to emerging care delivery models and consumer-facing healthcare experiences. The company's traditional development approach could prove too slow for the accelerated pace of healthcare innovation.

International expansion limitations: Epic's U.S.-centric software architecture makes international growth challenging, as evidenced by implementation difficulties in Denmark, Finland, and the UK.

The company's approach of maintaining a single codebase requires extensive customization for different healthcare systems and regulatory frameworks. This limitation could prevent Epic from capturing growth opportunities in global markets while international competitors develop purpose-built solutions for specific regions.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.